Summary:

- PayPal Holdings is set to release its second-quarter earnings report, with analysts anticipating a slight decrease in EPS.

- Despite the negative sentiment, we think PayPal’s headwinds are priced in, and a quality second-quarter earnings report is likely.

- PayPal’s long-term growth prospects will likely remain intact due to the firm’s dominant market share, loyal users, and thriving subsidiaries.

- Given its fundamental zeal, we are bullish about PYPL, especially with key metrics suggesting the stock is relatively undervalued and technically underpriced.

Tom Werner

PayPal Holdings, Inc. (NASDAQ:PYPL) is set to release its second-quarter earnings report before the market opens on July 30th. The event is much anticipated, given that PayPal has experienced a series of downward earnings revisions before its release. Moreover, PayPal stock’s beta coefficient of 1.6 echoes its volatility, meaning an earnings surprise could lead to significant movement in the firm’s stock price.

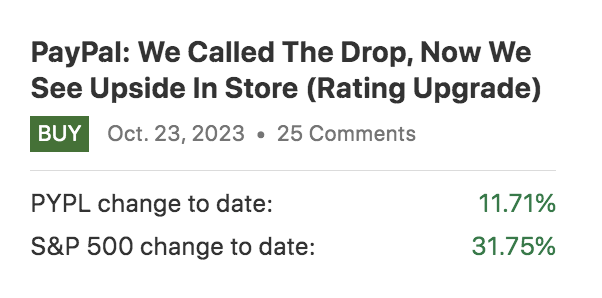

Our Previous Rating (Seeking Alpha)

We last covered PayPal in October, arguing that it presented a growth-at-a-reasonable price opportunity. Today, we dispense our updated thesis with a second-quarter earnings outlook.

Let’s get started.

A Broad-Based Outlook Of PayPal’s Q2 Earnings

Guidance

As mentioned in the introduction, PayPal has been subject to numerous downward revisions from analysts. Seeking Alpha’s database shows that 28 analysts have revised the firm’s Q2 earnings-per-share (EPS) target downward, versus one upgrade.

PayPal’s Q2 revenue is anticipated to settle at $7.81 billion, a slight deviation from the $7.7 billion it achieved during its first quarter. Moreover, PayPal is estimated to reveal a normalized EPS of 98 cents, ten cents lower than its first-quarter achievement.

Although analysts’ guidance can be telling, it is merely an indicator. We think the series of downward revisions shows a “crowding” behavior, which, whether for right or wrong, might’ve skewed estimates. As such, we won’t be surprised if a significant earnings surprise had to occur. In fact, estimating normalized and GAAP earnings can be difficult due to subjective classifications of core costs and the volatility embedded in some of PayPal’s business units.

We think the guidance is worth considering, but not something to bank on.

Key Earnings Metrics

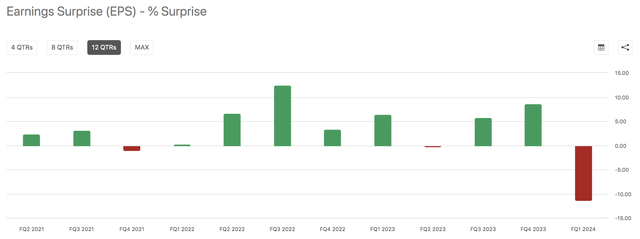

Although a simplistic observation, earnings momentum often leads to stock momentum. We like PayPal’s past earnings track record, wherein the firm has surpassed estimates in ten of its last twelve quarters. As such, another earnings beat might lead to the earnings momentum anomaly (aka fundamental momentum) having a material influence on PayPal’s stock performance.

Past EPS Surprises (Seeking Alpha)

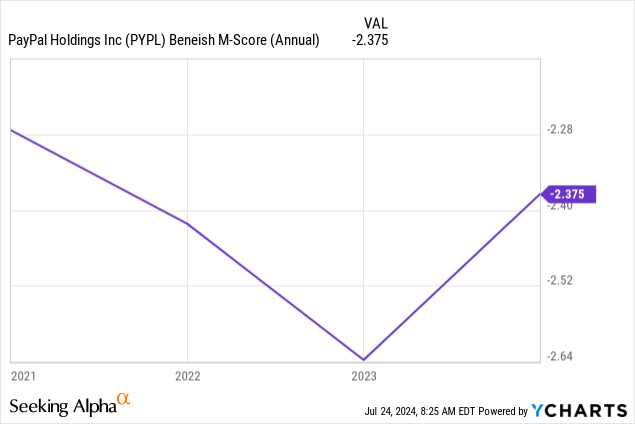

Another metric to consider is the Beneish M-Score, which measures whether a firm has applied conservative or aggressive earnings recognition practices. The metric is parsimonious and, therefore, merely an indicator. However, it is an indicator nonetheless.

