Summary:

- PayPal’s stock declined following Apple’s WWDC announcements introducing competing BNPL services from Affirm, but market reaction may be misguided.

- PayPal’s recent enhancements, strong financial health, and potential for earnings beat suggest a rebound is possible despite competitive pressures.

- The recent EU ruling requiring Apple to open their NFC technology to third-party providers could benefit PayPal in Europe, mitigating some risks.

Justin Sullivan

Investment Thesis

Since PayPal’s (NASDAQ:PYPL)’s Q1 report, shares of the global payment processing giant have declined. A big reason for this was Apple’s announcements at the Worldwide Developers Conference (WWDC) event back in June. Apple introduced a series competing consumer payment & financing rails option for Buy Now, Pay Later (BNPL) services to compete against established players such as PayPal (they partnered with Affirm to power their solution). PayPal stock has hurt from this, with their stock posting seven consecutive losing sessions following these developments.

Despite the market’s reaction, I believe the reaction is misguided. PayPal’s presence in the digital payments market and their established user base provide them with an advantage that the market seems to underestimate. While Apple’s entry into the BNPL sector is likely to disrupt, it does not necessarily spell a bleak forecast for PayPal. The market’s immediate reaction appears to be more of a knee-jerk response to Apple’s brand influence rather than a reflection of PayPal’s actual competitive standing, in my view.

Moreover, the enhancements PayPal has been implementing in their own services over the last quarter, such as expanding the functionality of Venmo and integrating it more deeply with e-commerce platforms like eBay, demonstrate their renewed approach to staying relevant in a rapidly evolving market. While Apple’s announcement has undeniably put pressure on PayPal’s stock in the short term, it is premature to discount PayPal’s ability to adapt and compete effectively in the long term.

Despite recent setbacks, PayPal appears poised for a potential rebound this quarter. An analysis of their recent performance suggests that the company is well-positioned to beat earnings estimates again, which could trigger a, in my opinion, long overdue jump in shares.

PayPal has demonstrated a strong track record in surpassing earnings expectations, as evidenced by their recent quarterly results. For instance, in the last reported quarter, the company exceeded the consensus estimate by reporting earnings of $1.40 per share against the expected $1.18 per share.

Despite the WWDC announcement, analysts overall have also revised their estimates higher for PayPal, reflecting growing bullish sentiment.

Given these factors, I believe PayPal is well set up to beat this quarter’s earnings expectations. The market’s recent bearish stance, driven by competitive pressures from Apple’s BNPL announcement, seems overstated and overly bearish considering PayPal’s strong operational fundamentals and proactive growth strategies. I still believe the stock is a strong buy.

Why I’m Doing Follow Up Coverage

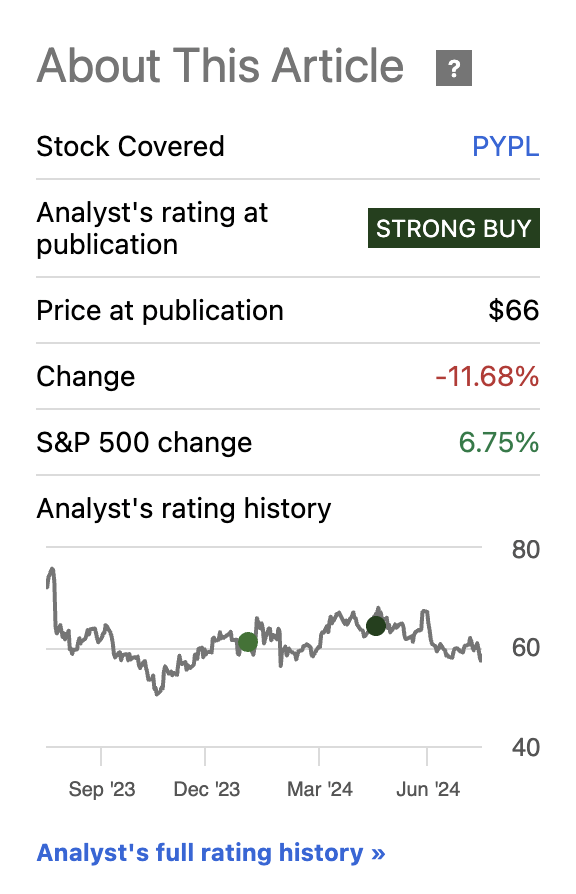

PayPal shares have experienced a turbulent year. The payment giant’s shares have trailed the broader market so far in 2024 and have unfortunately continued to underperform since my last coverage update in April. Despite an initially promising start, the company’s stock began to drop in mid-June, after the market spotted what they initially believed to be heightened competition following Apple’s WWDC.

