Summary:

- PayPal’s Q2’24 results showed strong account growth, and the Fintech raised its outlook for free cash flow and stock buybacks.

- The Fintech added 1.8M customers to its payments platform in Q2 and reported double-digit growth in transactions per active account.

- PayPal generated $1.1B in free cash flow in the last quarter.

- Shares remain a bargain from a valuation point of view.

BlackJack3D

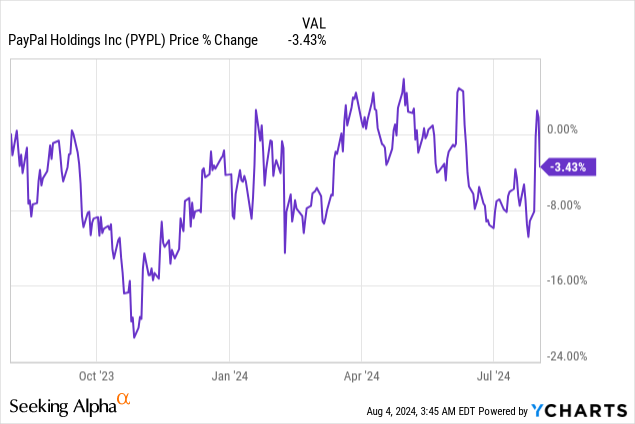

PayPal (NASDAQ:PYPL) reported strong Q2’24 results last week that showed growth in accounts, double-digit growth in transactions per active account, as well as 31% Y/Y growth in the important free cash flow metric. The payment processing platform also generated high-single digit top line growth in Q2’24 and reported much better than expected earnings per share due to PayPal’s focus on reigning in costs. PayPal pulled in a significant ($1.0B+) in free cash flow in the second fiscal quarter, which I believe continues to underscore my bullish investment opinion of the Fintech. With a P/E ratio that has hardly moved since my last coverage in May, PayPal continues to represent a deep bargain for value investors!

Previous rating

I rated PayPal a strong buy in May — The Rally Has Momentum — mainly because the Fintech managed to pull off a strong rebound in its free cash flow after selling European BNPL receivables to a private equity company at the end of last year. PayPal also achieved respectable free cash flow margins in Q2 and raised its forecast for FY 2024. In my opinion, PayPal’s Q2’24 earnings sheet confirmed my previous strong buy rating and PayPal’s shares remain chiefly interesting for Fintech investors due to its low P/E ratio and buyback potential.

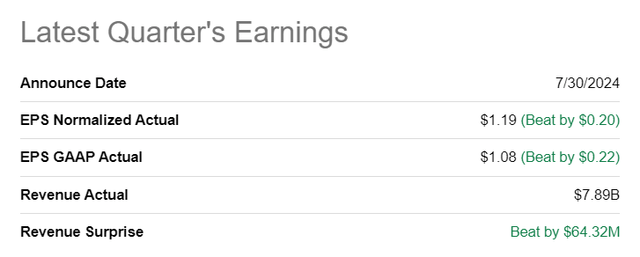

PayPal beat estimates

The Fintech beat consensus estimates for its revenues and its adjusted earnings: PayPal’s top line was reported at $7.9B, beating estimates by $64M, while adjusted earnings came in at $1.19, beating the average prediction by a large $0.20 per-share.

Seeking Alpha

PayPal’s Q2’24: rebound in retention, growth in transactions per active account, strong FCF margins

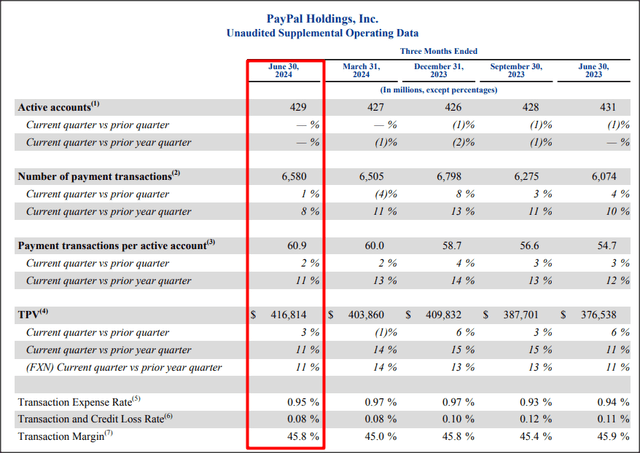

One of PayPal’s problems has been a slow erosion of the Fintech’s customer base. PayPal lost customers to other Fintech companies that also offer digital payment and processing services, resulting in a deteriorating customer retention trend.

This trend, fortunately, changed in the second fiscal quarter as PayPal added approximately 1.8M accounts (+0.4% Q/Q) to its customer base compared to the previous quarter, meaning the Fintech ended the June quarter with 429M customers using its payment platform. Growth occurred in both PayPal’s merchant and consumer business.

Another positive take-away from PayPal’s earnings report was that the company saw high-single digit growth in payment transactions per active accounts, which, I feel, is something that Fintech doesn’t get a lot of credit for.

