Summary:

- After a mixed quarter that was perceived as a very negative one, PayPal continues to slide to multi-year lows.

- As strong as the narratives around competition and margin headwinds are, I have hard time justifying the sell-off in the long run.

- PayPal has significant competitive advantages, and the management is making the right moves to improve them.

bombuscreative

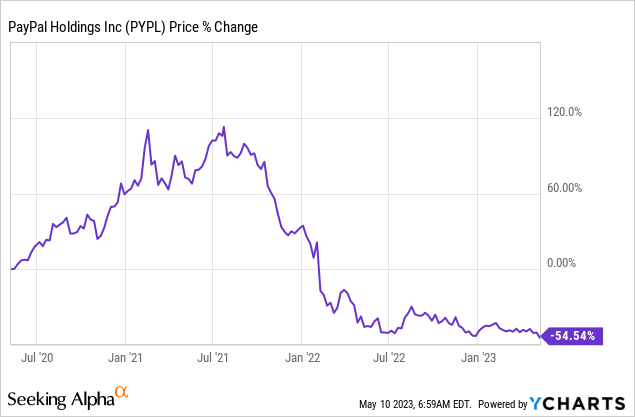

Following the recent quarterly results, the journey south for PayPal’s (NASDAQ:PYPL) stock continued and its now trades at levels last seen back in 2017.

It simply amazing how the stock could trade at prices of above $300 per share and in a period of less than two years to now reach levels slightly above $60. There are certainly cloud gathering around the company’s thriving business model, but that alone cannot explain such a violent move and as it usually happens share prices could overshoot both on the upside as well on the downside simply due to extreme narratives.

Although PYPL has never been among my top picks within the sector, recent developments have made the company an interesting case for anyone who is not influenced by the predominant narrative – whatever it may be.

PayPal’s Cratering Share Price

When judging the attractiveness of a stock, I usually begin with the business model itself, financials and competitive advantages and only then I look at how the company is priced.

In this case, however, I will start from the other direction and look at pricing first. Once I establish the attractiveness of PYPL from its share price point of view, I will have closed look at business fundamentals and some important competitive advantages.

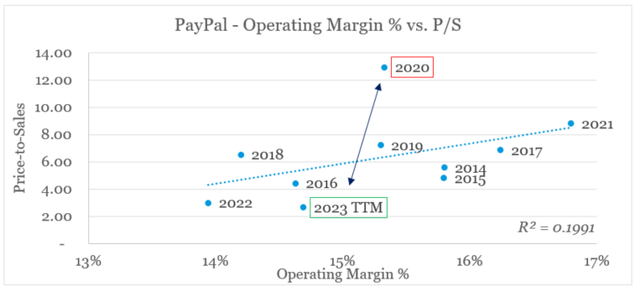

The graph below is in my view the most telling in terms of what has happened to PayPal in recent years. On the x-axis I have plotted the company’s operating margins and on the y-axis we have its Price-to-Sales multiple.

What we see is that over the years, the two variables exhibit a relatively strong relationship until the year 2020 – when hype around digitalization was running high and the markets were flooded with liquidity.

prepared by the author, using data from SEC Filings and Seeking Alpha

As of the time of this writing, the tables have turned rapidly and PYPL is now priced at the other end of the spectrum – at an extremely low sales multiple relative to its current operating margin.

This sharp repricing of PYPL in a matter of only a few years resulted in the absolute massacre of the enthusiastic buyers during 2020. A phenomenon that is hardly confined to PYPL alone.

As pessimism regarding PYPL was already running high, the recent results only confirmed most people’s fears of further deterioration of the company’s business fundamentals. As usual, the trend-following analysts also jumped on the bandwagon and continued to downgrade the stock.

