Summary:

- The digital wallet sector is experiencing robust growth, driven by trends like contactless payments, BNPL services, and the rise of virtual cards.

- Despite challenges from competitors like Apple Pay, PayPal’s wide platform reach and comprehensive financial services and brand trust gives them an advantage in the fight for market share.

- PayPal’s stock price reflects expectations of less than 5% growth over the next decade, suggesting the market foresees a considerable loss in market share in the coming years – a pessimistic view.

- Using a DCF, we can conclude that the market undervalues PayPal, with an intrinsic value estimation of $86 per share.

Editor’s note: Seeking Alpha is proud to welcome Sander Heio as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Justin Sullivan/Getty Images News

PayPal (NASDAQ:PYPL) is a household name in the digital payment industry, and chances are, you’ve likely encountered its services. This thesis posits that PayPal’s robust brand recognition and established trust, coupled with its unique positioning in the digital payments market, will enable it to sustain and possibly expand its market share beyond current market expectations, despite the competitive pressures and evolving industry dynamics.

Additionally, I will go through various aspects, including how the evolving landscape of digital payments, focusing on market dynamics and key trends shaping this sector. We quickly explore how emerging technologies like Apple Pay are influencing PayPal’s market strategy and operations. We will also go through a short company analysis and also PayPal’s recent stock price movements and a brief view about PayPal’s financial performance.

Then, at the end, I will show you the valuation method, the opportunity we are currently facing, and a summary of the investment case.

Sector analysis, digital wallet trends

In 2022, digital wallets comprised nearly half of global online transactions, with an expected rise to 54% by 2026. Their user-friendliness, especially in apps like Venmo, enhances their appeal, particularly among younger users. The digital payment market was valued at $102.60 billion in 2022 and is projected to grow at a 17.4% CAGR through 2032. This growth is fueled by increased demand for digital payment solutions and technology adoption, despite challenges in security and privacy.

Key trends driving growth in the digital wallet market include the rise of contactless payment methods like tap-to-pay and QR codes, bolstered by the COVID-19 pandemic. Additionally, the Buy-Now-Pay-Later (BNPL) service is gaining popularity, especially with rising inflation. BNPL’s transaction value is expected to reach $300 billion, potentially doubling by 2026. Significant BNPL spending occurs in areas like grocery shopping. Furthermore, companies are incorporating technology to enhance payment and financial services, adapting to evolving business finance roles.

Apple Pay impact on PayPal’s core operations

Apple Pay’s entry into the digital payment market has both directly and indirectly affected PayPal’s operations. While PayPal remains strong in areas unaffected by Apple Pay, the latter poses a significant challenge in digital wallets and mobile payments. Apple Pay’s seamless integration with iOS, using technologies like Face ID and Touch ID for secure and convenient in-store contactless payments, has increased competition for PayPal, especially in areas where it previously had less focus.

Apple Pay’s expansion into online payments has encroached on PayPal’s domain, particularly among Apple device users. This development might lead to a shift in user preference, potentially affecting PayPal’s online transaction volumes. However, PayPal’s platform-agnostic approach, functioning across various devices including Android, remains a key advantage, allowing it to serve a wider customer base beyond the Apple ecosystem.

PayPal’s services go beyond basic payment processing, offering a range of business tools including fraud protection, risk management, and credit options like PayPal Credit and Pay in 4. These services, broader than what Apple Pay offers, strengthen PayPal’s position in the e-commerce sector, catering to both individual and business needs with its extensive financial tools.

PayPal’s company analysis

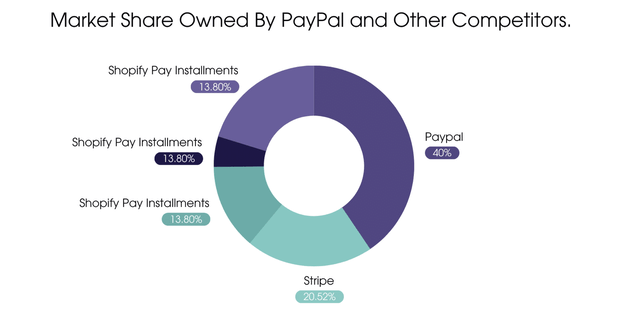

PayPal holds a significant share of the global online payment market, commanding 43% globally and nearly 59.63% in the U.S. Its platform is widely used by over 448,570 companies, reflecting its strong market presence. PayPal’s growth is bolstered by its subsidiaries like Xoom, Braintree, Honey, and Zettle, each contributing unique financial services. Despite competition from Stripe, Cash App, and Skrill, PayPal remains a leading digital payment provider, further strengthened by its acquisition of Venmo, which has seen substantial user growth.

