Summary:

- PayPal is a leading online payment platform with a strong business presence.

- The company faces competition from other payment providers in the market.

- The article provides an overview of PayPal’s valuation and perspectives on its future growth.

- I rate the stock a Buy and consider it a great value opportunity with a current defensive fair value of around $80.

JasonDoiy

Introduction

I have noticed recently that PayPal (NASDAQ:PYPL) is exceptionally undervalued, with the stock price down over 80% from its all-time high.

This presents a huge opportunity, but the investment has risks. The changing fintech landscape creates a problematic environment for the company to adjust to and remain relevant in. By looking critically at PayPal’s ecosystem, fundamentals, valuation, and peer comparisons, I’ve concluded that this is one of the best value investments available on the market. The primary concern I have relates to the company’s future growth prospects.

PayPal’s Business Overview

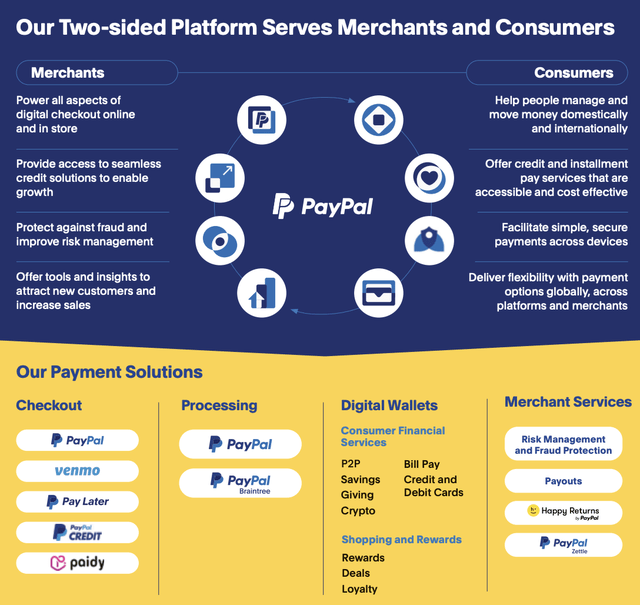

PayPal is an international leader in online payments. The company was initially established as Confinity in 1998 before merging with Elon Musk’s X.com in 2000 and being renamed PayPal in 2001. It was initially particularly successful due to its efficient, user-friendly digital transaction capabilities. In 2002, the company was acquired by eBay (EBAY), and it became its primary payment method. In 2015, PayPal was spun off as its own independent business, partly to facilitate its expansion and operations beyond eBay. The company is most commonly known as an integrated payment services provider, and it has acquired various companies in its evolution, including Venmo, a popular payment app in the U.S.

The company’s main revenue streams include transaction fees, cross-border fees, merchant services, fees and interest on loans, subscription fees, Venmo, partnerships, integrations, and foreign currency exchange.

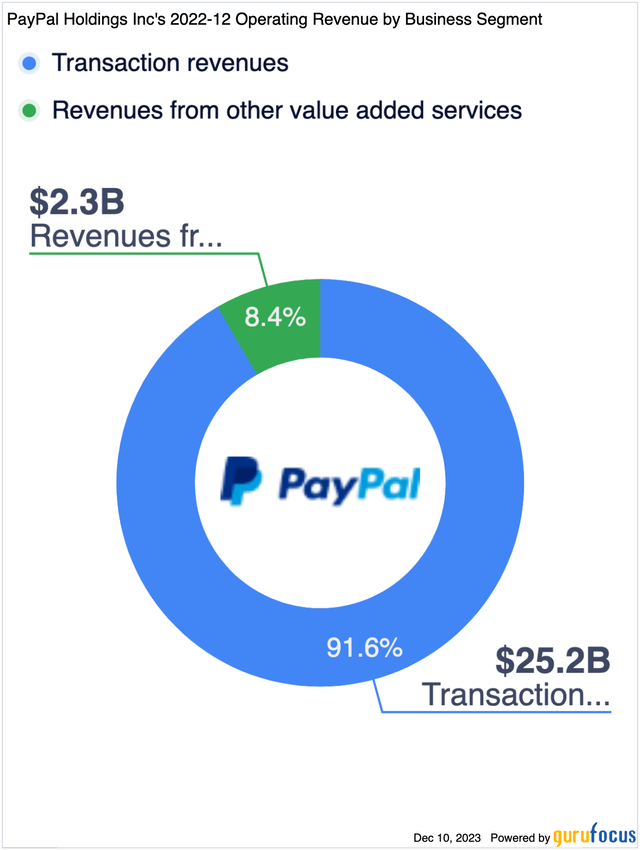

While significant differences exist between these revenue streams, they can be broken down into two simpler segments. The first is ‘transaction revenues’, and the second is ‘other value-added services.’

