Summary:

- PayPal stock was on a roll but its rally was abruptly stopped due to mixed Q3 results.

- The company missed Revenue estimates mainly due to a change in pricing strategy.

- However, TPV, earnings, and share buybacks are all at record levels.

- One more metric — an important one — is set to break to new highs in the coming quarters.

- Valuation remains depressed — PayPal stock is still a Strong Buy.

loops7/iStock Unreleased via Getty Images

Introduction

Last time I covered PayPal (NASDAQ:PYPL), I highlighted 8 reasons why I believed PayPal was a Strong Buy at $64 a share. Here are the reasons:

- Massive two-sided payment network with 45% market share.

- Growing engagement within the ecosystem with Active Accounts increasing QoQ.

- Record TPV with a long growth runway ahead.

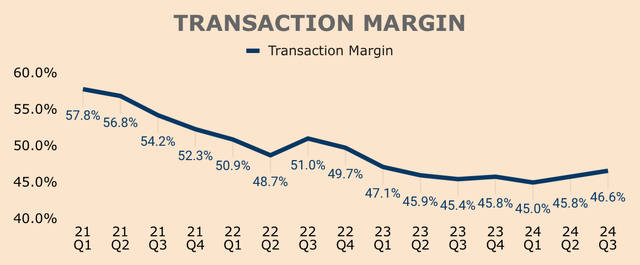

- Transaction Margin might have bottomed with ongoing monetization opportunities.

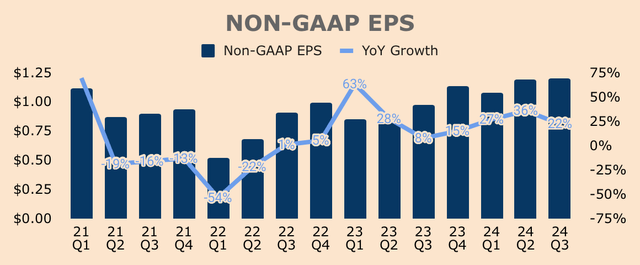

- Strong operating leverage with robust EPS growth.

- Rapid buybacks could compound investor returns.

- Raised guidance signals strong business momentum.

- PE ratio at an all-time low.

(Riyado Sofian — 8 Reasons To Buy PayPal)

Since that article, shares have rallied nearly 30% to $83.

The stock seemed unstoppable as it made new 52-week highs. However, it came to a screeching halt as shares slumped following the company’s Q3 earnings report.

In my eyes, this is just a healthy correction as PayPal’s underlying business fundamentals remain strong and the overall investment thesis remains intact.

Even after the recent rally and mixed Q3 results, the 8 reasons mentioned above still stand — I maintain my Strong Buy rating on PayPal stock.

Growth: Pending Record Active Accounts

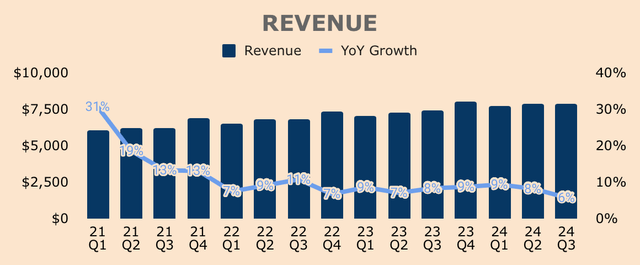

Jumping into the Q3 earnings report, Revenue came in at $7.8B, up just 6% YoY, which is the lowest quarterly growth PayPal has ever recorded as a public company. This also fell short of analyst expectations by $90M, which might explain the post-earnings selloff.

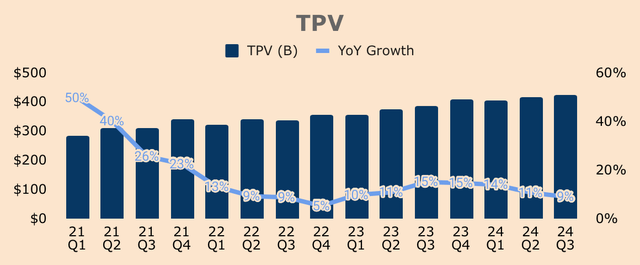

Nevertheless, Revenue growth for the quarter was driven by Total Payment Volume (TPV) growth across all major units:

- Branded Checkout TPV grew 6% YoY. This was relatively stable compared to prior periods.

