Summary:

- PayPal declined extremely steeply last week following earnings, but it seems like Mr. Market might be a bit irrational again.

- Not only could PayPal beat expectations, raise guidance and report solid first quarter results, the business model still seems to be intact.

- But PayPal’s stock continues to decline and is trading now for very depressed valuation multiples, which is generating a real bargain for investors.

- Of course, we saw a declining number of active accounts for the first time – and this should be watched closely as it could generate a long-term problem for PayPal.

Sezeryadigar

At the beginning of last week, PayPal Holdings (NASDAQ:PYPL) reported its first quarter results and although results seemed fine on the surface, the market reacted quite heavily to the results and PayPal lost about 15% in the following trading days and the stock declined not only to a new 52-week low but is now trading for prices we haven’t seen since 2017.

In the following article, I will look at some typical reasons why a stock might decline and analyze if this is also the case for PayPal. But although I see the risk of lower stock prices in the short term – we will get to this – the market got it wrong and is on its path to create a real bargain.

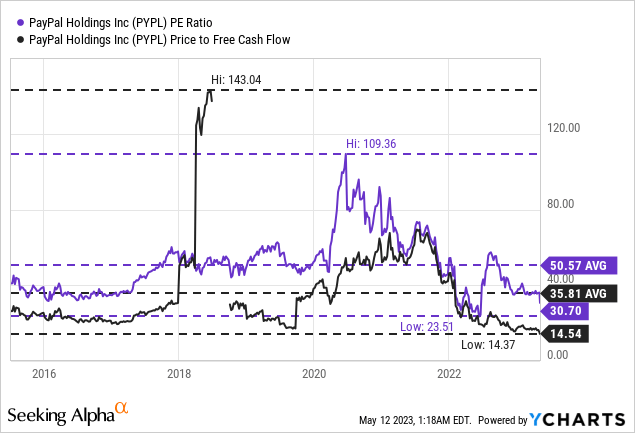

Valuation

One reason for the sell-off that is often overlooked is the valuation of a stock. At some point, a company can report great results and the stock will decline nevertheless as the valuation is not justified. And the extreme valuation of PayPal was actually one of the reasons for the stock to start its decline from $300 in the summer of 2021. At that time, PayPal stock was trading for about 70 times earnings as well as 70 times free cash flow and with growth slowing down and some bad news was enough to send PayPal on its decline and until date, the stock lost about 80% of its previous value.

But what was a justified reason for a decline at $300 does not necessarily be a reason at $70 or $75 – and it seldom isn’t. At the time of writing, PayPal is trading for about 30 times earnings and although it is one of the lower P/E ratios PayPal has ever been trading for, we can’t really argue for PayPal being cheap at 30 times earnings.

However, we should look at the much more important price-to-free-cash-flow ratio. And while PayPal is still trading for 30 times earnings, it is trading only for 14.5 times free cash flow – an all-time low. Such a valuation multiple can be seen as cheap for a high-quality business with a wide economic moat and with a stock already trading at such a low P/FCF ratio, the valuation multiples are no reason for any further declines.

Of course, we can’t look at valuation multiples in isolation. We also must look at the business, its ability to generate free cash flow and especially its ability to grow. 14.5 times free cash flow might still be unjustified for a company that is not able to grow its free cash flow anymore.

Quarterly Results

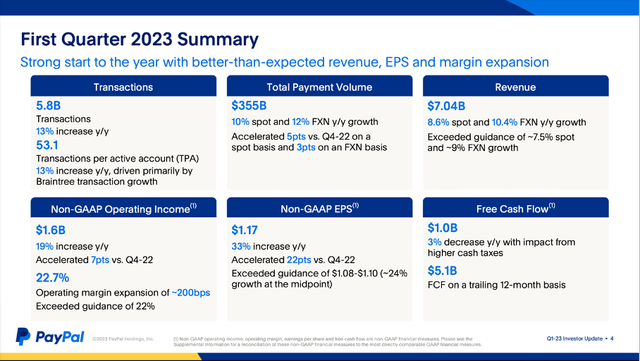

A second reason for a sell-off might be terrible quarterly results – and especially with low growth rates or a declining business, a P/FCF ratio of 14.5 might still not be justified. However, when looking at the results for the first quarter of fiscal 2023, it is hard to find a reason. Net revenue increased from $6,483 million in Q1/22 to $7,040 million in Q1/23 – 8.6% year-over-year top line growth. Operating income increased 40.5% YoY from $711 million in the same quarter last year to $999 million in Q1/23, and diluted earnings per share increased even 62.8% YoY from $0.43 to $0.70.

