Summary:

- PayPal delivered one of its best quarters in recent history.

- Earnings guidance was impressive, but the stock is still lower.

- We tell you why and where we think you should buy this.

Here Lie The Hopes And Dreams Of Those That Bought PayPal At $300 Justin Sullivan/Getty Images News

While we had been bullish on PayPal Holdings, Inc. (NASDAQ:PYPL) for a few choice months last year, we had a neutral stance in our most recent piece back in November.

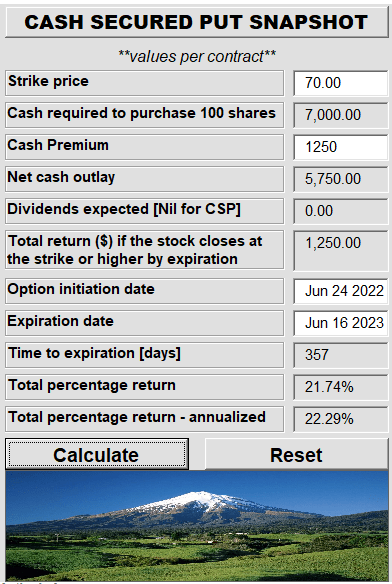

We thought a bounce was imminent when we wrote our bullish piece since the valuation had compressed sufficiently. While we were not all the way there yet, options offered lucrative earnings for a defensive entry price.

PayPal: Valuation Hits All-Time Low

With the price appreciation in the months following that piece, the above trade could have been closed with capture of almost 100% of the premiums without waiting out the whole term as we had suggested in our following article. We were back in the neutral camp once we reviewed the Q3 results in light of the prevailing macro environment. The revenue run rate was just about keeping up with the nominal GDP and transaction volumes were trending downward. On the other hand, while the transaction and operating margins were down year over year, they held up better than our expectations. With growth firmly in the past tense, we arrived at the fair value for this stock using free cash flow adjusted for stock based compensation. The number was 17X and concluded with:

PYPL is fairly valued today and unlikely to move much higher. Downside risks stem from margin compression and a possible recession. At 5% risk free rates, one could argue that PYPL should be valued at a 13-15X free cash flow multiple, especially since there is growth on the immediate horizon. We rate the stock at neutral/hold. We would now consider option entries only at $60 or lower and would close out our earlier suggested cash secured puts for $70 strike.

Source: PayPal: How To Value It Now That Growth Is Gone

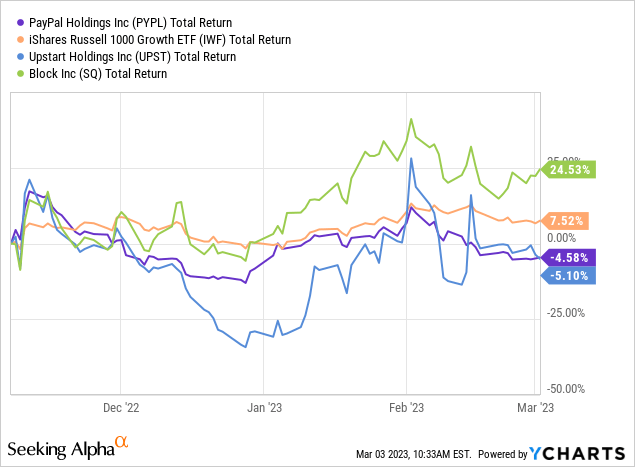

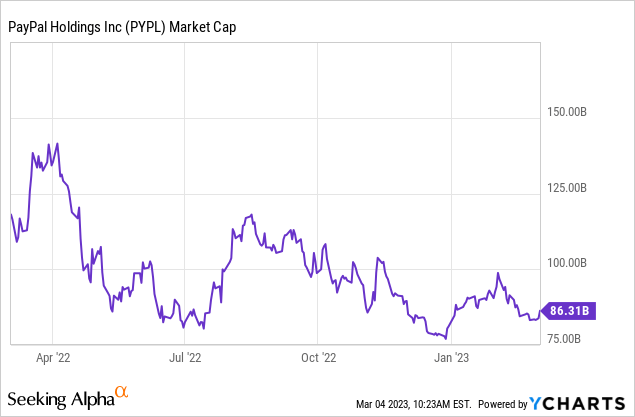

The stock price has been more or less flat since then, performing in line with another fintech fan favorite Upstart Holdings, Inc. (UPST).

