Summary:

- PayPal’s full-year results show a mixed performance, with declining gross margins but improved EBIT and net margins.

- The company’s initiatives to enhance user experience and drive higher sales conversion rates are promising, but their success remains uncertain.

- Despite negative sentiment and challenges ahead, PayPal’s strong balance sheet and potential for improvement make it a good long-term investment.

Justin Sullivan

Introduction

I wanted to revisit PayPal (NASDAQ:PYPL) after it reported its full-year results and see how the company progressed throughout the year and what is still in store that would help the company turn itself around. I believe the company is a good buy at these prices, as the company seems to be trading at its fair valuation and the dip on the day of the results presents an opportunity to accumulate more shares and wait for what I believe is an inevitable stock price appreciation once the company can prove itself and the initiatives introduced to bear fruit.

The last time I covered the company was back in September when I gave it a buy rating since it had finally reached my fair value, meaning it was a good time to start a position. Now fast-forward about half a year, and the company is back at my fair value, therefore I am upgrading the company to a strong buy and believe there is very little downside left, which doesn’t mean that the company’s share price won’t see further deterioration in the short term but as long as my long thesis remains intact, any further decrease in share price is welcomed for people to accumulate a full position, as this underperformance against the S&P 500 (SPY) of around 15% means it is not too late to start a position, and you haven’t missed the boat yet.

Briefly on Financials

As of Q4 ’23, which ended on the 31st of December released at the beginning of February, PYPL had around $15B in cash and short-term investments against around $9.7B in long-term debt. This doesn’t seem to be a very bad position, in my opinion. The company has more than enough cash to cover all outstanding debt if it wants to pay it off, which I don’t see why it would right now. The debt outstanding has been reduced by around $800m from the year before, so if it can continue to slowly chip away at it, the company will be able to focus its attention on furthering the growth of the company, as it badly needs it. So, let’s look at how the company’s metrics progressed in all of 2023, starting with margins.

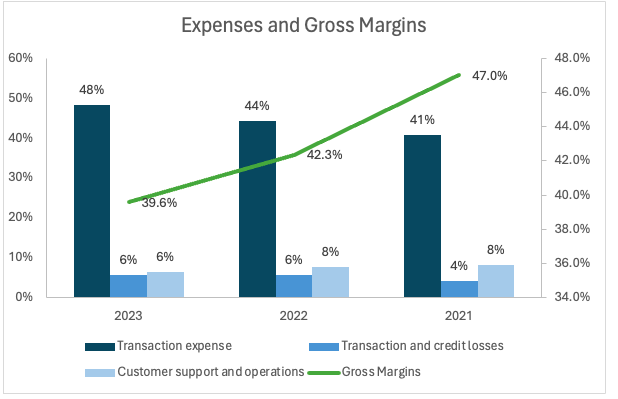

We can see quite a mixed performance over the last year, with gross margins clearly on a downtrend, while EBIT and net margins seem to perform slightly better. Does that mean that the company may have become a bit more efficient since net margins increased considerably? If we look at why the gross margins come down, we can see that transaction expenses have played the largest role in bringing it down.

Expenses and Gross Margins (Author)

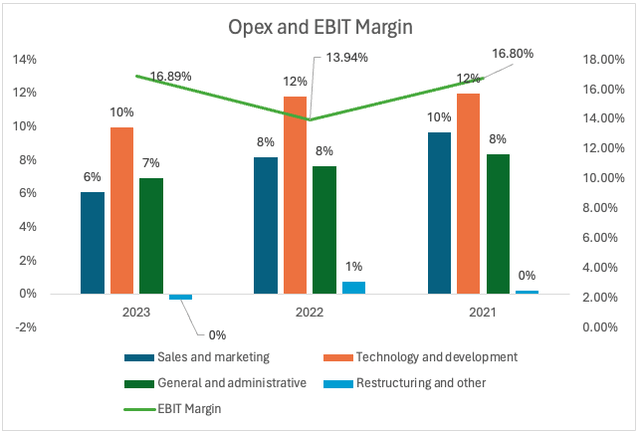

The main drivers of improved EBIT, which trickled down to the company’s bottom line were cutting down on sales & marketing, and technology development, while G&A went down only slightly, but still contributed to that improvement. I’m not sure if I agree with cutting down investments in technology development. This will improve margins in the short run, but if we look at the long-term picture, the slowdown in development and innovation will keep the company struggling to gain back its lost market share to other payment platforms.