- Unbranded Processing TPV grew 11% YoY. This was a major slowdown from 19% YoY growth in Q2 — another reason for the selloff. However, keep in mind that the slowdown was due to the shift in strategy from pricing-too-low to pricing-to-value. This is why, despite the slowdown, Braintree continues to contribute to the company’s Transaction Margin Dollar (TM$) growth.

- Venmo TPV grew 8% YoY. This was relatively stable compared to prior periods.

In aggregate, TPV was $423B, up 9% YoY, which again, is a slowdown from past quarters.

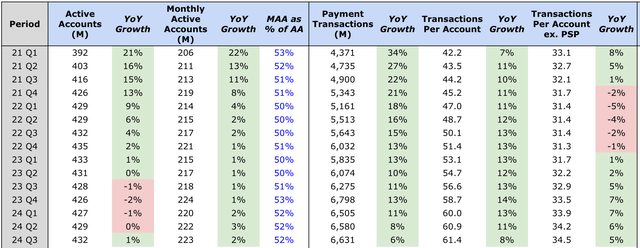

On the bright side, PayPal maintains strong engagement within its ecosystem. Most notably, PayPal added nearly 3M Active Accounts (AA) in Q3 to 432M and has grown its user base for three straight quarters. Monthly Active Accounts (MAA) also continue to grow, up 2% YoY to 223M in Q3. MAA as a % of AA was 52% in Q3, up 1 percentage point YoY, implying a more engaged user base as a whole.

In addition, Payment Transactions grew 6% YoY to 6.6B, resulting in 61.4 Transactions Per Account, which increased 8% YoY. Excluding Unbranded Processing, Transactions Per Account was 34.5, up 5% YoY.

The slowdown in growth across all metrics looks concerning at first glance. However, this was entirely driven by the deceleration in Unbranded Processing, or PSP, as management adopted a price-to-value strategy. This was intentional on management’s part as they “prioritize healthy, profitable growth rather than targeting a high proportion of processing volume at low or even negative margins”.

What this looks like in practice with some of our largest enterprise customers is often a renegotiated agreement that reduces our total share of payment processing to a more balanced level. So for example, from 95% to 75%, but with better economics and with a greater breadth of products and services.

(CFO Jamie Miller — PayPal FY2024 Q3 Earnings Call)

I don’t know about you but I prefer slow yet profitable growth over blistering but margin-destructive growth.

That said, expect the slowdown to continue as management guides for “low single-digit growth” in Q4, again, due to “Braintree merchant negotiations and ongoing efforts to drive quality, profitable growth”. On a positive note, management expects growth to reaccelerate at some point in the future.

As a result of these efforts, we expect lower Braintree volume and Revenue growth in the fourth quarter and through 2025 before reaccelerating from the reset baseline. This is a healthy profitable trade-off for the business that benefits Transaction Margin Dollar growth and build stronger, more strategic relationships.

(CFO Jamie Miller — PayPal FY2024 Q3 Earnings Call)

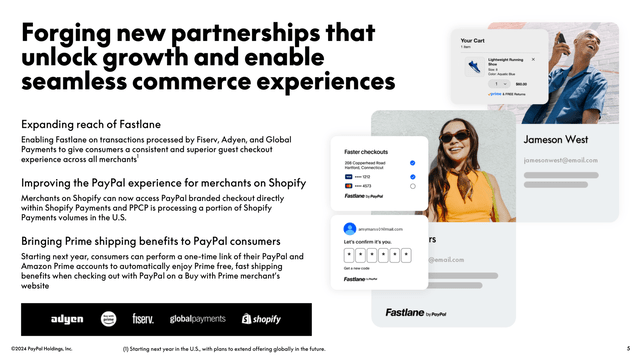

Speaking of strategic relationships, PayPal has announced new partnerships with some of the largest players in the e-commerce and payments industries, including:

- Adyen (OTCPK:ADYEY), Global Payments (GPN), and Fiserv (FI), to offer Fastlane by PayPal to accelerate guest checkouts — according to management, since its launch in August, over 1,000 merchants are now using Fastlane.

- Shopify (SHOP), with PayPal’s Branded Checkout integrated with Shopify Payments. In addition, PayPal Complete Payments (PPCP) will process a portion of Shopify’s US volume.

- Amazon, allowing consumers to checkout with PayPal on a Buy with Prime merchant’s website and automatically giving them free Prime shipping benefits.

