Summary:

- PayPal Holdings, Inc. stock price has remained stagnant due to EPS uncertainties.

- Despite EPS headwinds, I see improvement in revenues, earnings, and operating margins.

- Further positives including its leading market share, loyal user base, strong balance sheet, and cheap valuation ratios.

DNY59/iStock via Getty Images

PYPL stock is not loved by the market

I last wrote about PayPal Holdings, Inc. (NASDAQ:PYPL) a bit more than 3 months ago (on April 9, 2024). As illustrated by the screenshot below, that article was titled “A Good GARP Stock Made Even Better By Buybacks.” As the title suggests, I rated PYPL as a BUY based on the consideration of PEG (P/E growth ratio) and aggressive share buybacks. More specifically, I argued that:

PayPal Holdings, Inc. stock prices have remained stagnant recently, but its earnings have been improving, with projected growth in the next few years. At ~13x P/E, it is simply a good GARP opportunity (growth at reasonable price) considering its scale, differentiating business model, and growth potential. The company’s aggressive share buybacks further enhance the opportunity.

Since then, the stock has largely moved sideways and lagged the overall market (which staged a terrific price advancement of nearly 9%). Meanwhile, the company has also released its 2024 Q1 earnings since my last writing. Given the stock price changes and the updated financials, the goal of this article is to provide an updated assessment of the stock.

In the remainder of this article, I will explain why I see signs suggesting that PYPL has turned a corner and reiterated my bull thesis.

PYPL stock: EPS headwinds vs. margin expansion

As its President and CEO, Alex Chriss, commented in the earnings report:

2024 remains a transition year and we are focused on execution – driving our key strategic initiatives, realizing cost savings, and reinvesting appropriately to position the company for consistent, high-quality profitable growth in the future.

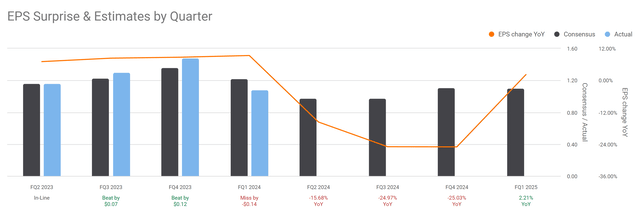

Indeed, the company has been facing substantial EPS headwinds in recent quarters. The top challenges on my list are the monetization of several of its initiatives (such as the free digital wallet) and also the integration of its recent acquisitions (such as Venmo). More specifically, the chart below illustrates its EPS surprises and estimates in recent quarters. As seen, its EPS trajectory can be described — at best – as inconsistent. In 2024 Q1, it missed consensus estimates by $0.14 per share. Looking ahead, the market expects 3 more quarters of consecutive EPS contraction, to be followed by a slight YOY growth of 2.2% in Q1 2025.

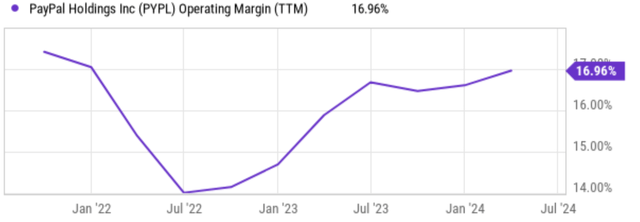

Despite these headwinds, I think PYPL may well have turned a corner, both financially and operationally. Despite missing consensus estimates, PYPL reported revenues and earnings that have shown significant improvement on a sequential basis. More importantly, its operating margins kept expanding substantially. To wit, the chart below shows PYPL’s operating margin in recent quarters. As seen, after reaching a bottom of about 14% in July 2022, PayPal’s operating margin has been improving steadily over the last few quarters. Its current operating margin hovers at 16.96%, not only far above its historical average but also near the peak level in multi-years. Meanwhile, other key metrics, including payment transactions and transactions per active account, also improved considerably in recent quarters.

