Summary:

- PayPal shares have surged 37.56% since July, driven by new leadership under CEO Alex Chriss and strategic partnerships, signaling a strong turnaround.

- Q3 earnings beat EPS estimates by over 12%, despite a slight revenue miss, showcasing durable growth and a focus on quality revenue.

- Key partnerships with Amazon, Shopify, and Apple enhance PayPal’s market position, promising significant growth and mitigating competitive risks.

- Despite slower than expected revenue growth, improving retail data and consumer optimism bolster PYPL’s outlook, reinforcing my strong buy rating on the stock.

Justin Sullivan/Getty Images News

Co-Authored By Noah Cox and Brock Heilig.

Investment Thesis

PayPal (NASDAQ:PYPL) shares have beaten the market and are up 37.56% since I last wrote on the payment processing company in late July. Shares then were worth $58.50. They are now worth $80.48 as of the time of this writing.

A big driver for the outperformance of the payments giant has been the market’s realization that the new leadership (through CEO Alex Chriss and his team) is now working. The new leadership team, just one year into the job helming the company is laying the groundwork for a powerful turnaround. Earnings estimates have been moving up over the last three months, and I think the handful of partnerships over the last quarter show that the company is headed in the right direction. The turnaround is accelerating. I’m optimistic.

The Q3 report helped remove many of the bear arguments around the stock. Some investors have been bearish on the company because they are concerned about competition with Apple Pay, but PayPal has gone so far as to directly refute these worries with a direct integration. The company is in a strong position. With this, I continue to believe shares continue as a strong buy.

Why I Am Doing Follow Up Coverage

PayPal continues to move in the right direction, with shares up nearly 38% since I last wrote on them. Chriss has only been at the helm of PayPal for about a year, but he’s already starting to have a huge impact on the direction of the company, and I think that’s being seen in the earnings.

After earnings were released on October 29th, I want to highlight the handful of key partnerships that PayPal has either reinforced or launched that, I think, will prove to be a big deal for the company. I’m doing follow up coverage to show why these partnerships are a big deal. I’m doing this follow-up coverage to show how the quarter is a rock-solid step in the right direction.

Q3 Review

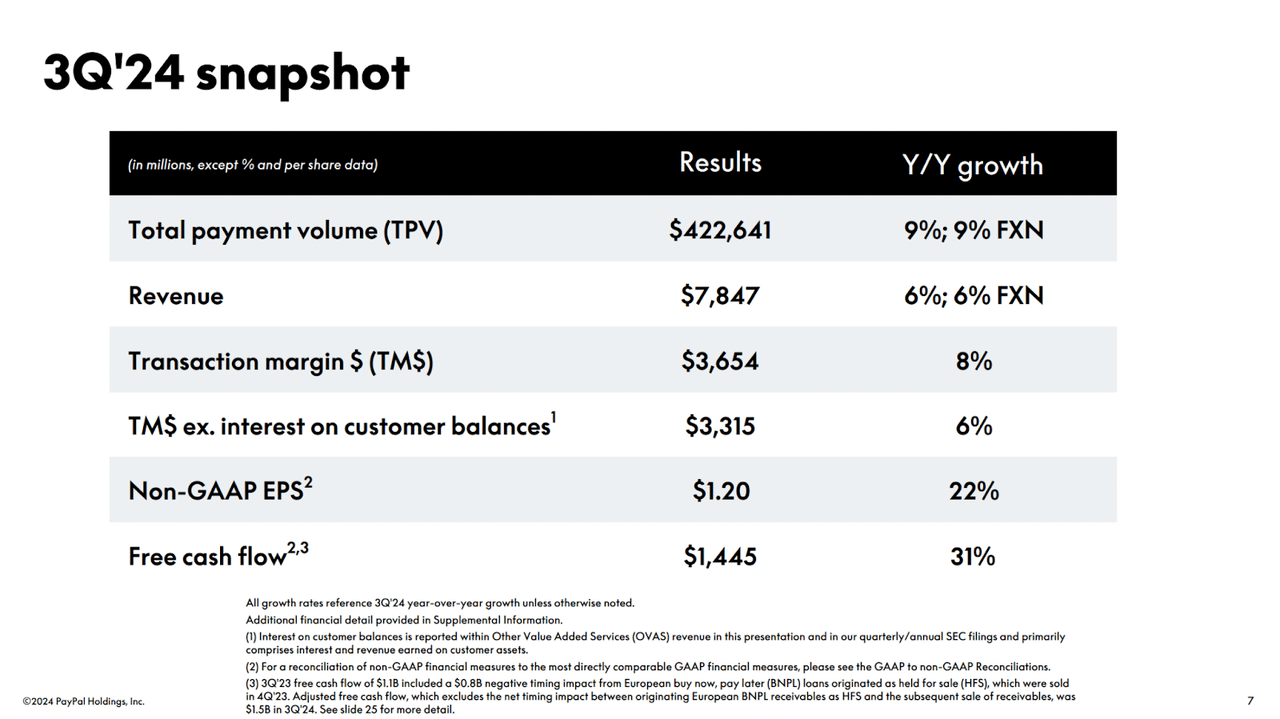

PayPal announced its EPS and revenue numbers yesterday, pre-market. For Q3, PayPal booked a solid EPS of $1.20, which beats the estimates of $1.07 by more than 12%.

Revenue numbers came in light, but growth was still durable. PayPal brought in $7.8 billion in revenue. While revenue missed the projection by about $90 million, YoY growth still came in robust at 5.4%.

While some investors were more cautious about the report, a big driver for this caution was the growth in PayPal’s TPV (total payment volume). As seen in the slide from earnings below, PayPal’s Total Payment Volume for Q3 came in at $422 billion. This represents a 9% YoY growth (down from double-digit growth in recent quarters).

