Summary:

- PayPal Holdings, Inc. stock has been consistently declining but how much is too much?

- Expectations going into Q3 are not indicative of a company in decline.

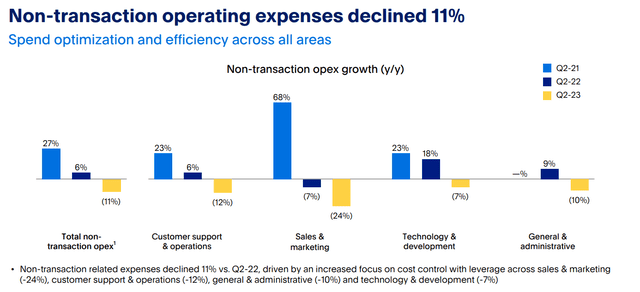

- PayPal has been operating efficiently as non-transaction Opex is down big YoY.

- The stock is technically weak and may not reverse its downward trend even with a positive Q3 earnings report.

chameleonseye

PayPal Holdings, Inc. (NASDAQ:PYPL) stock apparently knows no bottom, as the stock is down:

- 38% in the last 5 years

- 42% in the last year

- 32% YTD

- 32% in the last 6 months

- 15% in the last month

- 5% in the last 5 days

Since my last review almost 3 months ago, the stock has lost a further 22% compared to the market losing about 9%. A stock losing 20% from its highs is referred to as being in “bear market.” As a PayPal stockholder in the last 3 years, I don’t know how many bears within bears I’ve seen. Despite the pain, I retain by “Buy” rating on PYPL stock ahead of its Q3 earnings report, which we are previewing in this article and is expected on Wednesday, November 1st.

PYPL Q3 Preview (Seeking Alpha)

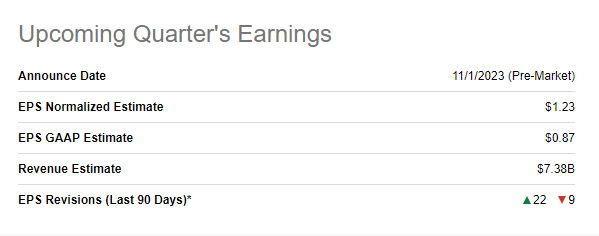

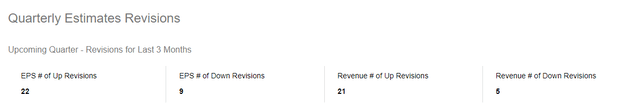

Mostly Upward Revisions

Despite the pain the stock has endured as described above, things don’t seem so bad looking at some of these numbers:

- PayPal is heading into the Q3 report with 22/31 EPS revisions and 21/26 revisions being upward.

- Should the company meet the EPS target of $1.23, it’d represent a YoY growth of nearly 14%.

- Should PayPal meet the revenue estimate of $7.38 billion, it’d mean nearly 8% YoY growth.

I don’t know about you but at this point, I am wondering if the market is expecting PayPal to solve the world’s hunger and pollution issues at the same time before the stock gets any semblance of respect.

PYPL Q3 Revisions Count (Seeking Alpha)

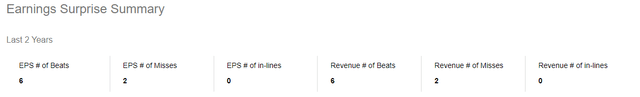

Beat or Miss?

PayPal has beaten both EPS and revenue estimates in 6 out of the last 8 quarters, which is, once again, not indicative of a stock that knows no bottom. Stretching back to the last 12 quarters, revenue surprises have ranged between -0.83% and 2.17%, a very tight range. This is in line with my revenue prediction covered below. EPS beats or misses have been by a wider margin, and I expect a beat (say 5% or more) based on the operating discipline highlighted below.

PYPL Earnings History (Seeking Alpha)

What To Watch?

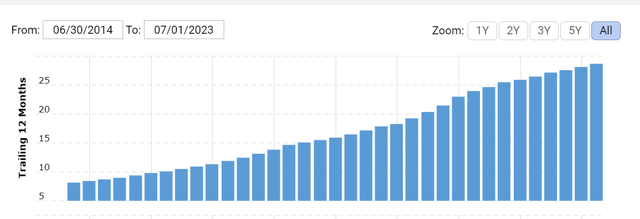

- While the stock has been on an eternal downtrend, PayPal is on a streak dating back to at least 2014, where it has reported increasing revenue on a trailing twelve months (TTM) basis. I fully expect this trend to continue when the company reports its Q3 revenue. For the record, given the seasonal ramp-up expected in Q3 and Q4, I am predicting revenue to come in slightly above consensus at $7.5 billion.

