Summary:

- As e-commerce penetration in retail sales is anticipated to increase significantly, the outlook for the industry is very promising.

- The diminished non-transaction expenses mitigate the margin contraction. The margin should improve after a number of quarters when the transaction margin stabilizes.

- Current macro headwinds and decline of retail sales in Euroarea, UK, and potentially in US remain the key threat, impacting the business model and TPV.

- Forward P/E under 13 with double-digit growth and a strong brand is difficult to find on the market today. Historically, based on EV/EBITDA and EBITDA margin, PYPL stock should trade much higher.

Justin Sullivan

When the stock price of PayPal Holdings, Inc. (NASDAQ:PYPL) dropped below 130 USD, I began to pay careful attention. The stock’s freefall is, in my opinion, exaggerated; at current prices, the company’s growth prospects, opportunities, and valuation make it increasingly attractive. Nonetheless, the company’s future is precarious due to shrinking margins, macroeconomic factors, and a significantly expanding competitive landscape. There are also new threats, such as FedNow in the United States, which allows banking customers to settle real-time payments. Such a technological development could hinder the expansion of PayPal in the United States, despite the fact that it is the company’s most important market. Nonetheless, PayPal still possesses a competitive advantage, which distinguishes the company from other service providers, and holds a substantial market share worldwide. E-commerce is advancing, which should be a great long-term driver of additional growth. However, over the course of the next few quarters, macroeconomic headwinds could slow growth as consumers have less disposable income. Nevertheless, the industry outlook appears to be very positive, and the combination of product scalability and a cheap valuation makes it very attractive under the current circumstances.

Industry overview and outlook

While almost everyone is familiar with PayPal and its services, we will also be discussing the competition, so it would be appropriate to look for a competitive advantage and a very brief introduction to the company.

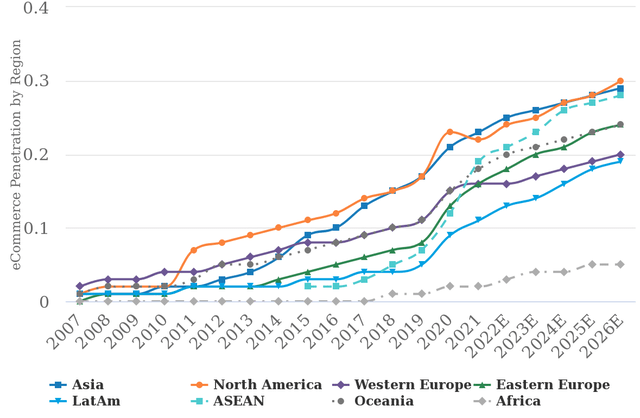

The PayPal business model provides a highly secure online platform, multiple payment options, and financial services with added value. Users can link their bank accounts, credit cards, and digital wallets, allowing for real-time transactions. eBay has played a significant role in the development of business models over the past decade. The business targets all types of customers, including small and medium-sized businesses, large corporations, and individuals. As previously stated, PayPal operates in an e-commerce environment, which is advantageous for the long-term as more and more volume is held online in both developed and developing nations. Therefore, if the company continues on its current path, the company’s potential is enormous. You can view the eCommerce Penetration by Region and its projected growth over the following years in the chart below.

As Mr. Brian Nowak from Morgan Stanley noted:

While the rise of e-commerce during the first year of Covid-19 in 2020 is easily explained, the fact that growth persisted in 2021 is evidence of a real behavioral shift to shopping online.

