Summary:

- PayPal has reported a double beat.

- The company upped its 2023 guidance, although Q2 guidance wasn’t strong.

- PYPL’s valuation is undemanding and could allow for upside potential.

chameleonseye

Article Thesis

PayPal Holdings, Inc. (NASDAQ:PYPL) has announced solid earnings results that beat estimates and has also raised its guidance for the current year. With better-than-expected business growth and an undemanding valuation, PayPal looks solid, but a potential recession could be a headwind for PayPal in the foreseeable future.

What Happened?

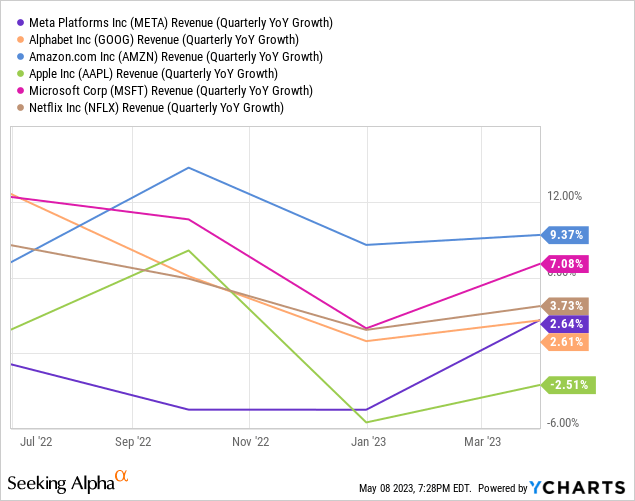

PayPal Holdings, Inc. announced its most recent quarterly results on Monday following the market close. These are the headline numbers:

Seeking Alpha

PayPal was able to beat estimates on both lines, which naturally is a compelling feat. While the revenue beat was not very meaningful, at less than 1%, the year-over-year growth rate of more than 8% was appealing, especially considering the macro environment and the comparables to the previous year’s period, where the pandemic still had a positive impact on online sales (versus brick-and-mortar sales), which generally is positive for PYPL and which made for a not-easy comparison. The earnings beat was pretty sizeable, but PayPal’s shares nevertheless dropped in after-hours trading — being down 5% at the time of writing.

A Compelling Underlying Performance And A Low Valuation

PayPal Holdings has benefitted a lot from the growth seen in the e-commerce space during the pandemic, when brick-and-mortar retailers were (at least partially) locked down and when consumers started to shop more from their homes. Paying via PayPal is much easier done online relative to in a physical store, thus PYPL was a winner in the more e-commerce-focused shopping environment a couple of years ago.

As the pandemic has waned, more shoppers flocked to brick-and-mortar retailers again, as consumers were eager to go out and leave their homes to do stuff in the “real world”. That made for a less beneficial environment for PayPal, whereas credit card companies benefitted from the changed retail environment.

That being said, PayPal still generated very solid business growth during the most recent quarter. Revenue growth of 8% was below what PYPL delivered during some times in the past, but the company is also a lot larger now, compared to a couple of years ago. The law of large numbers dictates that relative growth will inevitably slow down over time as a company becomes larger in absolute numbers.

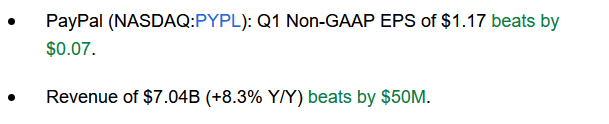

And relative to the growth performance of other large-cap tech stocks, PayPal’s sales growth was very encouraging:

Large and established tech companies such as Apple (AAPL), Microsoft (MSFT), Alphabet (GOOG)(GOOGL), Meta (META), Amazon (AMZN), and Netflix (NFLX) delivered sales growth of -3% to +9% during their most recent quarters, with a median of 3%. Relative to that, PayPal’s 8% sales growth was very compelling. Despite growing faster than these companies, PayPal Holdings trades at a huge discount compared to these tech leaders — more on that later.

Like other companies that are active around the world, PayPal felt some headwinds from currency rate movements. A strengthening US Dollar made its non-US revenues grow less in GAAP or reported terms, relative to the underlying (currency-neutral) sales performance in international markets. PYPL’s revenue would have grown by a little more than 10% at constant currency rates. The recent downward move in the US Dollar index suggests that currency rates will be less of a headwind going forward — and they could even turn into a tailwind in the second half of the current year, due to the US Dollar’s strength in H2 of 2022. If that holds true, investors can expect an improving sales growth rate for PYPL going forward — at least as long as the underlying growth momentum stays intact.

