Summary:

- PYPL’s turnaround is here with growing Active users and expanding operating margins, as the management drives engagement and optimizes costs.

- The same has been observed in the raised consensus forward estimates, highlighting the reversing market sentiments surrounding its long-term prospects.

- Given the robust FCF generation and sustained share retirement, PYPL remains well capitalized to continue returning value to its existing shareholders.

- Combined with its inherent undervaluation compared to its peers and historical means, we believe the stock offers interested investors with the opportunity of a great upside potential.

aluxum

We previously covered PayPal Holdings, Inc. (NASDAQ:PYPL) in February 2024, discussing how the stock’s excellent pre-earnings performance had exceeded expectations, with the management’s weak FY2024 guidance unfortunately reversing its upward momentum.

Despite so, we had maintained our optimism surrounding its eventual turnabout, with the new management already introducing highly promising growth initiatives while laying off additional headcounts, with 2024 likely to bring forth top/ bottom line beats despite the prudent guidance.

Since then, PYPL has already charted an impressive return of +12.1% over the past three months, well outperforming the wider market at +2%. Despite so, we are maintaining our Buy rating for the stock, thanks to the improving performance metrics and expanding profit margins.

Combined with its inherent undervaluation and robust shareholder returns, we believe that bullish support has finally materialized, with the stock likely to be slowly upgraded nearer to its fintech peers and historical means, offering interested investors with the opportunistic chance of a great upside potential.

The PYPL Investment Thesis Is Showing Great Promise – Further Aided By Its Inherent Undervaluation

For now, PYPL has reported a double beat FQ1’24 earnings call, with net revenues of $7.69B (-4.1% QoQ/ +9.2% YoY) and (new methodology) adj EPS of $1.08 (-5.2% QoQ/ +27% YoY).

Most importantly, the fintech’s Total Payment Volume [TPV] continues to grow to $403.86B (-1.4% QoQ/ +13.9% YoY/ +102.9% from FQ4’19 levels of $199B), with the Total Active Accounts finally increasing to 427M (+1M QoQ/ -6 YoY/ +122M from FQ4’19 levels of 305M), reversing four consecutive quarters of QoQ declines.

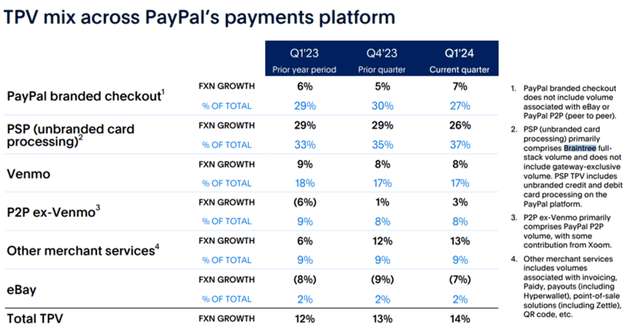

PYPL’s TPV Mix

On the one hand, we do not expect PYPL to regain its rich FY2019 operating margins of 23.2% (+1 points YoY) in the near term, attributed to the dilutive nature of the lower margin Braintree on its operations, as the payment platform increasingly comprises its TPV at 37% in FQ1’24 (+2 points QoQ/ +4 YoY).

This is along with Braintree’s high growth nature, with +26% YoY growth in TPV by FQ1’24, accelerated than the fintech’s overall TPV at +14% YoY.

As a result, it is unsurprising that PYPL’s adj operating margins have declined drastically to 18.2% by FQ1’24 (-0.1 points QoQ/ +0.9 YoY).

While the fintech may continue to report growing TPV and engagement trends, with higher transactions per active account at 60 over the LTM (+2.2% QoQ/ +12.9% YoY), it is unsurprising that the management has offered an underwhelming FY2024 adj EPS growth guidance “by a mid to high single-digit percentages.”

This is compared to PYPL’s historical adj EPS growth at a CAGR of +19.1% between FY2016 and FY2023.

On the other hand, we also believe that the PYPL management has demonstrated improved operating efficiency, as observed in the reduced adj operating expenses of $1.73B in FQ1’24 (-6.4% QoQ/ -3.3% YoY), after discounting for non-cash SBC expenses and restructuring-related costs.

With the management guiding further optimizations in FQ2’24, we may see the fintech’s bottom lines further improve sequentially, partially offsetting the impact of Braintree’s margin dilutive operations.

At the same time, PYPL aims to accelerate the growth of its Branded Checkout segment, currently at +7% YoY across its enterprise and international platforms, which has started to be accretive to its top/ bottom line growth in FQ1’24.

