Summary:

- PayPal’s Q2 2023 financial performance showed growth in net revenues, operating income, and Total Payment Volume.

- The company experienced double-digit growth in transaction count and a slight growth in active account numbers.

- PayPal’s stock price dipped post-earnings release but may be oversold, presenting a potential buying opportunity.

chameleonseye

PayPal Holdings, Inc.’s (NASDAQ:PYPL) recent financial performance showcased impressive momentum with a rise in net revenues and notable improvements in GAAP and non-GAAP operating income. The company observed growth in its Total Payment Volume (TPV) and transaction count, pointing to a bolstered transactional base. Active account numbers also slightly increased, emphasizing the company’s prominence in the digital transaction domain. This piece offers a refreshed look at the previous article on PayPal, delving into the recent financial results and examining the shifts in stock price to pinpoint potential investment avenues. Notably, while the stock price took a hit post-earnings release, it now appears oversold, suggesting potential for an upward reversal.

A Glimpse into PayPal’s Financial Performance

PayPal exhibited solid financial momentum in its Q2 2023 results. The company logged net revenues of $7.3 billion, reflecting an uptick of 7% and 8% on an FXN basis. There was a notable rise in GAAP operating income, climbing 48% to reach $1.1 billion, while non-GAAP operating income also soared by 20%, settling at $1.6 billion. With a GAAP operating margin of 15.5%, it widened by 432 basis points, and the non-GAAP operating margin expanded by 228 basis points to 21.4%. This is a striking difference from Q2 2022 when the GAAP EPS was a negative $0.29; in Q2 2023, it stood at a positive $0.92.

Transactionally, the company experienced year-over-year growth in double digits. Its TPV reached $376.5 billion, marking an 11% growth in both spot and FXN measurements. The firm oversaw 6.1 billion payment transactions, up 10% from the previous year. Moreover, there was a 12% increase in payment transactions per active account for the past year. Active account numbers also grew slightly, with a count of 431 million, up from 429 million in Q2 2022.

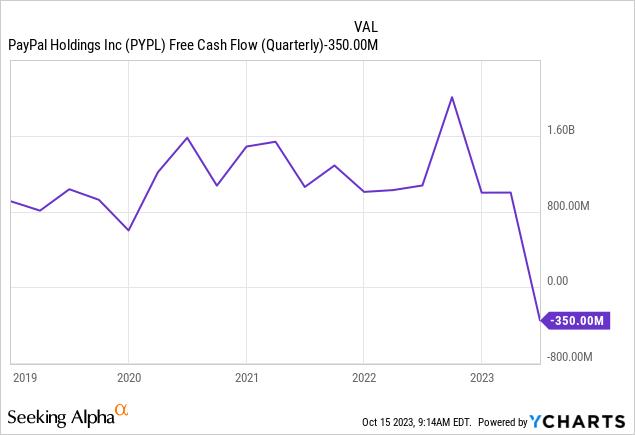

The quarter saw PayPal with a formidable balance sheet, holding cash, equivalents, and investments totaling $14.4 billion as of June 30, 2023. On the other hand, PayPal carried debts amounting to $10.5 billion. The company faced a cash flow from operations amounting to negative $0.2 billion and a free cash flow of negative $350 million, as shown in the chart below. Yet, PayPal’s commitment to its shareholders was evident, with the repurchase of around 22 million shares in Q2 2023, translating to $1.5 billion. Over the last year, PayPal bought back about 63 million shares, returning $4.9 billion to shareholders.

The key highlight was the unveiling of a collaboration between PayPal and KKR centered on European BNPL receivables. Through this alliance, KKR is slated to acquire up to €40 billion in present and upcoming BNPL loans from the UK and other European regions. This agreement is poised to generate an estimated $1.8 billion for PayPal.

In Q3 2023, PayPal anticipates net revenues nearing $7.4 billion, signifying a growth of about 8% on both spot and FXN parameters. They project GAAP earnings per diluted share between $0.85-$0.87, a drop from $1.15 the previous year. However, non-GAAP earnings per diluted share are predicted to surge by 13%-14%, ranging from $1.22-$1.24. For 2023, the GAAP earnings per diluted share forecast is around $3.49, a jump from $2.09 in FY’22. Moreover, PayPal is also optimistic about its non-GAAP earnings per diluted share, aiming for a growth nearing 20%, estimated at $4.95.

Delving into the Market’s Bearish Momentum

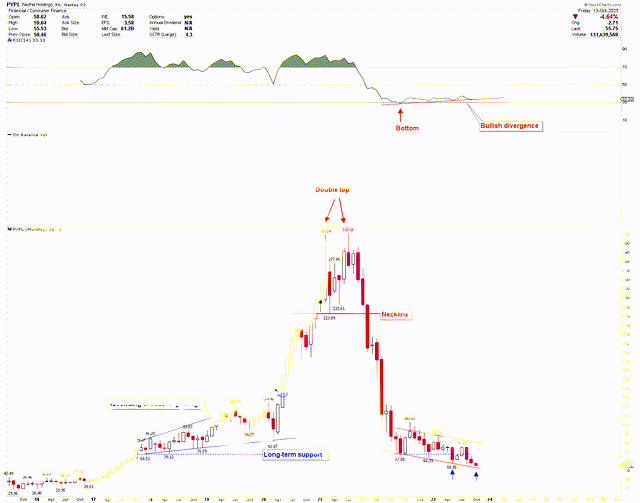

The recently revised chart spotlights significant changes in the price structure since the last update. Following Q2 2023’s earnings release, the price dipped, trading below the blue dotted line mentioned earlier as a long-term support. Nevertheless, the blue arrows hint at a potential price floor, suggesting a solid buying opportunity from these levels. The bullish divergence, previously discussed, is still relevant.

