Summary:

- PayPal is a leading fintech company with strong fundamentals.

- While its operating momentum has slowed down recently, its growth prospects over the medium term remain good.

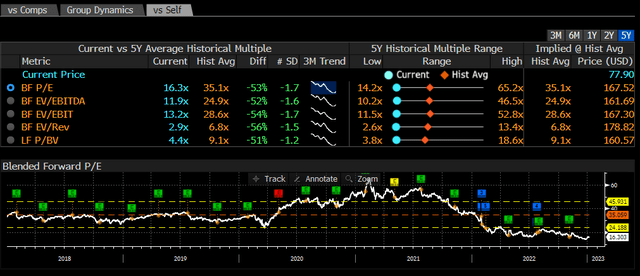

- Its valuation is too cheap at only 16x forward earning, providing a buying opportunity for long-term investors.

Prykhodov

PayPal (NASDAQ:PYPL) remains one of the best plays in the digital payments industry, due to strong business fundamentals and a rock-solid balance sheet. Its current valuation is quite cheap, showing that PayPal is undervalued and a good investment for long-term investors.

Background

As I’ve covered in previous articles, I see PayPal as one of the best plays in the long-term growth trend of digital payments and fintech.

PayPal is a leading fintech company that enables digital and mobile payments through its technology platform, and currently has a market value of about $87 billion. This value is much lower than in the recent past, as the company’s share price has corrected by some 77% since its peak in mid-2021, erasing all of its pandemic-driven gains.

PayPal’s shares have been quite weak over the past eighteen months, due to concerns of slowing growth, the possibility of paying too much on acquisitions (speculation on the Pinterest (PINS) deal), overall weakness in the digital payments industry, and an equities bear market.

Despite that, PayPal’s business continues to be quite strong and I like its long-term fundamentals, given that its position in the overall digital payments industry is not easy to challenge and PayPal should be one of the leading companies in this industry for many years ahead.

Business Model

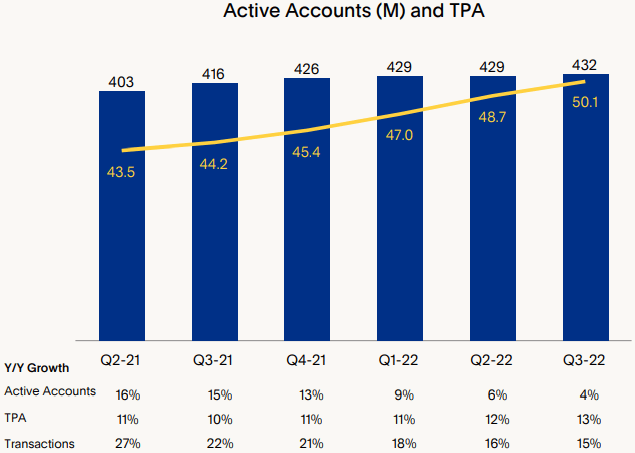

PayPal’s core business is the offering of payment solutions to merchants and consumers, operating across the globe. As of 30 September 2022, PayPal had about 432 million active accounts, including 35 million merchant accounts. While this represented an increase of 4% YoY, its growth has clearly decelerated from 2020-21, when it was growing its customer base by double-digits due to tailwinds from the pandemic and more people shopping online.

Active accounts (PayPal)

However, as can be seen in the previous graph, PayPal only increased its total active accounts by 6 million during 2022, which is much weaker than its historical growth since its IPO in 2015. Despite slower customer acquisition, its customer engagement has been quite good, given that total payment volume (TPA) and transactions have increased consistently at double-digits over the past few quarters, showing that PayPal’s existing customers are using PayPal more frequently as the company increases its product and services offerings.

Indeed, PayPal’s growth comes not only from a higher customer base but also by expanding verticals and increasing its total addressable market as the company is regularly adding new features and solutions to customers throughout its platforms, as part of its business strategy of offering a ‘super-app’.

Throughout its history, PayPal’s business has evolved significantly from being an online checkout button to offering several financial services. Its growth has been a combination of in-house developments and acquisitions, enabling it to increase its product and services offering, and its technological capabilities as well. PayPal has built a large network of consumers and merchants using its payment services, building a competitive advantage that is hard to challenge.

