Summary:

- PYPL’s sell-off has been overly done, with Mr. Market only spooked by the declining Active Accounts, since the management continues to iterate its FY2023 EPS guidance.

- Thanks to its use of AI-tools and the newly launched PayPal Commerce Platform, we may see structural improvements in the fintech’s transaction margins from H2’23 onwards.

- There are already early signs of e-commerce recovery, with PYPL recording “the highest monthly growth rate since the end of the pandemic” in July 2023.

- Perhaps this may be attributed to the July 2023 CPI already easing to 3%, potentially triggering the Fed’s pivot and the easing of the uncertain macroeconomic outlook in the near term.

- Therefore, we may see the US discretionary spending return by H2’23, boosting the fintech’s top/ bottom lines, thanks to the PSP partnerships with global marquee accounts.

SasinParaksa

The Braintree Investment Thesis Remains Brilliant, Though Unappreciated

We previously covered PayPal Holdings (NASDAQ:PYPL) in May 2023, discussing the drastic stock plunge to its September 2017 lows after the FQ1’23 earnings call. Much of the pessimism was attributed to the lower FQ2’23 guidance and the Credit Suisse analyst’s downgrade, resulting in a 6Y low bottom.

However, we remained optimistic about its prospects, especially due to its Payment Service Provider [PSP] segment, Braintree, connecting most digital wallet players to e-commerce platforms.

In the recent earnings call, PYPL already reported Braintree’s impressive Total Payment Volume growth rate of “nearly +30% on a FX-neutral basis” in FQ2’23, with more high-margin and value-added services to be introduced in H2’23 globally.

The management also guided improved H2’23 transaction margins from the 51.4% reported in the latest quarter (-1.9 points QoQ/ -3.8 YoY), though we are uncertain if it may return to FY2019 levels of 61.7% (-2.1 points YoY).

For now, much of the profitability tailwind is partly attributed to PYPL’s use of AI tools in advancing its processes, software development, and product infrastructure at an accelerated speed while saving costs at the same time.

Combined with the newly launched PayPal Commerce Platform to be widely implemented by the end of the year, we believe Braintree’s structural margins may incrementally expand as the macro headwinds lift.

For example, there are already early signs of e-commerce recovery, with PYPL recording nearly +6.5% MoM growth for branded checkout volume in June 2023 and another +8% MoM in July 2023, as “the highest monthly growth rate since the end of the pandemic.”

Perhaps this may be attributed to the July 2023 CPI already easing to 3%, compared to 9.1% a year ago, potentially triggering the Fed’s pivot in the near term. With the elevated interest rate environment likely to abate by 2024, we may see the US discretionary spending return by H1’24, if not earlier by H2’23.

The same has been reported by Amazon (AMZN), Shopify (SHOP), and MercadoLibre (MELI) in their recent earnings calls, with expanding Gross Merchandise Volumes and revenues across different territories, suggesting that the peak recessionary fears may have moderated.

Therefore, PYPL’s growing PSP partnerships with big tech/ e-commerce companies, such as Apple (AAPL), Meta (META), SHOP, and Booking (BKNG), amongst others, are highly strategic to its expanded checkout market share in the fintech industry, in our opinion. This may consequently boost the fintech’s top/ bottom lines moving forward.

Therefore, while PYPL may have reported underwhelming Active Accounts of 431M by the latest quarter (-0.4% QoQ/ +0.4% YoY), down by -1% from its peak of 435M in FQ4’22, we are not concerned yet.

We suppose the pullback in its Active Accounts may be attributed to the explosive growth the fintech has enjoyed during the hyper-pandemic period, from 305M in FQ4’19 to 435M in FQ4’23, expanding at a CAGR of +12.56%.

While it is unknown how many users have left for competitor’s offerings such as Zelle, Google Pay (GOOG), and Apple Pay (AAPL), amongst others, we remain optimistic about PYPL’s current prospects.

This is especially since its TTM transactions per active account increased to 54.7 (+3% QoQ/ +12.3% YoY), contributing to its expanding Total Payment Volume of $376.5B (+6.2% QoQ/ +10.8% YoY) in the latest quarter. This suggests the increased stickiness of its loyal consumer base thus far.