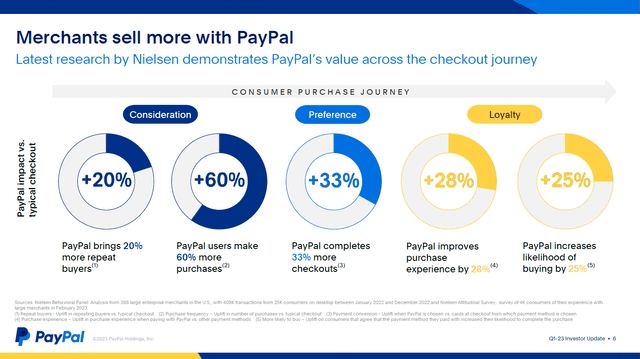

PayPal showcases some advantages that merchants have when they offer payments via PayPal:

This data from Nielsen suggests that online stores perform better when they offer PayPal as a payment option — apparently, users trust and/or like PayPal’s service. The better sales performance with PayPal should make more and more merchants use the service, which, in turn, should be positive for PayPal’s transaction volumes and ultimately, its revenues.

Better-than-expected sales growth is great, of course, but PayPal has turned into a “value” type of stock in the recent past, thus its earnings and margins matter a lot to investors as well. PYPL is not very sought after by the “high-growth at any valuation” investor crowd any longer, after all. Profits were higher than expected, and margins developed very favorably. During the quarter, PayPal’s operating margin (non-GAAP) was up 200 base points compared to the previous year’s quarter, as expenses grew less than revenue. PayPal had some profitability issues a while ago when it was letting its expenses grow too fast, but the company’s management has righted the ship, and things are now progressing nicely — sales are growing, and margins are improving — which is what investors want to see. PayPal even managed to lower its non-transaction expenses by 12% year over year, which is quite a feat, considering many other tech companies saw their expenses grow despite generating less sales growth than PayPal.

If PayPal keeps doing what the company has done in the recent past, i.e. grow its sales at a solid pace while keeping spending under control, then further attractive profit growth can be expected. PayPal’s guidance for the current year implies that this will be the case, as PYPL is forecasting earnings per share of around $4.95, which pencils out to a ~20% earnings per share increase versus the previous fiscal year.

Guidance for the current quarter, Q2 2023, is marginally below estimates, but I do not believe that this is a reason to worry. First, the guidance for the year has been increased, and annual results are more important than quarterly results. Second, PYPL has a history of being conservative with guidance and then beating those numbers. The company’s Q1 earnings per share, for example, were 8% higher than the number the company had originally guided for. When a company delivers guidance beats of this magnitude, a $0.01 or <1% guidance miss versus the consensus estimate does not seem dramatic at all, I believe.

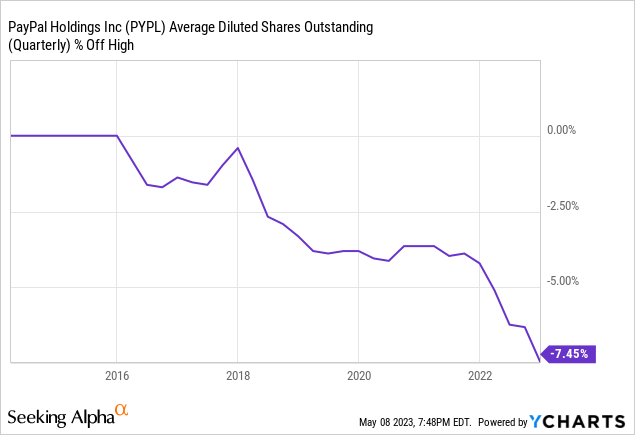

Since PayPal has turned into a value-type investment in recent years, shareholder returns have become a lot more important. Those oftentimes aren’t meaningful for fast-growing companies, but when growth slows down and cash flows grow, while valuations compress, dividends and/or buybacks can suddenly have a large impact on future returns. PayPal does not make any dividend payments, but the company is buying back its own shares at a quite compelling pace: Over the last four quarters, buybacks totaled $4 billion, and PayPal has guided for a similar buyback level throughout fiscal 2023. Investors can thus expect that the company will spend around $1 billion per quarter on buybacks on average. Buybacks during Q1 were a little higher, at $1.4 billion, which could indicate somewhat lower buyback spending in Q2-Q4, but it is also possible that PayPal revises its buyback guidance upwards later this year — with forecasted free cash flows of $5 billion in 2023, PYPL could easily spend more than $4 billion on buybacks this year. The fact that PayPal has a net cash position of around $4 billion also adds to its buyback potential going forward — its balance sheet is very strong.

As we can see in the above chart, PayPal’s share count has been moving down in recent years, although not very steadily. We also see that the share count reduction pace has increased meaningfully over the last year. Due to the now rather low valuation, that makes a lot of sense, and I would not be surprised to see PYPL reduce its share count at a similar pace in the current year and beyond as well.

As mentioned above, PayPal has a rather low valuation — based on current company forecasts (which could be conservative, considering the huge Q1 guidance beat), PYPL is trading at just 14.5x this year’s net profits, using the current after-hours price of $71.50. That seems like a pretty undemanding valuation for a company with a positive net cash position, ~10% currency-neutral revenue growth, ~20% earnings per share growth, and a compelling position in a growing market. While PayPal could be negatively impacted if there is a recession later this year or in 2024, which would presumably result in less consumer spending in online stores, the company still looks appealing for a long-term investment at current prices. A couple of years ago, PYPL was very overvalued — but that is not the case any longer.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, GOOG, META, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!