Summary:

- PayPal stock has responded favourably to the company’s robust Q2 earnings beat and raise.

- Consistent profit margin expansion, paired with better-than-expected growth, during 1H24 despite seasonality headwinds represent a strong set-up for PayPal’s “transition year”.

- PayPal’s upcoming Fastlane general availability and its continued execution on a SMB penetration strategy through PPCP are expected to be additive near-term growth drivers.

- However, we are incrementally cautious over the durability of PayPal’s progress in the longer-term, given the lack of management’s focus on a sustained adoption curve for its recent innovations.

JHVEPhoto

PayPal stock (NASDAQ:PYPL) has lost more than 10% of its value since key competitor Apple (AAPL) deepened its foray into consumer payment solutions with the launch of “Tap to Cash” in early June. Despite PayPal’s Q2 beat and raise, the stock’s responding uplift has yet to recover from its intra-quarter declines. As we had discussed in a previous coverage, Apple Pay’s deeper penetration into consumer payment solutions has come directly for PayPal’s Venmo monetization efforts this year.

Admittedly, PayPal management has delivered consistent positive progress on its “transition year”. This is corroborated by the Q2 beat and raise, which consisted of robust topline and total payment volume (“TPV”) growth to support margin expansion and an increased capital returns program for 2024. The stellar results also continue to highlight management’s commitment to driving profitable growth through prioritizing branded volume growth and price to value improvements in unbranded checkout.

Yet we remain wary of management’s increasing lack of focus in ensuring mass market adoption and long-term stickiness to the improving PayPal ecosystem, which they have been working hard to revamp. This accordingly raises concerns about the long-term sustainability of PayPal’s current FCF growth trajectory, which is critical to its generous capital returns program through share buybacks, as well as its valuation prospects.

Although the stock remains discounted at current levels on both an intrinsic and relative basis, especially given favourable near-term prospects, we remain incrementally cautions on PayPal’s outlook for a durable upward valuation re-rate.

Idiosyncratic 2H24 Tailwinds

Despite typical seasonality weakness in consumer end-markets, PayPal has delivered a “front-end loaded year” with consistent outperformance through 1H24. And we expect this trend to continue through the latter half of the year, consistent with management’s decision to raise their guidance for PayPal’s full year 2024 earnings to a range of $3.88 to $3.98 (previously ~$3.65). This is supported by several PayPal-specific tailwinds later this year, which will complement the upcoming back-to-school and holiday shopping season crucial to its TPV.

The upcoming general availability of Fastlane in August is expected to be a key company-specific strength later this year, complementing seasonality tailwinds from back-to-school and holiday shopping. Recall that Fastlane is one of PayPal’s core product innovation this year, deepening its focus on creating a frictionless purchase process by enabling fast-tracked guest checkout for consumers. Fastlane by PayPal saves consumer payment and shipping details during their first checkout experience at a supported merchant storefront. This essentially unlocks one-click guest checkout on all future purchases at online storefronts that support Fastlane by PayPal for the user, creating a seamless payment process for consumers while also driving conversion for merchants.

Specifically, early adopters of Fastlane during the pilot phase have shown an average conversion rate of 80%, versus up to 50% without the feature. This has resulted in a low double-digit uplift in guest checkout conversion for merchants that support Fastlane, highlighting the product’s value proposition. Fastlane is also not restricted to PayPal users. Consumers that opt into Fastlane do not need a PayPal account or wallet, allowing the company to better penetrate end-market wallet share. With Fastlane rolling out to all users and merchants ahead of the holiday shopping season, we expect the product to be an additive TPV growth driver. This would also inadvertently benefit transaction margin dollars by improving economies of scale in lower-margin unbranded volumes.

