Summary:

- PayPal delivered a top and bottom line beat in Q2, with revenue exceeding estimates by $80 million and non-GAAP revenue topping expectations by $0.20.

- Despite negative sentiment, PayPal continues to grow revenue and profitability, defying the narrative that it is a dying company.

- PayPal’s increased buybacks and profitability in Q2 signal a strong future, with potential for shares to trade between $80 – $100.

PM Images

PayPal (NASDAQ:PYPL) delivered a top and bottom line beat Tuesday, and shares got off to a quick start. In pre-market trading, shares climbed from $58.94 to over $64 as non-GAAP revenue topped the consensus estimates by $0.20 as revenue beat estimates by $80 million. I have been bullish on PYPL for some time, and even though I was extremely critical of how PYPL’s new CEO Alex Chriss, handled his first earnings call (can be read here) he is delivering on his vision even if the market is mispricing PYPL shares. The bear case has created a narrative that PYPL is a dying company, and this has been supported by take rate percentages. Companies that are on the decline don’t grow revenue or increase profitability, yet that’s exactly what PYPL is doing. PYPL continues to grow its top-line revenue as parts of the investment community doubt their relevancy after more than 25 years of revolutionizing digital global payments. I think the market is very wrong on PYPL, and that shares should be trading at a minimum range of $80 – $100. We will see how the market responds over the next several days as PYPL continues to prove this is a broken stock, not a broken company.

Seeking Alpha

Following up on my previous article about PayPal

PYPL is one of those companies that I have been super bullish on, and it hasn’t played out how I envisioned. The dark cloud hanging over PYPL is still there, despite positive price action after earnings. While many big tech companies are trading north of their 2021 levels, PYPL is still trading at a fraction of its previous highs that topped $300 per share, despite the company growing and buying back shares. Since my last article (can be read here), shares of PYPL have been in the red by around -5%, while the S&P 500 has appreciated by 8.64%. While I am still very bullish on shares of PYPL, I am not sure what this company needs to do in order to establish confidence across the investment community. This has been one of the most frustrating stocks I have invested in because it’s trading like a tobacco company rather than a technology company. I have covered-calls written for 8/9 at a $65 strike on my shares, and I hope I am forced to roll these up and out. If shares of PYPL can’t make some real progress this week, I am going to have to really consider an exit strategy because I feel like I am watching paint dry despite the strong fundamentals. I am following up with a new article to discuss the strong earnings PYPL delivered and why I believe a flurry of upgrades will occur, while addressing my position and what I plan on doing with my shares.

Seeking Alpha

The risks to investing in PYPL

At this point, the main risk to PYPL is that they can’t change investor sentiment. PYPL’s financials have never been the problem, it’s the narrative that it’s a dying company. The bears are focusing on two metrics, the total take rate, and transaction take rate, to justify their stance. While these are decreasing on a percentage basis, total payment volume continues to grow, which is correlating to increased revenue and profitability. If the Q2 earnings report doesn’t get investors excited, especially after the increased buyback, then I am not sure what will happen. Unfortunately, many investors only look at headlines rather than going through the numbers. The Apple (AAPL) event caused investors to panic with their announcements around Apple Pay, and more people seem to be under the impression that PYPL’s business is either shrinking or that competition will cause it to shrink. We will see what happens over the next several weeks, but if PYPL doesn’t get some upgrades and break out past $70, then I think we could see shares trade sideways for quite a bit of time.

Thank you to Alex Chriss for increasing buybacks

Over the past several months, I have been on several podcasts and gave an opinion on what I would like to see from Alex Chriss. I have stated several times that Alex Chriss should come out on the Q2 earnings call and announce a large one-time buyback of $5 billion in addition to the $5 billion authorization for 2024. Heading into Q2 earnings, PYPL had $9.69 billion in cash on hand, $4.63 billion in short-term investments, and $3.41 billion in long-term investments. Their on-hand liquidity was $14.32 billion, with $9.68 billion in long-term debt. My argument was that PYPL was expected to generate at least $5 billion in FCF, and their cash stockpile exceeded their long-term debt obligations. Since the market was discounting its shares, I had said I wanted to see Alex Chriss come out and say the best use of their cash was to repurchase even more shares because senior leadership feels the company is being drastically undervalued. I went as far as to say that they should also take the company private if the market continues to keep this multiple on its earnings.