PayPal Q1/23 Presentation

And PayPal certainly has been growing with a high pace in the past and the bottom line is only growing with such a high pace as the comparable results in the same quarter last year were not great. Nevertheless, the income statement is hardly providing a reason for a sell-off – only free cash flow declined 2.5% year-over-year from $1,026 million in Q1/22 to $1,000 million in Q1/23, but that is no reason for a sell-off.

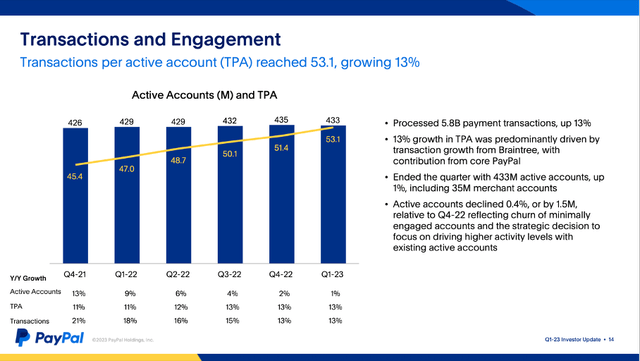

And when looking at additional metrics, it also seems rather difficult to find a reason to justify a double-digit stock price decline. Total payment volume increased 9.8% YoY to $354.5 billion in Q1/23 and payment transactions per active account also constantly increased. It increased 3.3% quarter-over-quarter and 13.0% year-over-year to 53.1 transactions per active account (on a trailing twelve-month basis).

Additionally, the total number of payment transactions also increased from 5,161 million one year earlier to 5,835 million this quarter – an increase of 13.1% year-over-year. Active accounts could also increase from 429 million one year earlier to 433 million right now – an increase of 0.9%. And while the hardly measurable year-over-year growth of active accounts is not a good sign, we can also look at the quarterly changes to find a potential reason for the sell-off. On the one hand, number of payment transactions declined from 6,032 million payment transactions in the previous quarter. However, this seems to be a seasonal effect that was also visible in Q1/22 and Q1/21. On the other hand, the number of active accounts declined from 435 million at the end of December 2022 and although it is only a small decline, it can be seen as alarming if PayPal would start to lose customers.

PayPal Q1/23 Presentation

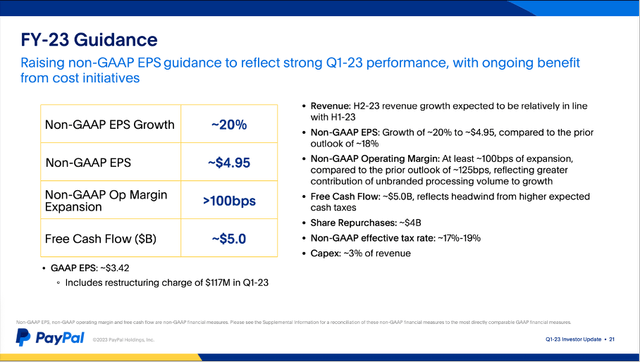

Beating and Raising Guidance

When being familiar with stock markets a little bit, we know that not just the results themselves are important but also the results in comparison the previous expectations. And great results can also lead to a huge sell-off, if Wall Street was expecting even better results (as these expectations are often already reflected by the stock price). But PayPal could beat expectations for earnings per share as well as revenue.

PayPal Q1/23 Presentation

Aside from expectations for the current quarter, expectations for the coming quarters are also among the numbers Wall Street pays attention to and a guidance below expectations is often the reason for a sell-off, but PayPal also raised its outlook and commented during the last earnings call:

For the full year, given our earnings outperformance in the first quarter, we are raising our outlook. We now expect non-GAAP earnings per share to grow 20% to approximately $4.95, an increase of 2 points of growth from the guidance we shared in February. At the start of the year, we indicated that our framework for 18% non-GAAP EPS growth in 2023, contemplated revenue growth coming in as low as mid-single digits. We also shared that our objective was to deliver revenue performance that exceeded this baseline.

Long-term Picture

When looking for further reasons for the sell-off, the slightly lower operating margin in PayPal’s guidance was often cited. Instead of a 125 bps expansion in a previous guidance, PayPal is now expecting operating margin to increase only at least 100 basis points. And while this is not great, I don’t know if it justifies a double-digit stock price decline.