PayPal FY2024 Q3 Earnings Presentation

What’s more, PayPal is investing heavily in improving its Branded Checkout experience. For one, the company recently launched PayPal Everywhere, which aims to drive higher omnichannel spending through improved mobile experiences and cashback rewards with the PayPal Debit Card. Since its launch in September, PayPal has added more than 1M new debit card users, and within the first two weeks of sign-up, PayPal saw a 5-fold increase in total omni spend.

Venmo is also seeing strong momentum with monthly active debit card users growing 30% in Q3. Keep in mind that debit card users spend 3 times more than non-debit card users, and considering that debit card penetration is only 5% of all Venmo active accounts, Venmo is still early in its monetization journey.

That being said, we should see PayPal’s growth accelerate once these partnerships and initiatives fully ramp up. More importantly, these developments should strengthen as well as expand the PayPal ecosystem.

As a reminder, PayPal recorded 432M Active Accounts in Q3. Its previous record was 435M back in Q4 of 2022, which is just 3M shy.

Considering PayPal’s renewed business momentum and the fact that Q4 is the holiday season, we might see Active Accounts reaching new all-time highs next quarter. This could be a major catalyst for the stock.

Profitability: Better Unit Economics

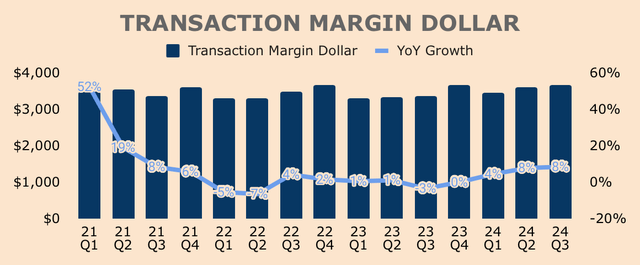

Despite lower volume growth due to the change in pricing strategy, PayPal was able to deliver higher TM$ growth, translating to improved unit economics per transaction.

As you can see, while volume growth has been slowing down, TM$ growth has been accelerating. In Q3, TM$ was $3.7B, up 8% YoY, the highest growth in 3 years. This was due to higher interest income, tech-led risk/loss improvements, branded checkout, Venmo, and Braintree.

However, it’s worth mentioning that management expects less interest income contribution in Q4 and beyond as interest rates start to come down. Excluding interest income, TM$ grew 6% YoY — moving forward, management will be focusing on driving growth in this metric.

Beginning in the fourth quarter, we expect minimal benefit from growth and interest on customer balances and then a headwind beginning in 2025 due to interest rate cuts.

(CFO Jamie Miller — PayPal FY2024 Q3 Earnings Call)

That said, as a result of strong TM$ growth, PayPal’s Transaction Margin saw a 120bps YoY and 80bps QoQ improvement, to 46.6% as of Q3. PayPal is still renegotiating its contracts with its clients, which takes time to materialize. The good news is that managements expect the renewals to be margin-accretive in the long run.

The agreements are typically multiyear in nature. Some renewals happen earlier than others. But we expect that more visible impact on TPV and Revenue over the next several quarters. But more importantly, we expect margin accretion to emerge over the next few years as well and part of that is these renegotiations.

(CFO Jamie Miller — PayPal FY2024 Q3 Earnings Call)

I’m excited to see how Transaction Margins evolve over the next few quarters as improvements in this metric is a bullish signal in regard to PayPal’s brand moat and pricing power.

What’s even more impressive, Q3 GAAP Operating Profit grew 19% YoY to $1.4B, resulting in a GAAP Operating Margin of 18%. This was due to strong TM$ growth as well as low Operating Expense growth of just 3%.

Consequently, Non-GAAP EPS grew 22% YoY to $1.20, which beat analyst estimates by $0.13.

Even though earnings growth has been robust over the last few quarters, management expects a “low to mid-single-digit decrease” in Non-GAAP EPS in Q4, to approximately $1.09 at the midpoint, mainly due to “elevated marketing spend to support key initiatives and new products”. I think the expected earnings decline took the markets by surprise — in a negative way of course.

Nevertheless, given all the new products and partnerships, I believe being aggressive in terms of acquiring new customers and maximizing engagement among existing customers, is the way to go.

That’s why you’ve seen so much focus for us in ‘24 around building a rewards platform and starting to – even in the marketing that you’ve seen us go out, really start to burn into the minds of our consumers that PayPal is the most rewarding experience and the most rewarding way to pay because we want people to be habituated into that Branded Checkout experience.