We take a look at the Q4 results next.

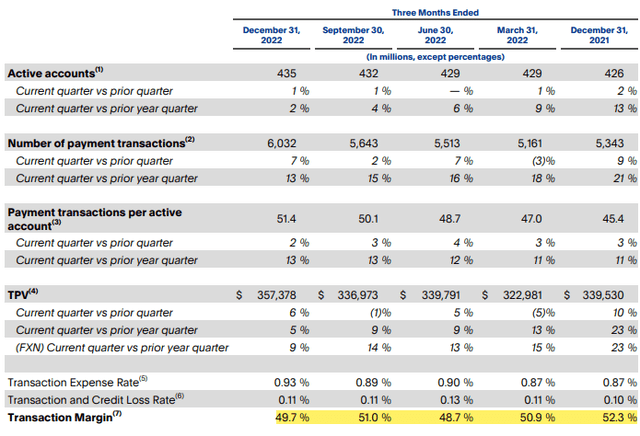

Q4-2022

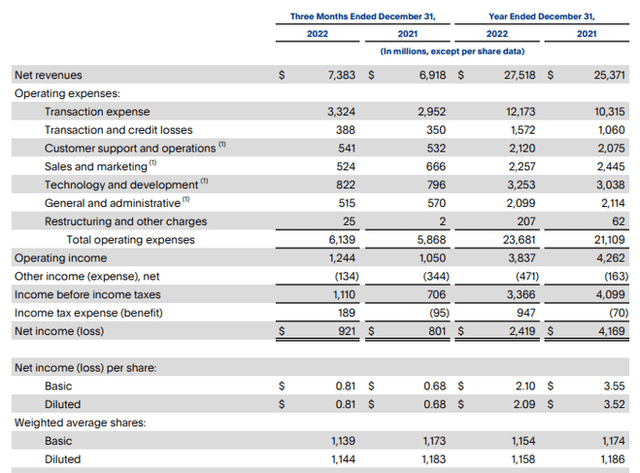

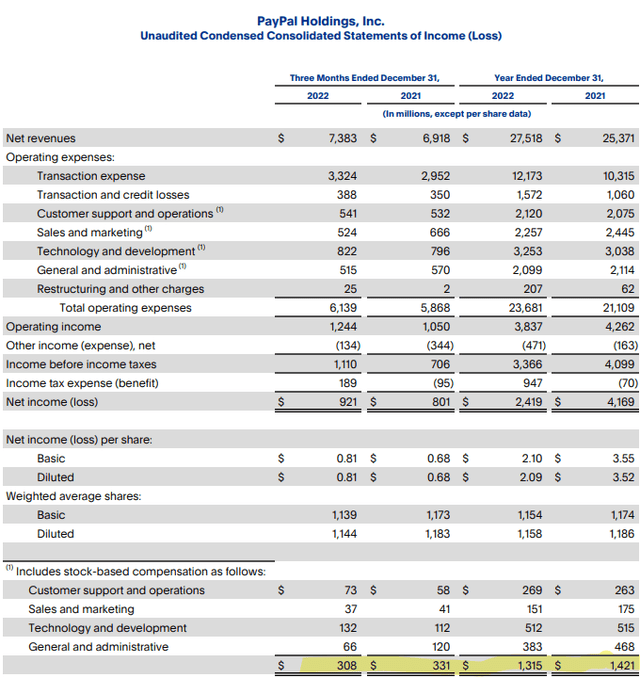

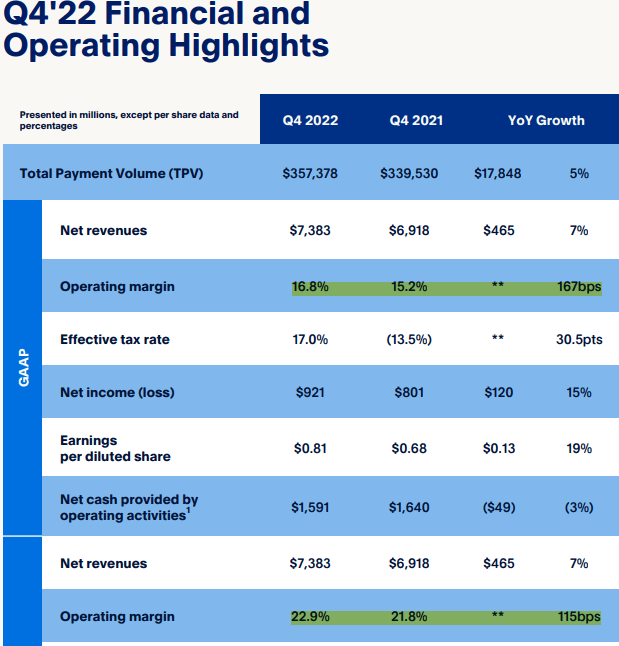

Q4-2022 was a good quarter and PYPL delivered a solid beat in earnings even though revenue came in a shade under estimates. This was definitely stronger than our outlook as we expected margins to stay weak.

Active accounts grew once more, despite intense competition and payments transactions were up 7%. In the slide below, you can see the transaction margin which, while lower than the 52.3% we saw last year, is still relatively healthy.