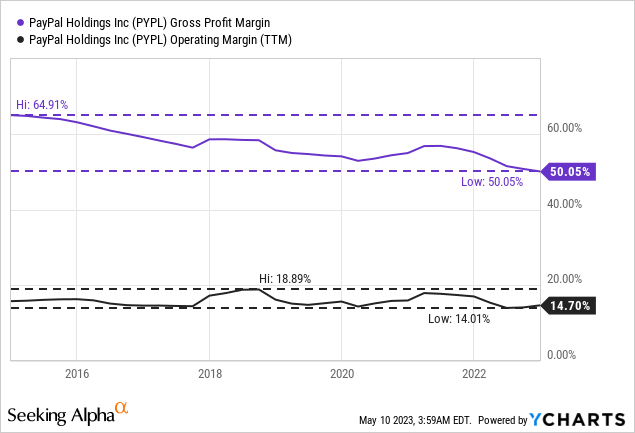

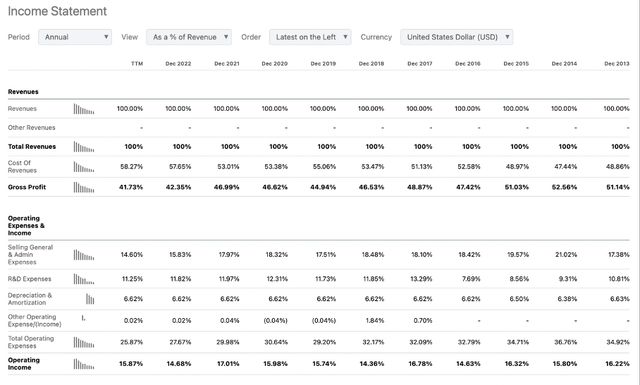

However, it is pointing us towards a potential bigger problem – the constantly declining gross margin. When looking at the chart above, the gross margin constantly declined from around 65% in 2015 to 50% right now (TTM numbers). When looking at the income statement over the years (according to Seeking Alpha) we actually get different numbers. I assume that in the following income statement (see chart below), more expenses are include in “cost of revenue” (PayPal does not really disclose a gross profit in its income statements) leading to a lower gross profit and therefore lower gross profit margin. But the picture is the same, we have a declining gross profit margin, which is not great.

PayPal Income Statement (Seeking Alpha)

But while gross profit margin is declining, operating margin is stable (which is a good sign and more important for a stable bottom line). Of course, when asking the question if PayPal has a wide economic moat around its business, the constantly declining gross margin is a strong hint for a missing moat around the business as companies with an economic moat are usually able to keep costs under control – especially costs of revenue. However, PayPal is a rather young business and lower consistency for margins is not such a big issue. And when trying to answer the question if PayPal has a wide economic moat, we can also look at the return on invested capital. In the last five years, the average RoIC was 12.45%, which is not an extremely impressive number, but high enough to assume a stable moat around the business.

One aspect to look out for is a stable gross margin and/or operating margin, but stable revenue growth is also important for a great long-term investment. And of course, it would not be surprising (and also not a problem) if growth rates would slow down over time, but PayPal’s growth rates are surprisingly resilient. Although the company was struggling a bit in the last few quarters, we are still seeing consistency. When looking at revenue as well as operating income, we see more or less stable growth rates between 15% and 20%.

|

Growth |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

|---|---|---|---|---|---|---|---|---|

|

Revenue 3-year CAGR |

17.77% |

17.25% |

17.73% |

18.66% |

17.91% |

17.89% |

17.98% |

15.69% |

|

Operating income 3-year CAGR |

18.84% |

13.28% |

21.23% |

18.37% |

20.72% |

14.91% |

19.99% |

13.17% |

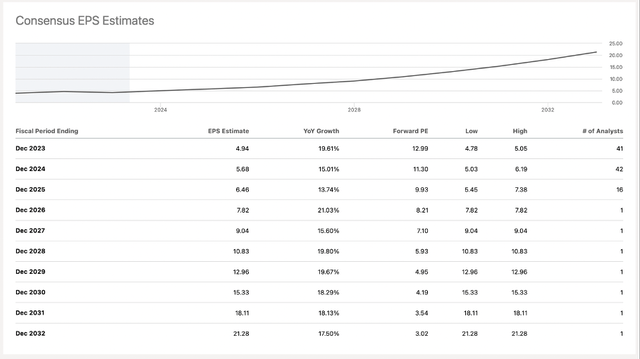

And for the years to come, analysts seem to be quite optimistic. Not only are analysts expecting PayPal to grow its bottom line with a solid pace in every year during the next decade, they are also expecting extremely high growth rates. The company is expected to grow its bottom line in the double digits every single year and with a CAGR of 17.82% until fiscal 2023.

PayPal Consensus EPS Estimates (Seeking Alpha)

When looking at the EPS revision trend, we can see that analysts are even getting slightly more optimistic again and after estimates have been lowered constantly for several quarters, analysts are now expecting slightly higher earnings per share for the years between 2023 and 2026 again.