(CEO Alex Chriss — PayPal FY2024 Q3 Earnings Call)

On the Unbranded Processing side, PayPal is positioning itself as the “best value” provider while leveraging its unmatched scale, network, and brand, rather than being the cheapest processor in the payments industry. While growth may be negatively affected in the short term, pricing to value will pay dividends in the long run in the form of better unit economics.

And on the Branded Checkout side, the ramp of new products and improved branded experiences like PayPal Everywhere and Fastlane should drive higher engagement and account growth.

Ultimately, these initiatives should trickle down to PayPal’s bottom line, delivering robust earnings growth for shareholders.

Health: Record Buybacks

PayPal’s balance sheet remains solid with $16.2B of Cash and Investments. Total Debt was $12.4B, bringing its Net Cash position to about $3.8B.

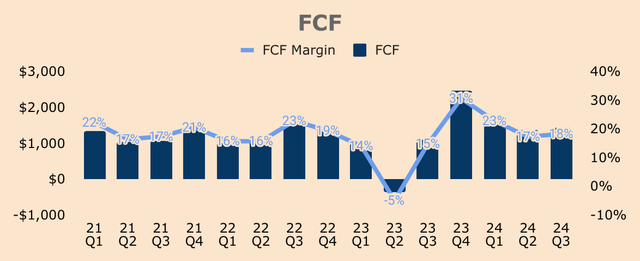

PayPal produced Free Cash Flows of $1.4B in Q3, representing an FCF Margin of 18%. Adjusted FCF, which excludes the impact from European BNPL loans, was $1.5B. PayPal used all the FCF generated during the quarter to buy back more shares.

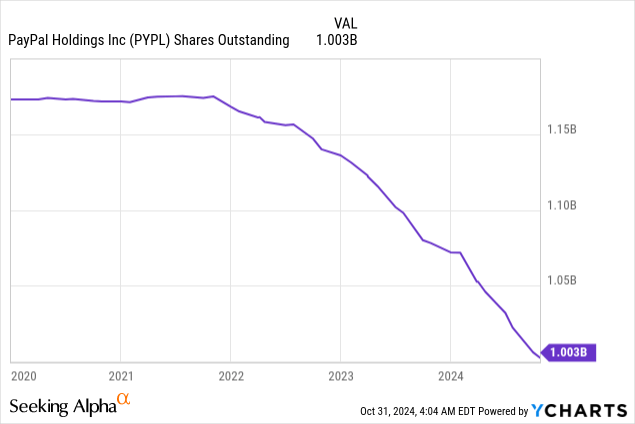

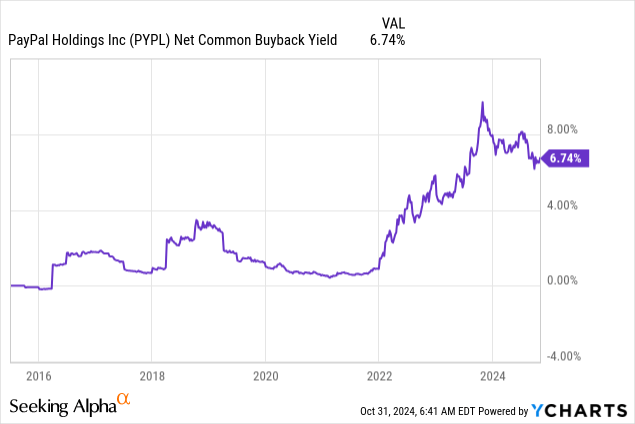

In Q3, PayPal repurchased $1.8B worth of common stock in Q3 — if I’m correct, this is PayPal’s highest buyback activity in a single quarter. On a trailing twelve-month basis, share repurchases totaled $5.4B, which helped reduce share count by 7% YoY. As you can see, its share count is in a free fall.

Management left their buyback guidance unchanged at $6.0B in 2024. Considering that PayPal repurchased $5.0B of common stock in the first three quarters of 2024, we can therefore expect at least $1.0B of repurchases in Q4. I predict at least $1.5B of repurchases in Q4, bringing its 2024 total to $6.5B.

