Summary:

- PayPal’s growth has flatlined, with topline sales only growing 7% YoY and EPS shrinking for three straight quarters.

- The company lacks user growth drivers as competition has reduced network effects and restricted take-rate pricing power.

- PayPal’s expansion into crypto presents genuine regulatory risks, and its PYUSD product has several potential issues including high fees, slow transaction times, and cutthroat competition.

- We rate PayPal a sell and think investors should find greener pastures elsewhere, despite the attractive valuation at only 20x FCF.

Milko

A few months ago, we wrote an article titled “FedNow Makes PayPal A Value Trap“, wherein we discussed how PayPal (NASDAQ:PYPL) had become ex-growth in light of increased competition, a distinct lack of pricing power, and a new challenger in the form of FedNow.

Since we published our thesis, there’s been a few updates to PayPal’s story; notably, a recent earnings report, and the launch of PYUSD, PayPal’s attempt to enter the crypto space.

Given that we remain the lone bear in the room (our original article is still the most recent “sell” article on PayPal even though it came out over 3 months ago), we thought it would be good to break down these new developments and explain why, despite the attractive valuation, PayPal is still positioned poorly in the broader payments landscape and doesn’t deserve an investment of your hard-earned capital.

Financial Results

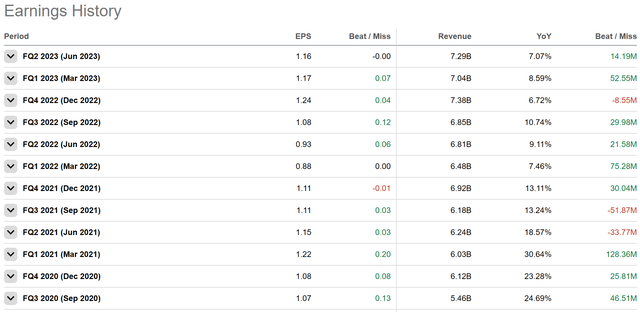

First, let’s have a look at PayPal’s recent results:

In their most recent quarter, the company produced $1.16 in earnings per share, on $7.29 billion in topline sales. EPS was in line with expectations, and Revenue came in slightly above expectations.

Many industry analysts came out and said that they remained optimistic after the results and were excited about the ‘brilliant‘ outlook.

Commonly cited reasons for the bullishness include recent Venmo integrations into mega-cap service providers and products, like Amazon (AMZN) and Apple (AAPL), along with stable revenue growth rates and a rebound in ‘TPV’, or Total Payments Volume.

However, we remain skeptical.

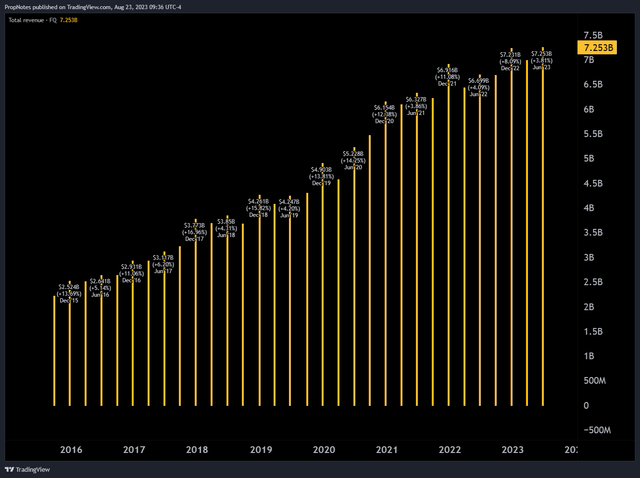

Hidden in plain sight is the fact that PayPal’s growth has flatlined over the last few quarters:

Between Q2 2022 and Q2 2023, topline sales only grew 7% YoY, and EPS actually shrank for the last three straight quarters.