PayPal’s market share (Demandsage)

Short dive into PayPal’s historical performance

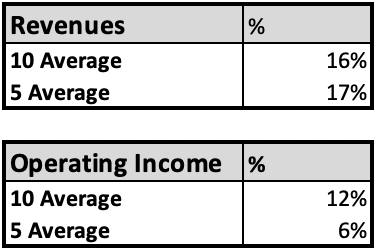

PayPal’s performance in the last decade has been strong, with a consistent revenue growth of 16% over 10 years and 17% over the past five. Its operating income has grown healthily, although recent years show a slowdown in growth rate, leading to concerns about future market share and earnings. The company has seen a gross margin reduction from 63% in 2014 to 50% in 2022, a trend common in maturing industries facing increased competition. This margin decline reflects changes in PayPal’s revenue stream, moving from higher-margin branded payments to the lower-margin Braintree business. This evolution is typical of a growing industry and is a strategic adjustment to a competitive and rapidly evolving digital economy.

Historical financial performance (Morningstar)

Despite a decline in gross margins, the past years likely due to a more competitive and mature sector, PayPal still maintains a strong market position and adaptability in the digital payment landscape. As a leader in e-commerce and digital transactions, PayPal is well-recognized, but it’s not immune to fluctuations typical in the tech sector. Shifts in financial metrics like EPS can impact investor sentiment and Wall Street reactions. However, it’s important for investors to consider the bigger picture, understanding that even successful companies face challenges like market saturation or economic downturns, without undermining their long-term potential.

What has happened to PayPal’s stock price the past two years?

PayPal’s financial performance in 2022 and 2023 was marked by a mix of resilience in revenue growth but also some concerning signals that have impacted investor sentiment. The company experienced a cut in its annual revenue growth forecast. This decision by PayPal to adjust its forecast reflected a broader market trend of conservative outlooks due to rising inflation and the looming threat of a recession, leading to an expected tightening in consumer spending.

PayPal share price (Yahoo Finance)

PayPal’s recent underperformance in the market is not merely a result of pessimistic market views. Several factors contribute to this trend. Higher interest rates significantly affect PayPal’s operations. Unlike typical tech companies, PayPal’s functions intersect with financial services, making it sensitive to economic fluctuations. Improved economic conditions can boost PayPal’s profitability, while lower interest rates could enhance its pricing by reducing the discount rate on future earnings and also potential pricing multiple expansion. Moreover, PayPal has experienced a downturn in key financial metrics. There’s been a negative trend in its GAAP EPS growth, alongside a decline in operational margins for the past ten years. This deterioration in key figures can lead to institutional investors withdrawing their investments, further affecting PayPal’s stock performance.

PayPal valuation

Simplified DCF

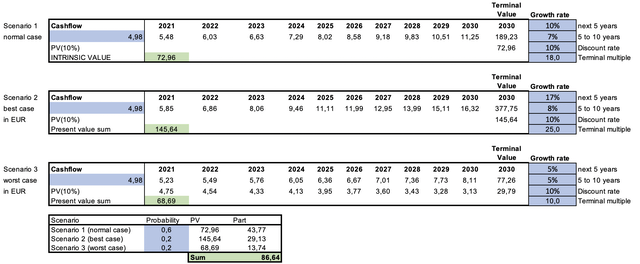

Now we are at the part we all been waiting for, the valuation. In conducting a discounted cash flow valuation for PayPal, a simplified approach is adopted where key variables such as growth rate, earnings per share, terminal multiple, and the weighted average cost of capital are the main figures. The growth rate is a pivotal factor in this analysis. Despite the increasing competition and concerns around Apple Pay’s impact on PayPal, consensus revenue estimates from sources like Seeking Alpha suggest an average compound annual growth rate of about 10% for PayPal until 2032.

This projection is set against the backdrop of the digital wallet payment market, expected to grow at a 17.4% CAGR over the next decade. In 2022 the digital payment market was valued at 105 billion dollars, and in 2032 it is expected to be valued at 510 billion dollars. This disparity suggests that analysts anticipate PayPal might lose some market share in the coming years.

For the valuation, two scenarios were constructed based on different WACCs. Each scenario includes a sensitivity analysis with varying growth rates and terminal multiples to account for potential fluctuations in PayPal’s performance and market conditions. The terminal multiple reflects the expected valuation multiple of PayPal, taking into account its market position and future earnings potential. Our EPS estimate is taken from Seeking Alpha analyst consensus, which shows a EPS in 2023 of $4.98.

