Summary:

- PayPal experienced a decline in its user base in Q3 2023, raising concerns about its future growth and competitiveness.

- The company faced a significant contraction in transaction margins, with projections of slower revenue and profit growth.

- The new CEO’s turnaround strategy lacks a clear value proposition and does not address declining user growth and contracting margins.

- PayPal faces strong competition from credit card companies and mobile payment processors like Apple Pay, and its crypto business has shown limited growth potential.

joruba/iStock via Getty Images

Overview of PayPal’s Recent Performance

PayPal (NASDAQ:PYPL) reported its third-quarter earnings on November 1st, 2023. Analysts welcomed PayPal’s new chief executive officer, Alex Chriss. Investors seemed to have high hopes for Chriss’s turnaround strategy for PayPal. PayPal’s stock price has gone up by 12 percent since the earnings report, but the stock price was still down 36 percent compared to one year ago.

Thesis to sell PayPal stock

We initiated the rating for PayPal in August as Neutral as we saw the risk and reward were balanced at the time. But in Q3, PayPal’s fundamentals deteriorated, and its initiatives, like cryptocurrency, have not shown promise. As we can see, the risk now outweighs the reward.

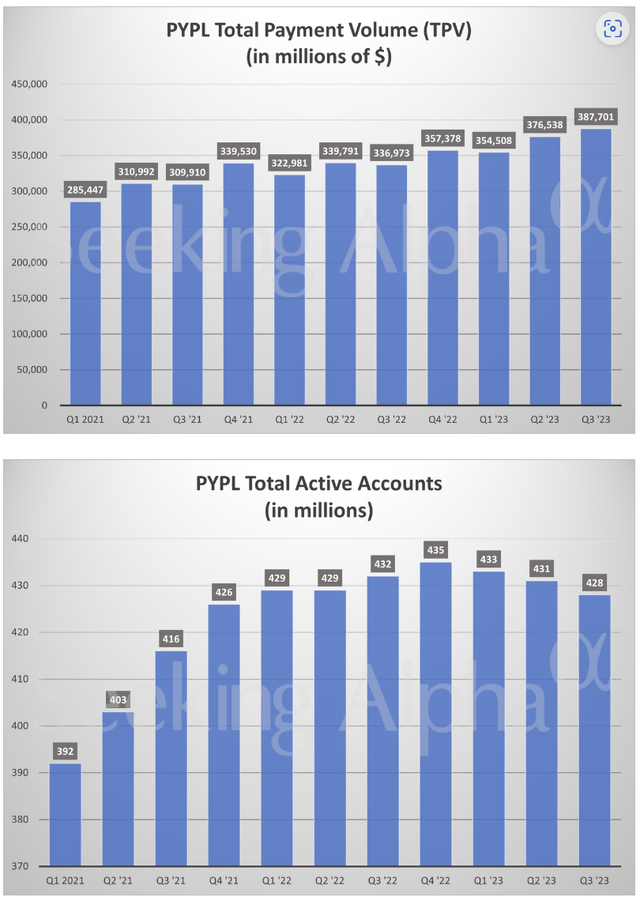

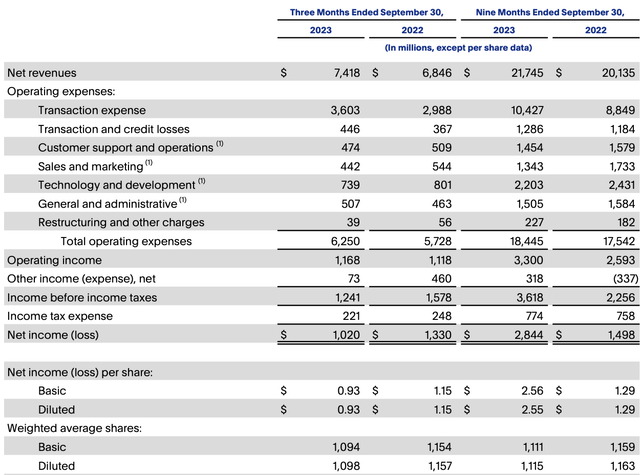

PayPal’s user base declined in the third quarter of 2023. Its transaction margin was heavily contracted during the third quarter. The company projected slower growth in both revenue and profits in the fourth quarter, along with worsening margins. This had a short-term negative impact on the business.