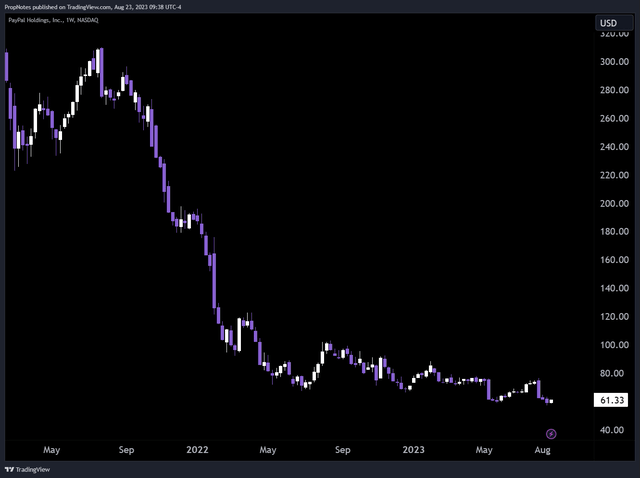

As a result of this slowdown, the stock has been punished beyond belief, as many well know, falling from over $300 per share to around ~$60 as of writing:

While some believe that these growth issues are overdramatized and that the company still has sufficient levers to improve top and bottom-line performance, we believe that the company has fundamentally gone ex-growth in terms of users. Their markets are either saturated (Venmo) or highly competitive (PayPal).

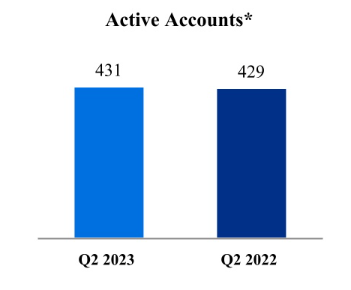

These recent results merely show that – with active accounts growing by only 2 million users YoY in Q2:

10-Q

Thus, in our view, PayPal should be seen as a company with a solid and stable business, but one that lacks any ability to grow the scope of the pie materially.

PayPal doesn’t have a ton of room to move on take rates given the competitiveness of other vendors like Stripe and Adyen, and there’s no clear value proposition for new users to sign up and boost TPV:

Checkout with PayPal” is no longer a material user acquisition channel.

This leaves P2P payments.

While the relative volume of P2P payments is small at just over a quarter of all PayPal’s transaction volume, the market need it fills is much, much more important. In the U.S., the easiest way to pay someone with instant settlement is via Venmo or PayPal.

FedNow is set to change all that. Unlike Zelle, FedNow is set to enable instant settlement at the base level, between banks. This entirely removes the need for PayPal or Venmo in P2P situations.

– Source: The above quotes were sourced from our May article on the company

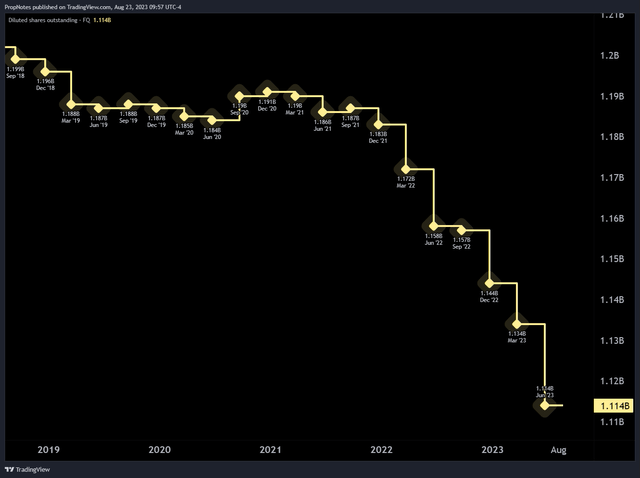

We would argue that PayPal management sees this, which is why the company has quickly transitioned to returning profits to shareholders in the form of buybacks.

In fact, one of the only bullish things about the company is how quickly PayPal management is buying back stock faster and faster over recent quarters:

Taken together, though, the company presents minimal avenues for growth, which is why the valuation has come in so much.