In addition to Fastlane, PayPal’s strategy of improving SMB penetration with PayPal Complete Payments (“PPCP”) continues to make progress. PPCP is essentially a payments solution one-stop-shop curated for SMB merchants, giving them access to PayPal’s latest and greatest branded checkout solutions and other value-added services. PPCP penetration has likely jumped from 7% in Q1, given the cohort’s TPV growth of more than 40% through the first half of the year. This also highlights further headroom for accelerated SMB merchant adoption through the holiday shopping season later this year.

The SMB-focused product has continued to prove itself an accretive factor to transaction margin dollars. Not only does it improve PayPal’s exposure to higher margin branded checkout volumes, but it also improves the company’s price to value capability by targeting the SMB merchant cohort that has less pricing power. This compares to PayPal’s larger enterprise merchant base that have historically pressured the company’s margins.

Although PayPal can generate better price to value from the SMB merchant base by taking advantage of their weaker pricing power, the company does not offer any less value proposition to the cohort. Specifically, SMBs that have adopted PPCP continue to demonstrate double the revenue per account compared to those on legacy integrations.

PPCP has also encouraged higher merchant uptake of PayPal’s expansive product portfolio, such as Venmo, PayPal Branded Checkout, Pay Later, and PayPal Credit. By improving SMBs’ access to the market’s ever widening array of payment methods, PPCP effectively helps the merchant base reduce their exposure to abandoned shopping carts at checkout. This, in turn, reinforces scale to PayPal’s branded and unbranded volumes as well, driving ensuing improvements to take rates and transaction margin dollars. This is corroborated by the maintained average uptake of four products observed across PPCP merchants, highlighting PayPal’s ability to forge deeper customer relationships with the platform, thus reducing the company’s exposure to churn risks.

And to further improve adoption, PayPal has also ensured the incorporation of low or no-code integration tools, which enables further efficiency gains critical to cost-sensitive SMBs. We believe PPCP remains a critical tool for PayPal in capturing higher-margin TPV from the underpenetrated SMB market ahead of the holiday shopping season.

Adoption Curve Uncertainties for “First Look” Innovations

Admittedly, management’s continued commitment to driving up penetration of higher-margin branded volumes remain critical to their focus on ensuring sustained profitable growth at PayPal. This is evident in PayPal’s’ deepening push into gaining share in the underpenetrated SMB market with PPCP as discussed above, while also rolling out tools like Fastlane to converge branded and unbranded volumes and improve their respective economics.

However, we see limited durability to PayPal’s recent performance improvements. While the First Look innovations are a step in the right direction, we are wary about the lack of a sustainable flywheel in this strategy. Specifically, PayPal appears to be lacking a gateway to ensure rapid consumer adoption of its new products, which would be critical to reinforcing stickiness to its broader platform. Only this would really give PayPal leverage in generating greater merchant adoption of its innovative payment solutions and tools, like Smart Receipts and Venmo Business Profiles, which underpins the generation of benefits right back to consumers to encourage adoption.

Lacking Gateway to Sustained Adoption

For instance, there is an increasing gross merchandise value (“GMV”) mix shift towards online marketplaces such as Amazon.com (AMZN). The e-commerce giant currently generates an estimated $700+ billion in GMV, which is 7x of second runner-up Walmart’s (WMT) $100 billion reported last year. And the lack of PayPal’s presence in the e-commerce giant’s checkout page draws questions to the long-term sustainability of its recent financial improvements generated primarily from SMB penetration.

Admittedly, SMBs represent an underpenetrated opportunity in e-commerce payment solutions, with the majority of their storefronts still primarily offline or in the process of coming online. But increasing adoption of multichannel commerce is enhancing integration of independent merchant storefronts with larger online marketplaces that boast the greatest exposure to consumer wallet share. And this convergence is evident in recent e-commerce partnerships, such as Shopify’s (SHOP) recent partnership with Amazon through the integration of “Buy with Prime” for its merchant base. The partnership has likely been additive to Shopify Checkout volumes, as it supports Buy With Prime integration. This has allowed Shopify to piggyback on Amazon’s robust Prime membership base, and the shopping destination’s deep reach into consumer wallets, which was evident in the platform’s latest sales record for Prime Day.

