Summary:

- We’re upgrading PayPal after Q3 FY24 earnings results and outlook pulled back the stock.

- Q3 results show promising profitability shift, with transaction margin growing to 46.6% and profits up 14% Y/Y, confirming management’s on the right track for profitable growth.

- PayPal also remains cheap relative to the peer group.

- We think sustained active account growth and better user monetization with partnerships should support the next leg of outperformance.

Paper Boat Creative

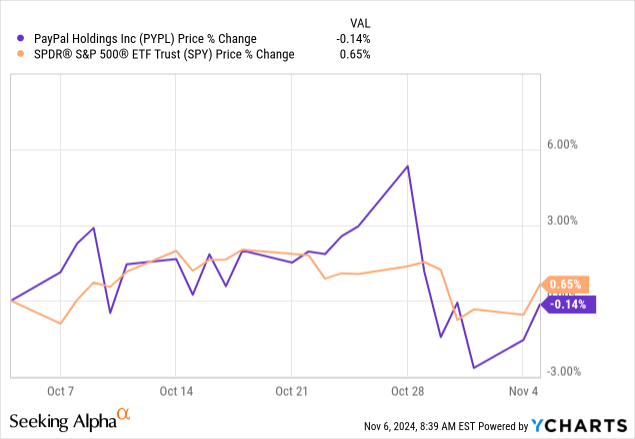

We’re upgrading PayPal (NASDAQ:PYPL) to a buy after Q3 FY24 earnings results’ revenue miss and higher-than-expected operating expenses dragged the stock price lower and brought down its RSI or relative strength index. Our hold-rating from last November was based on our concern that the company’s active account growth would remain under pressure and that management would struggle to boost the top line without active account growth and monetization. The stock is up 43% versus the S&P 500, up 31% since. We’re now upgrading the stock based on the healthier growth in active accounts and management’s focus on doubling down on profitable growth. We expect this shift in focus to pan out specifically well, considering the more consumer-friendly interest rate environment in the U.S. and the economic expansion that should play out in 2025. PYPL stock also underperforms the S&P 500 over the past month, as shown below, making it more attractive to jump in at current levels, in our opinion.

YCharts

The company reported adjusted EPS of $1.20 ahead of expected $1.07 and revenue of $7.85B, trailing estimates for $7.89B. Management also guides softer for Q4, noting “low single-digit growth” while estimates were for 5.4% growth to $8.46B. Management under CEO Alex Chriss, who hit his first year at the company recently, is shifting much-needed focus on profitable growth and better monetization with a solid set of strategic partnerships across its ecosystem that should extend the reach and boost profits sustainably.

A sustainable start to better margins

Part of our bullish sentiment is based on our belief that the Q3 results reset underscore this shift in focus to profitability, which is promising as PYPL’s transaction margin grew from 45.4% to 46.6% for the quarter. PayPal’s transaction margin is calculated by deducing transaction expenses and credit losses from transaction revenues and then dividing by the transaction revenues. We think the better margin for next quarter, in spite of the softer Q4 guide, is a positive that got overlooked this quarter. It confirmed that management is balancing costs with processing payments and credit risk while still focusing on profitable growth. PYPL’s CFO, Jamie Miller, noted the following about margins on the call:

Our focus on price to value is paying off with Braintree again contributing materially to transaction margin dollars even as volume and revenue growth deliberately slows.

Profits also jumped for the quarter, up 14% Y/Y, resulting in per-share earnings of $1.20 better than expected. While we’re upgrading the stock on our confidence in management’s theme of profitable growth, we don’t think this will happen overnight. We, however, do believe that a healthier interest rate environment in the U.S. should support higher total payment volume and even active accounts. Keep in mind that PayPal continues to make the bulk of its bank from U.S. net revenues, which came in at $4,518M for the quarter, versus international revenues, which hit $3,329M.