PYPL stock: growth catalysts

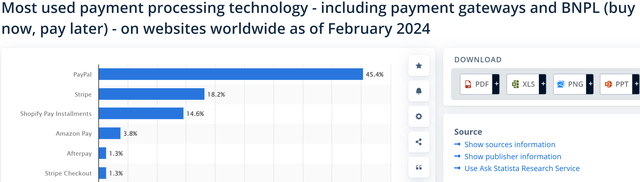

Looking ahead, I see robust EPS recovery and growth potential thanks to its leading market share and differentiating business model. PayPal boasts a leading market share of 45.4% in payment processing technology (see the next chart below), more than double its nearest competitor Stripe (as of Feb. 2024). Shopify Pay Installments comes in third place with a market share of 14.6%. This strong network effect creates a powerful advantage, as users are incentivized to join a platform with a large existing user base for seamless transactions. Augmenting its vast market reach, PayPal has also cultivated a loyal user base through its focus on a user-friendly experience and a wider range of financial services beyond just payments. This ecosystem approach fosters customer stickiness, potentially leading to higher lifetime value compared to competitors solely focused on transactions.

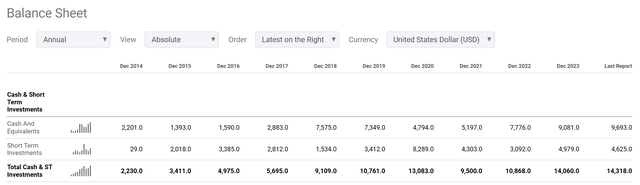

Moreover, its balance sheet is in excellent condition. The chart below (taken from its balance sheet) shows PYPL’s cash position in recent quarters. As seen, PayPal ended 2023 with cash reserves of more than $14 billion. The combination of healthy cash generation and sizable cash reserves gives the company plenty of capital allocation flexibility. As analyzed in my last article, the company has been aggressively buying back stock and I anticipate it to continue to do so over the coming years. Share repurchase at current valuation multiples (more on this a minute later) should be a good boost to EPS growth and shareholder return in the long term, as detailed in my analysis. Meanwhile, I would not be surprised to see management explore the possibility of strategic bolt-on acquisitions, given its currently cash-rich financial position.

Other risks and final thoughts

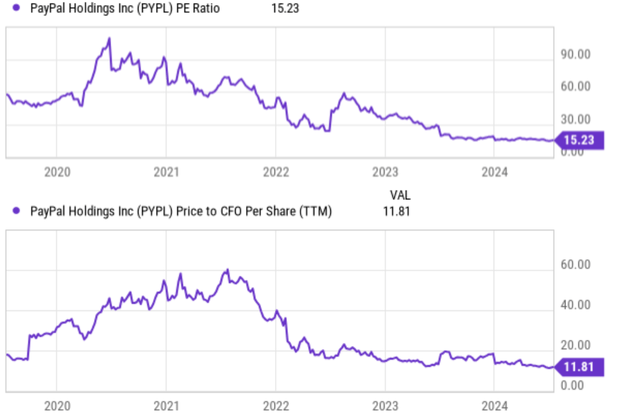

Despite the growth catalysts, PayPal Holdings, Inc. stock is trading at a very attractive valuation in my view. More specifically, the chart below shows PYPL’s P/E ratio (top panel) and its Price to CFO ratio compared to its historical levels (bottom panel). Overall, both the P/E ratio and Price to CFO ratio suggest that PYPL is trading near the lowest multiples in at least the past 5 years. To wit, the top panel shows that the P/E ratio is currently at 15.2x only, while its historical P/E has fluctuated in a range of ~15x to over 90x over the past 5 years. The bottom panel shows that the Price to CFO ratio is currently at 11.8x, again near the bottom of its historical range of ~11.5x and over 60x in the past 5 years.

In terms of downside risks, both PYPL and its peers are facing some common risks. Regulatory changes, particularly those focused on data privacy or transaction fees, can significantly impact profitability. The lawsuit MasterCard and Visa have been involved in recently regarding the cap or restriction of their transaction fees serves as an example to illustrate such risks. Additionally, the competition is also intensifying, not only from traditional payment processors (such as Visa and MasterCard) but also from new entrants. The increasingly crowded payment processing landscape, with new entrants like Apple Pay and digital wallets gaining traction, threatens market share and growth. Risks more distinct to PYPL, as aforementioned, include the uncertainties of monetizing some of its new initiatives and the integration of its acquisitions.

All told, the positives far outweigh the negatives in my view. As such, I see compelling reasons to consider PayPal Holdings, Inc. stock a BUY under current conditions. To recap, the top reasons analyzed in this article include the steady expansion of operating margins (a strong sign of profitability recovery in my view), leading market share with a strong network effect, and also attractive low P/E multiples. Finally, the solid balance sheet provides additional potential drivers for EPS growth, such as via share repurchases and bolt-on acquisitions.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If you share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.