Despite all optimism, we must take into account the risk of a recession, which seems not to be reflected in any growth assumptions so far. If the United States (and many other countries around the world) will be hit by a recession in the coming months – and the probabilities for that scenario are rather high – PayPal will be one of the companies affected as well. In case of a recession – going hand in hand with higher unemployment, lower disposable income, and high levels of uncertainty – people will spend less and postpone buying certain items and this will lower PayPal’s revenue.

Over the long run, I see several growth opportunities for PayPal, and I don’t want to repeat what I have written in my last articles. For PayPal’s growth opportunities in Venmo or Buy Now, Pay Later initiatives, see my last two articles (here and here).

Intrinsic Value Calculation

It already mentioned above that PayPal is trading for its lowest price-free-cash-flow ratio ever and such a low valuation multiple does not seem justified for the business. To back up that claim and determine an intrinsic value for the stock, we will also use a discount cash flow calculation.

We calculate with 1,134 million outstanding shares and as basis we take the free cash flow of the last four quarters, which was $5,081 million (and as always, we use a 10% discount rate as the minimum annual return I would like to achieve). When using these assumptions and a current stock price of $66, PayPal must grow slightly above 3% in the years to come to be fairly valued right now.

But despite PayPal struggling in the last few quarters and the number of active accounts declining for the first time, 3% growth seems completely unrealistic – in my opinion, PayPal should be able to grow with a much higher pace (even when making very conservative assumptions). Top line growth should be at least in the mid-single digits and PayPal seems to be able to keep its operating margin stable and therefore I am not assuming that margin improvements will add to bottom line growth, but it also should not have a negative effect on the bottom line. But share buybacks will continue to contribute to bottom line growth and while share buybacks could lead to a growth rate in the mid-single digits right now, we must expect a higher share price in the years to come leading to a lower number of shares that can be repurchased.

All-in-all, I would see a growth rate in the high single digits more than reasonable for PayPal. To be not too optimistic, let’s assume 8% growth for the next ten years (still a rather cautious assumption in my opinion) followed by 6% growth till perpetuity. When calculating with these numbers, we get an intrinsic value of $129.07 for PayPal and an almost 100% upside for the stock.

Just for fun, we also assume the growth rates analyst are projecting for the years until 2032 (see section above) followed by 6% growth till perpetuity and the intrinsic value for PayPal would be $254.76. And while such a price target might seem absurd right now, we should not forget that PayPal was trading for $300 not too long ago and investors obviously saw this as a reasonable price for the stock.

Share Buybacks

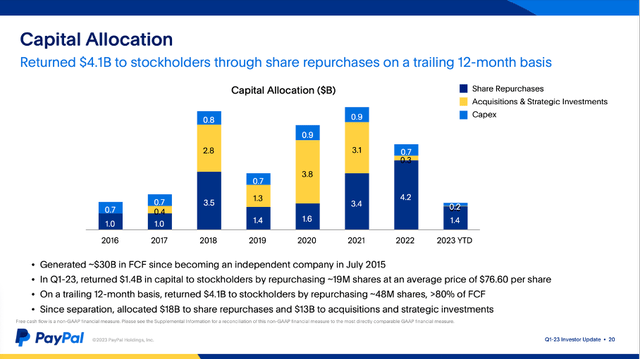

It is also good to know that PayPal is continuing to repurchase shares. If my intrinsic value calculations are correct and PayPal is deeply undervalued, management should put every dollar it doesn’t use otherwise in share buybacks.

PayPal Q1/23 Presentation

After PayPal spent already $3.4 billion in 2021 and $4.2 billion in 2022 the company is once again expecting to repurchase shares worth of $4 billion in 2023. In the first quarter of 2023, PayPal repurchased approximately 19 million shares for about $1.4 billion. And with a current market capitalization of $71 billion, the company can repurchase about 5.5% of its outstanding shares right now by spending about $4 billion on share repurchases.

Conclusion

We looked at several potential reasons for a declining stock price and aside from a declining number of active accounts (which is actually a little bit concerning) we could not find any real reasons to justify the recent sell-off. Especially when considering that PayPal is still able to grow with a solid pace and trading only for 14.5 times free cash flow, we are looking at a real bargain.

PayPal was struggling a bit in the recent past and at $300 the stock was clearly overvalued. But after losing about 80% of its previous value, we are looking at a real bargain in my opinion. Alarming is only the technical picture as it seems like PayPal is breaking a support level around $65 to $70 that was holding for almost a year. However, as long-term investors we should not pay attention to short-term stock price movements based on technical aspects. Of course, we can wait and hope for the stock price declining even lower and PayPal becoming an even greater bargain.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.