The ‘value-added’ services would include partnerships with financial institutions or e-commerce platforms, merchant interest and fees, and consumer credit products.

As of 2023, PayPal’s payment volume has increased 10.8% since 2021, standing at $376.54bn in Q2 2023. The total payment volume then reached $387.7bn in Q3 2023. The same source used to gather the Q2 payment volume data (DemandSage) also presents that 431 million people worldwide use PayPal as of 2023. This presents a picture where PayPal is arguably dominant, with 40.52% of the market share in the payment services industry. However, I think this needs to be revised. As we will see in my competitive analysis, the payments industry is a large and diverse space. PayPal also indirectly competes with Apple (AAPL) Pay, Visa (V), and Mastercard (MA) for transaction volume.

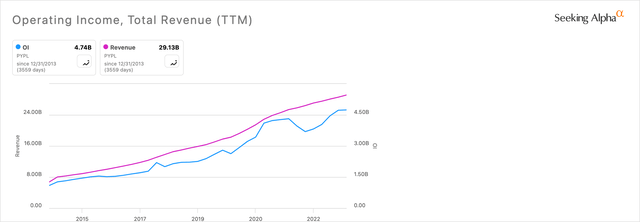

One of the most significant reasons for the stock dropping in 2021 was a rapid decline in operating profit, starting in Q3 2021. This was as revenue decreased at a much slower rate.

Part of the expense issues that would have led to decreased operating income could be related to the company’s setback when eBay transitioned to its own payment provider, known as ‘Managed Payments,’ in June 2021. This significantly reduced PayPal’s transaction volume. By Q2 2021, eBay contributed under 4% of PayPal’s volume, a 512 basis point reduction from Q2 2020.

Competitive Analysis

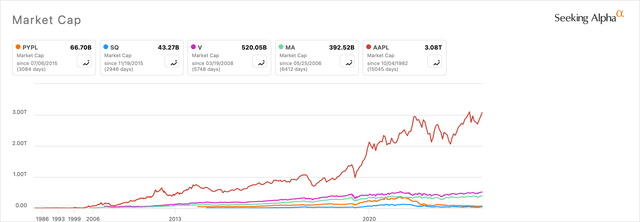

PayPal’s main competitors, based on my research, are Apple Pay, Square (SQ), and Stripe, among others. Yet, the company also faces wider, indirect competition from leading payment providers like Visa and Mastercard.

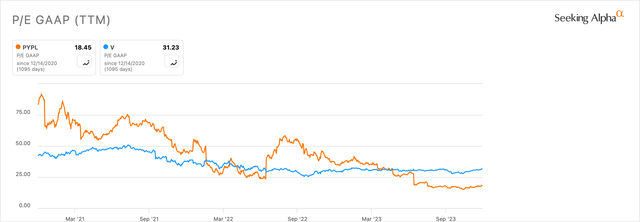

Taking a comprehensive look at PayPal’s main competitors ranked based on historical market cap presents an issue where most of PayPal’s larger indirect peers dominate it based on the power of resources to innovate:

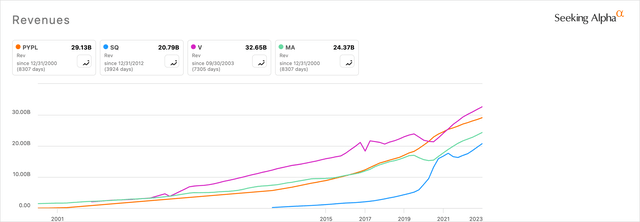

Let’s look at the peers again to comprehend the different revenues fully. I removed Apple because it has a much broader operational focus than the four remaining companies:

There’s a powerful observation here to be made. PayPal, although it has a market cap of around $453bn less than Visa, takes in just $3.52bn less in revenue at the moment.

This significant discrepancy is foundational to why PayPal could be considered a value opportunity. Yet, the reality is more nuanced than this, with specific future operational challenges that could thwart PayPal’s price return performance.

*Indirect Competitors (Author, Using Seeking Alpha)

PayPal is valued weakly at the moment for some specific reasons, but my analysis shows that these reasons are exaggerated in the stock price. The greatest of these is the heightened competition, especially as PayPal’s innovations quickly get adopted by its peers.