PYPL TTM Revenue History (macrotrends.net)

- PayPal has also been disciplined in its operations, as evidenced by the 12% reduction in non-transaction Opex in Q1 2023 and the 11% reduction in Q2 2023. I expect Q3 2023 to show YoY decline in this category, but it may not be a double-digit decline, as I expect additional spending heading into the holiday season.

- A report that Elon Musk and X are considering adding financial features to their platform adds more additional pressure for a company (and sector) seeing constant competitive and disruptive threats. Not to mention, Musk has a rich history with PayPal and may be curious to see how he could disrupt his old pals. It will be interesting to see if PayPal or the analysts bring up this threat during the Q&A session.

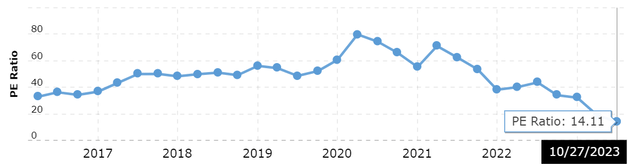

Valuation – Continues Getting Cheaper

- PayPal’s stock is heading into Q3 report with its cheapest valuation at least in the last 5 years. And, knowing that PayPal and FinTech stocks in general used to be highly valued not too far in the recent past, I am tempted to say this is the cheapest the stock has ever been.

- Looking at it another way, based on the TTM revenue referenced above, PayPal’s stock is trading at a hair less than two times sales. That screams undervaluation to me. As a comparison, Visa Inc. (V) stock is trading at nearly 15 times its TTM revenue of $32.65 billion.

- A median price target of $84 means the stock is trading nearly 70% away from the consensus offered by 37 analysts.

PYPL Historical PE (macrotrends.net)

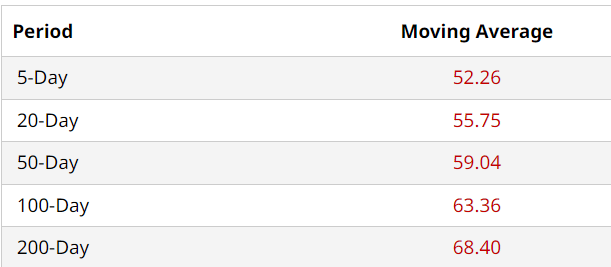

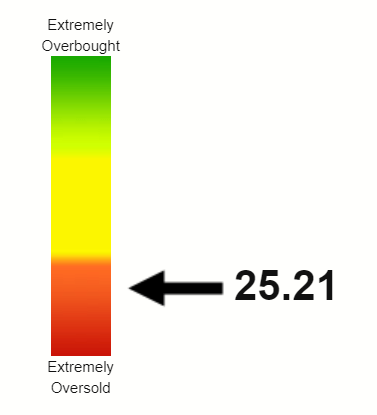

Extremely Weak, Technically

The stock is a good 35% away from its current 200-day moving average, clearly suggesting the base is changing. Another indication of the same is that the moving averages below are progressively lower, suggesting that the stock is likely to trend lower. While a Relative Strength Index [RSI] of 25 is below the textbook oversold level of 30 and suggests a bounce is due, PYPL stock has been close to the oversold level for a while as indicated by the 31.77 during the May review and 32.31 during the August review. Overall, the stock is heading into Q3 report extremely weak from a technical perspective and a mere meet or a small beat may not be enough to reverse the trend.

PYPL Moving Avgs (Barchart.com) PYPL RSI (stockrsi.com)

Conclusion

As if the existing pressure on the stock wasn’t enough, it has also found its way into the most crowded shorts list. The contrarian in me senses a Meta Platforms, Inc. (META)-type of comeback from PayPal’s stock, given how dark things look. PayPal may not revisit its glory days as a company and stock, but at less than two times (an ever-increasing) TTM revenue, I believe the upside potential is more from here. I retain my “Buy” rating on the stock and will be looking forward to bringing my average down further should the stock sell-off further, especially if Q3 numbers don’t scream “end of the world.”

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.