PayPal TPV Results (PayPal)

A big driver for the miss on revenue is PayPal’s focus on securing quality revenue.

PayPal CFO Jamie Miller provided commentary on the company missing the mark on revenue on the Q3 Call.

Our focus on price to value is paying off with Braintree again contributing materially to transaction margin dollars even as volume and revenue growth deliberately slows.

During the Q3 Call from October 29th, Chriss explained how the partnerships PayPal has landed are helping the company succeed.

…we’ve announced partnerships with Fiserv, Adyen, Amazon, Global Payments and Shopify, and we’re actively discussing more collaborations across the industry. These new and expanded relationships are a clear demonstration that our brand, innovations and momentum are resonating.

Chirss also announced on the call the makings of an additional partnership with Amazon (AMZN), which he is excited about. I share his enthusiasm.

Next year, we will expand our work together to give Prime members the option to link their Amazon and PayPal accounts so that consumers can receive Prime shipping benefits when they use PayPal, while shopping with Buy with Prime…there is significant opportunity here and more we can do to better serve the needs of small businesses.

Chriss also provided valuable information on “Fastlane”, PayPal’s new online payment method.

Since we launched in August, we have over 1,000 merchants using Fastlane to provide a seamless experience to their customers and drive increased conversion.

In the U.S., 170 million eligible customer profiles on the PayPal platform can now enjoy a seamless guest checkout, the very first time they try Fastlane. The scale of consumers who are primed to spend with PayPal puts us way ahead of other guest checkout solutions, and it is one of the reasons why so many platforms are choosing to partner with us.

While some FinTwit analysts rated PayPal’s Q3 at a B, I actually think this was an overall solid quarter. The company is focusing on durable, quality growth which, I think, will pay off in the long run. PayPal is still in the early stages of rolling out Fastlane, Buy Now Pay Later (which I’ll discuss later), and its new debit card as well. As these launches begin to grow in popularity, the company’s growth should improve.

Big Partnerships Are A Big Deal

I wanted to spend some time diving into some of the biggest partnership deals this quarter because I think this is key to the future of the company. One of these major partnerships is with Amazon’s Buy with Prime program. The partnership is part of Chriss’s plan to increase PayPal’s overall growth.

With the new partnership, Prime users will be able to link their Amazon account to their PayPal account. This will allow the user to have access to Prime free shipping benefits when they use PayPal.

Amazon is one of the biggest brands in the world. It sells roughly 12 million products per day to consumers worldwide. The traffic to Amazon’s website is incredible, and PayPal earning a chance to get its company associated with Amazon is a big deal to help facilitate more payments.

Similarly, PayPal partnered with Shopify with PayPal wallet transactions now directly integrated into the Shopify system. This partnership will reportedly create a single, unified payment platform, which will result in more efficient operations during checkout. If this is anything like the hyper-efficient ‘Fastlane’ checkout system PayPal has, I am highly optimistic.

In my last piece of research on PayPal, I explained that Apple’s (AAPL) new “Tap to Cash” feature had affected PayPal’s stock performance at the time (many investors were worried this would affect payment volumes). Now, Apple actually just announced a new direct partnership with PayPal. US customers will, starting next year, be able to see their PayPal balance when using their PayPal credit card in the Apple Wallet.

Next year, customers in the US will also be able to see their PayPal balance when using their PayPal debit card in Apple Wallet, giving them greater visibility and confidence when shopping…

Apple announced this on October 17. This is a big deal and mitigates many of the tap to pay disruption risks. PayPal now has similar features to what we see with other tap to pay alternatives.

Valuation

PayPal’s forward Non-GAAP P/E is listed at 18.91, which is exactly 52.73% higher than the sector median of 12.38. While the forward P/E ratio is well above the sector median, this is actually still below the five-year average forward P/E of 30.99. I’m reading this as a signal that the market believes the forward growth expectations for PayPal are lower right now than they were in the previous five-year average. I could not disagree more. While TPV is growing slower right now than it was before, these partnerships are laying the foundation for really healthy growth going forward.

I think PayPal has enormous growth potential ahead. I’m actually of the opinion that the forward P/E should be roughly 25, up from 18.91, to price in some of the upside of these developments. If we saw shares converge on a forward P/E of 25, this would represent about 32.20% upside in shares.

Risks

PayPal by increasing its exposure to US consumer e-commerce sites means the company is increasingly exposed to the health of the US consumer. US consumers, especially low-income Americans, have been struggling financially for over a year as inflation has forced many consumers to cut back and be more mindful about their spending and saving habits. Inflation has put a major strain on the wallets of everyday Americans.

However, fortunately for PayPal, retail data is starting to perk up, which indicates the consumer is doing better. According to an analysis from Reuters, retail sales increased 0.7% month-over-month from August to September. Additionally, overall spending increased 0.4% from August to September, and spending increased 0.4% in the same time period.

Adding to this, consumer confidence data this week showed that PayPal is now also benefiting from a consumer that is now both spending more than this time last year and also is now more optimistic about the future. This creates a strong feedback loop that usually results in further gains in consumer spending.

Bottom Line

Despite revenue coming slightly light for the quarter, PayPal has a lot of promise ahead with the handful of important partnerships I outlined. Now rounding his first year at the helm, CEO Alex Chriss has the company headed in the right direction, and PayPal’s shares are acting accordingly. While some would call the revenue miss a setback, I still think this was an overall strong quarter. They are focusing on quality revenue, which is key.

As PayPal ramps up payment volume through some of the biggest tech giants here in the US (and through platforms that support small businesses like Shopify (SHOP)) the company will continue to accelerate their turnaround.

I continue to be a strong buy on shares after earnings.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (main account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.