PayPal: Misunderstood Growth Story Spells Opportunity

Summary:

- PayPal’s new management is making significant changes to improve execution and regain market confidence.

- The company’s tepid forward guidance indicates cautious optimism and a focus on not overpromising and underdelivering.

- PayPal’s stock price has been recovering, but it will still face scrutiny from the market to assess its execution in the next four quarters.

- With the market still not fully appreciating PYPL’s growth thesis, high-conviction investors should capitalize on the market’s pessimism.

Michael Vi/iStock Editorial via Getty Images

PayPal Holdings, Inc. (NASDAQ:PYPL) investors have endured another roller coaster ride over the past two months, following PayPal’s relatively weak guidance at its fourth-quarter earnings call in early February 2024. As a reminder, I upgraded my thesis on PYPL to a Buy pre-earnings, as I assessed that buying accumulation was constructive. However, I didn’t expect PayPal’s outlook to be more cautious than anticipated, leading to a steep post-earnings selloff.

Despite that, I believe investors must give PayPal’s new management sufficient time to justify the organizational changes undertaken to lift PYPL from its misery. CEO Alex Chriss highlighted that he has “overhauled the majority of the leadership team.” Such significant changes at the top management level could introduce execution risks as the competitive landscape intensifies. Moreover, with PYPL still almost 80% below its all-time highs, it’s clear that the market has lost confidence in PayPal’s ability to execute.

PayPal management acknowledged that the direction and execution under the previous team (under Dan Schulman) didn’t meet Chriss’s expectations. He accentuated that PayPal “lacked a crystal clear value proposition for both consumers and merchants.” In addition, the “lack of focus” hampered its product development cadence and go-to-market effectiveness.

However, Chriss articulated that PayPal has made “significant changes in just four months, which could improve its ability to execute more efficaciously. Notwithstanding management’s optimism, PayPal doesn’t expect “tangible results to materialize in the near term.” Therefore, I assessed that PayPal’s tepid forward guidance indicates its cautious optimism about not overpromising and underdelivering.

PayPal guided to an adjusted EPS for 2024 to be “in line” with the $5.1 metric achieved in 2023. It also surprised Wall Street as the market reassessed PYPL’s ability to command a premium valuation for its stock. Despite that, PayPal management underscored its confidence in PYPL’s material undervaluation with plans to repurchase at least $5B in shares for 2024.

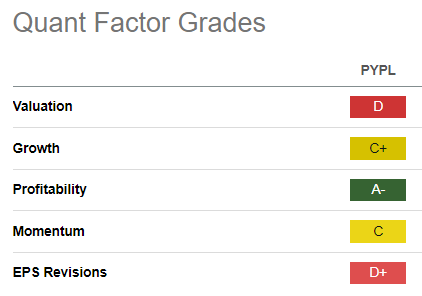

PYPL Quant Grades (Seeking Alpha)

As a result, PayPal’s confidence in returning significant value to shareholders should underpin the robustness of PayPal’s fundamentally strong business model (“A-” profitability grade).

Through massive scale emanating from its consumer and merchant ecosystem, PayPal facilitates $1.5T in commerce transactions through its platform. As a result, I believe PayPal’s leadership confers it significant advantages even as competitive dynamics intensify.

However, it also questions whether PYPL still deserves a growth premium, assigned a “C+” growth grade. Compared to its financial sector (XLF) peers, PYPL is valued at a marked premium. However, with 2024’s guidance suggesting flat earnings growth metrics YoY, it’s clear that PayPal’s challenges won’t be resolved in the near term. In other words, PayPal must prove to the market that it can consistently rejuvenate its earnings growth before a material re-rating can occur.

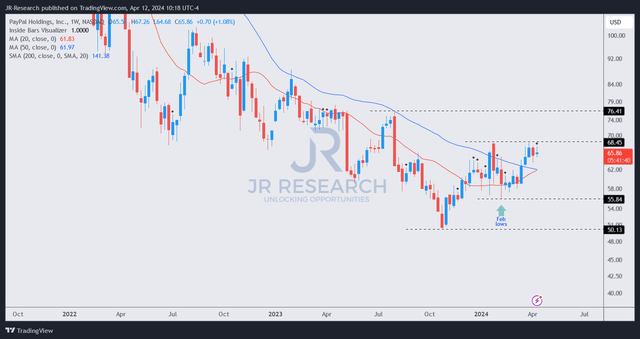

PYPL price chart (weekly, medium-term) (TradingView)

The good news is that PYPL’s price action suggests that the worst is likely over in 2023. Notwithstanding the post-earnings selloff in February 2024, PYPL has continued to recover through April, re-testing the $68 level.

The market seems to have given PayPal management the benefit of the doubt about its strategic overhaul. However, a further recovery would likely require PayPal to execute well, delivering the confidence for more investors to return.

Is PYPL Stock A Buy, Sell, Or Hold?

PayPal believes it has the scale and market leadership to execute better and regain investor confidence. However, the market will likely place PayPal in the penalty box over the next four quarters to assess its execution.

I don’t expect significant changes to its strategies, suggesting continuity from Schulman’s era. Therefore, the focus will likely be on its ability to execute and justify its growth premium.

While the company faces substantial headwinds, it’s competing from a position of strength with a proven business model. Coupled with improved buying sentiments over the past four months, I believe dip-buyers have been accumulating. The risk/reward balance is still skewed favorably toward buyers at the current levels.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!