Seeking Alpha

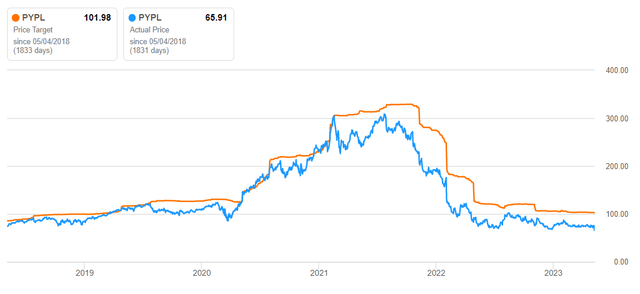

Although equity analysts are very good at pinpointing operational issues within a business, their track record of identifying long-term trends or temporary inefficiencies within the market is very poor. A clear illustration of that is the graph below, which shows that the consensus price target of PYPL simply follows the actual price with a bit of a lag.

Seeking Alpha

Ongoing margin pressures and the quarterly decline in active accounts (more on that later) were among the main reasons for PYPL decline following the latest earnings release. The company now expects its operating margin to expand by 100 basis points during the fiscal year, down from its previous expectation of roughly 125 basis points.

This is hardly good news for shareholders as competitive pressures in the sector intensify and a recession is looming on the horizon, but also hardly justifies a nearly 15% sell-off over the past 5-days.

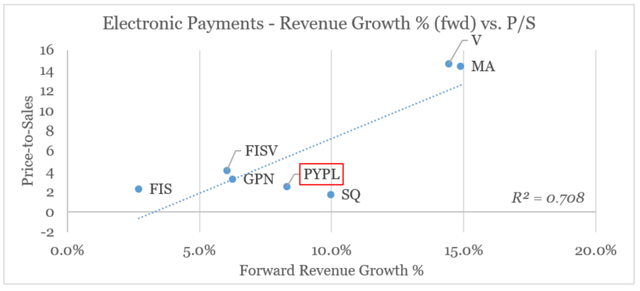

Relative to its peers in the digital payments space, PYPL also appears very attractively priced once we control for each of the company’s forward revenue growth rate (plotted on the x-axis).

prepared by the author, using data from SEC Filings and Seeking Alpha

Only Block, Inc. (SQ) is more attractively priced relatively to its expected revenue growth rate, but the company is experiencing some major problems of its own that in my view justify the conservative valuation.

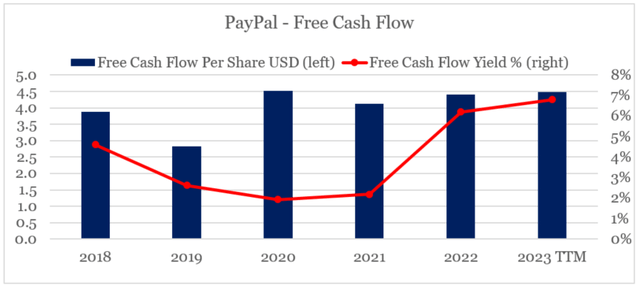

Lastly, we’ll have a look at PayPal’s free cash flow per share, which has been relatively flat over the past few years. Nevertheless, the company’s free cash flow yield of nearly 7% is now significantly higher than the average of 2% during the 2020-21 period.

prepared by the author, using data from SEC Filings and Seeking Alpha

Based on all that, PYPL is now priced at an extremely attractive levels and the market appears to be pricing in a significant compression in future margins as well as a much slower topline growth.

Is It Really That Bad?

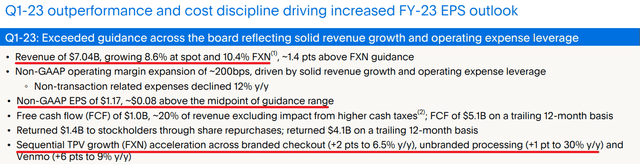

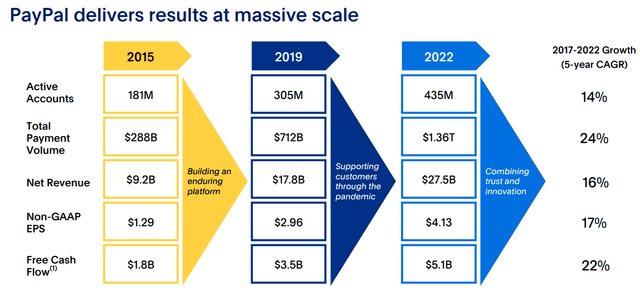

During the quarter, PayPal reported a strong topline growth and a Non-GAAP EPS above the midpoint of the previously announced guidance. While branded volumes grew at more than 6% over the same period of last year, it was unbranded processing that registered an impressive 30% growth.