The real long-term issue is PayPal’s lack of a clear value proposition for its customers. The company faces strong competition in the payments industry from credit card companies. PayPal’s user acquisition channel, Venmo, also faces challenges from strong mobile peer-to-peer payment processors like Apple (AAPL) Pay. We don’t believe PayPal’s 400 million total users or 85 million Venmo users give PayPal a competitive advantage.

Its low valuation seems more like a value trap rather than a real bargain to us. We believe the new CEO has not set up a solid turnaround strategy to stop PayPal’s decline. We recommend investors sell PayPal stock.

Financial Reviews

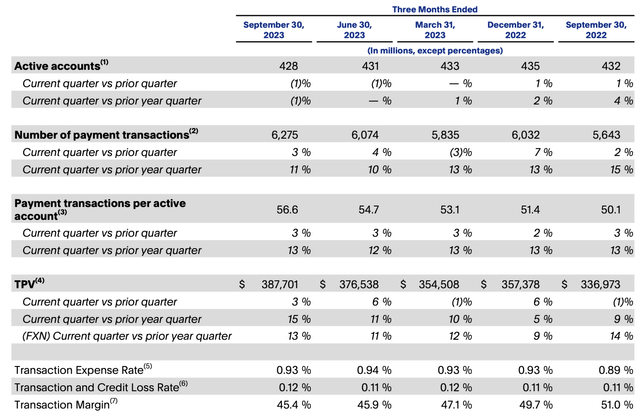

We reviewed its financials and earnings transcript. The company continued to lose account count but was growing its payment volume. This is not a good sign as the customer base is the long-term growth basis for the business.

PayPal increased its revenues by 8% but its transaction margin decreased by 560 basis points compared to last year. However, the company was able to grow its operating income by 4.5% due to heavily cutting costs by laying off operational staff.

In our opinion, layoffs seem to temporarily hide more serious underlying issues. Anyway, the company was able to return $1.4 billion in cash to shareholders through stock buybacks, which was the only thing that cheered investors.

Transparency and Reporting

While a new CEO always brings hope, we didn’t see many bright spots during PayPal’s earnings call. The only thing we view as positive is that the CEO decided to provide more transparency in PayPal’s financial reporting going forward. However, we didn’t hear any concrete strategies from the CEO on how he plans to turn around declining user growth and contracting margins.

Importantly, we’re committed to increase transparency and improve consistency in how we discuss our business and the ongoing enhancement of our disclosures

PayPal has 3 customer bases: individual consumers, small businesses, and large businesses. However, there is a strong connection between the individual consumer base and the merchant customer base. PayPal is able to negotiate fees with merchants depending on the scale of its individual consumer base. The company currently reports account counts in an aggregated form, which provides low transparency to investors. PayPal should break out account counts for each of the 3 customer segments – individual, small business, and large business. This would give investors more insight into the dynamics between consumer and merchant account growth. Declining consumer accounts will reduce PayPal’s negotiating leverage with merchants. More segmented reporting would make this clear rather than burying consumer declines in total account numbers.

Market Position and Competition

Branded vs. Non-Branded Transactions

The management mentioned that PayPal’s margin contraction was driven more by increased transaction volume from Braintree versus branded transactions. This is a red flag to us because branded transactions refer to individual customers who actively choose PayPal as a payment option, while Braintree transactions are non-branded. The difference between the two for PayPal is that PayPal charges higher fees to merchants on branded transactions compared to non-branded Braintree transactions. This signals that individual consumers are now using PayPal less often as their preferred checkout option. The shift towards more Braintree volume means PayPal is processing more transactions where they earn lower merchant fees. This mix shift is concerning, as it indicates declining engagement from PayPal’s branded consumer base which is critical for their long-term competitiveness and margins.

Apple Pay vs. PayPal

In addition to the strong competition from credit cards that we mentioned in our previous article, emerging mobile payments like Apple Pay and Google Pay are taking more market share from PayPal. Apple Pay now has 50.8 million users in the US and 700 million globally, almost double PayPal’s user base. According to Apple, it has over 2 billion active devices currently.