Therefore, while the fintech’s Braintree may have diluted its previously stellar overall gross profit margins, from 47% in FY2021 (+0.4 points YoY) to 39.2% in FQ2’23 (-1 points QoQ/ -1.6 YoY), the net effect remains acceptable for now, with things expected to improve from H2’23 onwards.

Perhaps this is why market analysts already project PYPL’s adj overall EPS to grow at a more than decent CAGR of +15.2% through FY2025, only slightly moderated compared to its normalized historical CAGR of +18.4% between FY2016 and FY2022.

As a result, we believe the stock’s sell-off has been overly done, with Mr. Market only spooked by the declining Active Accounts, since the management still delivered stellar FQ2’23 adj EPS of $1.16 (inline QoQ/ +24.7% YoY) while iterating FY2023 adj EPS guidance of $4.95 (+19.8% YoY).

So, Is PYPL Stock A Buy, Sell, Or Hold?

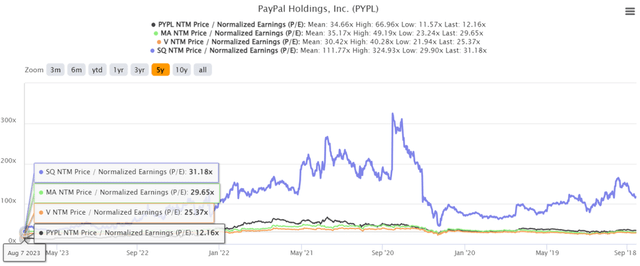

PYPL 5Y P/E Valuations

For now, PYPL’s valuations have been drastically impacted to NTM P/E of 11.83x, nearing its 5Y low of 11.57x, and comparatively lower than its 3Y pre-pandemic mean of 32.28x.

Mr. Market’s pessimism about the intensified fintech competition is visible indeed, since the stock is also trading way below its fintech/ payment peers, such as Block (SQ) at 31.05x, Mastercard (MA) at 29.23x, and Visa (V) at 25.14x.

Based on PYPL’s NTM P/E valuations and the market analysts’ FY2025 adj EPS of $6.31, we are looking at a long-term price target of $74.64, implying a moderate upside potential of +18.9% from current levels.

However, we are cautiously confident that the stock’s valuations may be eventually upgraded nearer to its fintech sector’s P/E mean of 20x, suggesting an expanded long-term price target of $126.20 instead, implying a tremendous +101% upside potential.

Then again, due to the lack of bullish support over the past year, PYPL investors must also be patient, since this optimistic reversal may take longer than a few quarters.

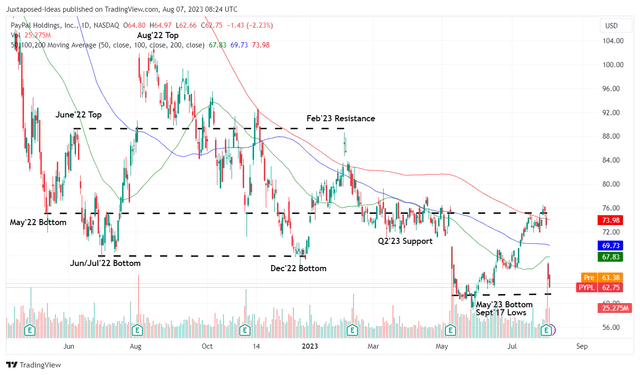

PYPL 1Y Stock Price

For now, with the PYPL stock still well supported at current levels, we believe this plunge is a great chance for opportunistic investors to dollar cost average, or for new investors to start small positions.

While the market remains overly pessimistic about the fintech’s prospects, we believe its high-volume/ high growth commercial segment, Braintree, has been underestimated indeed.

As a result of the highly attractive risk reward ratio, we continue to rate the PYPL stock as an excellent buy here, while similarly adding to our current holdings.

Nonetheless, we must also warn investors that the stock is unlikely to return to its hyper-pandemic valuations of 40x and consequently, stock prices of nearly $300, since the hyper-pandemic exuberance has already moderated. Therefore, investors must also temper their intermediate term expectations accordingly.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, AAPL, META, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.