Summary:

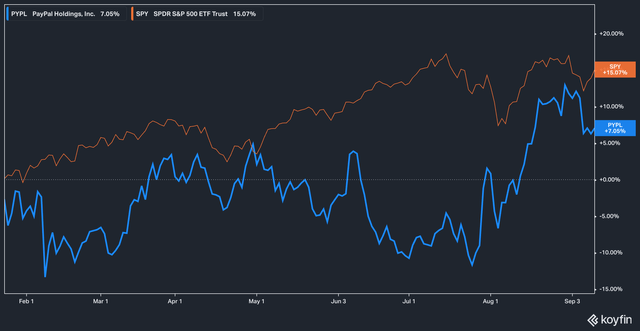

- PayPal has underperformed the broader market in 2024, with a ~7% total return versus the S&P 500’s ~15%.

- Despite past disappointments, recent developments and new management suggest better days ahead for PayPal.

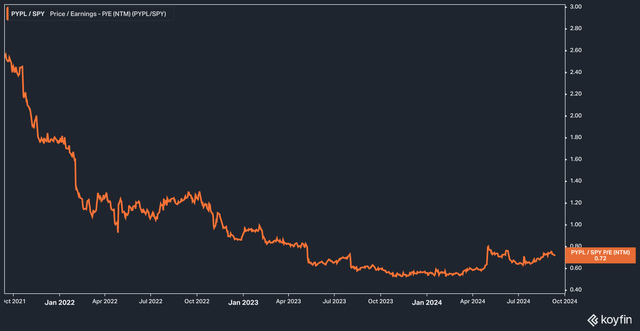

- PayPal now trades at a 25% discount to the S&P 500.

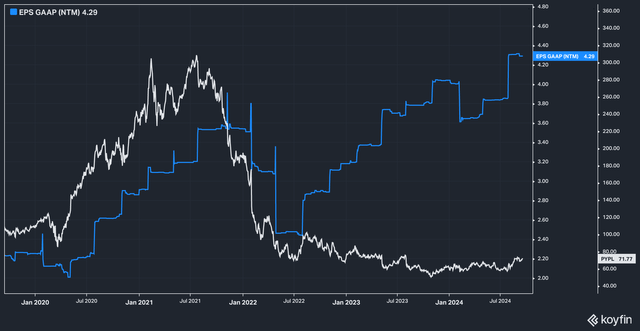

- While GAAP EPS forward estimates have rebounded past even prior highs, the stock price still remains depressed.

Chainarong Prasertthai

PayPal: A Long-Term Project

We have written about PayPal (NASDAQ:PYPL) multiple times in the past with a bullish sentiment (you can read some of our past analysis on the stock here and here), but things have taken… a while to materialize. While the stock hasn’t turned in a negative performance since our last article in January 2024, it has lagged the broader market overall with a ~7% total return against the S&P 500’s (SPY) total return for the same time period of ~15%.

PYPL Total Return VS SPY (Koyfin)

However, recent developments at the company and the performance of the stock have made us think that better days may finally be ahead for the company, and that the stock will improve from these levels. Let’s dive in!

Trading From A Discount

First, let’s start with some financials and valuation metrics. Everyone remembers the days when PayPal’s stock traded at a massive premium to the market before higher-for-longer interest rates and increasing competition laid it low. Today, the stock trades at a more than 25% discount on a relative basis to the wider S&P 500.

PYPL Relative Valuation to SPY (Koyfin)

Of course, this figure is not shocking given the general, pervasive sense of negativity surrounding the stock, such as investors becoming concerned about a lack of product distinctiveness and falling expectations. We think, however, that those concerns are a bit overblown–this is the payments’ industry, after all. While innovations do occur, they are rapidly adapted by competitors. Scale is what matters in this game.

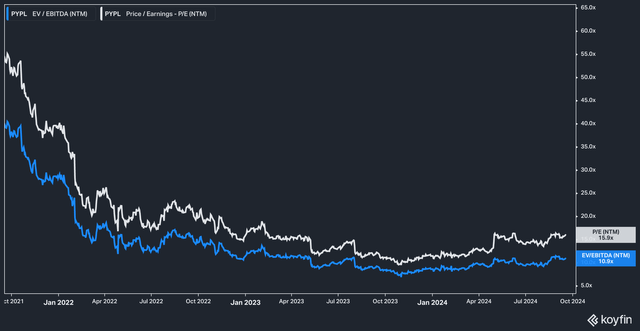

On a pure forward valuation basis, PayPal remains cheap as well.