PayPal’s Beneish M-Score is below -1.78, suggesting it has practiced conservative accounting practices, meaning potential surprises from past aggressive accounting practices are unlikely for Q2.

Aside: The M-Score doesn’t guarantee accuracy; it is merely an indicator.

Operational Talking Points

Headline

We decided to forecast PayPal’s fundamental aspects by looking at what happened in Q1 and interpolating those results with systematic factors.

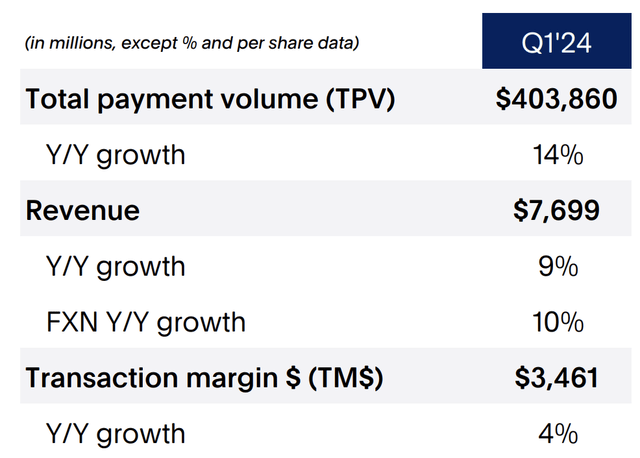

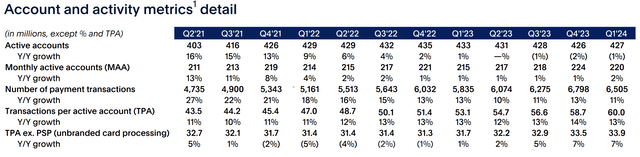

The following diagram shows that PayPal experienced 14% year-over-year growth in payment volume during Q1 and a 10% increase in fixed FX revenue. Moreover, transaction margins increased by 400 basis points, offering a margin expansion argument.

Despite PayPal’s positives, it experienced a 1% decrease in total active account growth. For those unaware, PayPal measures total active accounts as accounts that have completed transactions.

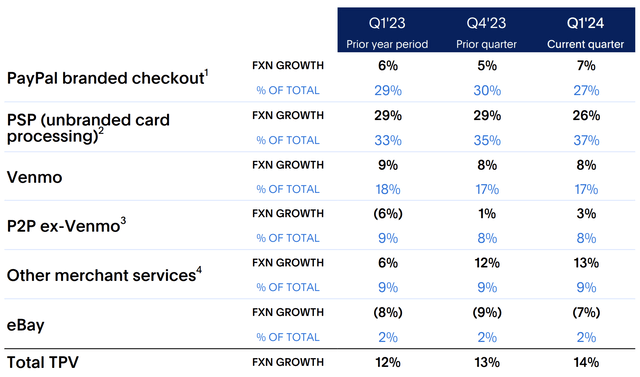

Fortunately, PayPal’s existing customer base proved loyal, as the payments per active account grew 13% year-over-year. Additionally, PayPal’s PSP, aka unbranded card processing, increased by 7% year-over-year.

Click to Enlarge (PayPal Holdings)

Lastly, a look at payment volumes stemming from PayPal’s third parties is telling. The firm is experiencing high volume via platforms it owns, like Venmo and Braintree (which falls under PSP). The feed from its eBay exposure is flat, but we see growth in some of PayPal’s forward-looking verticals.

What Do We Make of All This?

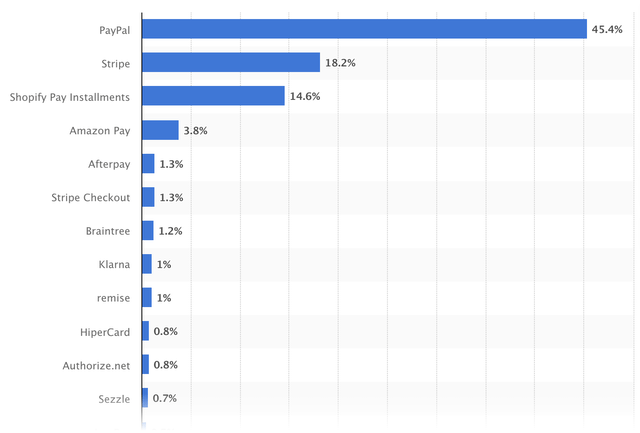

William Blair recently downgraded PayPal’s stock to “market perform” based on intensifying competition in the digital payments space.