While the company has cleaned house in the last several years and removed ghost accounts from its platform (resulting in downward pressure on customer accounts), those customers who have stayed with the payment processing platform are becoming more valuable simply because they transact more. PayPal’s active transactions per account grew 11% year over year to 60.9X and they, together with growth in total payment volume (+11% Y/Y), are supporting PayPal’s top line growth (8% Y/Y).

PayPal

What also stood out positively was PayPal’s free cash flow, which continues to be the main reason to invest in the company, in my opinion. PayPal generated $1.1B in free cash flow in the June quarter, showing 31% year-over-year growth. This growth was supported by strength in international transactions, higher accounts, as well as a growing transactions per active account figure. The Fintech was also able to translate this momentum into a free cash flow margin of 14% in the last quarter (+2 PP Y/Y). In the last year, the Fintech generated $5.7B in free cash flow, with positive momentum materializing in the first two quarters of the current fiscal year.

Because of this momentum in FCF and continual transaction strength on the platform, PayPal raised its guidance for its free cash flow to $6.0B (+$1.0B). Since PayPal has said it targets to return more free cash flow to shareholders, the Fintech also raised its stock buyback target to $6.0B, showing a 20% increase compared to its previous guidance.

Here is PayPal’s free cash flow trajectory…

|

PayPal |

Q2’23 |

Q3’23 |

Q4’23 |

Q1’24 |

Q2’24 |

Growth Y/Y |

|

Revenues ($M) |

$7,287 |

$7,418 |

$8,026 |

$7,699 |

$7,885 |

8% |

|

Adj. Free Cash Flow ($M) |

$869 |

$1,911 |

$774 |

$1,856 |

$1,140 |

31% |

|

FCF Margin |

12% |

26% |

10% |

24% |

14% |

— |

(Source: Author)

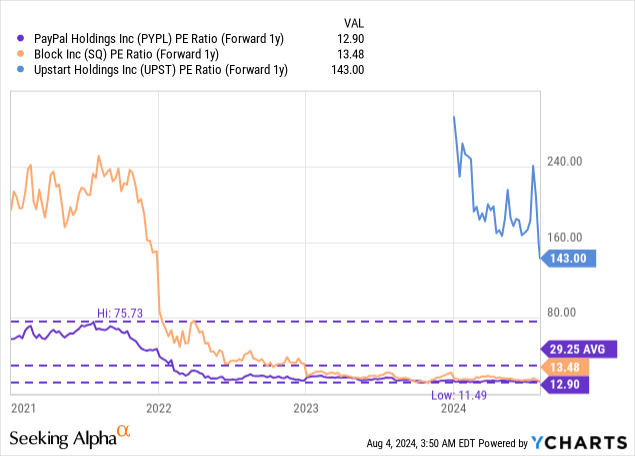

PayPal’s valuation

While seriously profitable from a free cash flow perspective, PayPal’s shares still appear to be underpriced, in my opinion, on an earnings basis, especially when compared against other mature Fintechs like Block (SQ).

PayPal is currently priced at a P/E ratio of 12.9X, which is still way below the company’s longer term P/E ratio of 29.3X. The sharp downside revaluation was at least in part driven by the Fintech’s account challenges as well as high operating costs that triggered the intervention of an activist hedge fund, Elliott Management, in 2022. I continue to believe that PayPal has enormous brand value, in part because of its large size (429M customers are using the platform worldwide) and because it has carved a niche out for itself that is associated with trust and transaction safety. Block, which has considerable momentum in its Cash App ecosystem, is trading at a P/E ratio of 13.5X, which makes shares only slightly more expensive.

As I indicated in my last work on PayPal, I continue to see a fair value for the Fintech in the neighborhood of $90 given PayPal’s enormous platform reach and considerable, recurring free cash flow. A $90 fair value implies a forward P/E ratio of ~20X, which is still way below the longer term P/E ratio of 29.2X. The $90 fair value is a long-term price target and may not be achieved in the short term. In the longer term, however, I see this as a realistic price target, under the condition that PayPal continues to grow its accounts and generates at least a $1.0B+ quarterly in free cash flow.

Risks with PayPal

The obvious risk here is a continual erosion of PayPal’s account base, which has been a serious headwind in the past. If PayPal loses customers to other Fintechs or digital wallets, PayPal may suffer long-term earnings and free cash flow pressure, which would not bode well for the company’s multiplier expansion. What would change my mind about PayPal is if the company were to see single-digit free cash flow margins and weakening FCF growth.

Final thoughts

PayPal is a promising Fintech play, and the second-quarter earnings scorecard was good, especially the guidance. PayPal generated once again a ton of free cash flow in its business in the second fiscal quarter, and the Fintech added 1.8M to its accounts, which was welcome news. Customers using PayPal also transact more, creating a lever for organic revenue growth. Finally, PayPal raised its free cash flow guidance for the current fiscal year and plans to buy back even more stock. In my opinion, PayPal is mainly a strong buy for free cash flow reasons and shares are impossible not to like at such a low earnings multiplier!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, SQ, UPST either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.