E-commerce as a percentage of retail sales continues to grow across regions (Euromonitor, National Data Sources, Morgan Stanley Research estimates)

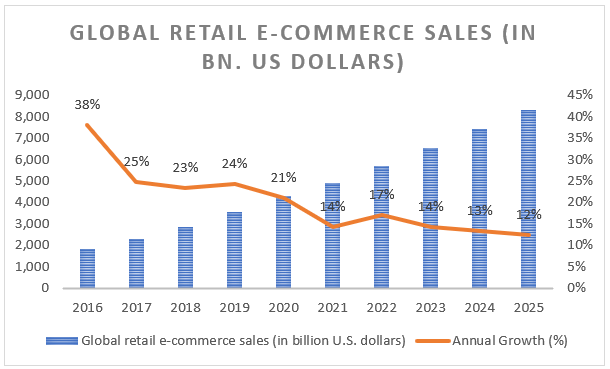

The anticipated increase in eCommerce market share provides PayPal and its competitors with a favorable outlook for the future. Despite the fact that volume estimates vary by country, type, and other metrics, Statista seems great potential in this market. From 2015 sales of $1,336 billion USD to a potential of $8,334 billion USD till 2025, which represents a 20% annual CAGR. From 2019 on, CAGR is reduced to 15%.

Global retail e-commerce sales (in bn. USD dollars) (Statista)

As the company is well-known among investors and the general public, a detailed introduction is unnecessary. Due to its strong brand recognition, loyal customer base, protection from buyer and seller, BNPL loans, and financial services related to merchants through Braintree and other services through PCPP, I believe PayPal still has a competitive advantage over its rivals. However, PayPal’s services may struggle in countries with strong customer protection that does not require the use of a platform, real-time retail payment settlements via bank transfers, and an acceptable fee structure provided by other fintechs. PayPal is an excellent tool, but not everyone can use it. As a European citizen, I find it unattractive. It is impacted by high FX fees and unfavourable currency fluctuations, and it requires a high margin from merchants who sell their products via PayPal to any retail platform. There are some fintechs which offer better FX rates. The customer protection is quite strong if you are buying the products within Europe. However, there is evidence that PayPal’s services and methods can increase product sales. So for merchants, it’s a big plus.

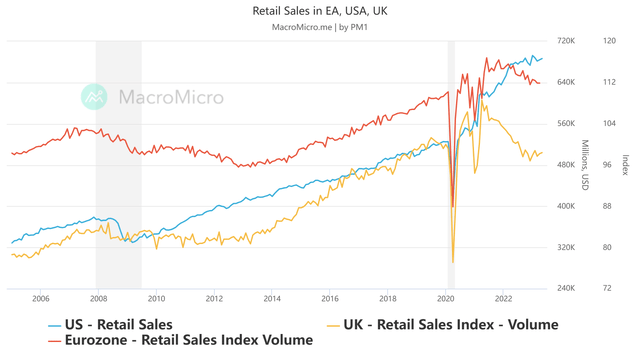

Retail Sales face headwinds in EA and UK

While retail sales in the United States remain robust, we observe significant headwinds in the United Kingdom and a slight decline in the Eurozone. Moreover, if we adjusted these data for inflation to obtain real retail sales, they would decline substantially. It indicates that volumes are declining, but we do not observe a similar decline due to higher nominal product prices as a result of inflation. I have created this chart via @MacroMicro.me.

Retail Sales in EA, USA, UL (Author via MacroMicro)

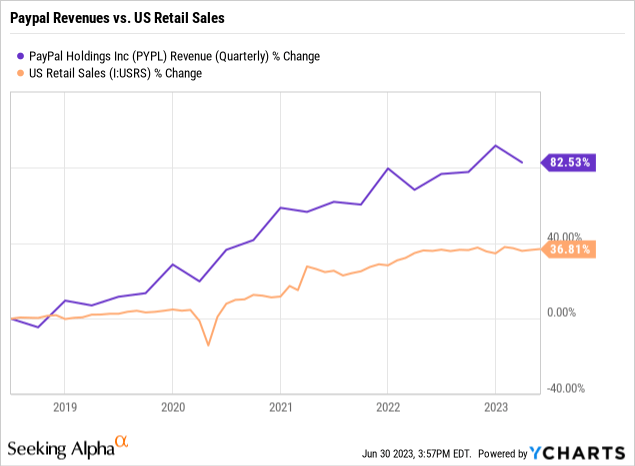

While retail sales are essential for e-commerce players and PayPal’s business model, the company’s overall results are not experiencing any significant issues or a downward trend. It is due to the numerous references to an optimistic industry outlook and the continued expansion of market share to new regions and retailers. Looking at the chart below, it is simple to see how PayPal’s revenue and retail sales have increased over the past five years. Yes, PayPal’s revenues are also affected by international revenue streams, but the trend is very positive despite global macroeconomic headwinds that have a significant impact on retail sales (and TPV), primarily in the UK and EA. In my opinion and belief, this is due to the continued expansion of digital payments and e-commerce.

