Summary:

- PayPal is set to report Q1 2024 earnings. All eyes are on the ongoing turnaround.

- The story around the company is becoming more about sustainable profitability as opposed to growth at any cost.

- Meanwhile, the stock is now priced at extremely conservative levels, which limits downside risk.

Images By Tang Ming Tung/DigitalVision via Getty Images

PayPal Holdings (NASDAQ:PYPL) is scheduled to report first quarter 2024 earnings early next week, and the hopes for a turnaround are running high.

After other peers in the electronic payments space, such as Visa (V) and Fiserv (FI), reported better than-expected results on the back of the strong consumer spending, the scenario of PayPal beating estimates appears more likely.

On the other hand, guidance for the rest of 2024 is likely to remain conservative given the cautious approach of the new CEO when it comes to managing expectations of investors and sell-side analysts through this transitional year for PayPal.

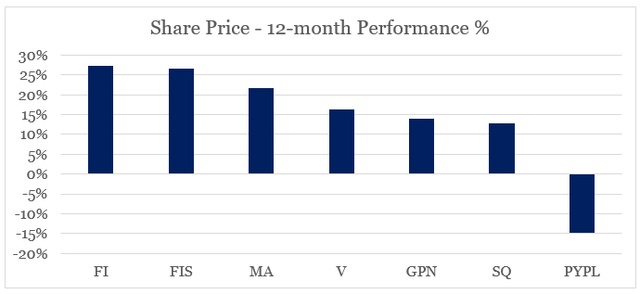

In the meantime, however, more investors are likely growing impatient with PYPL performance, as the share price is the worst performer within its peer group over the past year and the only stock with a negative return from a year ago.

prepared by the author, using data from Seeking Alpha

With so many mixed signals ahead of the earnings release, it’s essential for investors to sift through the noise and remain focused on what’s best for the business over the long run.

Implications From The Last Quarter

The last reported quarter and the share price reaction that followed have given us a very good indication of the disconnect between current market expectations and the long-term focus of PayPal’s management.

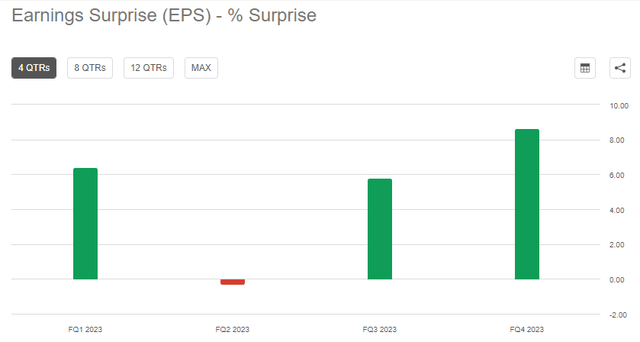

For the last three-month period of 2023, PayPal delivered better than expected results both on the topline and bottom-line figures. And yet, the market punished the stock on the day following the release, when it fell by more thаn 11%.

prepared by the author, using data from Seeking Alpha

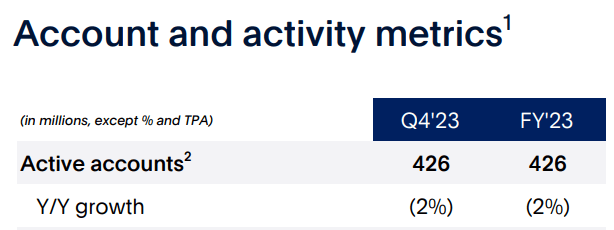

In my view, the sharp drop was not justified for anyone with an investment horizon of more than 12 months, but the market was increasingly focused on the 2% drop in active accounts, the workforce reduction and last but not least the disappointing guidance.

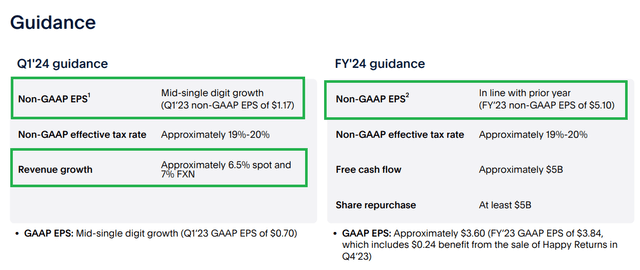

PayPal Investor Presentation

Indeed, a roughly 9% reduction in workforce in combination with the aforementioned drop in active accounts is hard to swallow as many of its peers continue to grow. It’s important, however, to keep in mind that given PayPal’s enormous size, it makes sense that the new CEO is prioritizing profitable growth and higher transaction margin dollars at the expense of growth at any cost.

