Summary:

- PayPal stock has outperformed the S&P 500 since my previous update, validating my bullish thesis.

- Management has shown glimpses of brilliance as its turnaround is finally in sight.

- PayPal is making progress in the branded and unbranded space, underscoring its improved execution.

- More effective monetization and integration with Venmo could unlock more optimistic growth prospects.

- I argue why PYPL stock is well-positioned to head higher as the market moves on from its past malaise. Read on to find out why.

Justin Sullivan

PayPal: Finally Bottomed

PayPal Holdings, Inc. (NASDAQ:PYPL) investors have not given up faith in the company, as the stock of the leading payments provider has continued its recovery over the past four weeks. Accordingly, PYPL bottomed out in late July before the company released its earnings scorecard. A post-earnings surge followed as PayPal’s Q2 earnings release impressed the market. Its ability to surpass Wall Street estimates and record a double beat on revenue and earnings provided much-needed momentum for buyers. As a result, the stock has outperformed the S&P 500 (SPX) (SPY) markedly since my last update in June 2024.

I urged investors to stay bullish on PYPL, even as the company needs to demonstrate its ability to ramp up its monetization initiatives to the market. The challenges faced in the unbranded space have also impacted PayPal’s transaction margins on the corporate level, impacting investor confidence.

However, PayPal posted a more assuring performance in Q2, showing that Braintree (its unbranded platform) has delivered more robust transaction margin growth as it seeks to overcome the struggles with profitability that impacted its progress.

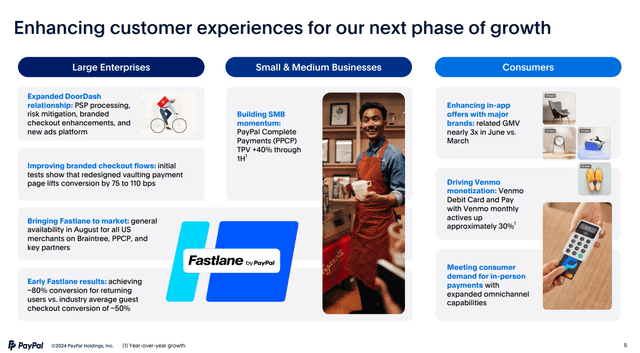

PayPal’s Next Phase Of Growth

PayPal’s next phase of growth (PayPal filings)

In addition, PayPal is looking to reignite investor interest in its growth thesis. I updated investors in my previous article that the stock is still priced for growth. Therefore, while reducing costs and improving operational efficiencies can help drive near-term bottom-line improvement, the company still needs a more robust growth strategy. I assess that the market seems relatively satisfied that the company has executed marked improvements in its approach, which is also reflected in its operating results.

In addition, PayPal’s guest checkout with Fastlane is expected to open up a new growth vector for the company. PayPal indicated that its guest checkout solution could potentially create a “seamless experience” that benefits developers and merchants. As a result, it should help to improve the platform’s ability to drive higher conversion rates. Accordingly, management indicated that Fastlane’s conversion exceeded 80%, markedly above the 50% attributed to competitive solutions. Hence, I urge investors to pay close attention to some of these nascent initiatives, as they can help rejuvenate the company’s growth prospects.

PayPal Focuses On Monetization And Integration

It’s important to note that PayPal is still a massive consumer payment platform. Based on its 429 M active accounts, PayPal is increasingly focusing on monetization. While its active accounts fell from 431M in the previous year, its TPV increased by 11% YoY. Therefore, the growth drivers in its branded and unbranded segments have been instrumental in its improved monetization. I assess that PayPal is expected to focus on monetization in its branded segment to help drive monetization and margin accretion, even as it competes in the lower-margin unbranded segment.

The company has also benefited from the resurgence in its P2P Venmo platform. Venmo delivered more than $73B in TPV, representing an increase of 8% YoY. Its active account has also reached 62M, corroborating PayPal’s improved adoption and appeal. Management has also developed new offerings (such as Venmo Teen Accounts) to drive earlier adoption and potentially promote customer loyalty at an early stage.

Interestingly, Apple (AAPL) recently announced that it has opened up its NFC technology. Apple’s decision will affect app developers in several important markets. While it could help PayPal gain market share, it’s crucial to note that Apple Pay is expected to remain the default option for iPhones. Hence, PYPL is still likely to face consumer resistance with the existing Apple Pay default, potentially hindering adoption. Despite that, Wall Street is optimistic about the latest developments and believes it could improve PayPal’s margins over time as it capitalizes on Apple’s ecosystem. However, it’s still too early for us to assess the impact of the changes, as Apple’s control in its iOS walled garden is expected to remain significant, with Apple Pay as default. Therefore, investors must be extremely careful about being overly optimistic in the early stages on these developments, as it could also attract other competitors to grab market share.