And as the CEO mentioned in the earnings call, I believe management seems similarly:

The other thing is, look, we came into the year with really muted expectations around e-commerce global, e-commerce growth. We thought it could be anywhere from like negative 2% to maybe positive 2%, call it flat in general. We saw that pickup in first quarter. We think it could be low single digits, maybe mid — as high as mid-single digits.

Clearly, consumers are turning more of their spend to e-commerce, and I think many of us expect it. And as long as we continue to see those trends, we think now it is very different than what we thought coming in that the back half growth is going to be equal to our first half growth. So it’s a much improved outlook than we have before.

Crucial takeaways from the latest earnings call and latest updates

From a financial standpoint, PayPal’s revenues totaled $7.04 billion, with branded TPV increasing by 6.5% YoY and unbranded TPV increasing by 30% YoY on a currency-neutral basis. Non-GAAP EPS for the first quarter of 2023 increased by a very solid 33% to $1.17, outperforming expectations and unexpectedly increasing EPS guidance, but outlook for operating margin decreased by 25 basis points.

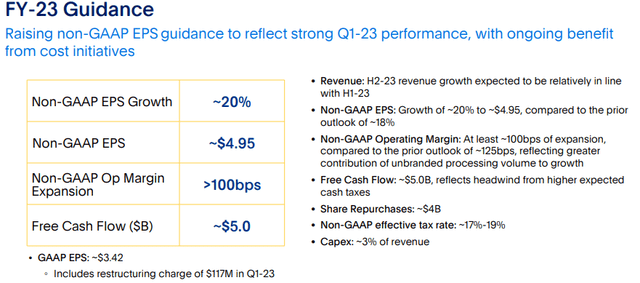

PayPal´s FY-23 Guidance (PayPal)

PayPal raised its outlook for group EPS growth from 18% to 20%, totaling $4.95, which I believe could be substantially higher due to the sale of its Buy Now, Pay Later (BNPL) loans in Europe to KKR, a private equity firm. According to the news, this deal was already included in the projection. The transaction is anticipated to generate approximately $1.8 billion for PayPal in the second quarter of 2023. Some estimates suggest that it could increase the company’s EPS by 2% in 2023. Due to increasing credit risks in Europe as a result of aggressive monetary tightening in Europe and an increase in the probability of delinquency rates, it may be a prudent move.

While such BNPL payments are a good option when there is an abundance of credit (monetary easing) and delinquency rates tend to decrease, it could be a good step in this time frame. During the period of strong tightening, the group may be exposed to greater risk, as they are not yielding for the “loan” period, which is merely interest-free, but are exposed to much greater risks. Despite the fact that I believe it’s a great tool for customers and PayPal’s business in the long run, I believe the current step is very appropriate. However, the efficiency with which these funds are spent is questionable. Some sources report:

PayPal expects the deal to initially generate about $1.8 billion, which the company plans to use to return capital to shareholders. PayPal said the deal is already contemplated in its full-year earnings and adjusted earnings outlook.

While this is good news for shareholders and the company as it reduces its credit risk, it is questionable whether reinvestments would be a better course of action. However, it has just demonstrated that shareholder value is a top priority.

