Summary:

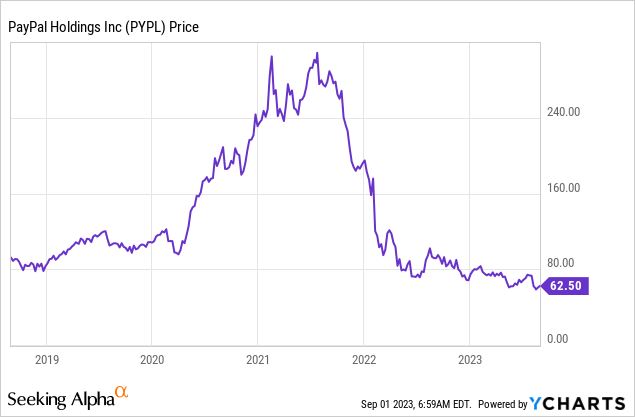

- PayPal’s shares have been in a relentless slide since reaching their all-time highs in 2021. The stock is now trading at the lowest price in five years.

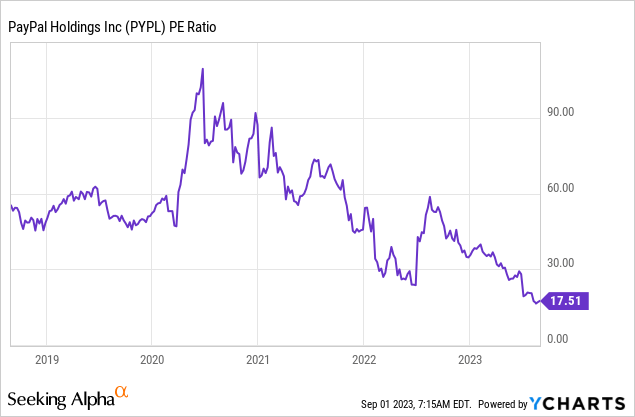

- Additionally, the fundamental valuation of the company has only improved as the share price declined, with the stock now trading at its lowest trailing PE multiple in five years.

- Despite the tempting fundamentals, there may be more to this story than meets the eye. PayPal will likely face a rapidly growing amount of competition over the coming years.

- Management may not be able to effectively compete in the shifting competitive landscape. Their moat is slowly being chipped away by both external factors and internal decisions.

- We are currently neutral on PayPal and believe there are better places to invest capital while this story plays out. More clarity is necessary for us to become outright bullish.

Justin Sullivan

Thesis

Despite the low valuation, we don’t believe that PayPal (NASDAQ:PYPL) represents a buying opportunity at this time. The company is facing an increasing amount of competition in their core areas of business and will likely see lackluster revenue growth and/or margin compression as a result. Payments is a difficult business to sustain a moat in and management has made a series of questionable acquisitions and policy decisions. Add to this the fact that despite the continued share price decline a prominent activist investor has exited their position only a year after taking it. While PayPal could end up being a great value investing opportunity at these prices, it could also become a value trap that underperforms the S&P 500.

Growing Competition

According to KPMG, global fintech investment was $105 billion in 2020 and $210 billion in 2021. According to Statista:

As of May 2023, there were 11,651 fintech (financial technology) startups in the Americas, making it the region with the most fintech startups globally. In comparison, there were 9,681 fintech startups in the EMEA region (Europe, the Middle East, and Africa) and 5,061 in the Asia Pacific region.

The venture capital industry pumped money relentlessly into consumer fintech for years. In addition to this, private equity was active in the sector and companies made numerous deals in fintech in order to either enter new businesses or bolster their existing ones. The end result of all of this investment and deal activity is a plethora of private companies/startups fighting for market share as well as PE/M&A deals that need to demonstrate their value. These ventures will need to take market share from someone, and currently PayPal is the king with a bounty on their head. While not all of these fintech companies directly compete with PayPal, many of them have some amount of overlap.