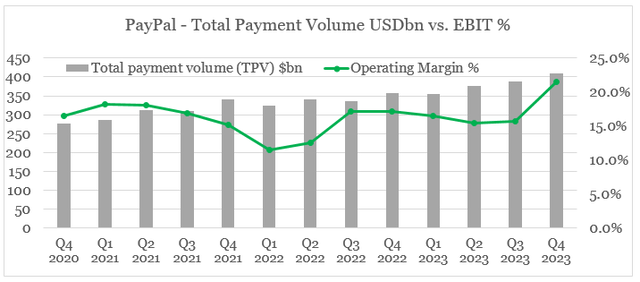

Therefore, it’s not surprising that payment volumes continued to improve, alongside PayPal’s operating margin, which stood at a record high during the last reported quarter.

prepared by the author, using data from earnings releases

Having said that I remain focused on the company’s ability to further reduce costs, following the reduction in non-transaction-related expenses by 9% during the last quarter. Paying close attention on how the market reacts to any potential disparity between revenue growth and margin improvements would be an important sign of whether or not PYPL stock has bottomed already.

When it comes to revenue growth, a 6.5% target should be relatively easy to achieve given the strength in consumer spending and sticky inflation. The flat EPS number for the year should already be priced in following the last earnings release, and all that puts PYPL in a very good position to achieve and even surpass its guidance.

On top of all that, as growth-oriented investors have shunned the stock, PYPL share price is already at too conservative levels that limit any further downside.

Limited Downside Risk

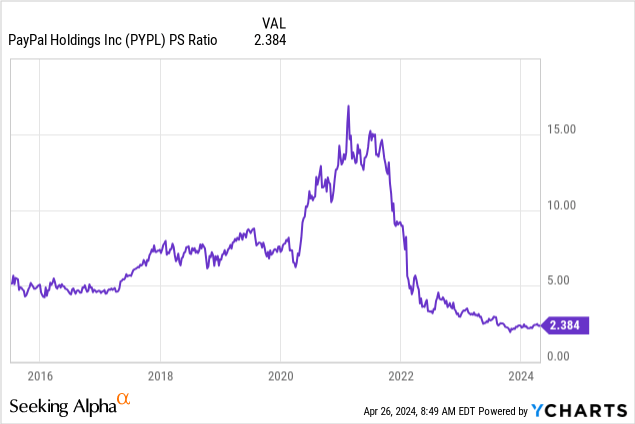

As PYPL share price continues to slide, the company now trades at a record low multiple of 2.4 times sales.

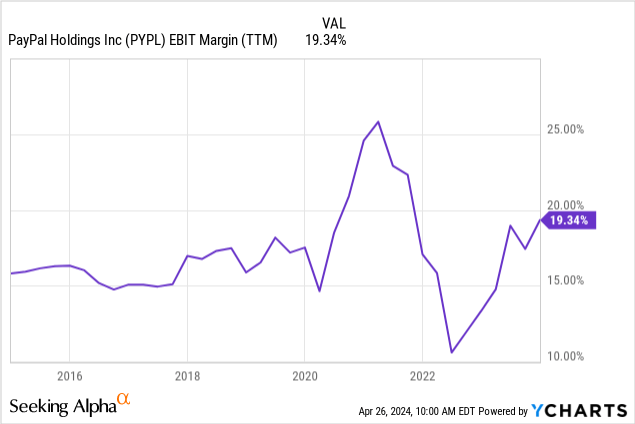

On itself this does not tell us much, but when it comes to profitability – PayPal’s current operating margin is at one of its highest levels since the company’s separation from eBay (EBAY) back in 2015.

This is a notable divergence between the two variables and it highlights the fact that the market now prices in a very gloomy scenario for PayPal’s profitability going forward. In my opinion this is highly unlikely even as the company faces stiff competition.