Taking into account this background and strong position in online payments, PayPal’s strategy has been to gradually integrate more products and services over the past few years, of which its acquisition of Venmo was quite important. This has enabled PayPal to be one of the largest players in the digital wallet space, reaching more than 77 million users in the U.S., helping it to eventually become a ‘super app’, which will basically be the primary source of all financial needs for consumers.

Even though the competition is quite fierce in the digital payments industry, PayPal has been able to consistently grow its business in recent years, showing that it has a superior business model and adapts its offerings rapidly to technological advances. For instance, PayPal has integrated cryptocurrencies into its digital wallets or has added Buy Now, Pay Later (BNPL) solutions included with PayPal checkout, two examples of how PayPal has expanded its products and services to remain very competitive in the financial industry.

Financial Performance

Regarding its financial performance, PayPal has a very good track record given that revenue and earnings increased quite rapidly over the past few years. More recently, PayPal’s business was boosted by the pandemic, which led to strong financial results both in 2020 and 2021. Its revenues amounted to $25.4 billion during the last year, an increase of 18.4% compared to 2020.

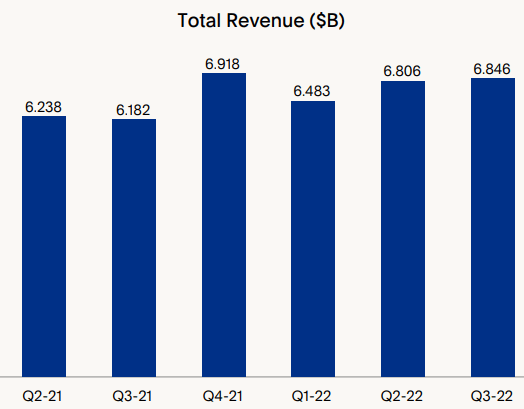

However, since mid-2021, growth has decelerated due to people moving again to physical stores, a weaker economic environment, the loss of payment volume from eBay (EBAY), and strong competition in the industry. During the first nine months of 2022, PayPal’s operating momentum has been relatively weak compared to its historical performance, even though there were positive signs of a rebound in the last quarter.

Indeed, in Q3 2022, its revenue amounted to $6.85 billion (up by 11% YoY), and 13% YoY ex-eBay, even though on a quarterly basis its revenue has been practically flat over the past few quarters.

Revenue (PayPal)

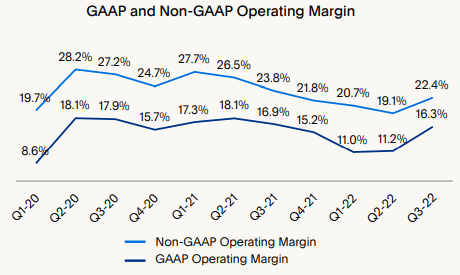

As revenue growth decelerated, but expenses continued to increase at a strong pace, due to inflationary pressures, higher funding costs, and the company’s investments, its operating margin has declined in recent quarters. In Q3, total operating expenses were $5.3 billion, an increase of 12.8% YoY, which led to a GAAP operating margin of 16.3%. This represented a rebound from the previous quarters, showing that after several quarters of negative operating momentum, PayPal is again delivering operating income growth.

Operating margin (PayPal)

For the full year, PayPal revised its guidance upwards and now expects annual revenue growth of 13% (ex-eBay), its non-GAAP EPS is expected to be in the range of $4.07-4.09, and free cash flow to be above $5 billion. Thus, despite the recent growth slowdown, PayPal is still growing quite strongly and its business remains highly cash generative, showing that it has strong fundamentals and its business is resilient during periods of challenging economic conditions.

Going forward, PayPal’s strategy should be focused both on user growth and higher user engagement as well, through new services like BNPL, crypto, or contactless in-store payment capabilities. New offerings are also expected to increase PayPal’s total addressable market, thus PayPal’s structural growth prospects remain good and its weaker financial performance in recent quarters may be only a temporary setback.