Another source of future competition comes from non-financial tech companies seeking to further monetize their user bases. An example of this is Apple (AAPL) Pay and Apple Wallet. Google (GOOGL), Amazon (AMZN), and Meta (META) are all exploring ways to integrate payments and financial services into their platforms as well. While PayPal certainly has a large user base, they can’t hold a candle to these companies when it comes to total active users. PayPal has been making deals with these companies such as supporting Apple’s tap to pay feature and adding the ability to pay with Venmo on Amazon. The problem is that PayPal’s leverage in these deals will likely decline over time as the big tech companies become the ones who create incrementally more value in the relationship.

Mastercard (MA) and Visa (V) are other legacy payments businesses that will need to adapt to a changing landscape. Many businesses dislike the seemingly ever-increasing interchange rates charged by the card networks and are actively looking for ways to avoid them. Rather than getting slowly disintermediated, the card networks will likely invest heavily into where they view the future of payments to be going. This could have overlap with PayPal’s current or future business endeavors and would cause them the additional headache of competing with deep pocketed payment stalwarts.

GPN (GPN), Fiserv (FI), FIS (FIS), and Stripe are all involved in the payments/fintech space. As their growth slows these companies will face pressure to expand from their investors and will be looking to capitalize on opportunities that are outside of their core business. This is another collection of deeply experienced financial players that are used to operating in a highly competitive environment, and could end up having some competitive overlap with PayPal in the future regarding SMBs and payments backend.

FedNow could end up snowballing into a problem for PayPal down the road. Many businesses use PayPal’s payment rails in the background, but if FedNow truly ends up being a better rail system it would be exceedingly difficult for PayPal to retain these customers. Not to mention that competing with the government is generally a losing proposition.

While the current financials are attractive, the competitive landscape is quickly heating up. PayPal has never experienced as much competition as they are going to face over the coming years. PayPal’s management will need to execute flawlessly in order to outperform going forward, and the nature of their business model doesn’t do them any favors.

Low Moat and Management Woes

In February Dan Schulman announced plans to step down as the CEO. He will be replaced by Alex Chriss (a former Intuit (INTU) executive) in September. Some investors believe that this change in management is the beginning of a turnaround, but it usually isn’t that simple. It doesn’t seem fair to place the blame squarely on Schulman. After all, the board is the one who picks the CEO. There are many other decision makers that work at the company. Schulman may be taking the brunt of the blame for PayPal’s struggles but their issues are the result of decisions made at multiple levels in the company and by many executives other than Schulman. Simply changing the CEO does little to address the underlying issues and ignores the other executives at the company who may be just as responsible for PayPal’s operational struggles.

PayPal has found itself competing in an increasingly hazardous market. This would be fine if investors could be confident that management will be able to execute and innovate. Unfortunately, management has not done much to instill confidence. The company embarked on an acquisition spree over the past few years (in the quest to build a “super app”) and doesn’t have much to show for it. Venmo monetization remains elusive, as due to the nature of the app the more they try to monetize it the less attractive it becomes. Over the years they have occasionally made policy decisions with unfavorable optics and have notoriously poor customer service. These things have turned off some users and weakened PayPal’s already tenuous moat. Active accounts can’t sustain a moat forever especially in payments, and especially when users are dissatisfied with the service. There is only so much differentiation that can happen in payments, with segments of the market eventually devolving into a race to the bottom on price. This has the eventual effect of compressing margins and slowing the revenue growth of companies competing in that market.

The loss of a prominent activist investor may be a red flag that the situation at PayPal has little hope of turning around soon.

Loss of Activist Investor

In 2022 the activist investor Elliott Management took a $2 billion stake in PayPal. There was a lot of investor excitement surrounding this move, and management seemed to be aligned with Elliott on the path forward. Fast forward about a year later and sometime in Q2 2023 Elliott dumped their PayPal stake. Activist investors can vary in the timeframe they take, but generally they hold until they don’t think any more value can be created. In stocks that are declining in price an activist investor will often continue to buy, as the discrepancy between price and value widens and will eventually lead to an even larger return if their activism bears fruit. PayPal’s stock has been trending downwards since Elliott took the stake and rather than buy more they chose to exit. This is troubling news for investors and could be a sign that there are more issues lurking in the background. It would have inspired confidence if Elliott had increased their stake in response to the share price decline instead of dumping it. How it all shakes out remains to be seen and bullish investors could end up being correct at the end of the day.