That same transaction margin led to an operating margin that expanded versus the 15.2% seen at the end of last year.

PYPL Q4-2022 Presentation

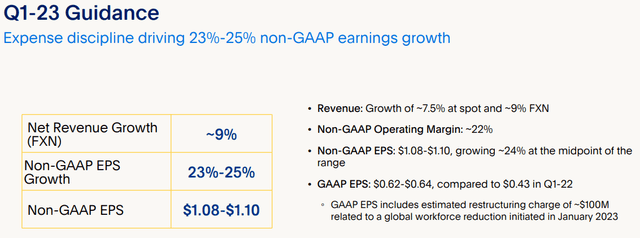

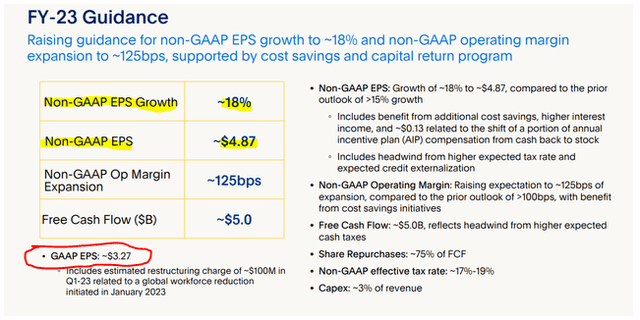

PayPal raised the ante for the bears by providing their best guidance in at least the last 4 quarters. Q1-2023 will show a 23-25% earnings growth, a number that was way ahead of analysts’ estimates.

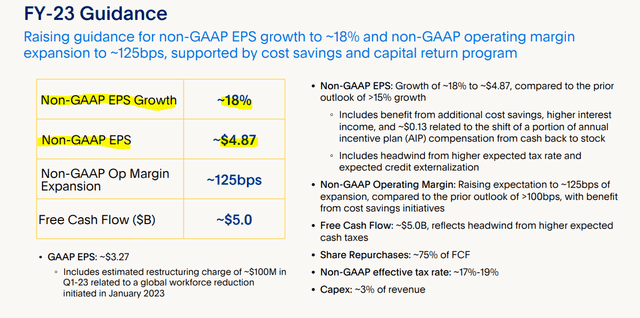

For the full year, earnings per share are expected to come in at $4.87.

