Summary:

- PayPal’s Q4-2023 results showed robust total payment volume and growing total revenues.

- Non-GAAP EPS beat expectations, but the company’s guidance for 2024 was extremely disappointing.

- We tell you why we think it is likely to break $50.00 in 2024.

Fajrul Islam/iStock via Getty Images

In our last coverage of PayPal Holdings, Inc. (NASDAQ:PYPL) we opined that things were setting up for a longer-term entry point, but we were not quite there yet. While the bulls saw a compelling buy and bears saw a terminal case, we went with a hold and suggested investors look at cash-secured puts for the $55 strike. We also used a four-letter expletive that growth investors hate. GAAP.

In such an environment, we would look for a minimum of 16X GAAP earnings as the buy point. We are close here to a significant bottom and one that will reward the patient buyers. If we were forced to pick a play here it would be to aim for the $55 strikes on longer-dated cash-secured puts.

Source: What Tops At 16X Sales Will Bottom At 16X GAAP Earnings.

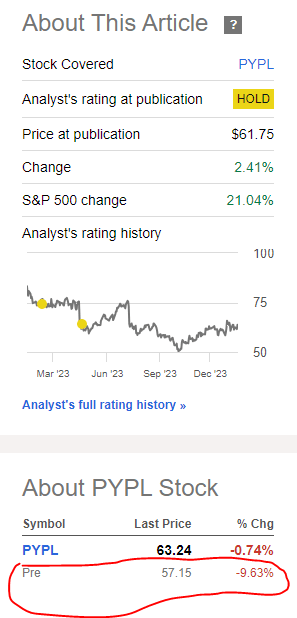

PYPL ignored the AI rally that followed and was sitting flat until the earnings were released. Then the floodgates opened.

Seeking Alpha

We look at the results, the guidance and update our thesis.

Q4-2023

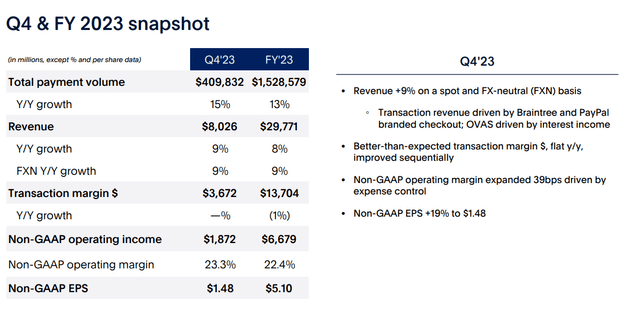

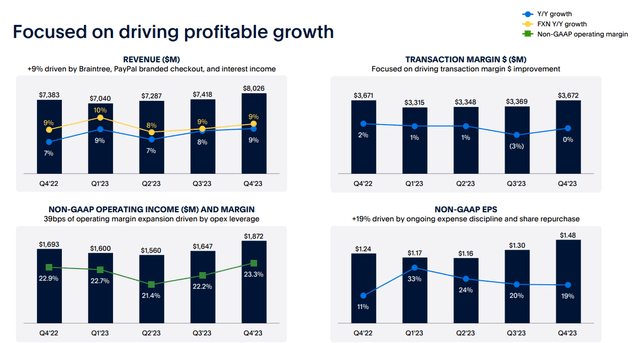

There was a good deal to like in the report as total payment volume stayed robust with a low-teens growth rate. Total revenues were also a positive sign with a 9% Q4-2023 expansion.

Interestingly though, it did not translate into transaction margins (in dollars, not percentages). You can see total transaction margin came in at $3,672 million a rounding error away from $3,671 last year.

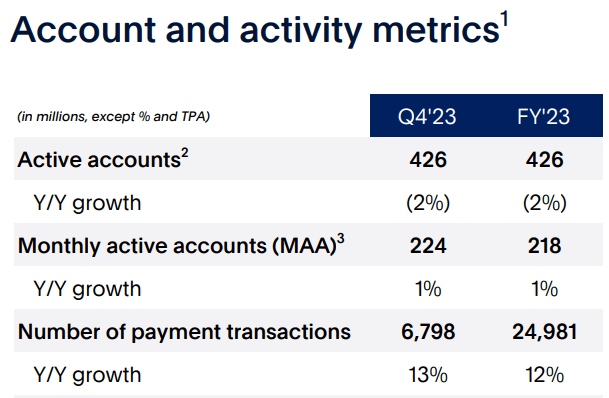

Non-GAAP EPS beat the street at $1.48 per share. The “PayPal is dying” meme has been driven by a focus on active accounts and those were down modestly. But these are primarily accounts which have had very little activity and the next metric, monthly active accounts, confirms this.

PYPL Q4-2023 Presentation

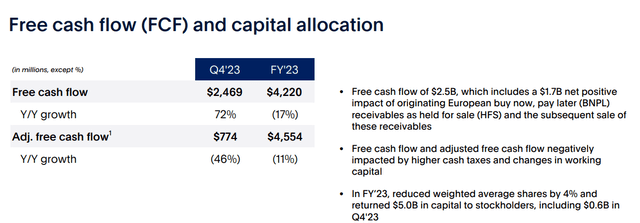

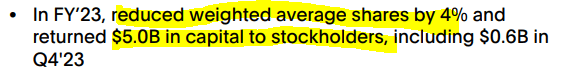

PayPal did some sizeable stock repurchases during the year and returned $5.0 billion to shareholders. Free cash flow was weak in Q4-2023, but there were some one-off events, that are not going to repeat.

Overall, the numbers were fine and analysts were not caught offside on the quarterly results.