Admittedly, additional partnerships with large enterprises and online marketplaces beyond Walmart and eBay (which recently started supporting Venmo) might be incrementally margin dilutive, given PayPal’s relatively lower pricing power. However, the strategy may be proving increasingly necessary to improve sustained Branded Checkout adoption amongst consumers. We believe this strategy could create a long-term self-sufficient flywheel to optimize the value that recent innovations can generate for all of PayPal, its merchants and its consumers.

Specifically, by potentially partnering with Amazon, PayPal Checkout could gain greater recognition and adoption through the expanded consumer base. This would accordingly add value to recently introduced consumer-focused products, such as Smart Receipts and Advanced Offers Platform, which is linked directly to Branded Checkout usage. And the resulting perks to consumers would then reinforce their recurring usage of Branded Checkout, which improves PayPal’s value proposition to merchants, enabling a self-sufficient flywheel. Although additional partnerships with large enterprises like Amazon risks margin dilution, it could represent an effective go-to-market cost that keeps giving. And PayPal has the cash flows to move forward with relevant investments, which could potentially lead to long-term returns as enhanced PayPal Checkout exposure through marketplaces like Amazon would likely reinforce consumer recognition and adoption of PayPal ecosystem tools for both online and offline purchases.

Missed Brand Awareness Opportunities

Another potential key to further optimizing the value of PayPal’s recent innovations is leveraging global events to improve its brand exposure. We believe the upcoming Olympics was a missed opportunity for PayPal. Admittedly, Visa (V) has long been the Olympics’ key payments partner and sponsor. However, PayPal – like many others in the broader tech industry – could have better leveraged the global event in improving its brand recognition and better its capture of relevant cyclical tailwinds.

For PayPal specifically, which has a substantial exposure to changes in retail spending, the coming Olympic Games is estimated to generate an additional $100 million in global sales from their licensed products alone. Meanwhile, the Paris Tourism Office estimates an incremental $2.8 billion in Olympics-related tourism revenue this summer.

With more than 40% of consumers in France already using PayPal, the Paris Summer Olympic Games would have represented a favourable opportunity for the company to improve its brand exposure and uptake. This would have also been complementary to PayPal’s ongoing efforts this year in improving underutilized products, such as its focus on improving monetization of Xoom. And on the merchant front, with many of PayPal’s products aimed at handling foreign exchange transactions and creating a seamless process for accepting international payments, the company could have taken advantage of the global event as an opportunity to demonstrate its value proposition.

Fundamental Considerations

Despite being incrementally cautious about the lacking durability to PayPal’s long-term growth outlook, we believe management’s raised guidance for full year 2024 proves conservative still given the company’s consistent outperformance in the first half. This is supported by ongoing price discipline observed at Braintree, as evident in PayPal’s sequential transaction margin expansion, which remains accretive to the company’s profitability and cash flows. Meanwhile, PPCP adoption amongst SMBs remain strong, driving further accretion to transaction margin dollars. The company also faces additive growth tailwinds to TPV with the upcoming general availability of Fastlane, which is expected to complement the back-to-school and holiday shopping season that have historically been a boon to PayPal’s performance.

