Summary:

- PayPal’s new CEO, Alex Chriss, is fostering partnerships with competitors, enhancing user value and driving higher-margin products, leading to a Buy recommendation.

- Recent integrations with Shopify, Fiserv, and Adyen are boosting PayPal’s transaction volume and margin expansion, evidenced by improved earnings and operating leverage.

- Venmo’s growth and deeper product integrations are contributing significantly to PayPal’s margin expansion and user engagement.

- Despite market concerns about competition and valuation, PayPal’s strategic partnerships and product innovations are expected to drive revenue growth and durable platform economics.

da-kuk/E+ via Getty Images

Investment Thesis

After years of following PayPal (NASDAQ:PYPL) and studying the transformation of this multinational financial technology company, I have amassed enough confidence to say: This PayPal feels different.

Over the past decade, PayPal’s market and product strategy have always centered around market consolidation and creating walled gardens with a clumsy litany of apps that rarely communicated with one another, often leaving PayPal users perplexed and frustrated about how to derive more value from their PayPal platform experience. Rising competition in the fintech and payments space left even less room for PayPal to deliver user value and growth.

Under the new CEO, Alex Chriss, PayPal is trying to do something it has strongly stayed away from in the past: reach across enemy lines and form alliances and partnerships with its peers, many of which have grown larger than PayPal under its very nose.

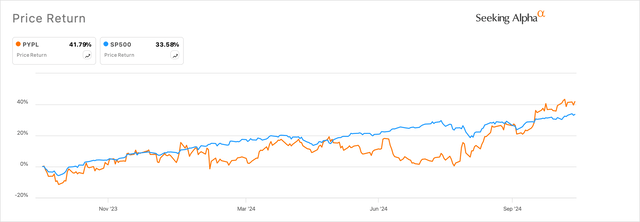

Exhibit A: PayPal’s stock is outperforming S&P 500 for the first time in many months. (Seeking Alpha)

This may be misunderstood by market participants as PayPal losing market share, but in my opinion, this is a new PayPal that is forging its own path by fostering partnerships with its peers and inserting their payment products.

I reiterate my Buy recommendation for PayPal.

PayPal Is Keeping Its Enemies Closer. That’s a Good Thing.

I have been positive on PayPal’s outlook this year based on the robust payment platform and integration initiatives that are being prioritized under the leadership of the new CEO. In April, I said how “management’s initiatives to drive adoption, deepen engagement, and build a better network with its partners and merchants are looking very promising.”

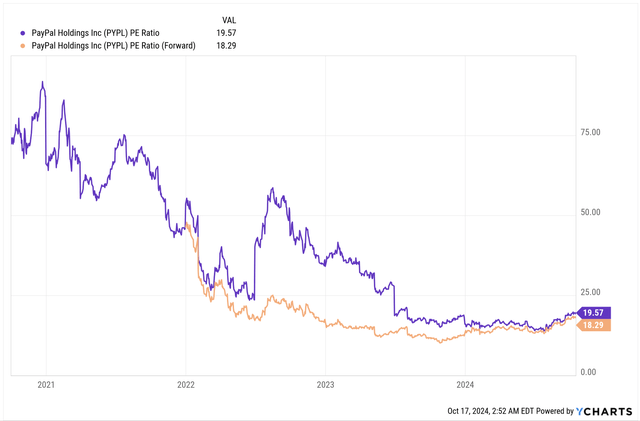

At the same time, I noted that the broader market sentiment was quite pessimistic, depressing PayPal’s valuation multiples because I suspected market participants were not fully understanding the durable impacts of management’s efforts to revitalize PayPal’s product suite.

Recently, some analysts downgraded PayPal, citing “competition and valuation concerns.” The analyst stated that they “remain worried about competitive pressures” and that the San Jose, CA-based payments company was “still richly priced vs. peers,” something I continue to find amusingly misplaced because it is fundamentally antithetic to PayPal’s current strategy.

While I do give merit to such concerns about competitive pressures, investors must also note that the current state of fintech and payment processors is deeply entrenched and broadened out, with a wide cohort of players across several niches in the payment space offering multiple types of payment solutions. With PayPal having already lost market share, the company’s new management has taken a bold look at its target market by forging partnerships with its peers across different product verticals.

Take the crowded online checkout market vertical, for example. Recently, PayPal expanded its partnership with Shopify (SHOP) to process online debit/credit transactions for the Canadian e-commerce platform. The integration with Shopify Payments is being managed under PayPal’s PPCP platform (PayPal Complete Payments), which merchants on Shopify can use to customize payment solutions that fit their needs. In addition, PayPal also struck deals with Fiserv (FI) and European payments giant Adyen (OTCPK:ADYEY) that enable customers on both of these two platforms to use PayPal’s online checkout solutions.

