Summary:

- PayPal reported solid quarterly results, but the declining margins and declining number of active accounts spooked investors.

- Nevertheless, long-term growth potential is massive and we can assume that PayPal will continue to grow in the double-digits.

- And even if growth would slow down, PYPL stock is still extremely undervalued at this point.

bizoo_n

My last article about PayPal Holdings Inc. (NASDAQ:PYPL) was published about 3 months ago. At this point, PayPal was trading almost for the same price as right now. In the meantime, the stock increased to $76 but after earnings were reported, the stock crashed again and is once again very close to multi-year lows.

In the following article we look at the quarterly results and try to understand why the stock crashed once again. We are also taking a critical look at our very bullish position as we could be just wrong about PayPal and are not seeing what everybody else is seeing. But – spoiler – I still think the market is wrong about PayPal and not getting the bigger picture.

Quarterly Results

PayPal reported solid second quarter results for fiscal 2023. Net revenue increased from $6,806 million in Q2/22 to $7,287 million in Q2/23 – resulting in 7.1% year-over-year growth (and 8% growth on a FX-neutral basis). Operating income grew 48.3% year-over-year from $764 million in the same quarter last year to $1,133 million this quarter. And instead of a diluted loss per share of $0.29 in Q2/22, PayPal now reported a diluted net income per share of $0.92 this quarter. Adjusted diluted earnings per share increased from $0.93 in Q2/22 to $1.16 in Q2/23 – resulting in 24.7% year-over-year growth.

PayPal Q2/23 Presentation

Free cash flow “declined” from $1,075 million in Q2/22 to a loss of $350 million in Q2/23. Adjusted free cash flow declined from $1,075 million in the same quarter last year to $869 million this quarter.

We can look at the two different segments:

- Transaction revenues increased 4.5% year-over-year from $6,272 million in Q2/22 to $6,556 million in Q2/23.

- Revenues from other value-added services increased from $534 million in Q2/22 to $731 million in Q2/23 – an increase of 36.9% year-over-year.

Two Problems

So far, when looking at the results, PayPal still seems to be a solid business. Nevertheless, the stock declined steeply following results. When looking for a reason there seem to be two major issues – the declining number of accounts and the declining margins.

Declining margins

We see a constantly declining gross margin in the last few years. This is usually not a good sign as declining margins are often indicating price pressures and it might also indicate a missing moat.

In 2015, the reported gross margin was 65% and declined to 49.12% in the current quarter. However, when looking at the operating margin we see much more stability and operating margins between 14% and 19% in the years 2015 till 2023.

When comparing PayPal’s gross margin to competitors, we see especially Mastercard Incorporated (MA) and Visa Inc. (V) with a much higher and stable gross margin. Competitors like Fiserv Inc. (FI) see increasing gross margins over the years and among companies that can be seen as peers, PayPal is certainly struggling.

Overall, we don’t see a huge problem for PayPal yet – as long as the operating margin is stable, I don’t see a huge issue. And for PayPal as growing business moving into new business segments, declining (gross) margins are not unusual.

Declining accounts

A second major issue is the declining number of active accounts. While active accounts still increased from 429 million in the same quarter last year to 431 million this quarter, the number declined quarter-over-quarter for the second time: From 435 million in Q4/22 and from 433 million in Q1/23. And like Meta Platforms (META) is looking at the number of daily active users and Mastercard and Visa look at the number of issued cards, the number of active accounts is important for PayPal.

PayPal Q2/23 Presentation

But not only the number of active accounts is important and a way to grow. PayPal can also grow its total payment volume by increasing the number of payment transactions – compared to 5,513 million in Q2/22, PayPal reported 6,074 million in Q2/23. And the main reason for the increasing number is the increased number of payment transactions per active account – compared to 48.7 in Q2/22 and 53.1 in the previous quarter, PayPal reported 54.7 payment transactions per active account in Q2/23. As a result, the total payment volume increased from $339,791 million in Q2/22 to $376,538 million in Q2/23 – 10.8% year-over-year growth.

Nevertheless, the declining number of active accounts is an issue for PayPal that needs to be resolved.

Buy Now Pay Later

While the number of active accounts is declining, Buy Now Pay Later is contributing to growth and in Q1/23 the cumulative number of people that have used it was 32.2 million (compared to 18.1 million one year earlier).

PayPal Management Meeting Presentation 2023

And according to PayPal’s own presentation made during the PayPal Management Meeting in June 2023, PayPal is the most preferred Buy Now Pay Later provider (with 43% of respondents preferably using PayPal ahead of Afterpay and Klarna).

PayPal Management Meeting Presentation 2023

During the last earnings call, CFO Gabrielle Rabinovitch commented on the progress:

The largest growth area for us continues to be our Buy-Now-Pay-Later solutions, where our performance continues to be very strong. Of course, going forward, given our partnership with KKR, the majority of the originations are going to be funded off-balance sheet for us, and we’ll be able to support the sustained growth of that business.

