Summary:

- PayPal investors were hit by a massive selloff this week as the company reported its first-quarter earnings.

- Structural headwinds likely spooked investors, even as the company continues its growth in unbranded processing.

- PayPal bears could argue that the company’s network effect moat could weaken further, worsened by lower profitability.

- We assessed that the selloff is justified. However, the extent of the hammering has likely reflected its near-term headwinds.

- While it’s still too early to assess its medium-term risks, PYPL stock is still within the buy zone.

Justin Sullivan

PayPal Holdings, Inc. (PYPL) was hit by a train last week as CEO Dan Schulman and his team released their first-quarter earnings.

On the surface, PYPL‘s report was pretty decent, coming ahead of Wall Street estimates, as it upgraded its FY23 earnings guidance. Accordingly, PayPal lifted its full-year adjusted EPS outlook to $4.95, implying a 20% YoY growth, up markedly from its previous 18% uplift.

However, under the hood, PayPal sees stress on its transaction margins. Management didn’t inspire enough confidence indicating a lift in its transaction margins moving forward, pressured by the growth in unbranded processing.

Acting CFO Gabrielle Rabinovitch articulated that the company is on a “multiyear journey” to “transition the business” as PayPal strives to “drive more profitable volumes through the unbranded processing side.”

As a result, she prudently cautioned investors that it could “take several quarters” before we could potentially see an inflection in its transaction margin.

Revised Wall Street estimates on PayPal‘s transaction margins suggest structural weakness through FY25. Accordingly, the company is expected to post a transaction margin of 47.1% this year, down from last year’s 50.1%.

However, it’s expected to continue trending down through FY25, reaching 45.3%. As such, it should inform investors why management has been proactive in cutting its non-transaction-related OpEx over the past year, attempting to bolster its adjusted EBIT profitability.

Hence, investors face a structurally lower-margin business, despite the company’s valiant efforts to rein in its OpEx base. However, that effort is likely to run into challenges this year as the company laps the benefits moving ahead.

The TPV growth (up 30% YoY, FX neutral basis) in its unbranded business helped to bolster its overall TPV growth (12% increase, FX neutral basis) in Q1. However, its branded business TPV saw just 6.5% YoY growth (FX neutral) in Q1, way below its corporate average.

Therefore, while PayPal attempts to continue its transition to bolster growth through its unbranded business, investors are likely spooked by the structurally-lower profitability company. Coupled with the leveling of the tailwinds from its OpEx base improvement, investors have the right to ask whether PYPL is reasonably valued at the current levels.

Our intrinsic value assessment suggests that PYPL seems significantly undervalued, with a blended fair value closer to about $90. Therefore, the market’s reaction last week is hard to understand, as sellers wreaked havoc against PYPL, falling to lows last seen in 2017.

PYPL ended the week very close to last week’s lows, suggesting that buyers have yet to return to defend against the capitulation. Hence, it does bring into mind whether our intrinsic valuation assessment could have been too optimistic.

PYPL quant factor ratings (Seeking Alpha)

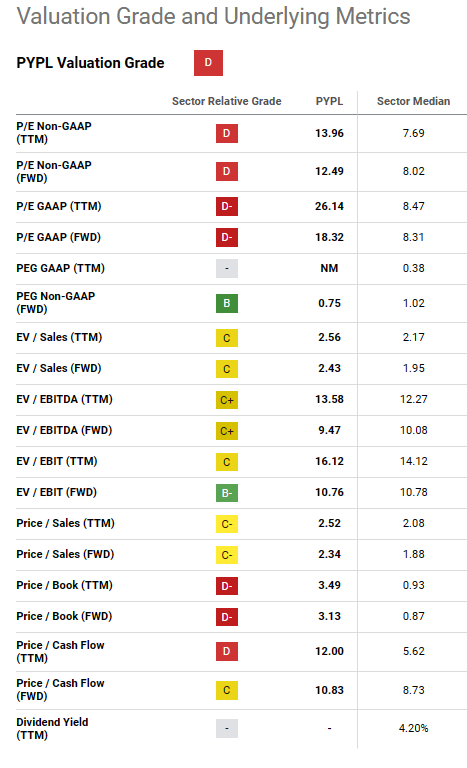

Seeking Alpha Quant rated PYPL‘s valuation with a “D” grade despite the steep selloff. The relative comparison with PayPal‘s sector peers suggests that PYPL still traded at a steep premium, as seen above.

Hence, the selloff could have been a substantial downward de-rating suggesting that the market thinks that PayPal‘s competitive moat could weaken with its new growth vector.

PayPal‘s moat is reflected in its “network effect.“ However, given the significant slowdown in branded processing, the market might consider that PayPal’s moat could weaken further as it moves further into unbranded, competing with Adyen (ADYEY) and Stripe.

Management attempted to assure investors that PayPal is “taking share,” as Schulman stressed:

Within the highly fragmented processing ecosystem, our PSP offering across unbranded and other merchant services is growing faster than the market, and we are taking share. We believe that in an apples-to-apples comparison, our volumes in these areas are now roughly equal to that of Adyen and Stripe. – PayPal earnings call

Adding to the increasing competitive threat that Apple (AAPL) has thrown at PYPL, the leading payments processing company could face worse structural headwinds.

Hence, PayPal bears could argue that our intrinsic value assessment is too optimistic, indicating that investors might need to account for a much wider margin of safety which we usually use to account for high-execution risk companies.

Considering that, we assessed that a 30% discount against our fair value estimates is justified, indicating that PYPL is still within the buy zone (marginally).

However, as the business could face substantial structural headwinds, suggesting that PayPal‘s consensus estimates could be too optimistic, we believe PYPL is no longer a steep bargain at the current levels.

With that in mind, we lower our rating on PYPL by one notch.

Rating: Buy (Revised from Strong Buy).

Important note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice. The rating is also not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have additional commentary to improve our thesis? Spotted a critical gap in our thesis? Saw something important that we didn’t? Agree or disagree? Comment below and let us know why, and help everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!