Margins under the scrutiny and competition battle

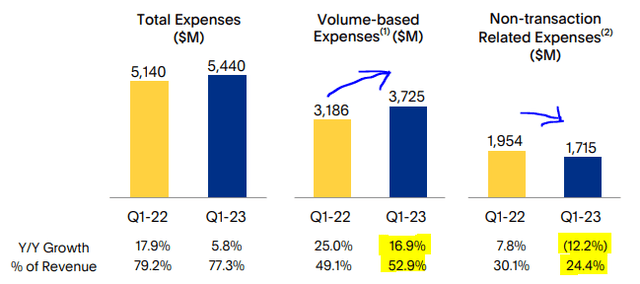

PayPal’s margin is one area where I anticipate potential difficulties. In my opinion, PayPal is expensive, particularly for retailers. Despite management’s efforts to reduce operating costs, long-term margins are declining. Decreased non-transaction related expenses serve as a mitigating factor. The following table details the increase of specific expenses. Volume-based expenses increased by 17% YoY and now account for 53% of revenues (previously 49%), whereas non-transaction-related expenses decreased by 12% YoY and now account for 24.4% of revenues (previously 30%).

Volume-based vs. non-transaction related expenses (PayPal)

Higher volume-based expenses were the result of increased credit provisions, which are expected to decrease in the next quarter due to the sale of a significant portion of the BNPL portfolio. The second reason, in my opinion, for their decision to sale is to increase profitability. Currently, the company is required to create provisions, which increases volume-based expenses and decreases both operating income and net income. Thus, the impact of increasing credit provisions on earnings per share is direct.

However, management repeatedly mentioned in the earnings call the significant cost-cutting efforts, increased efficiency, and increased TM rate:

And then just from a TM standpoint, we did see some pressure as well in Q1 specifically on the unbranded side for PayPal. And this is not Brain business. This is the transitioning of our unbranded processing on the PayPal side to PPCP has created some pressure in the quarter, which we don’t to be sort of ongoing as we think about how we exit the year given what our expectations are for PPCP. So we’re continuing to be disciplined about the growth of the business. I would say Q1 did have some nuances to it, which included about 130 basis impact just from normalizing our credit provisions. So that’s not specifically related to unbranded, branded mix. It really was sort of credit loss provisioning that impacted the TM rate as well. We do expect all these strategies to start to play out and start to help turn the overall TM profile, but I would expect it’s going to take a number of quarters before we see what we would call an inflexion point. First of all, obviously, we had good solid progress against what we said we’re going to do, negative 12% in Q1. I think our OpEx for the full year could decline as much as negative 10%, which is a bit higher than we expected. By the way, it’s not about cost reduction. It’s about doing things better.

While there may still be pressure from TM expenses in 2023, I believe it will pay off, as the unbranded segment is rapidly expanding. Moreover, according to management, they are just getting started with AI and its cost-nature, which is a positive development. AI will have an impact and enable not only cost reduction and performance enhancement, but also the completion of tasks without trade-offs. It requires performing both in that area.

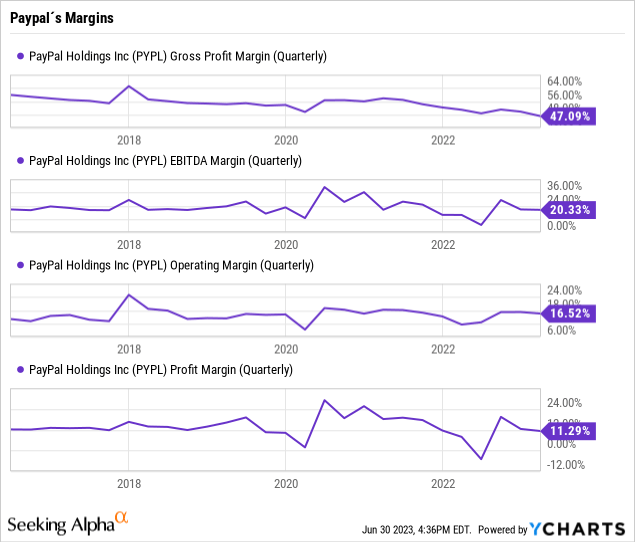

Moreover, the relationship between stock price, margins, and net income is quite evident. If the profit margin does not improve, the stock price will not recover. Despite its dubiousness, gross margin had to be reduced in order to become increasingly competitive in the face of intensifying competition. Nevertheless, the outlook for the industry remains strong, so I believe that, in the long run, we will see higher EPS even if we would see lower-persisting margins.