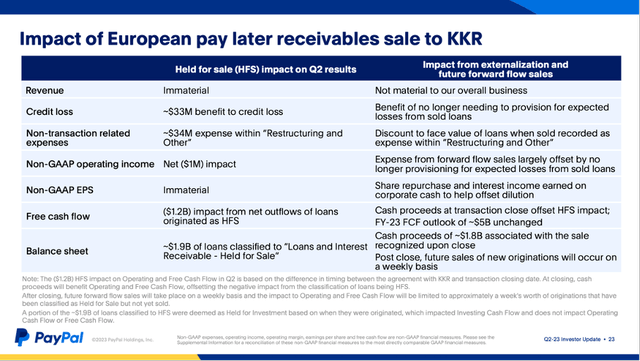

It was already reported in June that KKR will buy a substantial portion of PayPal’s Buy Now Pay Later loans in Europe. As a result, PayPal will offload credit-risks, which must be seen as rather positive and the proceeds from the sale of the European BNPL will be recognized in cash flows from operations later this year and offset the decline in cash flows from operations that was reported in the previous quarters.

PayPal Q2/23 Presentation

It is not like I don’t think PayPal can’t handle some credit risk, but it is actually good to have as little credit risk on the balance sheet as possible. This is one of the huge advantages of companies like Visa and Mastercard – they profit from growth and rising number of credit card holders and increasing volume but are not confronted with the associated risk of defaults.

Long-term Growth

But PayPal can not only grow by focusing on Buy Now, Pay Later. When looking at the payment industry as a whole or Fintech, analysts are expecting high growth rates. According to the 2022 McKinsey Global Payments Report, global payments revenue is expected to grow with a CAGR of 9% in the years to come.

McKinsey Global Payments Report 2022

And the Boston Consulting Group is expecting global financial services revenue to grow 6% annually till 2030.

Boston Consulting Group

And BCG is also pointing out that about 80% of adults in the world can be seen as underbanked or unbanked, which is a huge addressable market for companies like PayPal and – at least in theory – huge growth potential. While the Fintech growth was mostly led by payments so far, especially B2B will be important in the years to come. Overall, annual fintech revenues are expected to grow from about $245 billion in 2021 to $1.5 billion in 2030 – resulting in a CAGR of 22.3% for the industry.

Boston Consulting Group

Other studies are seeing similar growth rates for the Fintech industry – growth rates ranging from about 19% annually till 2028 to 21% annually for the years till 2030. And if PayPal should be able to keep its market share among the Fintech businesses it could grow its revenue 20% annually.

And when looking at the $250 billion in global fintech revenues the Boston Consulting Group is estimating, PayPal only has a market share of 11% to 12% (when taking the current TTM revenue numbers). And considering $2.1 trillion in global payment revenue (according to McKinsey), PayPal has only a small fraction of that market (about 1%) and a reasonable assumption is that Fintech businesses – including PayPal – will gain market shares from other players like banks and combined with the overall market growing, we should be optimistic for PayPal.

Analysts Being Optimistic

Growth rates around 20% annually are also the expectations of analysts in the next few years for PayPal. While the same analysts “only” have a price target of $90 for PayPal (which is already implying a huge upside potential at this point), they are expecting double-digit growth rates which does not add up.

PayPal: EPS Estimates till 2032 (Seeking Alpha)

But when looking at the growth assumptions for the years to come and calculating with the exact numbers for the next few years followed by 6% growth till perpetuity (as always), we get an intrinsic value of $254.81 for PayPal. And while that might be too optimistic it seems to be closer to the stocks real intrinsic value than the current stock price. Of course, estimates were lowered over the last few quarters – reflecting the negative sentiment which also seems to be priced into the stock. However, it still doesn’t add up – the high growth expectations for the business (even if they have been lowered over the last few quarters) on the one side and the depressed stock price on the other side.

Intrinsic Value Calculation

And PayPal is one of the major bargains in the market and one of the most mispriced stocks – as I have already pointed out in past articles. Simple valuation metrics are already indicating that PayPal is rather cheap at this point. The stock is trading for a P/E ratio of 17.5 and a P/FCF ratio of 19.5 right now. And we saw above what growth rates PayPal is still reporting and what growth rates analysts are expecting for PayPal and the whole payment and Fintech industry. And these growth rates and valuation multiples don’t match. PayPal is also trading close to its lowest valuation multiples in the last few years and clearly below the 5-year average valuation multiples.

Even when calculating with rather modest growth assumptions for the next few years, PayPal is also clearly undervalued using a discount cash flow analysis. In my last article I assumed 8% growth for the next ten years followed by 6% growth till perpetuity – and I will calculate with these growth assumptions again. As basis we can take $5 billion in free cash flow.

PayPal Q2/23 Presentation

And when using 1,113 million outstanding shares and a 10% discount rate (as always), we get an intrinsic value of $129.41 and therefore PayPal is about 50% undervalued in this scenario. Although PayPal could grow earnings per share only with a CAGR of 7.29% in the last five years, these assumptions are rather cautious in my opinion.

Conclusion

Although the market sees this different, PayPal is extremely undervalued and one of the best bargains in this market. And as PayPal is trading almost for the same price when my last article was published, the conclusion can be similar once again:

Alarming is only the technical picture as it seems like PayPal is breaking a support level around $65 to $70 that was holding for almost a year. However, as long-term investors we should not pay attention to short-term stock price movements based on technical aspects. Of course, we can wait and hope for the stock price declining even lower and PayPal becoming an even greater bargain.

And I see it similar this time – there is a technical downside risk, and we should not rule out even lower stock prices in the short-to-mid term. But the stock is extremely undervalued from a fundamental point of view and in 5 or 10 years from now, PayPal will most likely trade for a much higher price.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.