Summary:

- PayPal’s stock rallied 4% after better-than-expected earnings for 3Q FY2023, reversing a previous decline.

- The new CEO’s turnaround strategy and resolution of the CEO uncertainty can improve the stock’s sentiment.

- PayPal’s declining transaction take rate and transaction margin can be addressed by prioritizing improvements in the customer checkout experience.

- The risk and reward are getting more attractive as the stock is currently trading at a 10-year low of 9.8x P/E FY2023.

Sundry Photography

What Happened

PayPal Holdings, Inc. (NASDAQ:PYPL) saw a 4% rally following better-than-expected earnings for Q3 FY2023, reversing a nearly 30% decline that occurred after disappointing 2Q. I believe that the risk and reward for the stock is becoming more attractive, as the current valuation accounts for many of the growth headwinds the company has faced.

Investors are closely monitoring the actions of the new CEO, Alex Chriss, as he works to implement a turnaround strategy for PYPL. At the very least, the uncertainty stemming from the lack of a CEO has been resolved. Therefore, I have upgraded my rating for the stock from “hold” to “buy,” as the company’s fundamental outlook has undergone a significant reset.

With non-GAAP P/E FY2024 currently trading at less than 10x, I believe this represents an appealing long-term value opportunity, provided that PYPL can successfully overcome its growth challenges.

Q3 2023 Takeaway

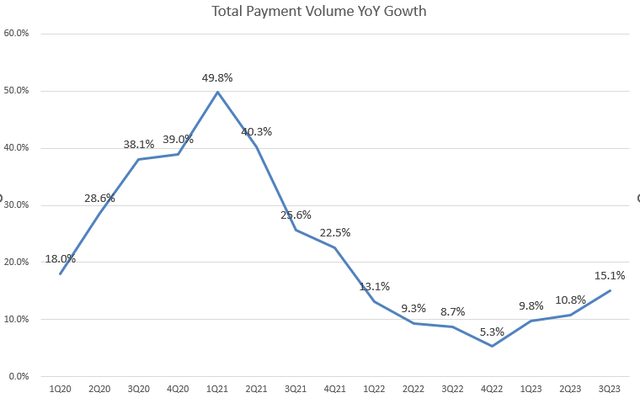

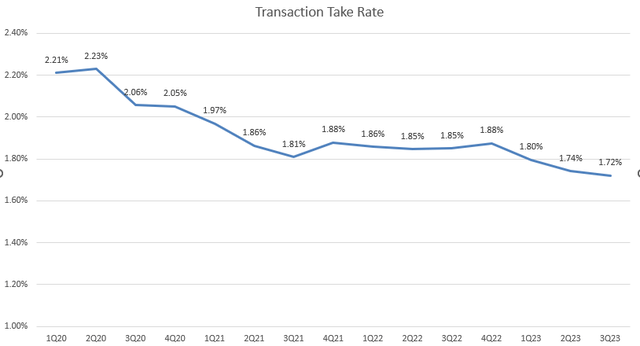

PYPL’s earnings for Q3 FY2023 exceeded market consensus, with both revenue and adjusted EPS beating expectations. The chart above shows a rebound in the total payment volume (TPV) over the past few quarters since 1Q FY2023. However, many key metrics still indicate year-over-year declines. In the last quarter, the total number of active accounts amounted to 428 million, falling short of the 431 million in the previous quarter of 2Q FY2023 and 432 million in Q3 FY2022. Furthermore, PYPL’s transaction take rate, which I consider the most important metric, continues to decline, now standing at 1.72%. I will provide more details in the next section.

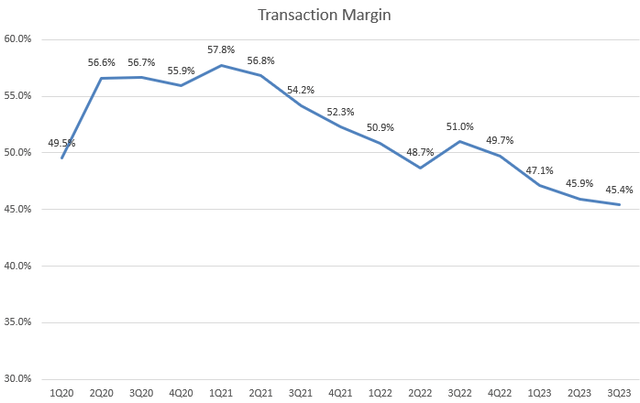

In the meantime, PYPL’s transaction margin continued to contract, reaching 45.4%, which is down from 45.9% in 2Q FY2023. The company’s guidance for 4Q FY2023 includes an adjusted EPS of $1.38, below the consensus of $1.40. Lastly, the management anticipates that net revenue will continue to grow at a high single-digit rate in the next quarter.