OpEx and EBIT Margins (Author)

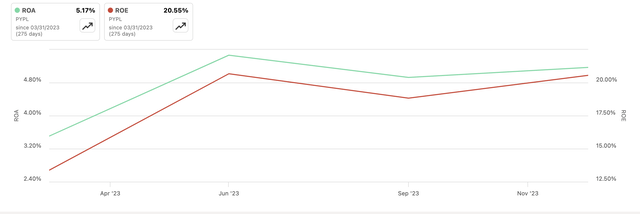

Unsurprisingly, the company’s ROA and ROE also saw a slight bump because of the cutbacks. I am not sure how sustainable these levels will be but since the company announced further cost-cutting measures recently (I will cover in the next section), I could see these improving further over the next year.

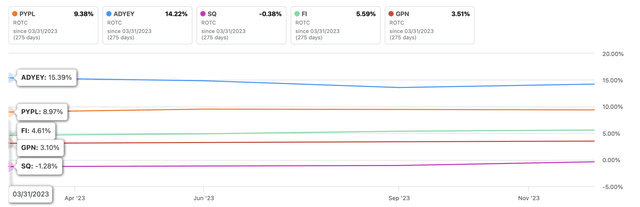

In terms of competitive advantage against its peers (as selected by SA), PYPL’s ROTC is only second to Adyen’s (OTCPK:ADYEY). It is worth noting that Adyen’s ROTC has been on a decline, while PYPL’s has been steady and slightly trending upward. Again, I would need a couple of more quarters to determine where this metric is going to go, and whether it’ll continue to trend up or not.

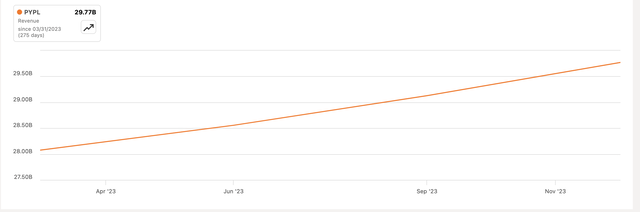

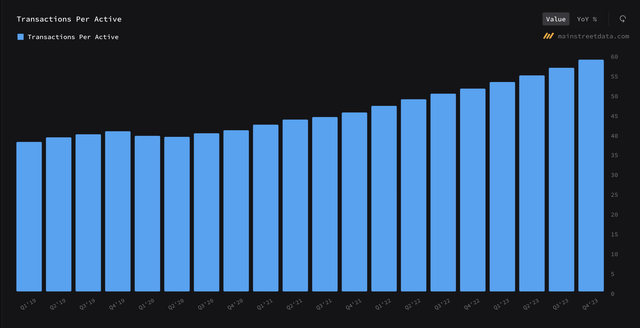

In terms of revenue over the past year, we can see a steady upward trajectory. The decrease in total active accounts was more than offset by an increase in transactions per active account and total payment volume, or TPV. It seems that people who are still using PYPL are much more active on the platform than before, and if this continues, PYPL should see the trajectory sustaining.

Furthermore, transactions per active account have been on a steady climb over the last 4 years or so. If this continues, the company will continue to offset the declines in active accounts.

Transactions growth (MainStreetData)

Overall, the company is heading in the right direction for a turnaround. The company’s financial position is still very strong and getting stronger with every down payment on its outstanding debt. I am not sure the company should be making cuts in the innovation and development segment of expenses, but we will have to wait for the next couple of quarters to see how these have progressed.

Comments on the Outlook

So, we can see the new CEO Alex Chriss has been busy in the first few months at the helm of the company, delivering some solid cutbacks that improved the bottom line, and sustained growth in revenues. There is still a long way to go before he proves to everyone that it can turn this ship around, so what is the management’s long-term plan for making the company more efficient and profitable, not just in the short run but also sustaining it for the long haul?

A good way to start is by cutting the company’s workforce. I am not a fan of this sort of cutback; however, it is definitely an efficient way of making the company look more profitable, however, the long-term effect of these job cuts may be negative in terms of morale, and in the short-term, we may see profitability come down due to severance packages and other money drains associated with job cuts.

In the recent press release called The First Look, the company introduced a lot of features that are meant to enhance user experience and reduce friction, which in turn should translate into higher sales conversion rates. Fastlane is one of those enhancements, which allows users to pay anonymously without the need to create an account. This is still in the pilot phase, but early results suggest that checkouts increased by 40%. This initiative is meant to create a better overall experience for the customer and the enterprise, which should in turn increase the company’s top-line growth.