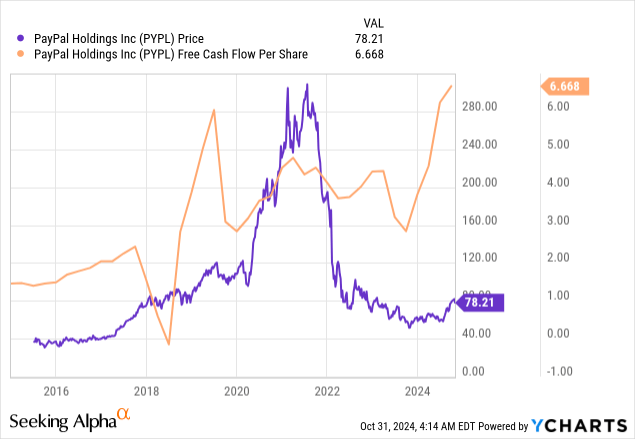

With record buybacks in place, its share count will continue to shrink, thus amplifying EPS and FCF/Share growth. As you can see, PayPal’s TTM FCF/Share is at all-time highs — eventually, the stock will track FCF/share.

Valuation: Still Dirt Cheap

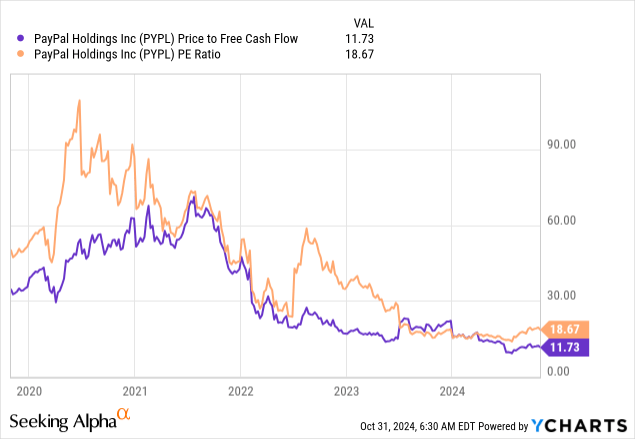

Turning to valuation, PayPal still trades at a PE Ratio and Price to FCF Ratio of 18.7x and 11.7x, respectively, and as you can see, both ratios are basically at their lows. This also represents an Earnings Yield of 5.4% and an FCF Yield of 8.5%, higher than the current 10-year Bond Yield of about 4.3%, making PayPal a relatively more attractive investment vehicle.

Thus, despite the recent run-up in share price, PayPal is still trading at dirt cheap valuations.

It’s also worth noting that PayPal is buying back shares aggressively at a Buyback Yield of 6.7%.

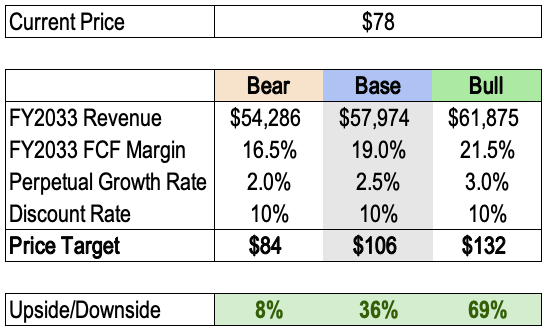

I have my base case price target at $106 a share, just $2 lower than in my previous article, mainly due to slower expected growth, offset by higher FCF Margins. This represents a 1-year upside potential of 36%, which is why I kept my Strong Buy rating on PayPal stock.

Author’s Analysis

Risks

- Growth Slowdown: With the change in pricing strategy, we saw how the Unbranded Processing side of the business decelerated substantially over the past couple of quarters. While I advocate for higher quality, higher margin Revenue, more merchants may churn in the process and PayPal may lose market share, which may lead to negative growth in the near term.

- Competition: The commoditization of digital wallets and payment processing services could pressure PayPal’s earnings and growth potential. But what caught me by surprise was that management decided to partner up with competitors like Adyen, Fiserv, Shopify, Amazon, and Global Payments, instead of undercutting them and hurting its bottom line. I think that’s clever of management.

Thesis

PayPal’s Q3 results were not the most impressive by any means, with the company missing Revenue estimates, solely due to a change in pricing strategy, which saw a material slowdown in its Unbranded Processing unit.

However, the silver lining is that PayPal continues to process record volumes, and still manages to grow earnings and FCF at a rapid clip. Moreover, the company is still buying back shares aggressively, which should lower share count and subsequently boost per-share metrics.

Not to forget, valuation remains depressed — even taking into account the recent rally over the past month or so.

As a reminder, PayPal is the largest two-sided payment network in the world. Importantly, PayPal has strategically partnered with industry juggernauts and is proactively improving its Branded Checkout experience, which should attract more users to the platform.

After all, Active Accounts is only 3M away from its previous record of 435M — we could see new highs as early as Q4.

Exciting times ahead for PayPal.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.