Can Crypto Power Growth?

As a result of the aforementioned user growth issues, management has begun looking at new ways to grow the pie that still lies within the company’s core competency: payments.

Thus, given the potential promise of crypto as the payment network of tomorrow, the company has tried to place itself squarely in the middle of that ecosystem, providing a sound stablecoin product, PYUSD, and a reliable fiat-to-crypto bridge user experience.

While this move will undoubtedly grow revenue due to the company’s massive existing userbase (providing PYUSD and then storing collateral in treasuries is a mostly risk-free arbitrage), there are a number of unforeseen risks that the company or its investors may not be thinking about.

First, crypto remains a regulatory nightmare. The SEC, CFTC, and other regulatory bodies have no idea how to treat the nascent industry, and a move like this puts PayPal squarely in the regulator’s crosshairs, a la Coinbase (COIN) or Circle.

Ongoing litigation has led to wild swings in price for public companies and private crypto projects alike, which adds volatility to any investment thesis.

Plus, Paxos, PYUSD’s legal issuer, has already come under fire for its BUSD product, which is unpopular with regulators given its ties to Binance. It seems like a strange choice of vendor on PayPal’s side.

Overall, this is a difficult risk to quantify, but it should be viewed as a net negative.

Second, and perhaps more importantly, is that Crypto is largely going offshore.

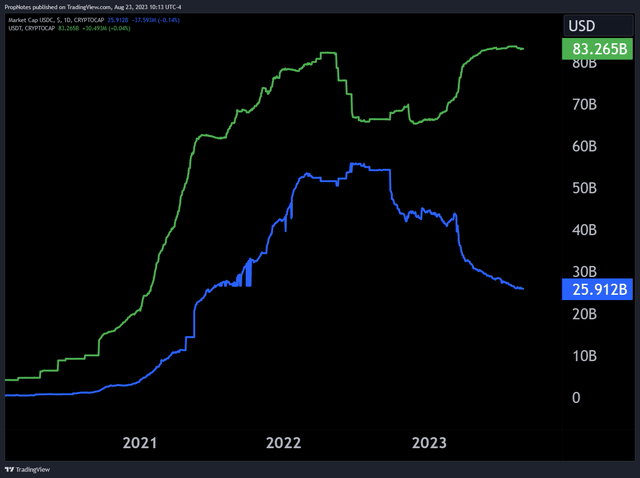

Here’s a market cap chart of USDC (in blue), the largest U.S.-based stablecoin, and USDT (in green), its offshore equivalent:

Both of these coins grew tremendously in market cap during the bull run of 2021, and USDC looked like it may begin to overtake Tether. However, the FTX blowup and subsequent crypto crackdown have begun to re-shift stable flows towards less-regulated choices.

Additionally, PYUSD, as a product, has two further issues.

First, it runs on Ethereum, which is the slowest, most expensive blockchain in popular use. This will hinder actual usage of the product given the high fees.

Second, PYUSD has a no-fee structure. While this may be tempting to see as a good thing, some deep within the crypto community have speculated that one of the main reasons for the trends on the chart above is that Tether may be executing a strategy to slowly drain USDC of funds, via a complex series of transactions that hinge on USDC being fee-free to redeem.

While we don’t endorse this view, we bring it up as a way of representing the new ‘wild west’ arena PayPal is entering. If they create PYUSD as a cash-grab product and don’t properly look after it, then it’s hard to see the product lasting long in the cutthroat crypto space, where potential competitors are allowed to play by different rules.

Final Thoughts

Overall, we maintain our “sell” rating on PayPal. The company can’t grow users, which means that it can’t materially grow revenues or earnings past a certain point.

In our view, the valuation is justified, and the recent developments around earnings and crypto further increase the risks present in the stock, without carrying commensurate potential rewards.

Trimming exposure from this value trap and finding better places to deploy capital seems like the best course of action.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.