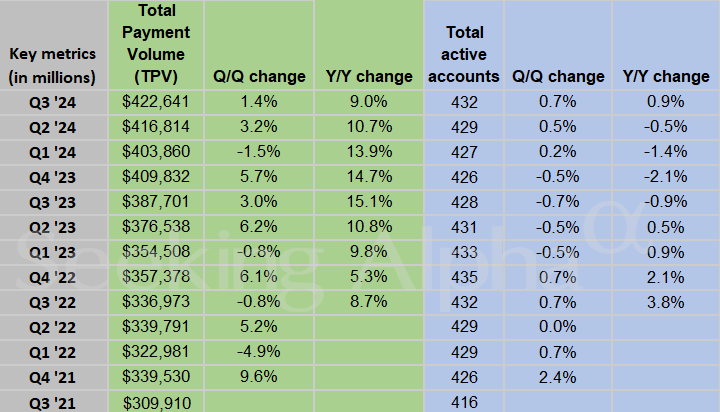

More growth in active accounts with management’s focus on narrowing transaction loss will further boost outperformance. This quarter, active accounts increased 0.7% Q/Q and 0.9% Y/Y to 432M versus consensus for 430.5M, marking the highest level of active accounts since Q1’23 when active accounts came in at 433M and the highest sequential rebound since Q4’22. Total payment volume, or TPV, grew 9% Y/Y and 1.4% Q/Q to $422.6B, slightly outpacing estimates for $422.5B. Operating margin also beat estimates, coming in at 18.8% versus estimates of 17.4%. The following chart outlines PayPal’s total payment volume and total active accounts.

Seeking Alpha

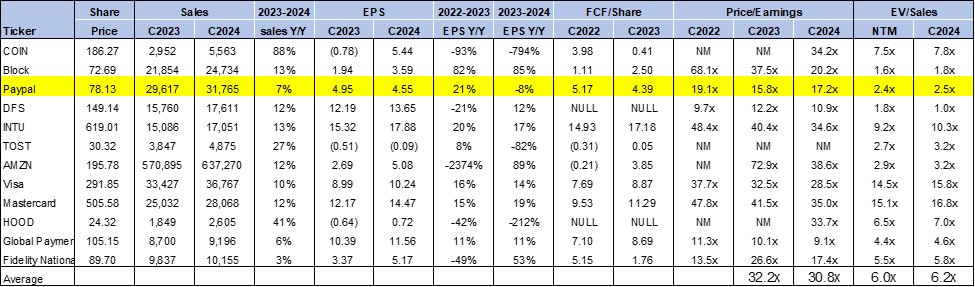

Valuation & Word on Wall Street

PYPL valuation also slightly reset after the earnings report; the stock remains cheap relative to the peer group. The stock is trading at a 2.5x EV/C2024 Sales versus the fintech group average of 6.2x. On a P/E ratio, the stock trades at 17.2x versus a group average of 30.8x. The multiples are higher than they were almost a year ago now, when the stock’s EV/Sales and P/E ratios stand at 1.9x and 9.9x, respectively. We think PayPal continues to be undervalued for its growth potential, with active account growth and monetization opportunities. PYPL’s valuation also reset alongside the price correction post-earnings, which dragged its RSI to 37 from 67 pre-earnings. We think midterm investors should explore entry points at current levels after management de-risked the Q4 outlook. The table below outlines PayPal’s valuation against the peer group.

TechStockPros

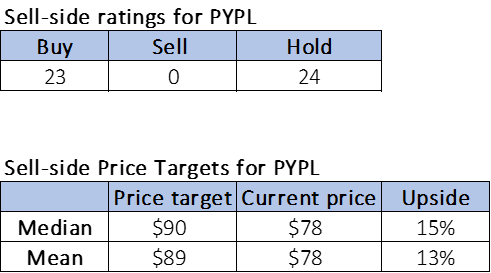

Wall Street is pretty equally split between buy and hold ratings, with 23 for the former and 24 for the latter. The sentiment is more bearish than it was last November, when the stock had 27 buy-rated analysts and 19 hold-rated. The sell-side price targets are for a more moderate potential upside, with the stock currently priced at $78, a median of $90, and a mean of $89 for a potential 13-15% upside. The following charts outline PayPal’s sell-side ratings and price targets.

TechStockPros

What to do with the stock?

We’re upgrading PYPL to a buy based on our belief that while there are some near-term challenges due to the shift in focus, these are growing pains and will lead to a healthier growth rate in 2H25. We expect active accounts to grow and transaction loss to shrink in a healthier macro backdrop; we’re already seeing that momentum with this quarter’s higher margin. We recommend investors explore entry points into the stock at current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Tired of losing money? Our Tech Contrarians team of Wall Street analysts sifts through the noise in the tech industry and captures outperformers through a coveted research process. We let the work speak for itself here.