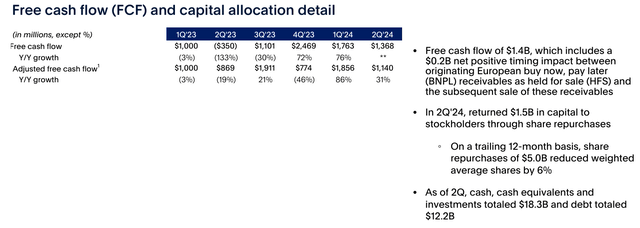

In Q2, I got part of my wish, and I will take it. In addition to repurchasing $1.5 billion in buybacks, PYPL increased its share repurchase plan by 20% to $6 billion from $5 billion. Heading into Q2 earnings, PYPL had already repurchased 12.98% of the common shares outstanding since the close of 2015, as more than 150 million shares have been bought back by the company. At this rate, PYPL could repurchase every share over the next 11 years as the market cap is under $65 billion. I am in favor of buying back more stock because, in the process, PYPL creates a more attractive value proposition since its profitability is increasing. This will provide an additional boost to EPS and make the valuation look even more ridiculous. Returning capital to shareholders through buybacks while the company continues to grow should be a strong catalyst for investors to change their perspective on PYPL’s future. This isn’t a company in decline, and the increased profitability and additional buybacks in 2024 should send a strong message to the market.

PayPal Q2 Presentation

PayPal came out swinging in Q2, and it’s the exact opposite of a dying company

PYPL continues to prove the bears wrong in the face of increased competition. The narrative about PYPL’s relevancy in a digital payment landscape is incorrect as its revenue continues to grow. PYPL grew its revenue by $598 million or 8.21% YoY in Q2 while seeing a 2.42% QoQ bump of $186 million. When I look at PYPL on an annualized basis, the trailing twelve-month (TTM) revenue of $31.03 billion has grown by $1.26 billion (4.22%) compared to the $29.77 billion of revenue PYPL generated in 2023. PYPL started 2024 off by having generated $15.58 billion in revenue, which is 8.77% ($1.26 billion) higher than the $14.33 billion of revenue generated in the first half of 2023. Everyone has an opinion, and while mine differs from the bears, the numbers are facts. The numbers indicate that PYPL is still growing its top-line, and even as an emphasis is placed on what the competitors are doing, I think the investment community is overlooking the fact that PYPL is still growing and is still very relevant in the digital payment space.

Steven Fiorillo, Seeking Alpha

I think that too many people are getting hung up on active accounts not being at their all-time highs and the declining take rate. While these numbers shouldn’t be overlooked, they are not the most important numbers to focus on. In Q4 of 2022, PYPL had 435 million active accounts with only a 50.80% activity rate on a monthly basis. In Q2, PYPL had 429 million active accounts, but its activity rate increased to 51.75%, which helped drive the transactions per account higher and total payment volume. A large component of the bear thesis is that the total take rate has decreased from 1.99% to 1.89%, and the transaction take rate has declined from 1.80% to 1.72% since Q1 of 2023. This is the equivalent of the total and transaction revenue divided by total payment volume. I think investors should focus on the total payment volume flowing through PYPL’s ecosystem as it’s up 11% YoY and how this translates to topline revenue growth, which was 8% YoY in Q2. The market is looking over how revenue growth is driving profitability, and focusing on metrics that shouldn’t have this much of an emphasis unless revenue and profitability were declining.