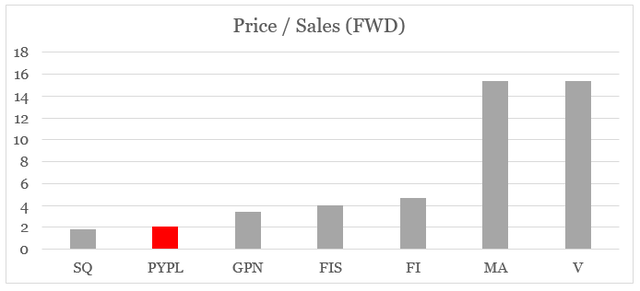

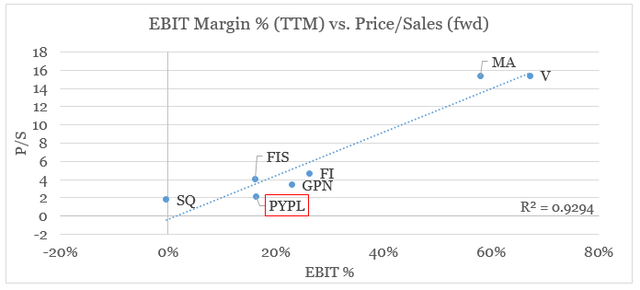

On a cross-sectional basis, PayPal also trades at the second lowest forward sales multiple within its peer group. The only with a lower multiple is the troubled Block (SQ), which is still loss making on an operating income basis. What’s even more surprising is that a significant share of Block’s revenues are reported on a gross basis which further deflates the company’s price/sales multiple. Thus, it’s fair to say that PYPL now trades at the lowest sales multiple within the peer group below.

prepared by the author, using data from Seeking Alpha

Adding current operating margins within the picture and we could see just how undervalued PYPL is relative to its peers when considering profitability metrics. Note that SQ’s price/sales multiple should be nearly twice as high as the one plotted on the graph below once we adjust for Bitcoin-related revenues that are reported on a gross basis.

prepared by the author, using data from Seeking Alpha

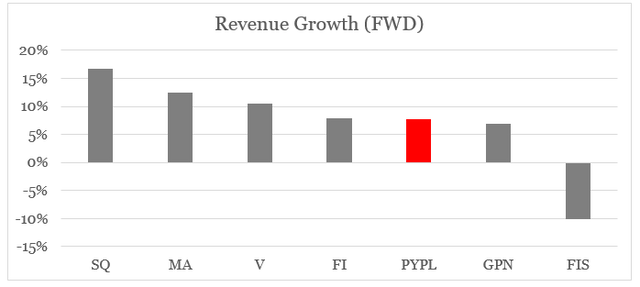

A contra argument here would be that PYPL is growing at a much slower pace than its peers, but in fact the difference is not significant that the peer average once we account for Block’s bitcoin revenue and Fidelity National Information Services divestments.

prepared by the author, using data from Seeking Alpha

Based on all that, PayPal’s share price is less likely to experience a sharp drop to the extent in did in February when the company announced its Q4 2023 results. Of course, this is true in the case of the company not reporting surprisingly bad quarterly results and reducing its guidance for full fiscal-year 2024.

Conclusion

As PayPal is about to report its Q1 2024 results, the expectations are rather mixed with a supportive macroeconomic environment on one hand and an ongoing turnaround on the other. While growth and active accounts remain in the spotlight, I will remain focused on margins and PayPal’s ability to sustain these going forward. With the stock now priced at record low multiples, both relative to its historical and peer fundamentals, any potential downside from here is fairly limited provided that 2024 guidance could be sustained.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please do your own due diligence and consult with your financial advisor, if you have one, before making any investment decisions. The author is not acting in an investment adviser capacity. The author's opinions expressed herein address only select aspects of potential investment in securities of the companies mentioned and cannot be a substitute for comprehensive investment analysis. The author recommends that potential and existing investors conduct thorough investment research of their own, including detailed review of the companies' SEC filings. Any opinions or estimates constitute the author's best judgment as of the date of publication and are subject to change without notice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

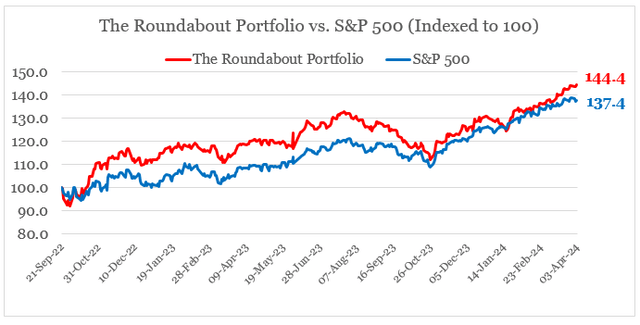

You can gain access to my highest conviction ideas across a wide range of sectors by subscribing to The Roundabout Investor, where I uncover conservatively priced businesses with superior competitive positioning and high dividend yields.

Performance of all high conviction ideas is measured by The Roundabout Portfolio, which has consistently outperformed the market since its initiation.

As part of the service I also offer in-depth market analysis, through the lens of factor investing and a watchlist of higher risk-reward investment opportunities. To learn more and gain access to the service, follow the link provided.