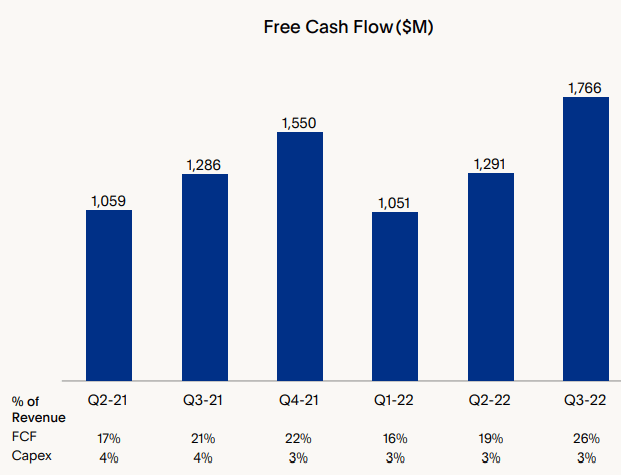

Regarding its capital allocation in recent quarters, PayPal has maintained a good cash flow generation capacity, which it uses to finance acquisitions and repurchase its own shares, while capex spending has been relatively limited as expected for a technology company. In Q3, PayPal generated the highest quarter free cash flow in its history of close to $1.8 billion (+37% YoY), a fantastic achievement during a difficult period. Moreover, its balance sheet remains very strong, given that it had a net cash position of about $5.5 billion, thus it does not need to retain much cash and can return a large part of its cash flow generation to shareholders ($939 million in Q3).

Free cash flow (PayPal)

Medium-Term Estimates & Valuation

While PayPal’s growth momentum has been weaker in recent quarters, the company’s long-term growth prospects remain good, supported by PayPal’s business strengths and competitive advantage in the industry.

According to analysts’ estimates, PayPal revenue should grow to $37.7 billion by 2025, which represents annual revenue growth of about 10% over the next three years, which is much lower than its historical growth, but still an acceptable growth rate for a company like PayPal. Its bottom line is expected to be above $5.4 billion by 2025, which seems quite conservative given that it represents a net profit margin of only 14.3% (vs. 16.4% in 2021).

Due to much lower estimates when compared to high expectations when the company presented at its investor day in February 2021, PayPal’s share price weakness since its peak in 2021 is clearly justified. As growth stalled, PayPal suffered a strong de-rating, given that its shares were trading at a peak valuation of more than 60x forward earnings (next twelve months), while currently, they are trading at some 16.3x forward earnings.

This is a very undemanding valuation for a growth company like PayPal, and way lower than its historical valuation of 35x forward earnings over the past five years. While I’m not expecting PayPal to trade again at its historical valuation, a multiple between 25-30x seems reasonable over the medium term, which means that PayPal has significant upside potential over the next two to three years, both from increasing earnings and a higher multiple.

Risks

Regarding the most important risks, I see competition and a pricey acquisition as two potential risks that investors should be aware of when investing in PayPal.

The global payments industry is quite fragmented and highly competitive, being in constant change. This means that PayPal’s leading position in the industry is not a certainty over the long term, as new entrants or technology developments may potentially weaken its position.

Indeed, there are a lot of players in this industry and competition is strong from traditional banks, payment companies, and fintech. However, the company recognizes these risks and is frequently innovating and integrating new products and services into its platforms, rapidly adapting its business to new offerings, such as BNPL or cryptocurrencies.

Another risk is PayPal’s strategy to become a ‘super app’, which may lead the company to pursue a large acquisition that may not be well received by the market. To some extent, this happened in 2021 with the speculation of a potential $45 billion acquisition of Pinterest. PayPal denied its interest in acquiring Pinterest, but the market punished PayPal’s shares, showing that a large deal must make sense, both from a business standpoint and also from a financial perspective, to be well received by the market.

Conclusion

PayPal has a very good business and its growth prospects remain strong, despite recent headwinds that caused severe share price weakness over the past eighteen months. Nevertheless, PayPal remains one of the best plays in the digital payments investment theme and its current valuation is clearly undemanding, providing a great entry point for long-term investors.

Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

If you are a long-term investor and want to be exposed to several secular growth trends, check out my marketplace service focused on different secular growth themes, namely: Digital Payments/FinTech, Semiconductors, 5G/IoT/Big Data, Electric Vehicles, and the Metaverse. If this is something that you may be interested in sign up today.