PayPal Q2 Presentation

While revenue grew by 8% YoY in Q2, PYPL drove larger levels of profitability to the bottom line. PYPL grew its non-GAAP operating income by 24% to $1.46 billion and increased its margin by 2.3% to 18.5% YoY in Q2. This allowed PYPL to generate $1.19 in non-GAAP income, an 36% increase YoY from $0.87, which was generated in Q2 2023. This also allowed PYPL’s FCF to increase to $1.37 billion in Q2 after generating -$350 million due to a $1.2B negative timing impact from European buy now, pay later loans originated as held for sale in Q2 of 2023. On an adjusted basis, PYPL’s adjusted FCF has increased by 31% YoY in Q2 2024. The market should focus on PYPL’s increased profitability and guidance. PYPL is now projecting that its FCF will come in at $6 billion rather than $5 billion for the year, and its GAAP EPS will be between $3.88 – $3.98 rather than $3.65. At some point, the market will recognize that profitability matters and that PYPL is undervalued.

PayPal Q2 Presentation

PayPal is trading like a tobacco company rather than a digital payment company

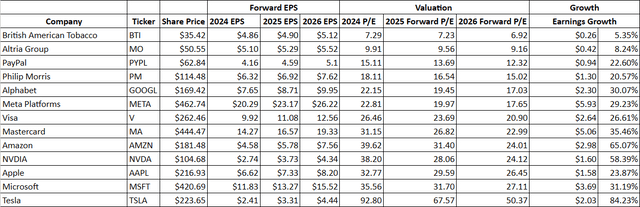

The forward valuation based on analyst estimates is so low for PYPL that they are valuing them the way they value a tobacco company. Currently, the big 3 tobacco companies, British American Tobacco (BTI), Altria Group (MO), and Philip Morris (PM) trade between 7.29 and 18.11 times 2024 earnings, and the range for 2026 is 6.92 times – 15.02 times. Currently, PYPL is trading at 15.05 times 2024 earnings and 12.28 times 2026 earnings. The street is expecting PYPL to grow its EPS over the next 2 years by 22.60%, which is 2.03% more than PM, yet PM is getting a larger multiple. When I look at the Magnificent 7 and add Visa (V) and Mastercard (MA) in the mix, they are trading between 22.15 times and 92.80 times 2024 earnings. It’s hard for me to agree with the current valuation when PYPL is trading at less than 16 times 2024 earnings and less than 13 times 2026 earnings.

I believe that PYPL is undervalued and should be trading closer to 20 times 2024 earnings, which would place shares at around $83.50 per share. This would give PYPL a forward earnings multiple of 16.37 times 2026 earnings, which is more than justifiable considering that companies such as PM are trading at 15.05 times 2026 earnings. PYPL isn’t a broken company as it’s still growing its top and bottom line, it’s a broken stock. Shares of PYPL are extremely enticing at these levels, and there is no reason why it shouldn’t trade like a technology company. I think that as earnings are digested, we will see shares of PYPL get some upgrades based on the value opportunity its forward earnings are representing.

Steven Fiorillo, Seeking Alpha

Conclusion

PYPL delivered a top and bottom line beat in Q2 while raising their guidance on profitability and the amount of capital being deployed to buybacks. I have covered calls written for 8/9 at a $65 strike, and I am shocked they aren’t underwater yet. PYPL continues to prove it’s not a dying company as its revenue continues to trend higher. I am bullish on PYPL because Q2 further solidified this is a broken stock, not a broken company. While I would have liked Alex Chriss to allocate more toward buybacks, I think he sent a bullish signal by increasing buybacks by 2024 by 20%. Only time will tell how the market reacts, but I don’t think PYPL trading between $80 – $100 is unreasonable. If PYPL sells off and retraces again below $60, I will have to seriously consider the opportunity cost of staying in the investment, even though I am very bullish. I think PYPL deserves an upgrade cycle from the analyst community, as Alex Chriss and senior leadership deliver value by increasing profitability.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, MO, BTI, GOOGL, META, AMZN, NVDA, TSLA, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.