PayPal Monthly Chart (StockCharts.com)

The chart also draws attention to the forming of an ascending broadening wedge pattern during 2018 and 2019. Surprisingly, instead of a typical downward break before stabilizing, it broke upwards, marking one of the most robust market rallies. This upward momentum was attributed to the substantial growth driven by a swift transition to digital payments during the COVID-19 crisis. With lockdowns and a new norm of social distancing, there was a surge in online transactions. PayPal seized this opportunity, expanding its services and introducing innovations such as the “buy now, pay later” feature and QR code payments. Additionally, the company’s acquisition of Honey and its dive into cryptocurrencies added to investors’ trust, showcasing PayPal’s adaptability and foresight in the evolving digital finance landscape.

After breaking upward from the ascending broadening wedge, the price saw increased volatility and overstretch, indicating a correction pattern observed at the strong resistance. This became clear when the stock price pulled back from its high, leveling off around the starting point of the ascending wedge. The descent below the blue dotted support line indicates that the stock might be oversold, signaling a possible upturn once the price base is formed.

Key Action for Investors

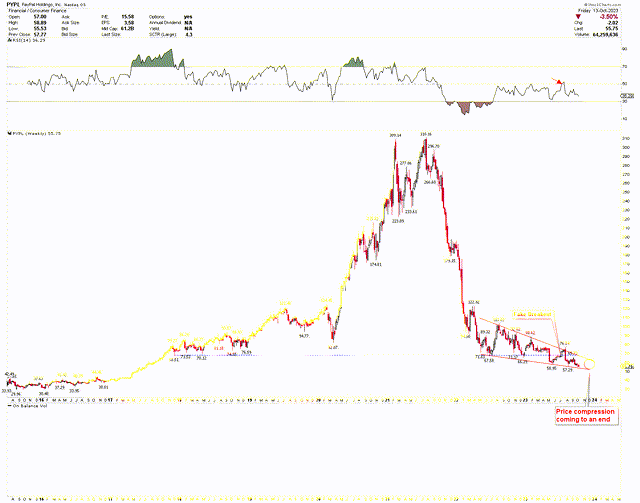

The discussed chart has been updated, showing a false breakout above the dotted blue line. The price is now moving within the triangle, suggesting compression. This compression appears nearing its conclusion as the price slows at the triangle’s edge. After the earnings announcement, the price declined, producing a sell signal marked by the RSI’s downturn from its mid-point. Although the price trend is descending, the slowing rate of this decline highlights possible signs of an approaching solid market base.

PayPal Weekly Chart (StockCharts.com)

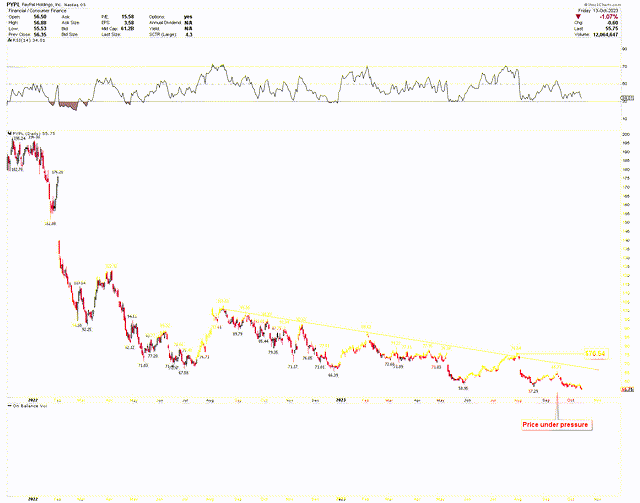

The daily chart also highlights short-term pressures in the PayPal market. It’s noteworthy that PayPal will only showcase bullish tendencies once its price consistently closes above $76.54. However, considering its current position, accumulating more long positions at current levels seems to be a promising long-term investment strategy.

PayPal Daily Chart (StockCharts.com)

Market Risk

In Q2 2023, even with consistent results, there’s mounting concern about PayPal’s performance in the upcoming quarter. This stems from the drop in GAAP earnings per diluted share, moving from $1.15 to somewhere between $0.85-$0.87. Such a decline might make investors wary about the firm’s ability to maintain its financial momentum. As a significant player in the digital payment realm, PayPal’s operations span various nations, making it susceptible to the ever-evolving economic and regulatory landscapes, with Europe and its recent BNPL pacts particularly noteworthy. While not explicitly stated in the initial information, it’s imperative to recognize that the domain of digital payments is witnessing increased competition, with both established financial entities and emerging fintech startups vying for a share of the market with analogous services.

Technically speaking, the stock price is currently entrenched in a pronounced bearish trend. A compelling buy signal is emerging due to the steep price drop, solid support levels, and distinctive price patterns. Yet, if the price fails to break above $76.54 and dips below $45, it could disrupt the price structures, suggesting that the prices might stay low in the long run.

Bottom Line

PayPal has demonstrated commendable financial performance in Q2 2023. The robust increase in net revenues, GAAP and non-GAAP operating income, and growth in TPV and transaction count illustrates a robust transactional foundation for the company. Despite a temporary dip in stock price post-Q2 earnings, the evidence suggests this could be a temporary trough, with a possibility of an upward reversal.

The company’s promising financial history, combined with innovative ventures such as the collaboration with KKR and other strategic moves, puts PayPal in a promising position. The market charts indicate the potential for an upswing in stock price, pointing to lucrative investment opportunities. Even though the price continues to reflect a bearish trajectory, the deceleration in its decline could trigger the next price surge. Investors can increase their buying positions at the current rates, poised to capitalize on potential future price increases. As long as the price remains over $45, there’s a good chance for it to turn upside.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.