PayPal Investor Presentation

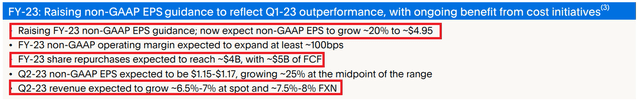

In terms of guidance, non-GAAP EPS is now expected to grow at a slightly higher rate when compared to the previous one – roughly 20% for the year to $4.95, compared to an 18% growth to $4.87 three months earlier. Revenue growth during the second quarter, however, is expected to slow down to around 7%.

PayPal Investor Presentation

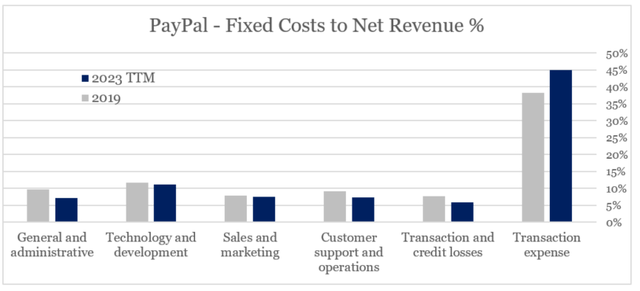

Overall, the results were mixed, but the market has started to price-in a further deterioration in fundamentals through the rest of 2023. The lower expansion of PayPal’s operating margin, however, was in the spotlight during the quarter as transaction-related expenses continue to increase as a share for revenue.

prepared by the author, using data from SEC Filings

This was largely driven by the larger share of unbranded processing operations.

Transaction expense as a rate of TPV came in at 93 basis points, 5 basis points higher than Q1 last year. This increase was primarily driven by 30% growth in our unbranded processing volumes. These volumes grew approximately 3x faster than our overall TPV growth. As a result, transaction expense dollars grew 17%.

Source: PayPal Q1 2023 Earnings Transcript

Although this is likely to continue to put pressure on margins, the management is already addressing the issue through its value-added services within PayPal Complete Payments platform.

PayPal Investor Presentation

Third, we are focused on substantially improving the margin structure of our unbranded business. Our PayPal Complete Payments platform opens a new $750 billion TAM in the small and midsized business market, with a significantly enhanced margin structure compared with our largest enterprise customers.

Source: PayPal Q1 2023 Earnings Transcript

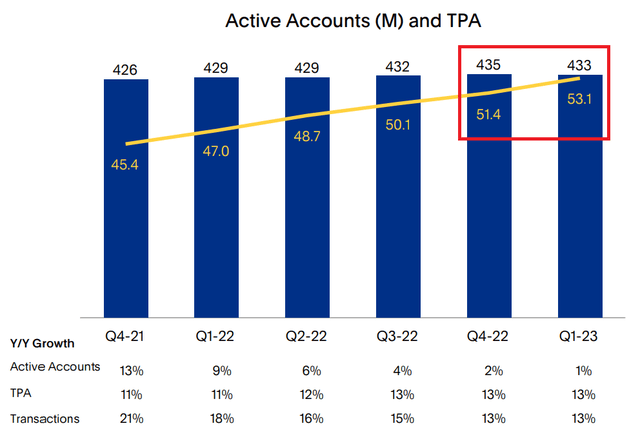

Another major issue during the quarter was the fact that active accounts fell to from 435m to 433m in the past 3 months. Although these headwinds are likely to persist in the short-run, the long-term impact is mostly speculative. Moreover, transactions per account continued to improve which supports the management’s claim that they are prioritizing high-value accounts.

PayPal Investor Presentation

A period of flat to declining active accounts is also to be expected as PayPal has experienced a long period of very high growth in active accounts, adding roughly 130m from 2019 through 2022.