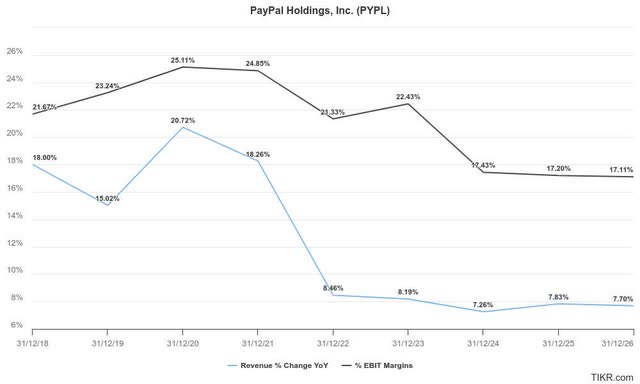

PayPal: Best Growth Days Likely Over

Consequently, I believe that Wall Street’s estimates of PayPal are realistic. The company’s revenue growth and adjusted operating margin are expected to remain well below its pre-COVID momentum. In other words, PayPal’s best days seem to be over, even as it refocuses on creating new growth vectors and expanding its product lineups.

While management upgraded its FY2024 outlook and upsized its share repurchase program, it might not be enough to drive a much more robust valuation re-rating. Given the increasingly intense competition against big tech and leading players in the unbranded space, investors are likely waiting to assess how its growth initiatives pan out before returning more aggressively.

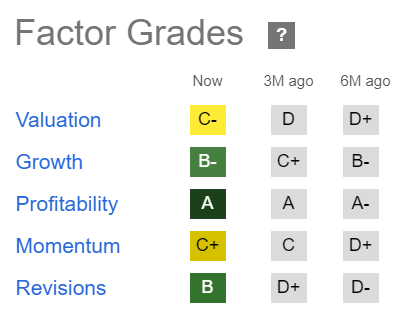

PYPL Quant Grades (Seeking Alpha)

However, PYPL is no longer assessed as overvalued, even after the recent market outperformance. Its “C-” valuation grade is a marked improvement over its “D” grade three months ago.

Analysts have also lifted PayPal’s earnings estimates, although most downgraded its revenue growth prospects. However, I assess a significant headwind could have been removed as PayPal regains the market’s confidence over its ability to drive profitability growth.

Much will likely depend on how its unbranded segment performs, as the new branded initiatives are still nascent. Despite that, PYPL’s buying momentum has improved (“C+” grade), underscoring buyers have become more confident about its ability to engineer a sustained turnaround.

Is PYPL Stock A Buy, Sell, Or Hold?

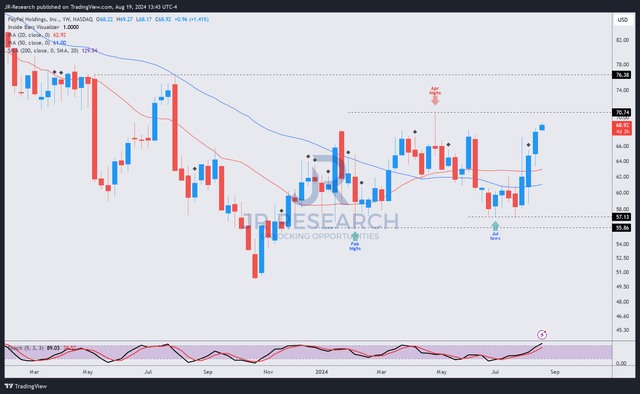

PYPL price chart (weekly, medium-term) (TradingView)

PYPL’s price action is increasingly bullish, although a resistance zone just under the $70 level could hinder further upside in the near term. Getting past that zone has proved challenging, as it attracted selling pressure in April before a marked decline.

However, PYPL’s dip buyers resoundingly overcame selling pressure at its July 2024 lows, helping the stock bottom out before its recent resurgence. Consequently, I assess that PYPL’s recovery is considered early, corroborated by its improving profitability and growth initiatives.

Macro headwinds impacting consumer spending are also expected to weaken as the Fed potentially moves into cutting interest rates starting in September 2024. While competitive headwinds are expected to remain intense, PYPL’s pessimism seems baked in as the market looks past its previous struggles.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!