For example, look at the organization’s Buy Now, Pay Later scheme, which saw massive uptake but has recently been copied by Square, Stripe, and Apple Pay Later.

PayPal’s buy now, pay later (BNPL) program spurred strong checkout volume and TPV increases. It’s offered nearly 200 million loans to almost 30 million customers globally since launching in 2020. The program is available at about 300,000 merchants worldwide. – Insider Intelligence

One of the most profound considerations I think PayPal will face in the coming years is how to remain relevant in a highly saturated and innovative market. The adoption of AI in the payments sector is undoubtedly going to create new companies with new availabilities. If organizations with significant moats based on advanced technology appear, PayPal may lose substantial market share.

To combat this, PayPal is focusing on integrating AI and has already done so for quite a while. Its core segments that have integrated such capabilities so far are security and customer service. For example, AI is used in the PayPal chatbot assistant, in error prevention, and to support staff. Fraud detection systems built on pattern recognition and complex artificial intelligence to combat AI identity creation are also areas the company is ramping up on.

Valuation Perspectives

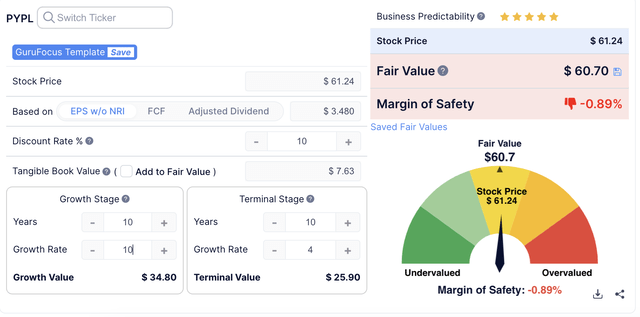

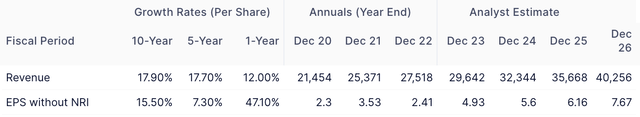

A discounted cash flow analysis of PayPal reveals it to be around 30% undervalued if we take the 10-year average EPS w/o NRI growth rate. However, I want to look at a more pessimistic view because PayPal’s long-term revenue growth has slowed. If I were going to be generous and assume the company can innovate and grow from here, I might use a 10% annual growth rate:

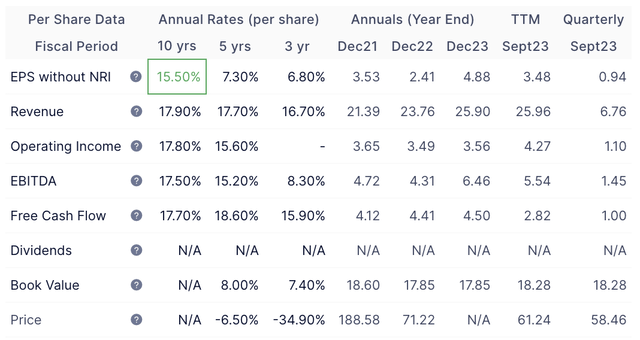

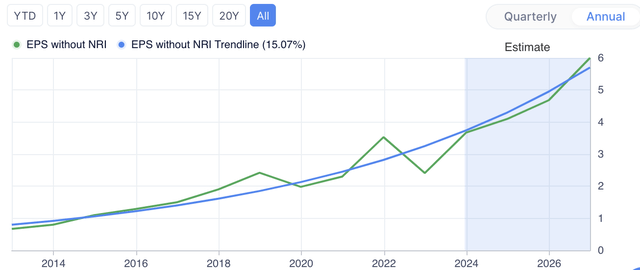

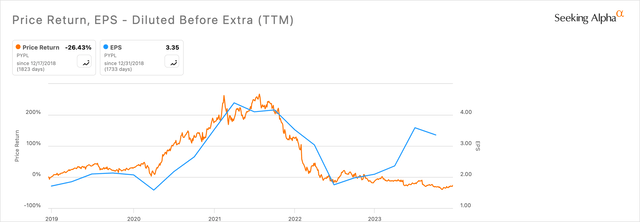

I have done this because the 10-year EPS w/o NRI average annual growth rate is 15.50%. Considering the 3-year rate is 6.80%, 10% seems optimistic on the surface.