Using a higher WACC of 10%, the calculated fair value for PayPal’s stock using a sensitivity analysis stands at $86 per share. This higher WACC accounts for increased risk and discount rates. Conversely, with a lower WACC of 7%, which assumes less risk and a more optimistic outlook, the fair value is estimated at $112 per share.

DCF sensitivity analysis (Sven Carlin Template)

PayPal’s market position

In evaluating PayPal’s market position, it’s crucial to acknowledge its strong brand recognition and status as a well-established player in the digital payment space. PayPal was ranked of all global brands as the second most trusted brand, right behind Google. This has to add some value, I don’t think the customers are ready to move to other competitors right away just because they have “better solutions” or services.

Despite the growing presence of competitors like Apple Pay, I have a prevailing belief in PayPal’s resilience. Analysts have raised concerns about PayPal potentially losing market share and not fully capitalizing on the burgeoning digital wallet sector, which I believe is true, but not so dramatically as the market has priced PayPal at the moment.

Presently, PayPal’s current valuation at $62 dollar per share implies a modest annual growth rate of less than 5% the next 5 years, with a 15x terminal multiple and a WACC of 10%. This scenario seems overly conservative and somewhat unlikely. For such a valuation to hold true, PayPal would need to experience significant market share erosion and fall short of growth projections.

Consider the broader market context: the digital payment market is projected to reach a valuation of $510 billion by 2032, five times the value from 2022. Then it’s worth questioning whether PayPal’s share price will remain stagnant at $62 over the next decade. If one believes that PayPal’s stock will not appreciate in value despite the market’s expansion, this effectively implies a bet on PayPal losing substantial market share and diminishing to a minor role in the digital payment landscape. I believe it would be quite remarkable if a such a big brand to lose this much market share within 2032.

The opportunity

The current valuation of PayPal at approximately $60 per share seems excessively pessimistic. According to my analysis, this suggests that PayPal would need to maintain a growth rate below 5% for the next five years and a growth rate of 2% from 2029 and onwards. Considering the future outlook, this implies that PayPal is expected to lose a considerable market share the next 10 years, as mentioned before. Further, I believe that the market has priced in nearly all the risks and the worst is behind us, and a further decline in share price would imply an even greater loss in market share and revenue growth than currently anticipated.

Further, I believe this to be highly unlikely, given PayPal’s status as a leading digital wallet provider. Throughout the years PayPal has cultivated a significant level of trust, a crucial asset in the digital payments sector where trust can be rare. This established trustworthiness is a component of PayPal’s value, particularly in an industry where consumer confidence is paramount for success. Further, analysts predict a more optimistic revenue growth of about 10% annually for the next five years, which, even if true, supports a valuation well above $60 per share.

Assessing PayPal’s future risks

Despite its strong brand and current market dominance, PayPal’s continued success hinges on its ability to innovate and stay ahead of the curve or alongside it. While a robust brand name and reputation are valuable assets, they are not infallible shields against the competitive tides. The key lies in not resting on past laurels but continually evolving.

The appointment of Alex Chriss as the new CEO signals a commitment to more innovation, as demonstrated by the recent launch of new products and services, including those leveraging AI. PayPal plans to unveil an AI-powered platform this year, designed to empower merchants to connect with new customers by leveraging insights from the vast swath of merchant transactions processed by PayPal.

However, this ambitious venture is not without its risks. The primary concern is whether these new offerings can perform effectively and keep pace with, or outstrip, competitors’ innovations. The success of these products in delivering value compared to those of competitors is challenging to predict. Nevertheless, I place considerable weight on historical performance, an area where PayPal has consistently shown strength throughout the years.

Conclusion

The current valuations I think the risk/reward is quite attractive. Taking into account PayPal’s unique market position and the growing digital payments market, I am willing to take a position in PayPal, because I simply think that the market is too pessimistic towards their market recognition and brand power. While the threat of competitors, recession and Apple Pay is a legitimate concern, and the fact that PayPal’s success will depend on its ability to innovate and evolve alongside or ahead of market trends. The potential for PayPal to navigate through these challenges, and also maintain more market share then what’s priced, ultimately suggests that the company’s valuation does not fully reflect its potential, and the market has an overly bearish view on PayPal at the moment. This scenario makes a very compelling case for considering PayPal.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.