However, PayPal has its own extremely robust clientele and target population trends, and I believe there is a tremendous untapped potential in EMEA countries. There are solid grounds for my belief that PayPal will succeed in the future. The first is the industry outlook, which is rapidly expanding. It’s the most important factor. Global e-commerce payments are increasing, and their market share will continue to expand annually. In addition, I would like to discuss my perspective on the competition, as I believe it is an excellent topic. Nonetheless, I am certain that the company’s market share will not be jeopardized if it is able to compete in a landscape of increasing competition. Just maintain it. Even if the company’s market share were to decline, which is likely due to the presence of a large number of known and unknown competitors, I am confident that the company will expand due to the optimistic industry outlook. In addition, even if the company decided to implement a new product or service, it could afford to do so very easily because it has the industry’s most devoted customer base and the largest market share.

The platform is not irreplaceable, but it is adaptable and beneficial for both buyers and sellers

As previously stated, there are a large number of users who enjoy the platform, and due to PayPal, merchants are increasing their sales because customers are more at ease in terms of safety. Through Braintree, it is vastly improving merchant tools such as payment acceptance, enabling multiple payment methods (debit cards, credit cards, and digital wallets), and managing customer information. It combines the capabilities of Braintree and other PayPal services via PayPal Commerce Platform. PCPP’s objective is to provide businesses with a comprehensive set of tools and services for managing their payments, financial, and commerce operations, as well as advanced features such as subscription management and fraud protection.

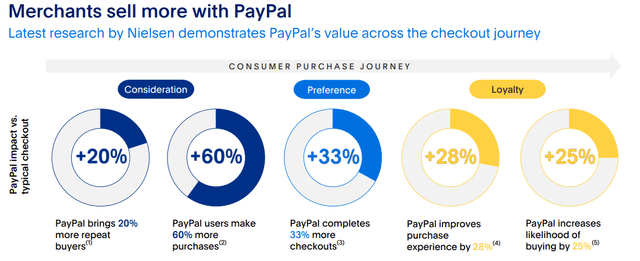

I believe that PayPal’s most significant competitive advantage is its core characteristics. Nonetheless, as I will explain below, PayPal’s ecosystem for merchants is a value-added method that can enhance their business models. According to PayPal’s research, businesses that use this platform sell more and become more attractive. It is based not only on my personal experience but also on the experiences of other users. When utilizing a platform, consumers become more daring when deciding to purchase goods internationally, particularly from lesser-known sellers.

Merchants sell more with PayPal (PayPal 1Q2023)

In addition, there are newly announced contracts with major brands:

We are currently piloting the upcoming launch of Venmo teen accounts, which have been requested by both parents and teens for some time. Our Amazon and Starbucks experiences continue to grow nicely, and we recently launched PayPal and Venmo with McDonald’s and just signed a deal with Microsoft to launch both Pay with Venmo and Buy Now, Pay Later for Microsoft’s Xbox store.

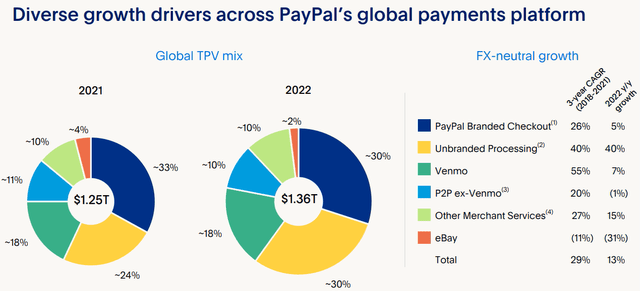

Regarding the Global TPV mix, which amounted to $1.36 trillion in FY 2022, 30% was unbranded processing, 30% was PayPal Branded checkout, 18% was Venmo, and the remaining 8% was comprised of other payment methods. Contribution from eBay Inc. (EBAY) is currently minimal. While TPV growth compared to 2021 was quite astounding, reaching 13% YoY FXN, it is doubtful that we will be able to surpass this number due to declining retail sales in Europe and the United Kingdom. On the other hand, if PayPal continues to improve and the unbranded category continues to grow (which is now the largest contributor), as well as if PayPal continues to expand significantly, I believe that the stock will experience substantial growth.