The other initiative that was introduced is Smart Receipts. This will allow the merchant to send out a personalized recommendation along with a cashback incentive, which should drive higher transaction volume. Tailoring promotions and marketing to every person is much better than random advertising, so I agree with this initiative, however, since it is still very new, we will need to see how this will translate into more sales, and whether it is a successful initiative.

Another incentive to reinvigorate sales, and possibly improve total active account numbers, is the CashPass. This will give offers to loyal users of the app, like cash back incentives if they pay with PayPal at select partners like Best Buy, McDonald’s, Uber, and Walmart. It is worth mentioning that the CashPass and Smart Receipts will use AI to tailor what the customer sees, I am a little skeptical of this right now since it is still rather early in the AI progression, and I don’t think AI is going to perform as well as everyone hopes it will, especially for choosing what to show individual customers as suggestions for purchasing next. All these initiatives did not go down well on the day, as the share price slumped, which, to be honest, I don’t think was justified. These are solid initiatives, and if they are successful, the company will be getting much closer to a turnaround.

I also believe for the company to see success in the future, the management should put more focus on Braintree, which accounted for a big chunk of the actual growth of the company.

For the year ahead, the management guided for a soft year, which did not go down well with investors. The share price crashed 11% on the day of the FY23 results. The company is going to experience a transition year, which will, of course, bring further obstacles, like lower profitability and efficiency. The company guided non-GAAP EPS to be $5.10 a share, which is around 43 cents lower than the consensus. I fully expect 2024 to still be a tough year for the company while it experiments with new ways of incentivizing users to continue to use its platform and increase the active accounts or at least get more out of the current active accounts, to offset the declines.

Risks

The company is in constant negative attention from investors and users alike. This will no doubt continue to weigh on the company’s share price and may bring it further down. So, expect more volatility and no growth in the share price until the company proves to everyone that it will more than survive in this business but turn around and thrive.

The aforementioned initiatives are promising; however, we don’t know how successful these will be at translating into higher sales and profits for the company. The company is spending a decent chunk of resources to reinvigorate itself; however, these initiatives may flop and not be worth the ROI for the company in the end, which will continue to weigh on its reputation, and its share price.

The mentioned initiatives may not translate into higher monthly active accounts, and if these continue to decline, the company’s share price will continue to suffer, as the bears will continue to say the company is on its last legs.

Valuation and Closing Comments

My price target for the company hasn’t changed since the last time I covered the company. I am sticking with a fair value for the company to be around $59 a share, which means the company is trading at its fair value and wouldn’t be a bad time to start a position if you already haven’t. It may seem like there is no upside since it is trading at my calculated fair value, but how I look at fair value is it is a good time price to start a position, and if it goes below this value, it is on a discount and should accumulate more. My assumptions are on the conservative end of things, so the fair value I calculate has a decent margin of error built in. The plummet in share price on the day of FY23 results turned out to be a good opportunity for the accumulation of the stock for the long term. I have been buying some shares recently at these prices as the company hit my fair value back a few months ago and is hovering at this price, which should be seen as an opportunity to get in before it takes off.

The company’s negative sentiment towards it is quite reminiscent of the days when Meta Platforms (META) was one of the most hated companies out there and was trading at a ridiculous multiple. I’ve seen many commenters suggesting this, and I have to agree. The company seems to be trading at a decent discount because many people are suggesting the company is done for. PYPL has a very strong balance sheet in my opinion, and is generating decent cash, which is exactly what Meta was and still is doing to this day, and its share price skyrocketed ever since the lows of $130 a share.

I also think that the company will not see a lot of moves to the upside for the next couple of quarters because the recently announced initiatives will take time to show results, whether positive or negative. I also don’t think the company will see much more downside risk, and it looks like the company is trading at a bottom. I will be following any news coming out about PayPal and its initiatives to rejuvenate its top-line growth and improve profitability. The next report only comes out in May, so we will see if there will be any other news coming before then. I would like to see some comments on the preliminary results of the aforementioned initiatives.

PayPal is not going away anytime soon. It is still a juggernaut in the payments space, and if it can improve on the most important metrics mentioned, the investors will start to see the company’s massive potential and will drive up the share price. It may not be this year, but over the next couple of years, I would say is possible.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.