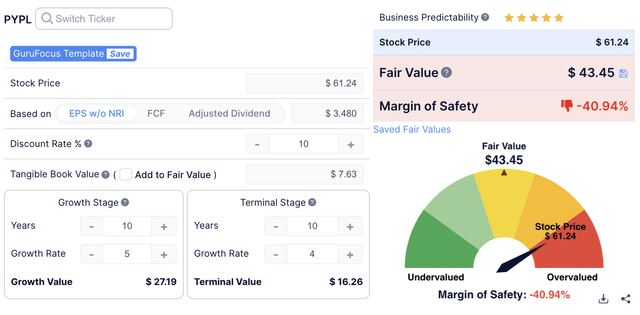

A more pessimistic DCF calculation could look as such:

While that assumes growth to be slowing based on long-term trends, this is only part of the picture. In the last year, the EPS w/o NRI has shot way up:

If the analyst estimates are correct, assuming a 15% growth rate may be more fair. If so, we’re looking at a 28.11% undervaluation in the current stock price:

These scenarios do not price in a potentially continued relevance and growth to PayPal a decade out, in which the terminal value growth could increase significantly. However, due to the current competition risks, it is speculative to assume a higher growth rate and more sensible and defensive to use a standard 4%.

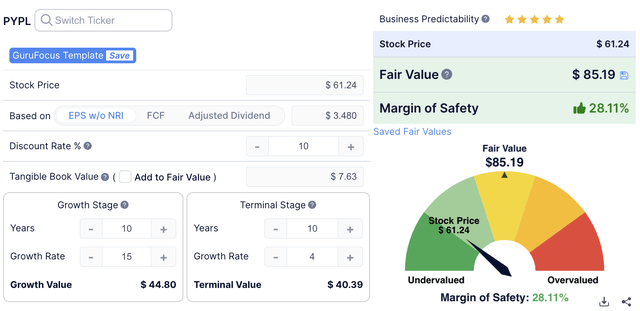

Let’s also review the company based on EPS and stock price to give a more detailed visual of the price-to-earnings picture:

And there we have it: we can see the undervaluation nicely exhibited in the share price lag in catching up with the new EPS after the COVID-19 boom and decline. I’m asking myself, ‘Will the EPS growth be maintained?’. It’s uncertain, but the shares look undervalued even if the EPS is only kept steady. If the investment adds up to a growth and value play, that’s two in one in my books.

From reviewing these perspectives, I would say the fair value of incorporating analyst estimates into the DCF calculation and a defensive approach would be around $80 right now.

Risks

There are some important risks that I need to consider when evaluating this stock and understanding whether PayPal can reach my defensive $80 fair value. Yet, I think my estimate is, as I say, defensive. Partly because I predict that the company’s continued innovation will push growth and drive revenue so that this isn’t purely a value trade but a value investment.

One of the specific operational difficulties the organization has faced recently includes Venmo being taken off Amazon as of 01/10/2024. While nowhere near as big a hit as PayPal being removed as the primary payment system on eBay in 2021, this will hurt the company’s revenue.

In addition, the company is under new management. As of September 2023, Alex Chriss, is the new CEO and President of PayPal. Jamie Miller is now the new Executive Vice President and Chief Financial Officer as of November 2023. Multiple other leadership changes have been made, and under this new management, the focus is on operational efficiency, profitability, innovation, market positioning, and a customer-centric approach. The risk is whether the new leadership can pull of the significant adaptations needed in order to drive the revenue growth to pull past a defensive fair value estimate in the long term.

I do think it is significantly unlikely for PayPal to not have a price rebound in the short-to-medium term. The only way I can realistically see this happening is a significant shock in reduced revenues or operational hazards that create poor margin results. It seems unlikely, given the company’s management shifts, intentions, and already evidenced strong financial results recently mentioned above.

However, one of the important notes I have made to myself is that the company is carrying a significant level of liabilities as compared to previously. For evidence, total liabilities were 52% of the assets in 2015 but are 74% today. This is likely caused by and also could be a hindrance in financing innovation efforts to remain competitive with the significant peers outlined above. Such a high level of liabilities could hinder its mobility to finance large, expensive projects later on.

Conclusion

In my opinion, this is a fantastic opportunity. I can’t see a better value investment on the market right now, and I own the shares as of just a few days ago. I’m convinced this is one of the more stable value investments to make at the moment. My only question is whether I’ll hold it for a long time or wait until the valuation looks fair again. I’ll be watching the management’s operational decisions and the earnings results to monitor my investment as such.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.