What these integrations and partnerships do for PayPal’s users, on the merchant side and the user side, is give them more reason to transact via the PayPal platform. For PayPal’s users, for example, PayPal is pushing products such as Fastlane, which sits on top of all the integrations that PayPal is engineering based on its industry partnerships.

That is driving more users to PayPal’s platform for the first time in months, but, more importantly, these integrations are allowing PayPal to push higher-margin products such as Branded Checkout through these payment integrations, which results in higher margins generating revenue.

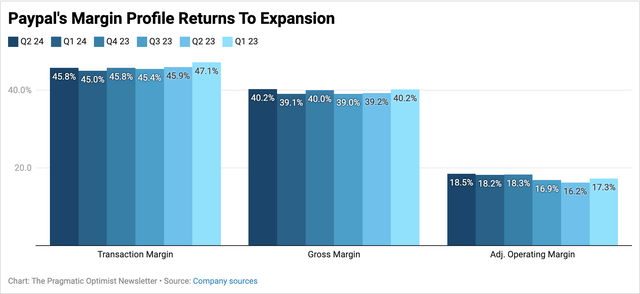

The results could be seen through the earnings reports published in the trailing twelve months and in the recent Q2 earnings report, which shows that margin expansion has returned to PayPal’s operating leverage as seen in Exhibit B below. While transaction margins and gross margins finally appear to be stable, adj. operating margins expanded by 231 bp over the last year.

Exhibit B: PayPal’s margin expansion adds more promise to the transformation outlook (Company filings)

Management also noted how Venmo has been another integral part of the margin expansion story, with this product vertical seeing some growth. At the recent Communacopia conference, PayPal’s CEO elaborated on the growth and deeper product integrations:

We have seen a 30% monthly active user increase in Q2 with Venmo. We’ve also been starting to integrate the debit card. The debit card previously, we had it, but it was disconnected from a customer experience perspective. We’ve now deeply integrated into the onboarding flow.

The margin expansion story that PayPal has demonstrated in the past year illustrates the importance of the company’s strategy to reach out to its peers, forge partnerships, integrate PayPal’s payment solutions for the merchant and the user, and drive value through the company’s payment suite of products once again, creating an environment of durable platform economics.

Upgrading PayPal’s Price Target

In my previous analysis of PayPal, I stated that my outlook for the company’s growth prospects assumed a ~9% CAGR in adj. earnings growth on consolidated sales growing at ~7.5% CAGR. My assumption for those growth rates was based on robust product innovation that would drive up user adoption on the platform.

But the progress that PayPal has demonstrated on the margin front looks even more promising than I expected. On the Q2 call, management upgraded their margin outlook for the year, expecting transaction margin dollars to grow in the “low to mid-single digit percentage” point range.

If I take the midpoint of street estimates for earnings to grow ~11% through 2026, this would indicate a valuation multiple of ~21x, implying ~15% upside from current levels.

Exhibit C: PayPal’s forward earnings multiple continues to be depressed given misplaced investor concerns (YCharts)

Risks & Other Factors To Look For

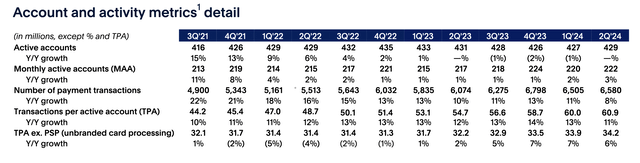

Many market participants have pointed to concerns about a continued growth slowdown after observing the company’s TPV growth and revenue, as I have illustrated below.

Exhibit D: PayPal’s key operating business metrics as of Q2 2024 (Company presentation)

While these concerns are valid and may create near-term volatility, the margin expansion that PayPal continues to deliver points to an environment of durable economics for the company to fundamentally position itself in. This should allow the company to return to revenue growth in the next 1-2 quarters, assuming the margin expansion story does not deteriorate again.

Takeaway

PayPal’s product integrations and industry partnerships strategy is breathing a new lease of life into the company, which had seen user decline and transaction processing slowdowns in the last year.

In an extremely crowded fintech space, peer pressures are bound to exist, but PayPal’s partnership strategy with its peers is giving the company a unique opportunity to position its higher margin branded checkout products, which have already started to show results.

I reiterate my Buy recommendation on PayPal and am raising my price targets.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.