Summary:

- PayPal beat EPS expectations for Q4’22 last week.

- I believe the forecast for FY 2023 is better than expected, given the weakening macro environment.

- Valuation based off of free cash flow remains attractive.

Justin Sullivan

PayPal (NASDAQ:PYPL) submitted its earnings sheet for the fourth quarter last week, and the payments company beat earnings expectations. Infinitely more important, PayPal’s guidance for FY 2023 once again proves that the FinTech’s free cash flow is highly resilient and predictable, and that high free cash flow margins are sustainable even in a world marked by high inflation and slowing economic growth. After the earnings release, I am more convinced than ever that PayPal offers investors deep free cash flow value and the stock remains a strong buy!

PayPal’s Q4: A decent earnings report

Before PayPal released earnings, I presented my expectations about the FinTech’s likely performance in the fourth quarter in my work “PayPal Q4 Earnings Preview“. These expectations regarding net new active accounts and free cash flow were largely met.

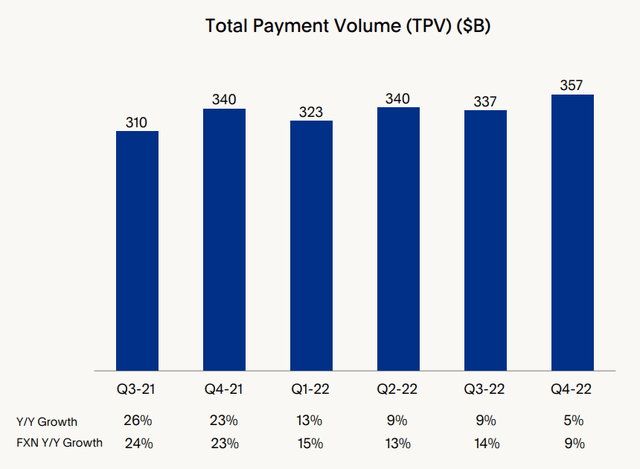

PayPal saw $7.38B in revenues in the fourth quarter, showing 7% year-over-year growth. PayPal’s topline results were made possible in large part because of 5% growth in Total Payment Volume/TPV.

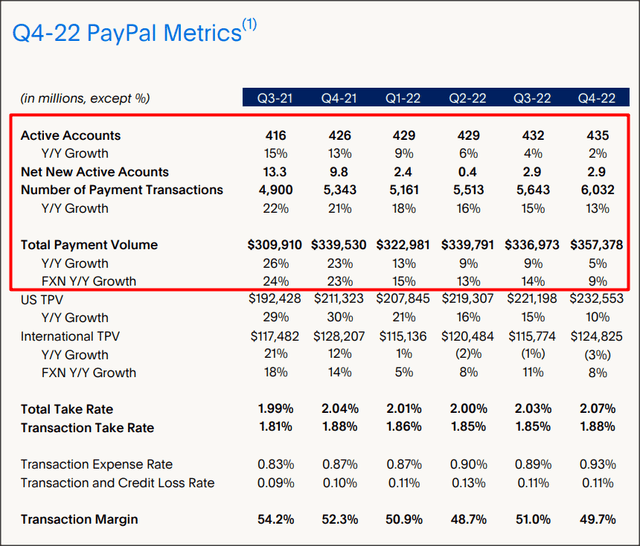

Total Payment Volume expresses the amount of dollars that gets processed through PayPal, and it reached $357.4B in Q4’22, showing a $20B improvement compared to the previous quarter. The results met expectations, as the market expected single-digit growth in revenues (according to PayPal’s Q4’22 guidance) and TPV due to consumer spending headwinds (inflation). On a currency-adjusted basis, PayPal reported 9% growth in TPV and net revenues.

PayPal also added 2.9M new accounts to its ecosystem – the same amount it acquired in Q3’22 – which was slightly below my expectation of 3.5M. PayPal ended the fiscal year with 435M customers in its payments network, including 35M active merchant accounts, and added a total of 8.6M accounts in FY 2022. Given the headwinds in the business, I believe PayPal executed reasonably well in the fourth quarter.