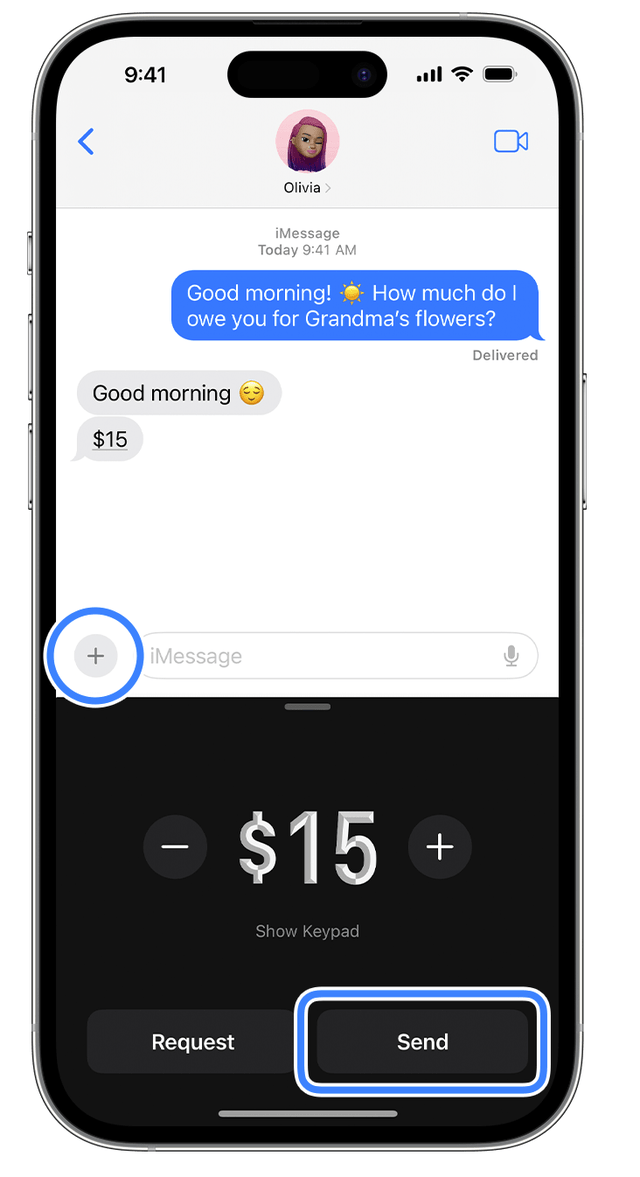

Venmo vs. iMessage

PayPal investors were still hoping that Venmo could turn the business around. However, Apple users can send payments through iMessage. Apple has 1.3 billion iPhone users as of 2022, compared to just 85 million users for Venmo. We think Venmo’s long-term outlook is bleak given Apple’s massive built-in userbase advantage. Users already have payment functionality baked into their iPhones, reducing the need for a separate Venmo app. The huge disparity between Apple’s users and Venmo’s makes it unlikely that Venmo can compete as a top peer-to-peer payment platform long-term.

The New CEO’s Approach and Data Strategy

The new CEO’s initiatives seem to focus on building PayPal into more of a platform company by leveraging technology and data.

Let me touch briefly on our evolution to operating as a platform company. Our ability to seamlessly delight customers end-to-end is a function of the quality of our technology and data platforms, which are very strong. But we have a significant and important opportunity to further become a platform company that builds company-wide capabilities, accelerates at scale and drives efficiencies across the organization.

Apple and PayPal have very different approaches to handling user data security.

Apple Pay processes payments using a device-specific number and unique transaction code. This means your actual card details are never stored on your device or Apple’s servers. You also need to authenticate with Face ID, Touch ID, or your passcode to use Apple Pay, adding further security.

PayPal takes a different approach – they monitor every transaction in order to try to prevent fraudulent behavior, identity theft, and phishing. PayPal has a dedicated security team that aims to identify and address any suspicious activity.

The key difference is Apple Pay emphasizes privacy and minimizing data collection. They don’t store user card details and transactions aren’t tied to your identity. PayPal collects more data about transactions and users in an attempt to detect fraud and abuse, at the expense of privacy.

One risk or reason we can think of why the founder stepped down and brought in an outside CEO is that monetization of user data can be a double-edged sword. Apple is known for its strong data privacy protections. PayPal’s ambition to further leverage user data could backfire if privacy issues arise or data practices stray outside norms. PayPal will need to tread very carefully to avoid a customer backlash as it seeks to wring more revenue from user data.

Overall, we do not find the new CEO’s ambition to transform PayPal into a platform company very compelling at the moment because PayPal is facing increased competition and has a declining client base. We believe that the management should prioritize these concerns over monetization because investors should expect the stock price of PayPal to continue declining if the user base decreases further.

PayPal has guided slower growth in both revenue and profits in Q4. Additionally, margins will continue deteriorating. This suggests the issues at PayPal are accelerating, not stabilizing.