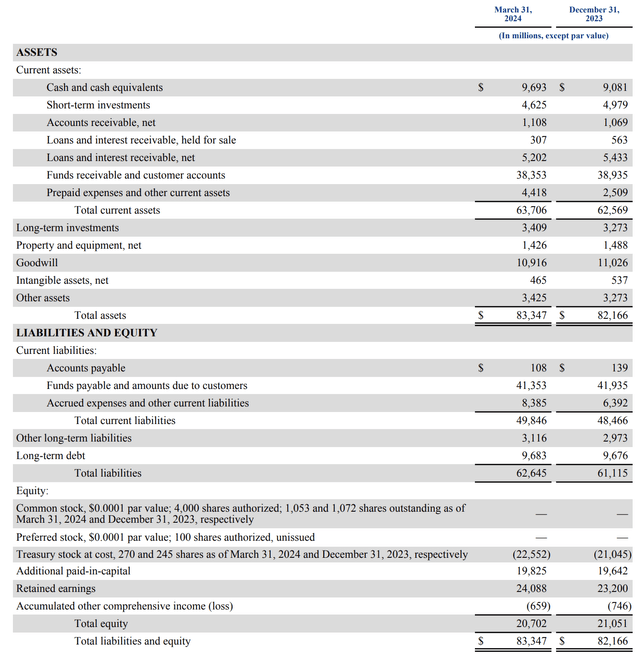

Our previous articles (about PayPal) highlighted enhanced competition as a salient risk factor. However, it is worth remembering that PayPal retains a dominant market position, allowing it advantages such as economies of scale, bargaining power over affiliates, and pricing power over its consumers. Moreover, PayPal has cash and short-term investments of approximately $14.318 billion, allowing it to acquire rising stars to fend off its competitors—PayPal used this tactic when it acquired Braintree in 2013.

Given the above, it is too early to conclude that PayPal has reached maturity; we believe additional long-term growth is possible.

PayPal Market Share ex-Braintree (Statista)

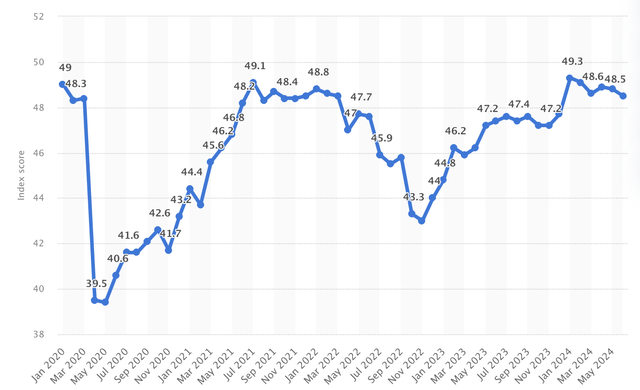

Although we think PayPal’s long-term prospects are intact, we fear short-term demand might wane. What’s our basis? Firstly, global consumer confidence has stagnated, meaning slower growth in reported Q2 transaction volume is highly possible. Moreover, we believe a knock-on effect might occur in the buy-now-pay-later arena, as the U.S. credit card delinquency rate has increased by about 71 basis points year-over-year to 3.16%.

Global Consumer Confidence Index (Statista)

Digger Deeper Into The Financials

Income Statement

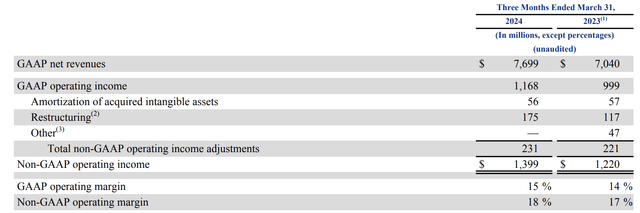

PayPal achieved a higher operating margin in its first quarter on a GAAP and non-GAAP basis. Whether that will reoccur in Q2 is debatable. However, restructuring charges and amortization costs can probably be omitted from the equation, arguably leading to a higher core profit margin.

Our basis for backing out the abovementioned costs is that amortization is a more subjective line item. Additionally, PayPal’s restructuring costs are likely due to the firm’s integration of high-growth subsidiaries and unit restructuring amid a reduction in headcount.