Transaction Take Rate is Under Pressure

Due to intense competition in recent years, particularly from Apple Pay, PYPL’s transaction take rate has declined from 2.06% in Q3 FY2020 to 1.72% in Q3 FY2023. One of the key metrics for assessing the competitiveness of a fintech company is transaction take rate, which is calculated by dividing transaction revenue by TPV. A lower transaction take rate signifies that PYPL will generate less transaction revenue from payment transactions.

It’s common for a company’s transaction rate to gradually decrease as more competitors enter the market. However, a significant drop in the transaction take rate over the past three quarters serves as a warning sign for the company’s growth prospects.

During Q3 earnings call, the management explained a lower transaction take rate was largely driven by three factors: lower gains from foreign currency hedges, a decline in foreign exchange fees, and the headwind from lapping elevated contractual compensation from merchants.

As mentioned earlier, PYPL’s active customer accounts have been facing headwinds, declining for three consecutive quarters starting from 1Q FY2023. This trend contrasts with the healthy and steady e-commerce growth experienced this year. In addition, investors are concerned about the sluggish growth of its high-margin branded products. For instance, PYPL’s branded checkout volumes increased by only 6% in Q3 FY2023 on a FXN basis, compared to a growth of 7.5% in Q3 FY2022. Therefore, we need to see a clear rebound in its branded checkout volumes before we become more optimistic about the company’s growth outlook.

Focus on Transaction Margin

During the previous meeting, the management discussed the potential for margin expansion in FY2023. Despite PYPL’s transaction margin showing signs of decline in recent quarters, the company is committed to reducing non-transaction-related expenses by up to 10% this year, aiming for a minimum of 100 basis points of expansion in non-GAAP operating margin.

However, as a turnaround strategy, I think one of the key drivers for the stock upside would be a consistent improvement of its transaction margins. PYPL’s transaction expenses have been on the rise, largely due to the company’s strategic focus on large enterprise merchants who demand lower fees compared to SMBs. Furthermore, we have observed that branded checkout volumes have only experienced single-digit growth over the past few quarters, significantly lagging behind unbranded products. This shift in product mix has also put downward pressure on PYPL’s transaction margin as well.

I believe that a reacceleration of branded checkout volume will play a crucial role in improving transaction margin. The management has acknowledged that the Braintree business currently starts with a margin that is lower in comparison to what is typically seen in other markets. Therefore, it is essential to monitor the growth of branded checkout volumes in the upcoming quarters.

Valuation

As shown in the chart, PYPL is currently trading at a P/E GAAP TTM of 14.4x, continuing breaking new lows over the past decade. When we consider the Bloomberg non-GAAP earnings consensus for FY2024, PYPL is trading at 9.8x P/E, which indicates that the stock’s low valuation has priced in many of the growth headwinds.

However, it’s important for investors to be aware that the stock could become stuck in a value trap if we don’t see a clear rebound in branded checkout volume and transaction margin. Additionally, if the transaction take rate continues to decline in the next quarter, it becomes difficult to maintain a substantial recovery in revenue growth.

Conclusion

In sum, PYPL has faced many challenges in recent quarters, including a declining transaction take rate and a persistent decline in active customer accounts. While the new CEO has outlined plans for margin expansion and cost reduction, the stock’s valuation remains low, with a P/E at a 10-year low. This suggests that many of the growth headwinds have already been factored into the stock’s price. Therefore, I’m bullish on the stock over the long term. However, investors should still be cautious in the near term, as PYPL may find itself in a value trap if these key metrics continue to deteriorate in the upcoming quarters.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.