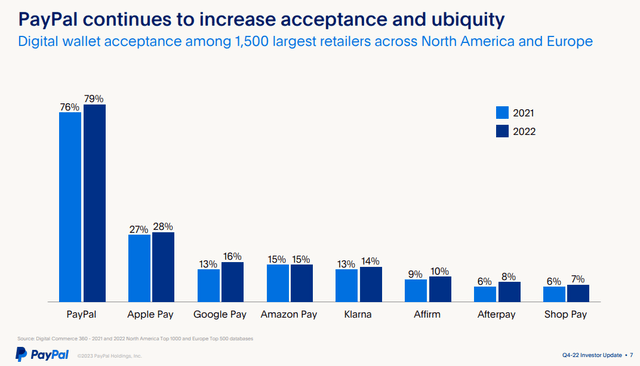

Although topline and TPV growth are clearly slowing down, indicating a challenging e-Commerce environment in FY 2023, I believe the key benefit to investing in PayPal relates to the size of its payments network. With 435M accounts on the PayPal platform, no other personal finance company comes close to the FinTech regarding scale. PayPal is the most widely accepted wallet in North America and Europe, which creates a high barrier of entry for any new FinTech. The large number of merchants that accept PayPal payments also represents a significant competitive advantage for the FinTech… which allows the company to generate enormous free cash flow each quarter.

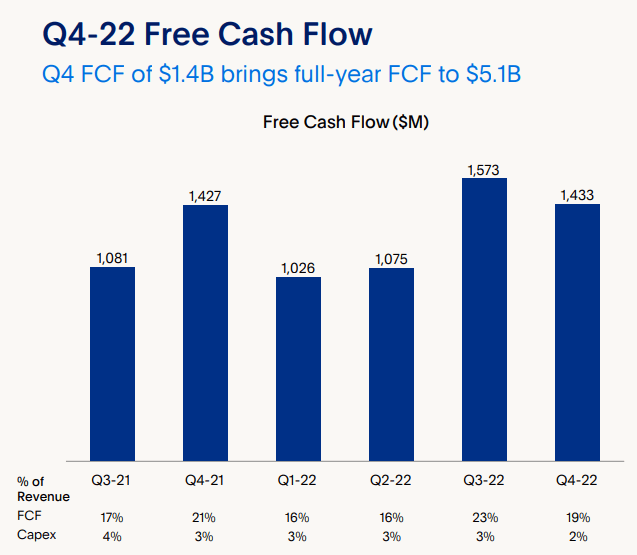

Free cash flow

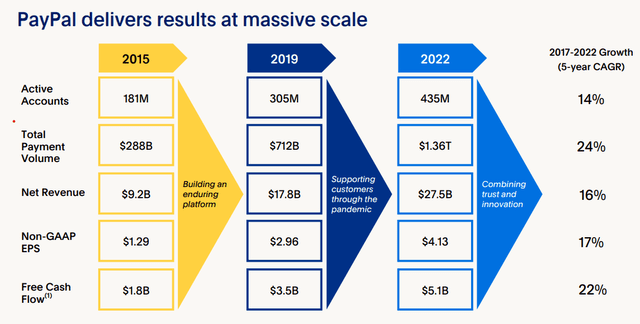

PayPal generated $1.4B in free cash flow in the fourth quarter on revenues of $7.4B, which translates to a free cash flow margin of 19%. The company’s large scale and customer base act as a moat for PayPal’s business, which allows the generation of stable and predictable free cash flow. PayPal reported a total free cash flow of $5.1B for FY 2022 and an FCF margin of 19% as well.

PayPal

By adding millions of new customers to its platform, PayPal has been able to deliver impressive free cash flow growth over time. PayPal’s 5-year free cash flow rate was 22% which was supported chiefly by two factors: net new active account and TPV growth. Net new active accounts grew at an average annual rate of 14% while TPV gained 24%, on average, since FY 2017. Although TPV and account growth is slowing, PayPal has reached a free cash flow level that facilitates material stock buybacks each quarter.

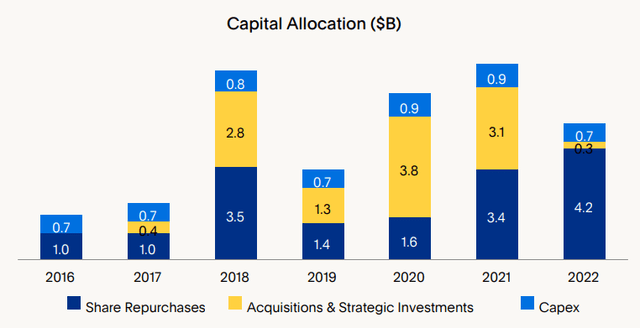

In the fourth quarter, PayPal bought $1.0B of its shares, which came on top of the $3.2B the company already repurchased in the previous nine months. In total, PayPal bought $4.2B worth of its shares in the market in FY 2022 which translates to a free cash flow return ratio of 82%. In FY 2021, PayPal returned 69% of its free cash flow, so clearly, PayPal is getting more aggressive here with its buybacks.