Balance Sheet

A time-series analysis of PayPal’s Q1 balance sheet shows little change from its previous quarter. I would, however, urge investors to consider the company’s quick ratio of 0.31, which signals a drag on liquidity. Moreover, PayPal has more than $38 million in funds receivable, which we deem risky, given the aforementioned status of the credit card environment.

We don’t think investors will see many surprises in PayPal’s Q2 balance sheet. However, we reiterate the risk factors mentioned above.

PYPL Stock Valuation

Peer-Based

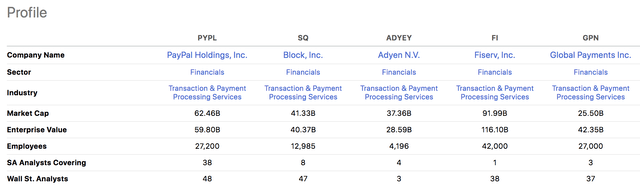

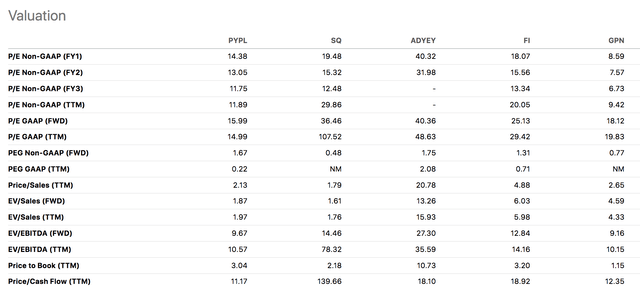

We decided to use a peer-based methodology to assess PayPal’s valuation outlook, whereby we used Global Payments (GPN), Fiserv (FI), Adyen (OTCPK:ADYEY), and Block (SQ) as peers. Note that these aren’t PayPal’s only peers; therefore, there is a degree of subjectivity.

In isolation, we like the look of PayPal’s valuation metrics. For example, its forward GAAP price-to-earnings ratio of 15.99x is about 66% below its five-year average, signaling that the stock might be cyclically undervalued. Additionally, we think PayPal’s forward EV/EBITDA ratio of 9.67x shows that the firm’s economic returns are keeping up with its size, especially as the ratio is about 57% below its five-year average.

Furthermore, PayPal’s valuation multiples stack up well against its peers. Global Payments arguably has better multiples on some fronts. However, PayPal is lower across the board than its other peers, allowing us to conclude that the stock flashes signs of relative value.

PYPL Stock Valuation (Seeking Alpha)

Technical Analysis

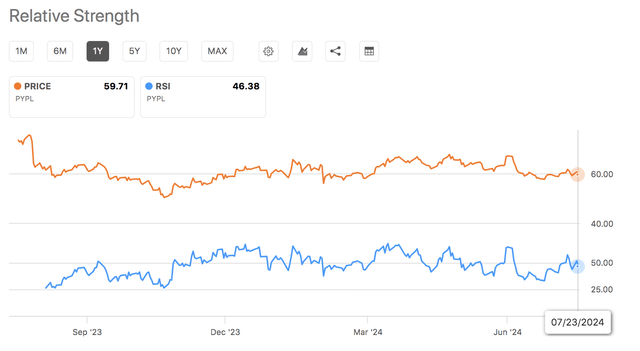

PayPal’s stock has shed about 20% of its value in the past year, dragging it below its 10-, 50-, 100-, and 200-day moving averages. In addition, PayPal’s RSI is below 50, suggesting it has room to roam into.

Given the above, we think PayPal has runway. However, PayPal will probably need a catalyst for its technical features to pay dividends. As such, much will hinge on its second-quarter earnings report.

Conclusion

After assessing PayPal’s stock, we noticed that analysts and investors alike anticipate a softer second-quarter report (compared to Q1). Features such as waning consumer confidence and rising delinquency risk support the sentiment. However, we see a few positives that could impact PayPal’s long-term and short-term performance.

From a short-term perspective, we anticipate benefits from factors like PayPal’s earnings history, favorable M-Score, and customer loyalty. Moreover, we see long-term growth prospects stemming from acquisitions and PayPal’s dominant market share.

Lastly, key metrics suggest that PayPal’s stock is relatively undervalued and technically underpriced. As such, we believe a successful second-quarter report will send its stock into recovery mode.

Consensus: Bullish Outlook Maintained.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Kindly note that our content on Seeking Alpha and other platforms doesn't constitute financial advice. Instead, we set the tone for a discussion panel among subscribers. As such, we encourage you to consult a registered financial advisor before committing capital to financial instruments.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.