Diverse growth drivers across PayPal´s TPV (PayPal 4Q2022)

Earnings revision, share buybacks and valuation

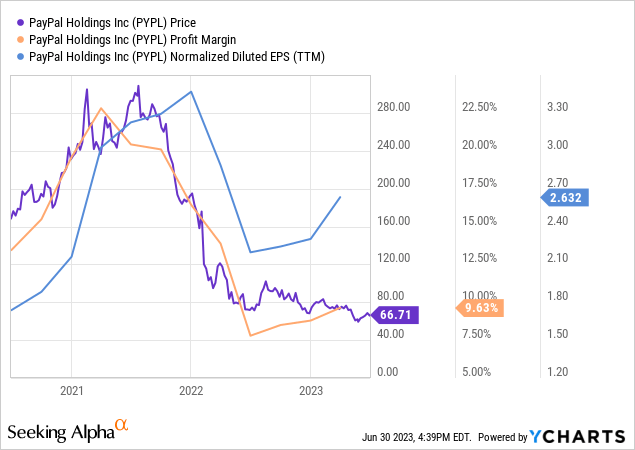

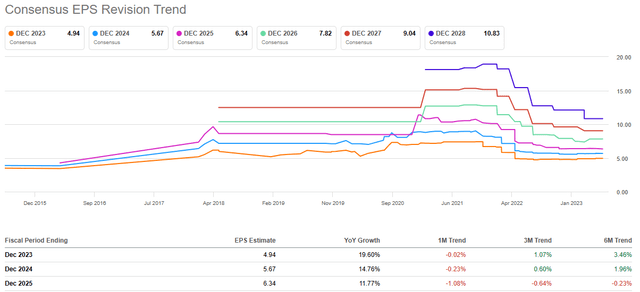

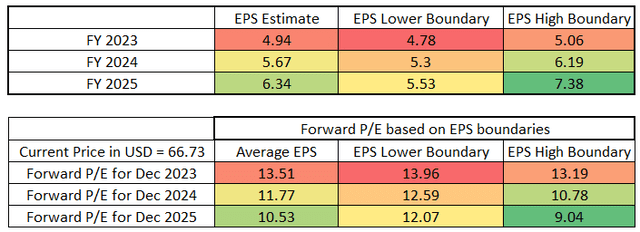

First, the significant price decline is also influenced by the massive negative EPS revision trend, which peaked in 2021 and reached historical lows in 2023. The management and analysts predicted that the COVID trend in e-commerce would persist in the event of growth, which now appears to be an extremely optimistic prediction. However, it appears that we have found a bottom in terms of estimated Dec 2023 EPS as well as EPS for 2024, with estimates for Dec 2023 increasing from $4.72 to $4.94 and for Dec 2024 increasing from $5.55 to $5.67.

PayPal – Consensus EPS Revision Trend (Seeking Alpha)

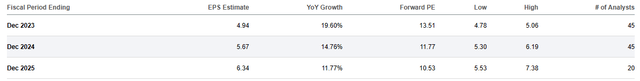

Similarly volatile is the revenue stream. However, we can see that the correlation between stock price and earnings revision trend published in the SA section is significant. Nevertheless, based on this estimate, the current pricing is becoming extremely attractive. While it is anticipated that the company’s EPS will increase by double digits in the first three years, the Forward P/E for Dec 2023 is astonishingly attractive at 13.5 and for Dec 2024 it is 11.77. Despite increasing competition, I find it to be a bargain for such a fast-growing company that proves its dominance annually.