PYPL EV/EBTIDA and PE, 3 yr (Koyfin)

With a forward P/E of only ~16x next year’s earnings estimates and an EV/EBITDA of ~11x, it’s clear to us that despite our optimism around PayPal, the wider market has not yet caught on to our enthusiasm.

PayPal is also cheap compared to its larger peers, with Visa (V) and Mastercard (MA) trading at 27x and 32x earnings, respectively. Block (SQ), arguably PayPal’s most pure competitor, currently trades at a 17x earnings valuation, a slight premium to PayPal, and a gap we think management can close and create new upward separation on with strong execution of new business lines.

In our view, these data points support our thesis that PayPal has brighter days ahead. Let’s take a look at one of the main drivers of our optimism.

New Leadership, New Business Lines

On August 14th of last year, PayPal’s board announced that Alex Chriss would join the company as CEO to succeed Dan Schulmann. This was big news–part of the main concern investors had around PayPal was the perception that things were getting stale in the C-suite (the reality of which was essentially confirmed by Chriss in a November 2023 interview he gave to American Banker). The news didn’t do much to move the stock upward, however, as Paul Singer’s Elliott Investment Management announced it was dissolving its stake in the company on the same day.

The market arguably values the opinion of Paul Singer more than an unproven CEO for a company that has been seen as having its best days behind it, so in the months following the announcement, the stock fell by ~18% before beginning a steady climb upward.

Now, however, there are real signs that the new management team is beginning to pull the company around the corner.

For one, in May of this year, the company brought on Mark Grether from Uber (UBER) to run its newly christened PayPal Ads division. While this development didn’t take center stage on PayPal’s latest earnings call, it was discussed in some detail on September 9th at the Goldman Sachs Communcacopia + Technology conference.

Chriss has this to say about PayPal’s new ad venture and the company’s unique proposition to advertisers:

This is really about data and it’s about being able to be personalized and strategic with your advertising dollars. Right now, when we look at both large enterprises and then the full long tail all the way through to small businesses, there’s a lot of ad dollars being spent in sort of general spray and pray type of advertising. It’s not targeted. It’s not all that effective and the costs are going up.

We have unique data and a unique experience with consumers. We’ve actually seen not just their intent of what they’re searching for, but we’ve seen their actual purchases. And we’re building profile information for those consumers. And with their permission and with their ability to adjust it, we can actually leverage that profile information and give our merchants the ability to target exactly the right customer that they want at the right time and have that advertising be effective in the ROI that they want to spend.

While it’s understandable that PayPal may not be touting this on their conference calls (after all, there are few things that say ‘give me your business’ worse than ‘we’re going to sell your data to advertisers’), this is something that should make PayPal’s investors extremely pleased.

PayPal, after all, has information that some of the most powerful ad generating machines on Earth don’t – actual purchase data. We think that this has the potential to become a real game-changer for the company, and provide a method for chipping away a decent slice of the multi-billion online ad market.

On the financial and fundamental side of things, we believe that the market continues to underestimate PayPal’s strength.

PYPL price performance vs. GAAP EPS estimates, 5yr (Koyfin)

The above chart illustrates perhaps the most fundamental reason why we are excited about PayPal stock right now. In late 2021 and into 2022, forward GAAP EPS estimates collapsed along with the stock price. Since then, the price has remained depressed while estimates have exceeded even the prior highs when the stock traded for a massive valuation.

Does that mean that PayPal will return to the lofty levels it once held? No. But what it could mean (and we think should mean) is a re-rating higher in accordance with the businesses current prospects.

Risks

Risks to our PayPal thesis are the Fed deciding not to cut interest rates, though we think the likelihood of that is minimal and may not even be a question by the time this piece reaches publication. Other risks center around execution: can the company deliver on its slew of new ideas? Management has had a year to assess and lay the groundwork for a new, reinvigorated PayPal. Now is the time to execute–which is much easier said than done.

Putting It All Together

PayPal has been the target of much negativity and pessimism in the market, and for a long time, the company probably deserved what it got. However, as new management grows into the role and expands and streamlines PayPal’s offerings, we think that the market is likely to eventually see the light and reward shareholders for their patience.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The content in this article is for informational, educational, and entertainment purposes only. This content is not investment advice, and individuals should conduct their own due diligence before investing. The author is not suggesting any investment recommendations—buy, sell, or otherwise. This article is not an investment research report but a reflection of the author’s opinion and own investment decisions based on the author’s best judgement at the time of writing and are subject to change without notice. The author does not provide personal or individualized investment advice or information tailored to the needs of any particular reader. Readers are responsible for their own investment decisions and should consult with their financial advisor before making any investment decisions. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer or the solicitation of an offer to buy or sell the securities or financial instruments mentioned. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.