As the fintech launches more in-app offerings, such as those introduced in the First Look Call on January 25, 2024, we may also see its existing users remain sticky while attracting new users to its platforms, naturally driving the growth of its TPV and top/ bottom lines ahead.

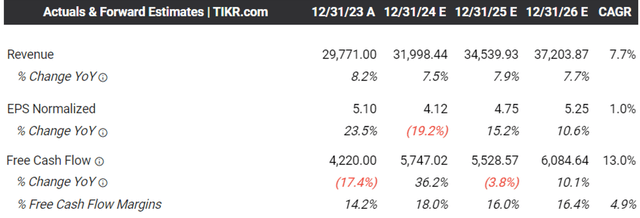

The Consensus Forward Estimates

At the same time, based on the (new methodology) FY2023 adj EPS of $3.83 and the consensus forward estimates above, it appears that PYPL is expected to generate a promising top/ bottom line expansion at a CAGR of +7.7%/ +11.1% through FY2026.

This is compared to the previous estimates of +7.4%/ +7.1%, respectively.

It is apparent from the raised numbers that the market is also growing increasingly convinced of PYPL’s ability to consistently generate profitable growth, as observed by the double-digit Free Cash Flow generation through FY2026, with the management seemingly laser-focused to “drive more efficiency across the organization.”

As a result, we believe that the management remains well capitalized to continue returning value to its existing shareholders, with 62M or the equivalent 5.4% of its float already retired over the LTM and 116M/ 9.7% since FY2019.

This is on top of PYPL’s sustained deleveraging observed in the balance sheet, with a net cash situation of $4.63B in FQ1’24, compared to $4.38B in FQ4’23, $0.17B in FQ1’23, and $5.79B in FY2019.

This is based on cash/equivalents and short-term investments of $14.31B (+1.8% QoQ/ +34.3% YoY/ +33.1% from FY2019 levels of $10.75B) and long-term debts of $9.68B (inline QoQ/ -7.6% YoY/ +95.1% from FY2019 levels of $4.96B).

So, Is PYPL Stock A Buy, Sell, or Hold?

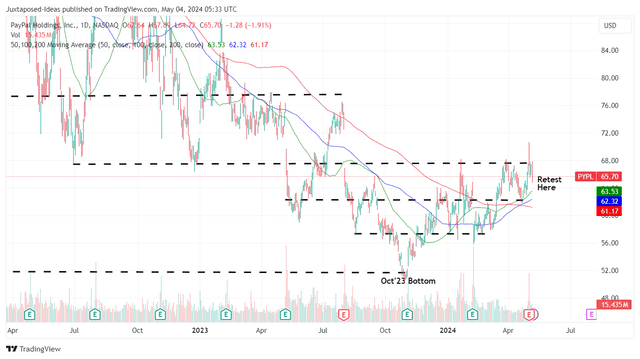

PYPL 2Y Stock Price

For now, PYPL has already charted an impressive recovery of +32.9% from the October 2023 bottom while outperforming the wider market at +21.1% over the same time period.

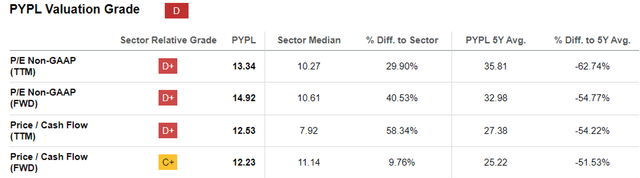

PYPL Valuations

At the same time, PYPL remains inherently undervalued at FWD P/E valuations of 14.92x, when compared to its 5Y average of 32.98x, despite the notable recovery from the November 2023 bottom of 9.42x.

PYPL’s undervaluation is even more apparent when compared to its direct peers, such as Block, Inc. (SQ) at 20.36x, Mastercard Incorporated (MA) at 30.94x, Visa Inc. (V) at 26.93x, and SoFi Technologies, Inc. (SOFI) at 95.32x.

Based on the FWD P/E of 14.92x and the (new methodology) LTM adj EPS of $4.07, it is apparent that PYPL is trading near our base-case fair-value estimates of $60.70.

Otherwise, assuming a re-rating in its FWD P/E closer to its historical means and direct peers, we may be looking at a bull-case fair-value of $134.20 based on its 5Y mean P/E valuations of 32.98x, as the fintech slowly improves its operational efficiency and grows its profit margins.

Combined with the promising factors discussed above, we maintain our previous Buy rating for the PYPL stock, since its value play prospects continue to offer opportunistic investors with an excellent upside potential.

For now, with the stock failing to break out of its 2024 resistance levels of $67s, it appears that we may see another retest of its previous support levels of $62s. As a result, interested investors may consider dollar cost averaging at those levels for improved upside potential.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.