Summary:

- We are maintaining our HOLD on PayPal.

- Consistent with our expectations, PayPal’s active accounts contracted in 3Q23, and we expect the active accounts growth to remain under pressure through 2024.

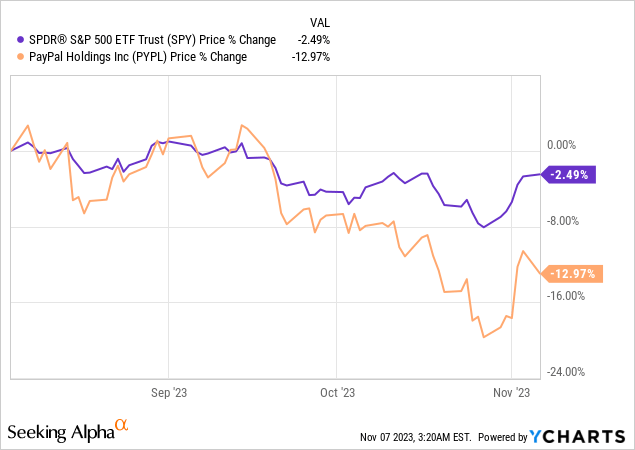

- PYPL stock has declined about 13% in the last three months and underperformed the S&P 500 by over 10%.

- We believe the recent stock price recovery is attributed to management’s cost cuts while focusing on profitable growth. We are, however, less excited about this strategy.

- We expect the stock to be an inline performer through 1H24.

Abstract Aerial Art/DigitalVision via Getty Images

We are maintaining our hold rating on PayPal (NASDAQ:PYPL) despite better-than-expected earnings results. Consistent with our expectations, PayPal’s active accounts contracted this quarter, and we expect active account growth to remain under pressure through 2024. We attribute PayPal’s earnings beat to higher transaction volume, which is a near-term positive but won’t sustain longer financial outperformance, in our opinion. While we think macro headwinds are subsidizing and consumer spending continues to show resilience, especially after the Fed kept rates stable this month, we don’t see enough near-term catalysts to offset the slower active account growth.

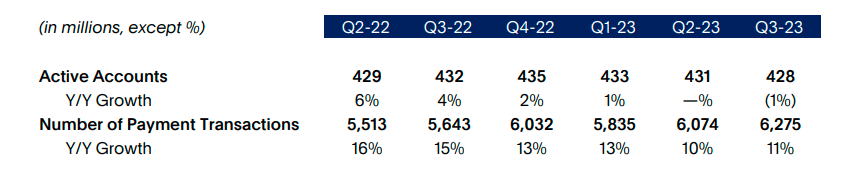

PayPal’s active accounts contracted in 3Q23 as expected. The following chart from 3Q23 outlines the slower growth rate of active accounts Y/Y in FY23.

3Q23 earnings presentation

PayPal reported revenue of $7.418B, up 1.79% QoQ and 8% Y/Y; revenue growth slowed sequentially this quarter compared to 2Q23, in which revenue grew 3.5% QoQ. We expect pressure will remain on top-line and active accounts growth. Despite the upcoming Holiday season, which historically boosts sales between Black Friday, Christmas, and New Year, management still guided lower than consensus for the next quarter, guiding for revenue growth of 6-7% Y/Y. We’re less optimistic about the stock’s upside in the near term and recommend investors stay on the sidelines as we think PayPal will be an in-line performer through 1H24. The stock is down 13% over the last three months, underperforming the S&P 500 by over 10%.

The chart below outlines PYPL’s three-month performance against the S&P 500.

YCharts

We don’t see outperformance through 1H24, primarily due to macro headwinds and stiff competition from Apple Pay. Apple (AAPL) has seen its service category surge QoQ throughout FY23; we think Apple Pay is slowly grabbing market share due to its integrated nature in the Apple ecosystem. We expect PayPal to start losing market share faster going into 2024 as competition coupled with macro uncertainty would challenge PayPal’s title as the dominant player in the industry.

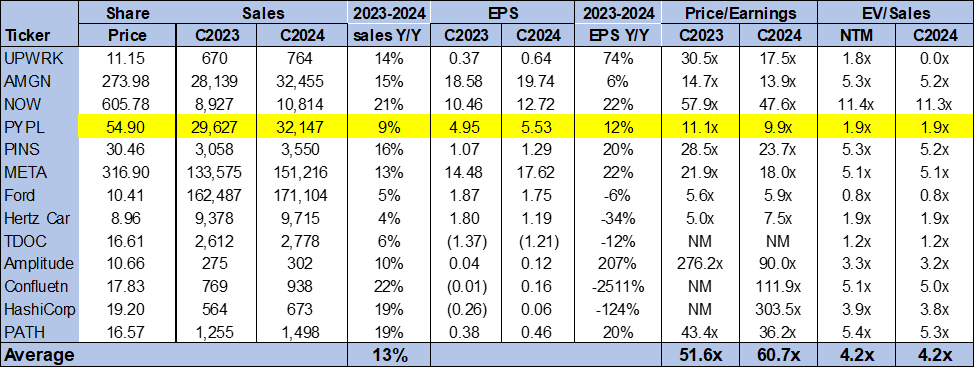

Valuation

From a valuation standpoint, PayPal is trading at a 1.9 multiple on an EV/Sales ratio for C2024, while the peer group is trading at 4.2x. On a Price-to-earnings ratio, PYPL is trading at a multiple of 9.9 for C2024, while the peer group is trading at 60.7x. While PayPal seems to be undervalued compared to the peer group, we believe that investors shouldn’t buy the stock on weakness as we don’t see material outperformance into 2024. Staying on the sideline would be the optimal recommendation, in our opinion.

The table below outlines PayPal’s valuation against the peer group.

TSP

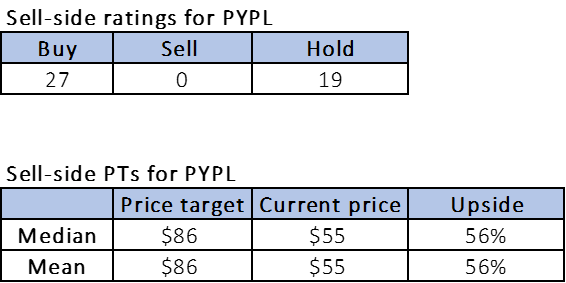

Word on Wall Street

Wall Street has a mixed sentiment on the stock, leaning more toward a buy-rating. Of the 46 analysts covering the stock, 27 are buy-rated, and the remaining are hold-rated. The stock is currently priced at $55 per share. The median and mean sell-side price targets are $86, with a potential 56% upside.

The following charts outline PayPal’s sell-side ratings and price targets.

TSP

What to do with the stock

We’re maintaining a hold-rating on PayPal. Consistent with our expectations, the company’s active account growth has slowed, a trend likely to extend into 2024. The stock has seen a 13% drop over the last quarter, underperforming the S&P 500 by over 10%. Despite a recent uptick in stock price-attributable to cost-cutting measures aimed at profitability-the long-term impact of this strategy remains to be seen. We believe PayPal will perform in line with the market through the first half of 2024 and recommend investors stay on the sidelines for the near term.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Our investing group, Tech Contrarians, discussed this idea in more depth alongside the broader industry and macro trends. We cover the tech industry from the industry-first approach, sifting through market noise to capture outperformers.

Feel free to test the service on a free two-week trial today.