EPS and Forward P/E projections (Seeking Alpha)

However, PayPal’s policy is to concentrate a large portion of FCF on share repurchases. However, based on the current market price, as of writing, of $66.7 for PayPal, the minimum and maximum Forward P/E are as follows:

Forward P/E and EPS Boundaries (Author via Seeking Alpha)

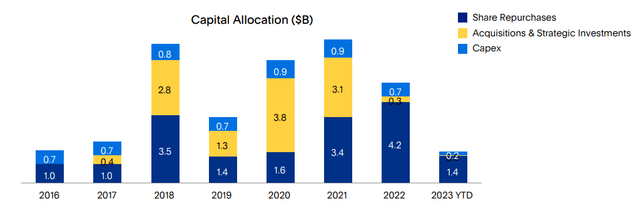

In the most recent earnings call, management disclosed plans to use $4 billion in FCF for share repurchases. Imagine that the same policy will persist in FY 2024 and FY 2025. The company’s robust buyback policy will continue to be supported, in my opinion, by its increasing profitability and projected cash flow. Just assume $3 to $4 billion in share repurchases over the next three years annually. It could be $9 to $12 billion by the end of the fiscal year 2025. With a current market capitalization of nearly $76 billion and an attractive valuation, it is remarkable.

PayPal – Capital Allocation (PayPal 1Q2023)

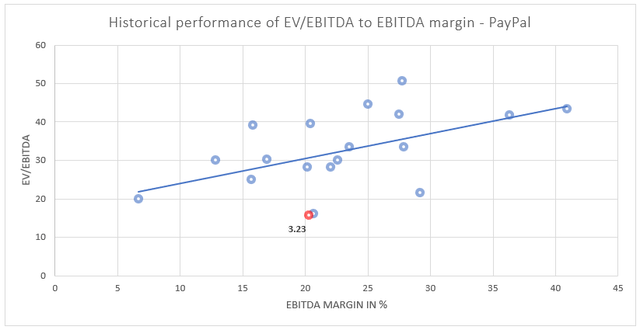

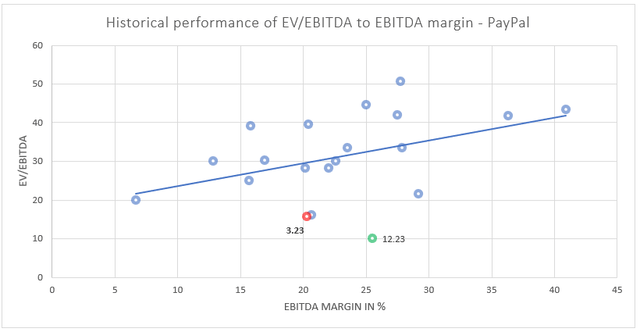

Note that these P/E ratios reflect the fact that PayPal is becoming extremely cheap based on Forward P/E valuation. You simply do not see a company with a clear focus on generating double-digit EPS growth year after year, along with a very cheap valuation based on Forward P/E under 15. (with such great market share). However, there are numerous comparison and valuation methods available, and it is always a good idea to determine whether a company is inexpensive based on certain metrics. I created a scatterplot based on the historical multiple of EV/EBITDA (for each quarter from 9/2018 to 3/2023) and EBITDA margin. However, this only confirms that the multiple premium should be higher as the margin increases. Now, for the 1Q 2023, PayPal has achieved an EBITDA margin of 20.3%, while its EV/EBITDA ratio at the end of the 1Q was 15.74. Now it would be less, as market capitalization has just decreased as a result of falling prices.

PayPal -Historical performance of EV/EBITDA to EBITDA margin (Author. Dataset by GuruFocus.)

Based on these assumptions (EBITDA margin), PayPal is almost 50 percent undervalued relative to its historical evidence, despite the fact that one could argue that it is still not cheap. On the basis of historical data, the fair value would not be EV/EBITDA equaling 15.74 with 20.3%, but instead it would be 30.7. According to these data from GuruFocus, in my calculation the stock would need to increase by 96% to reach its fair value, based on its historical EBITDA margin and EV/EBITDA relation. Why it is not simple, it is just another indication that PayPal is trading at a discount relative to its historical evidence. However, we should consider some forward-looking datasets. According to Seeking Alpha’s estimates, the Forward EV/EBITDA ratio is an absolute bargain, reaching 9.97, which is 7.0% below the sector average and 62% below the 5-year average. Nevertheless, I believe it is always appropriate to compare these ratios to margin or forward-looking statements.