PayPal Investor Presentation

The Brand As A Competitive Advantage

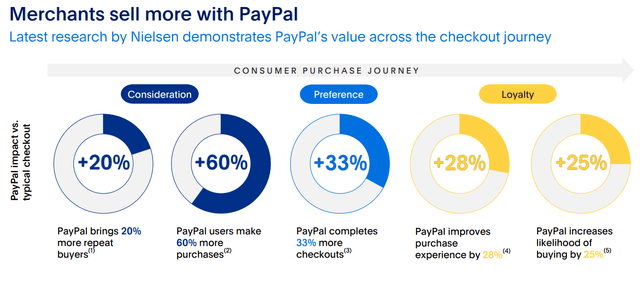

In addition to the strong business performance over the long-run, PayPal’s brand offers a major competitive advantage in addition to the company’s wide network effect.

The brand metrics across the consumer purchase journey provide a meaningful context on what it really means to own one of the strongest global brands in digital transactions. From more repeat buyers and purchases to a higher likelihood of repeat purchases.

PayPal Investor Presentation

Given its heritage, PayPal’s global awareness is unmatched by most of the newly emerging peers and gives the company an opportunity to improve perceptions by turning it into a digital wallet powerhouse. By adding a number of value added services, PayPal not only grows its non-transaction related revenues, but is also improving customer perceptions of its iconic brand.

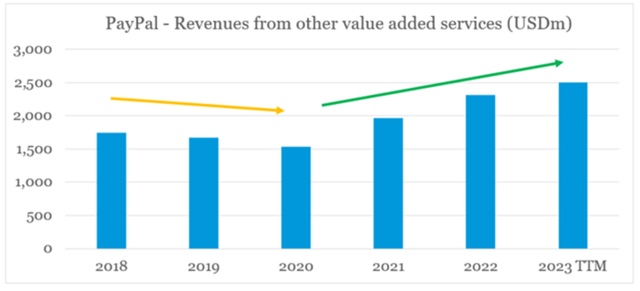

prepared by the author, using data from SEC Filings

It is worth mentioning that the increase in other value added services we see in the graph above is attributable to the higher interest earned since 2020.

Revenues from other value added services increased $191 million, or 39%, in the three months ended March 31, 2023 compared to the same period in the prior year primarily attributable to increases in interest earned on certain assets underlying customer account balances resulting from higher interest rates and interest and fee revenue on our loans receivable portfolio driven by consumer interest-bearing installment loans and our PayPal Business Loan (“PPBL”) products.

Source: PayPal Q1 2023 10-Q SEC Filing

However, expansion into adjacent service offerings moves the PayPal brand beyond its narrow focus related to e-commerce transactions and improves customers’ perceptions regarding relevance, innovation and security.

PayPal Investor Presentation

Conclusion

After falling nearly 80% from its 2021 highs, PayPal appears increasingly attractive for anyone willing to look beyond the narratives and taking a long-term view on the business. Although short-term challenges are likely to remain and the digital payments space is getting increasingly competitive, the company is among the well-positioned businesses to capitalize on its strong competitive advantages. Having said that, the share price could experience more pressures in the coming months, but the extremely conservative valuation have significantly reduced downside risk.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FISV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including a detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for better positioned high quality businesses in the digital payments space?

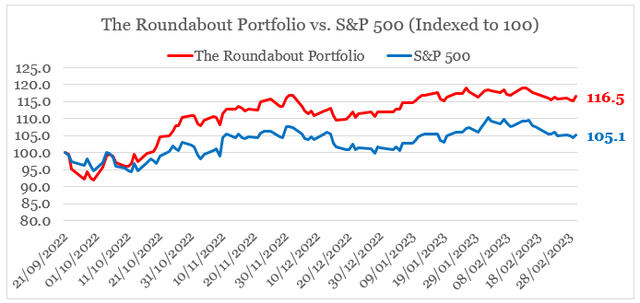

You can gain access to my highest conviction ideas in the sector by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.