Guidance & Our Outlook

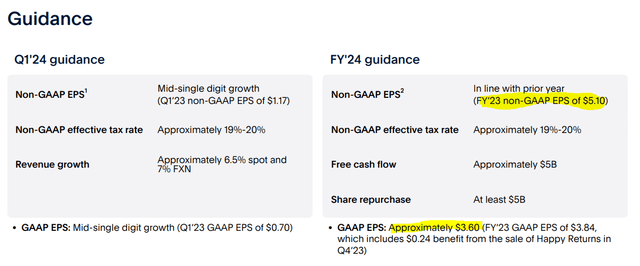

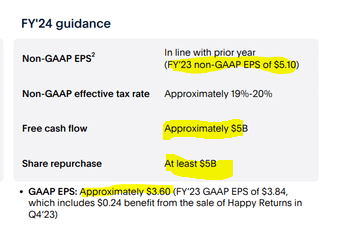

PayPal dropped the hammer on the bulls just as they were getting ready to celebrate the earnings beat. The guidance for 2024 was just plain awful. Non-GAAP EPS is expected to come in about in line with the number for 2023.

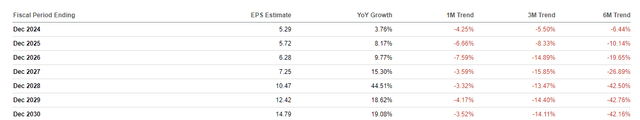

So that growth thesis is done and dusted. Regardless of how cheap it has become relative to the 2021 top, there was still a crowd of investors buying this for the “growth”. So their exit, will pressure the stock. More importantly, this is a complete disaster relative to expectations. The results came out on February 7, 2024, and the analysts were quick to downgrade their numbers. So the $5.29 below, is actually after the estimates were lowered. Prior to that, we were expecting $5.51. We think at least another 15 analysts will be issuing downgrades to realign with expectations.

One other point here is that the estimated trend is easily the worst we have seen. Longer-term estimates (2028-2030) have been cut in half over the last six months! Even those estimates have required the usual “hockey-stick” extrapolations. For those unfamiliar with the term, it refers to a sudden increase in future sales or earnings with no real catalyst. You can see that for PayPal where sales will suddenly accelerate starting in 2027.

There are likely to be further margin pressures as competing services bring the heat in 2024 and 2025. It is one thing to hold your own in a strong economy, it is another to do it in a hard landing. The recent payroll data points to some rather strange movements under the hood (See, A Tale Of Two Labor Markets) and this will likely play out over the next 6-12 months. Our net conclusion here is that there are a ton more downgrades left, and you have to just not buy at this point.

Valuation & Verdict

PayPal has appeared cheap all the way down, based on price anchoring and price anchoring alone. No rational valuation metric makes a company trading at 16X GAAP earnings, with no growth, a compelling buy. Sure, you can argue that there is a possibility of a buyout. You can also argue that if there is a reacceleration down the line, the company could see some valuation expansion. But it is a stretch to argue that this is cheap. Even the oft-cited free cash flow metric is at best dubious as a measure of cheapness. The company will apparently have $5.0 billion in free cash flow and buyback $5.0 billion in stock in 2024.

PYPL Q4-2023 Presentation

That gives it a free cash flow yield of about 8%. 8% free cash flow yield for a non-growing company is hardly a game changer. You could use a stock screener to find 50 in a heartbeat. More importantly, or perhaps most importantly, that free cash flow yield is exaggerated. You can see that in 2023 numbers.

PYPL Q4-2023 Presentation

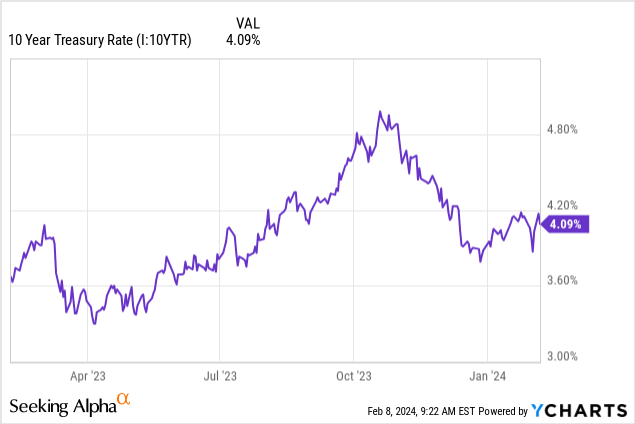

PYPL’s 200-day moving average was close to $64.00 at the end of 2023. So if you use that price to calculate the market capitalization and then divide it with the free cash flow, you should get a free cash flow yield of close to 7.1%. So ideally, the share count should have reduced by 7.1% when you buy back $5.0 billion worth of shares. The difference is the stock-based compensation which acts as an offset. So real free cash flow yield is about 4%. If you got excited about that non-growing 4% free cash flow yield, you should consider a 10-year Treasury bond. “Free Cash Flow Yield” is slightly higher.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

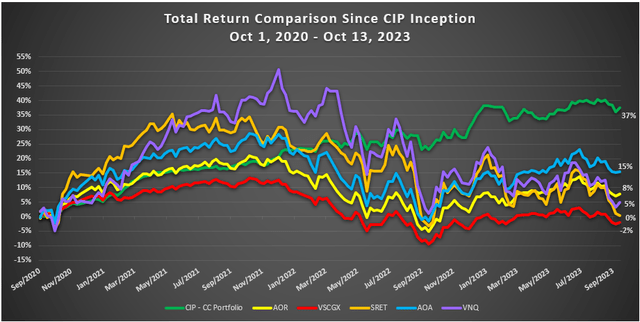

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Take advantage of the currently offered 39% discount on annual memberships and give CIP a try. The offer comes with a 11 month money guarantee, should you cancel within the first 30 days.