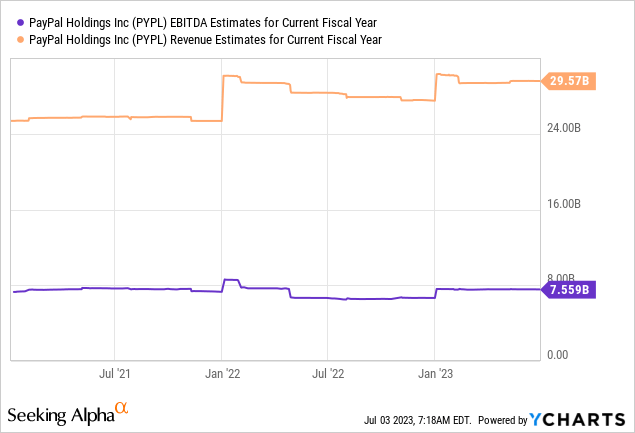

Using YCHARTS data, we can easily conduct a forward-looking analysis if we seek revenue estimates for the current fiscal year and EBITDA. We can estimate the EBITDA margin, which is expected to rise to 25.5%. It is uncertain whether the company will reach this goal, but based on current levels, the forward EV/EBITDA ratio relative to its estimated EBITDA margin would appear as follows (12.23 due to year-end):

PayPal – Historical performance of EV/EBITDA to EBITDA margin (Author. Data by GuruFocus and Seeking Alpha)

Summary and risks

I am aware that estimates are subject to change every month. Nevertheless, based on the revision trend, we can assume that the EPS bottom is behind us for FY 2023. Assuming that is fairly valued and even if it materializes, the relationship between current and fair value based on EV/EBITDA and EBITDA margin would be even greater than it is now. On the other hand, due to numerous macro factors, the group may not achieve the same high valuations as it did during the bubble period in late 2021 and early 2022. In addition, it may not reach such a valuation based on trading multiples because its growth will be less significant than in previous years. In spite of Forward P/E, EV/EBITDA, and margin development, PayPal is still, in my opinion, excessively cheap.

However, there is still expanding competition from many parties, including Google Pay, Apple Pay, Block (SQ), and many more. I believe PayPal still has a competitive advantage, primarily due to its excellent relationship with merchants, whose payment options perform better when PayPal is integrated. Despite the downward trend in margins, I anticipate that this will be temporary in 2023. On the other hand, non-transaction-related expenses, which have decreased substantially, should decrease in the upcoming quarters thanks to the AI, providing a significant mitigating factor. A couple of quarters from now, both transaction-related and non-transaction-related expenses should have made more substantial progress. Braintree is largely responsible for the significant growth of unbranded volumes in TPV, as the company’s market share continues to rise. Overall and global TPV will be a challenge in 2023 due to weakening retail sales in the United Kingdom, the Euroarea, and possibly the United States. That is a significant risk going forward. Therefore, if the US retail sales trend worsens, it can reduce margins and profitability and make stock even more affordable. On the other hand, the continued expansion of e-commerce should mitigate even this factor. Considering the next two to three years, I believe there is ample room for expansion if macroeconomic headwinds disappear. Nonetheless, this company should be placed on a watchlist due to increasing competition. However, in my view, any company in the industry – Transaction & Payment Processing Services – has neither a customer- nor a merchant-friendly platform as PayPal.

In conclusion, I consider this company and its stock to be undervalued due to the extremely positive outlook for the industry as a whole, despite the possibility of continuing macroeconomic headwinds, the combination of a low valuation and the expectation of improved margins primarily after several quarters, as well as a quality product with a strong market share. However, despite my expectation of a short- to medium-term slowdown in the technology sector, I believe there may be an opportunity to load up on shares for less than 60-62 USD.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PYPL over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.