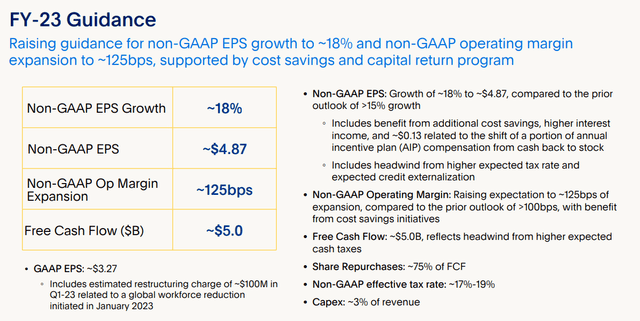

Guidance for FY 2023

There were two big takeaways regarding PayPal’s guidance for FY 2023. First of all, the company expects 18% year-over-year growth in EPS to $4.87 which beat the Wall Street prediction of $4.76… which was good news. Secondly, PayPal again budgets with $5.0B in free cash flow this year. If we were to assume that PayPal again returns approximately 80% of its free cash flow to shareholders, another $4.0B could be spent on buybacks in FY 2023.

PayPal is undervalued

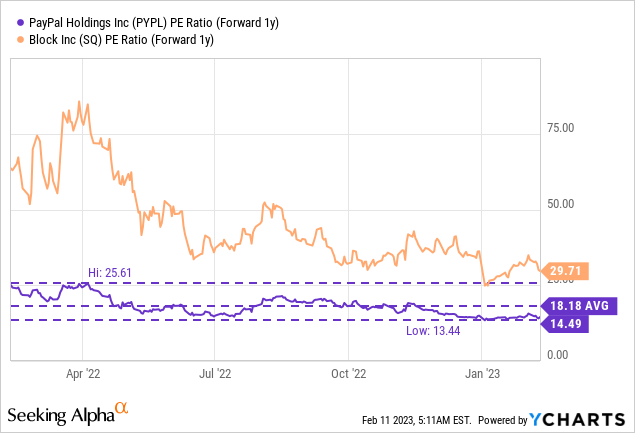

I am generally not a big supporter of stock buybacks because I believe too many companies are buying back their own shares at the wrong time… which is when the stock is expensive. This is not the case for PayPal which has, due to a large decline in its market cap over the last year, very low valuation ratios based off of free cash flow and earnings.

PayPal currently has a market cap of $91B, which implies a P/FCF ratio of 18.2 X. Considering that PayPal achieves strong and stable free cash flow margins of around 20% annually, I believe shares are actually quite cheap.

Regarding earnings, PayPal is now valued at a P/E ratio of 14.5 X which is value territory considering that PayPal’s EPS growth this year is expected to be in the high teens. Block (SQ), which is often named as a key competitor for PayPal, is trading at a much higher P/E ratio of 29.7 X, and Block is not nearly as profitable as PayPal. So both in terms of free cash flow and earnings, I believe PayPal is a very good deal for investors that want to invest in a leading FinTech franchise.

Risks with PayPal

The two biggest commercial risks for PayPal are a continual slowdown in TPV and net new active account growth rates, which would most definitely be reflected in weaker topline growth. I also see a returning strength of the USD as a risk factor for PayPal as the FinTech does business in many different currencies. An appreciation of the USD makes profits achieved outside of the US less valuable for US-based FinTech companies. What would change my mind about PayPal is if the company were to see a steep drop-off in free cash flow and scaled back its stock repurchases.

Final thoughts

PayPal’s guidance for FY 2023 is very solid, and the $5.0B FCF forecast strengthens my argument that PayPal is chiefly a buy because of its resilient free cash flow. The FinTech generated 19% free cash flow margins in a very challenging year for PayPal. Still, the company added 8.6M new customers to its business and defended its free cash flow. The potential for stock buybacks remains highly attractive and PayPal has proven that it is willing to double down on buybacks when the stock is cheap. I believe there is a lot more to like here than dislike, and therefore continue to recommend PayPal as a long-term investment in the FinTech industry!

Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.