Our Take

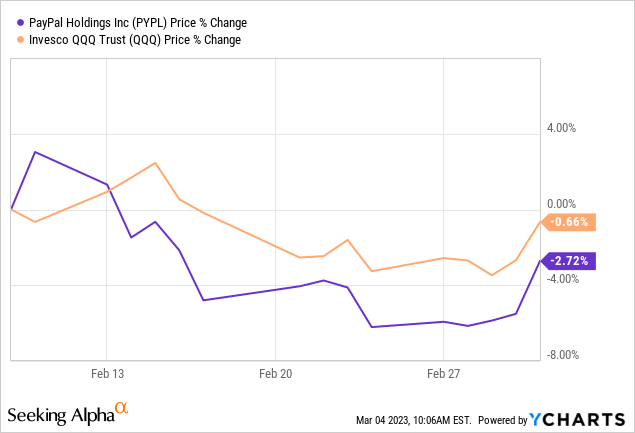

The market did not get too impressed with those results and the early gains were squandered in the days ahead.

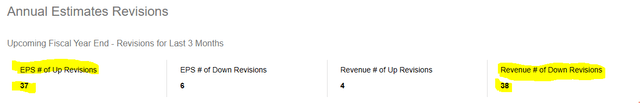

Bulls might be frustrated here and wondering exactly what the company needs to do to catch a break. There are three different parts to this answer. The first is that revenues are always the story for growth stocks. You can dance on the earnings beat, but if revenues come in under, there will be pressure. So the fact that 38 analysts brought down their revenue numbers, while 37 revised their earnings estimates higher, has a lot to do with this.

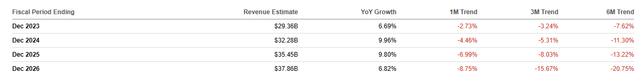

On the revenue side, estimates have been falling for quite some time as PayPal is maturing as a growth play. Estimates for 2026 are down almost 30% in the last 6 months.

This is basically what happens when analysts take a current growth trajectory and extrapolate it into infinity. When the cycle normalizes, there are these unrealistic expectations which need to be grounded.

The second part is that analysts still think that margins will continue expanding, as evidenced by EPS growth being stronger than revenue growth.

While that may play out for 2023, we think beyond that, they may again have to cut estimates. We think markets already know this and are discounting a very slow growing company in the future.

Valuation

The final piece is the valuation story. At 15X earnings, PYPL stock might appear to be a growth investor’s dream. Certainly when investors were paying 17X sales in 2021, the odds were firmly stacked against them. The problem of course is that those are non-GAAP earnings and exclude $1.31 billion of stock based compensation.

This works with PYPL issuing stock to employees and the repurchasing that as a way of deploying free cash flow. We and most analysts that have invested outside of the bubble years of 2020 and 2021, believe that the GAAP number is actually quite appropriate.

An alternative is to compute the adjusted free cash flow yield by taking the company provided free cash flow and subtracting the stock based compensation out. The rationale is that the initial portion of the stock buyback is just being used as an offset to keep share counts static, you really should not be giving the company credit for that. So adjusted free cash flow works to around $3.7 billion. On the current market capitalization, you have a 4.3% adjusted free cash flow yield.

We hate to break it to you, but that is not much in an era of 5.5% risk free Federal Funds rate.

Verdict

The good news is that PYPL does have a respectable valuation. 4.3% adjusted free cash flow yield or 23 times GAAP earnings are actually very nice valuations relative to what madness transpired over the markets in the last 2 years. The bad news is that it is not remotely low enough if you understand the history of bubbles. Bubbles end with extreme undervaluation and we are not there yet. Cisco Systems, Inc. (CSCO), Microsoft Corp. (MSFT) and Intel Corp. (INTC) are all good examples that found a true bottom in March 2009 as their PE ratios markedly compressed from Dotcom days.

Yes, that was during the global financial crisis, but you can see that journey was 85% complete even before the collapse we saw in the latter half of 2008. We will add here that the interest rates were slashed to the bone and the stocks still became that cheap. At the minimum you should expect a similar outcome when interest rates are so high and climbing.

While PYPL is one of the few growth stocks with respectable valuations, we don’t think the journey is over. If you embrace that forecast, the best way to play it is to sell cash secured puts at $60 or lower strikes, after the stock takes rough tumble. We rate this a hold at present. Marrying our thinking on PYPL with our outlook on the market, makes us believe that a longer term buying opportunity will present itself in late 2023.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Are you looking for Real Yields which reduce portfolio volatility? Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.