Price Action and Valuation

PayPal is trading at multi-year lows and is well off their 2021 high. This negative price action has shown no signs of stopping but has slowed in its pace. The valuation has massively improved and the slowdown in price declines likely means that the selling is exhausted. Now the question will likely be whether the stock can outperform the S&P 500 going forward. While the current fundamentals look good and investors are certainly getting a better value than they were a couple years ago, we believe the business will face a growing amount of challenges going forward that will pressure their revenue growth and margins.

On a trailing PE basis PayPal is trading at their lowest valuation in the past five years. This has attracted many contrarian and value investors to the stock. Despite this perceived valuation discount we believe that the stock is still overvalued due to slowing growth and stagnant operating margins.

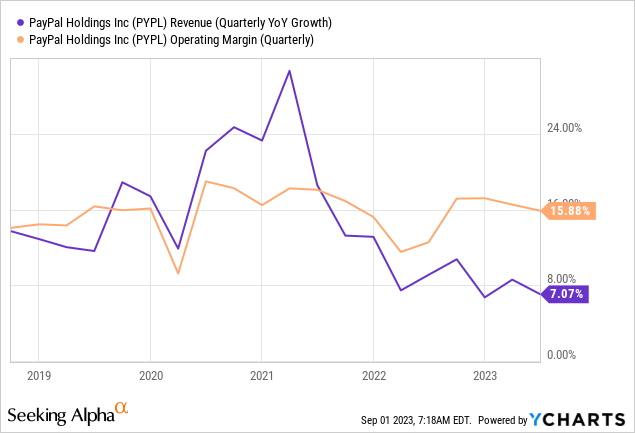

PayPal has had relatively stable operating margins over the past five years, and their earnings growth has been fueled entirely by increasing revenue. This rate of revenue growth is slowing considerably. If the company wants to continue to grow earnings at a similar pace going forward they will either need to re-accelerate revenue growth or finally expand their operating margins. We believe this will prove challenging as the increasingly hazardous competitive landscape will pressure PayPal’s operations to the detriment of their financial results.

This begs the question: what would we pay for PayPal’s stock? Full disclosure that our fund already has long exposure to PayPal. For the reasons mentioned in this article we aren’t looking to add more anytime soon. In order for us to become more bullish on PayPal the company would need to address their slowing revenue growth and improve their operating margins through improvements in efficiency. Even then the issue of competition looms large and is a constant threat to the company going forward. We believe the company is currently trading at a fair valuation, but it’s nothing to get excited about given the risks. If the fundamental picture remains the same and the trailing PE gets down to around the 10 area as the result of a capitulation event we would consider growing more bullish on the company. A trailing PE multiple of 10 is significant because this puts the market cap very close to our estimated acquisition floor (price at which acquisition offers would be coming in from both financial and non-financial companies), limiting the downside risk and improving the overall risk/reward through an additional margin of safety.

Risks

A risk to the bull case for PayPal is if the company is unable to effectively compete and slowly loses active users over time as well as sees a compression in margins.

A risk to the bear case for PayPal is if the company can successfully monetize Venmo and/or increase the value added for PayPal users. This could lead to the company being able to make more money per active account and would strengthen their moat, leading to increased revenues and higher margins.

We are altogether neutral on the company. We want to like PayPal because the current valuation is tantalizing, but the road ahead looks treacherous and we aren’t confident that management can effectively navigate the changing competitive landscape. This is one to keep an eye on for sure.

Key Takeaway

Despite the tempting valuation we believe there is too much uncertainty to take a position here. PayPal could experience difficulty growing revenue and earnings at an above market rate as the competitive landscape heats up. PayPal may end up being a value trap that underperforms the S&P 500, and as such we would rather allocate capital elsewhere for the time being.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, GOOGL, AMZN, PYPL, META, INTU either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

UFD Capital Value Fund, LP has long exposure to PYPL, AAPL, GOOGL, AMZN, INTU, and META. UFD Capital, LLC manages a hedge fund and does not provide investment advice to anyone else. Nothing contained in this article is investment advice or financial advice of any kind and investors should do their own research and consult a professional before making financial decisions. Nothing contained in this article should be interpreted as a solicitation to buy or an offer to sell securities.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.