PYPL Stock Performance (Seeking Alpha)

However, I believe this market reaction appears to be likely misguided as we head into PayPal’s earnings. The consensus EPS estimate for 2Q is set at $0.98/share, with revenue projections at $7.81 billion. I’ll dive into this estimate later but this feels overly pessimistic.

Contrary to the prevailing market sentiment, I think Apple’s foray into digital payments does not nearly negatively impact PayPal as much as investors think.

With this, PayPal’s actual financial health remains strong, with first quarter earnings reflecting a 9% revenue increase to $7.7 billion, and a notable rise in Total Payment Volume (TPV) by 14% to $403.9 billion. The payment processor’s ability to generate free cash flow, amounting to $1.8 billion in Q1 along, shows their financial resilience despite what the market is perceiving as existential competitive threats.

Post WWDC Analysis

The WWDC sell-off in PayPal has left analysts more bearish. Apple’s introduction of features like “Tap to Cash” and access to installment loans through Apple Pay has affected PayPal’s stock performance. I think if we dive deeper there are actually some wins PayPal has scored (including against Apple which I am separately bullish on as well). On top of this, the Affirm partnership will not be as big of a competitive threat as it appears on the surface.

While this wasn’t announced at WWDC itself, it came at the same time which is key: Apple lost an antitrust case in Europe, which now requires them to open their near-field communication (NFC) technology to third-party payment providers (including PayPal). I believe this ruling could be a boon for PayPal, allowing them to leverage NFC on iPhones in Europe, thereby enhancing their market position and expanding their reach among Apple’s extensive user base. The settlement could reshape the competitive landscape of digital payments in Europe, providing PayPal with opportunities to increase transaction volumes and improve their cost efficiency. PayPal does really well in Europe, this settlement was a big victory.

Despite the concerns over Apple’s new fintech features, Affirm (AFRM)’s recent CFO fireside chat shows that they expect to make roughly the same long run margin on their deal with Apple compared to current BNPL financing products. With this, management noted the process Affirm will follow to finance consumer purchases now:

When we integrate into the wallet, that’s us getting the wallet to directly initiate Affirm transaction as opposed to looking like a visa transaction to the wallet that then behind it becomes an Affirm transaction. And so we think about the latter, just the card version as honestly, it’s already integrated everywhere. I’m exaggerating a little bit. I’m sure there’s cases where it’s not, but you can put your Affirm card, and I certainly do, in any number of wallets today, and it works great.

But that is different than when I’m checking out with one of these wallets, take ShopPay Installments is a really good example. I can still use my Affirm card in ShopPay and it’ll look like a Visa card to ShopPay. However, in the ShopPay experience, I’m also able to take out a ShopPay Installments loan, which is obviously delivered by us. And that is the second experience that’s unique, and we think about integrating with the wallets. That’s the one that becomes really valuable because it’s a distribution that’s wider. You don’t have to have the Affirm card. -CFO Fireside Chat.

While this will definitely reduce friction for users to use Affirm, keep in mind that PayPal can now replicate this same process with consumers in Europe because they won this NFC lawsuit. In the US, if they win a similar lawsuit, expect Affirm (and Apple’s) moat in this space to dissipate.

With this, PayPal’s management remains optimistic about their innovations and future growth. CEO Alex Chriss highlighted on their most recent earnings call the substantial growth in PayPal’s metrics, including a 14% jump in total payment volume year-over-year. In addition, the number of first-time users of PayPal’s debit cards surged by 38% year-over-year, with debit card users generating nearly 20% more revenue than non-users.

Moreover, the introduction of PayPal’s new guest checkout system, Fastlane, is expected to lift payment volumes further and improve monetization rates for Venmo and other services. The company has a lot of optimizations under the surface and the Apple/Affirm partnership is not nearly as damaging as it appears. I remain optimistic.

Earnings Expectations

Like I mentioned before, analysts forecast PayPal to post an EPS of $0.98/share on July 30th when they report, a decrease YoY and reflective of the current environment for the company (they are undergoing big transformations). Revenue estimates stand at $7.81 billion, with a solid 7% YoY increase anticipated.

However, the revisions paint a bleak picture, with 37 downward revisions for EPS against just one upward revision, indicating a pervasive pessimism about PayPal’s near-term profitability. This trend is mirrored in revenue forecasts, which also saw more downward than upward adjustments, suggesting that expectations for the company’s performance have been tempered. This is exactly what we want to see from analysts (assuming our assumptions are true that the company is actually in good shape). An overly pessimistic market means an earnings beat is not expected and not in investors positioning.