We now expect fourth quarter revenue to grow between 7% and 8% on a currency neutral basis or approximately 6% to 7% at spot. In addition, we expect non-GAAP EPS in Q4 to be approximately $1.36, representing 10% growth relative to 2022.

Our guidance contemplates a sequential improvement in transaction margin dollar performance. That said, on a year-over-year basis, we now expect transaction margin dollars to decline.

Analysis of PayPal’s Crypto Business

In our previous article, we mentioned that PayPal’s crypto initiatives were an area to watch as a potential growth driver given PayPal’s large user base advantage over crypto exchanges like Coinbase.

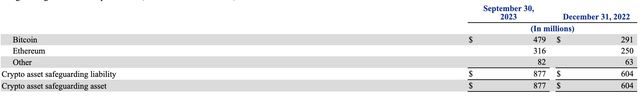

However, PayPal’s customer crypto assets on the platform declined to $877 million in Q3 down from $1.016 billion in Q2. This is not an impressive result in terms of asset size or growth rate.

In addition, PayPal’s PYUSD stablecoin business seems to still be in the start-up phase. PYUSD ranks #482 by trading volume among stablecoins.

With a market cap of approximately $158,763,822, PYUSD currently ranks 240th among digital assets. Furthermore, PYUSD has experienced a 24-hour trading volume of $2,847,923, ranking it at 482nd.

While PayPal’s large user base gives it a potential advantage in mainstreaming crypto adoption, results thus far suggest limited consumer interest in holding crypto within PayPal.

Overall, we conclude that PayPal’s crypto business is unlikely to become a significant growth driver in the near term given the modest crypto asset balance and minimal stablecoin adoption.

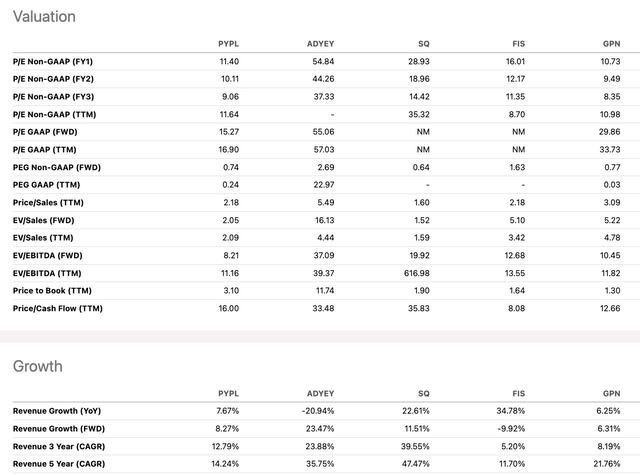

Valuation Analysis

In our opinion, PayPal currently does not have a clear and compelling value proposition for customers and thus its market position is relatively weak.

For example, Square (SQ) competes in payments by offering checkout systems for physical merchant locations. PayPal tries to compete through its P2P service Venmo. However, major players like credit card companies and mobile payments have much larger user bases than PayPal and Venmo. Their user engagement is also higher. For instance, an average of 41 iMessages are sent daily per user. Venmo sees a much lower usage frequency compared to iMessage.

Therefore, we view PayPal’s current valuation metrics like a P/E ratio in the low teens and a PEG ratio below 1 as a potential value trap. The low valuation multiples likely reflect structural challenges rather than an attractive entry point.

The market seems to be losing confidence in PayPal’s long-term prospects. Unless the new CEO can articulate a compelling strategy for differentiated value creation, we think PayPal’s stock will continue languishing as a value trap. The valuation might look cheap, but the business appears broken.

Conclusion

PayPal has started to decline in user base and we are not impressed with the new CEO’s turnaround strategy so far. PayPal faces strong competition in the payment space and lacks differentiation compared to peers. It also lags behind in user base size.

While PayPal continues generating cash flow and returning capital to shareholders, we see an emerging risk that PayPal fails to turn around and becomes a low-margin commoditized business competing mainly on price in payments.

PayPal has yet to articulate a compelling strategy to reignite user growth and leverage its large user base for competitive advantage. The low valuation multiples appear to be a value trap rather than an attractive entry point.

Unless PayPal can show concrete signs of inflection in user engagement and retention, we believe downside risk outweighs upside potential. We recommend selling PayPal stock and waiting for a better entry point after a turnaround strategy takes hold. PayPal’s challenges seem likely to persist in the near term. We rate PayPal a Sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.