Valuation

Despite an expected GAAP earnings per share (EPS) growth rate that surpasses the sector median (28.16% vs. 3.60%), PayPal’s price-to-earnings (P/E) ratio remains only is slightly higher than that of their peers (15.61 vs. the sector median of 12.38- a 26.04% premium). This slight premium is really interesting compared to the growth rate I mentioned earlier which is 682.45% higher than the sector median. This discrepancy provides a compelling investment opportunity given the potential for valuation convergence in my opinion.

Beyond the next 12 months, the projected EPS growth for PayPal over the next 24 months also stands out, with estimates reflecting an increase compared to the sector. Specifically, PayPal’s forward GAAP EPS is anticipated to grow by 10.26% in 2025 and by 11.05% in 2026, demonstrating strong growth rates.

My current valuation fair-value estimate assumes that PayPal should trade at a 50% premium to the sector median GAAP P/E due to the fact that I think they should still have ample growth opportunities and the competitive threats are not nearly as serious as analysts make them out to be.

At a 50% GAAP forward P/E premium, this would imply an additional 19% upside in shares. Keep in mind this does not include the $5 billion in buybacks that PayPal is doing annually.

Risks

Since the days of Steve Jobs, Apple has consistently demonstrated their capability to disrupt markets with new technologies (the iPhone being the most notable), and is most likely to introduce further fintech payment technology that could pose a real challenge PayPal’s market position, on top of the WWDC announcements they’ve already made. The technology giant’s introduction of “Tap to Cash” and the expansion of Apple Pay’s functionalities have already put pressure on PayPal to deliver. I think they’re set to deliver given recent regulatory rulings.

Again, the recent ruling by the European Union (EU) that requires Apple to open their NFC technology to third-party payment providers is a huge mitigating factor for PayPal on this front and eliminates a lot of the competitive risks that Apple could bring, especially in Europe. This ruling enables PayPal to leverage the same hardware as Apple (Apple’s true moat), thereby making a more level playing field in the European market (I eventually believe this will spread to other markets too including the US).

With their biggest competition addressed, I think the other biggest risk with the payments giant are the rising default rates on Buy Now, Pay Later (BNPL) loans. Consumers increasing their use of BNPL services, such as those offered by Affirm, Afterpay, and Klarna, and this has led to a phenomenon referred to as “phantom debt,” where consumers accumulate debts that are not easily tracked by traditional credit reporting systems.

A recent survey also found that 43% of BNPL users were behind on their payments, with 28% delinquent on other debts due to BNPL obligations. I believe this shows the financial situation that many consumers face, exacerbated by the ease with which BNPL loans can be obtained and the lack of comprehensive reporting to credit agencies. It’s a hidden debt mountain in a lot of ways.

The Consumer Financial Protection Bureau (CFPB) has also noted that BNPL products often lack the same consumer protections associated with traditional credit products, and could potentially lead to surprise fees and hidden interest charges. It’s a bad setup for many BNPL loan issuers and consumers.

Fortunately for PayPal they’re also mitigating this risk. Last year, the company announced their partnership with KKR. In a multi-year agreement, KKR (KKR) is set to purchase up to €40 billion in consumer loan receivables from PayPal across several European countries, including France, Germany, Italy, Spain, and the United Kingdom.

This deal involves KKR acquiring the debt on a rolling basis, starting with an initial €3 billion, and continuing to reinvest the repaid funds into more loans, aiming to reach the €40 billion mark over several years. This is a symbiotic relationship with PayPal reducing credit risk and KKR holding the company accountable for the quality of BNPL loans they issue. KKR is a sophisticated institution. They would likely not buy loans that were deemed too risky given the widely known stats about BNPL loans. This forces PayPal to issue high quality, more disciplined credit.

Bottom Line

Despite recent market turbulence, I believe PayPal remains a strong buy. The stock has fallen following Apple’s announcements at their WWDC event, which introduced new payment rails that will compete directly with PayPal’s BNPL services and some analysts fear will beat them at their own game.

Despite this, I believe PayPal’s established market presence and sticky active account user base (not total accounts CEO Chriss noted they are pruning inactive accounts) provide a competitive advantage that the market seems to missing. The recent EU ruling mandating Apple to open their NFC technology means PayPal has an opportunity to follow Apple, see what works, copy them and provide the same technology to their user base. It really strengthens PayPal’s position in Europe.

While PayPal of course faces challenges from this increasing competition and rising BNPL defaults, their strategic initiatives and strong market fundamentals provide what I believe to be is a solid foundation for future share-price growth. I believe PayPal stock remains a compelling opportunity ahead of their earnings.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.