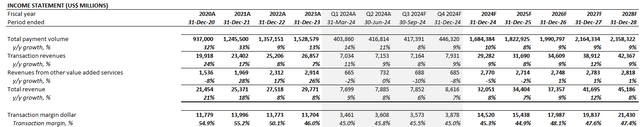

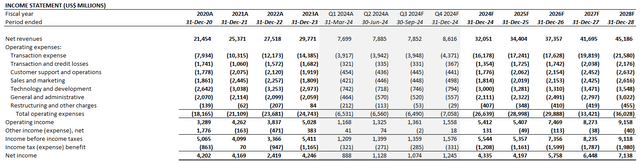

Taken together, we expect PayPal to grow 2024 revenues by 8% y/y to $32.1 billion. This would be driven by TPV growth of 10% y/y to $1.7 trillion, with a transaction take-rate of 1.74% in line with management’s expectation of moderating headwinds from PayPal’s unbranded-weighted revenue mix. Considering incremental accretion from ongoing price discipline actions at Braintree, scale from strong PPCP uptake, and additive growth to TPV anticipated from Fastlane’s general availability, we estimate $14.5 billion in transaction margin dollars for full year 2024, which would represent 6% y/y growth.

This combination likely suggests that the higher range of management’s guidance for mid-to-high single digit non-GAAP earnings expansion this year as the base case. We believe this would also reinforce confidence in expectations for $5+ billion in FCF this year to bolster PayPal’s capital allocation priorities, which include a raised share buyback budget from the previous $5 billion to now $6 billion, as well as continued growth investments.

Valuation Considerations

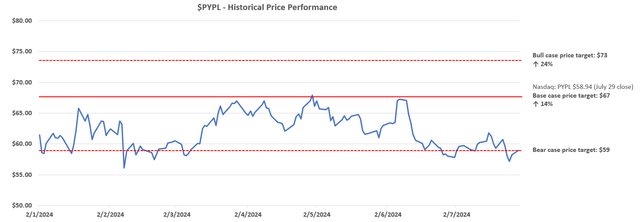

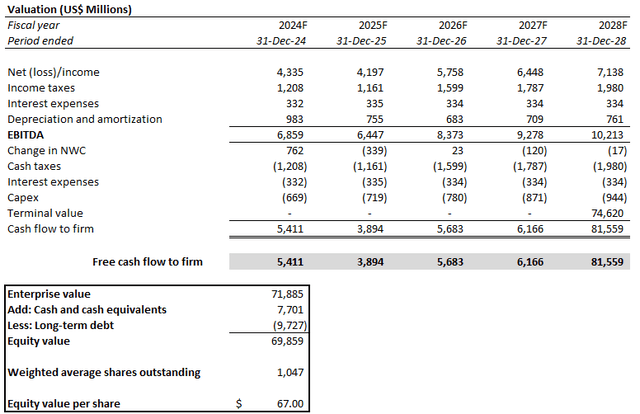

Although PayPal has been consistently outperforming in recent quarters, increasing uncertainties to its long-term market position in payment processing solutions represent a growing overhang on the stock’s valuation prospects. As a result, we are updating our base case price target for the stock to $67 (previously $70).

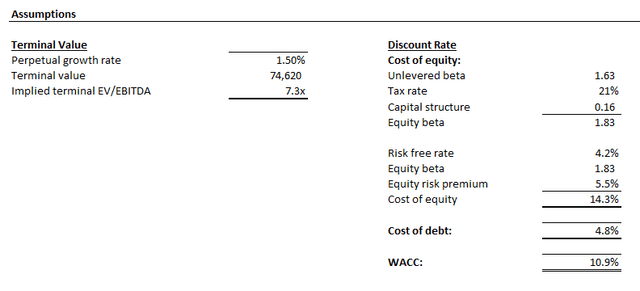

The price target is derived under the discounted cash flow (“DCF”) approach. The analysis considers cash flow projections taken in conjunction with the fundamental forecast discussed in the earlier section. A 10.9% WACC is applied, which is consistent with PayPal’s capital structure and risk profile. The analysis also considers an implied perpetual growth rate of 1.5% on estimated terminal cash flows. This is consistent with the anticipated pace of long-term economic expansion across PayPal’s core operating regions. The valuation assumption is also reflective of our increased concerns over the durability of PayPal’s recent fundamental outperformance, given the lack of a sustained user acquisition and retention gateway over the longer-term.

Conclusion

The latest Q2 outperformance is evidence that new management continues to execute and deliver on PayPal’s “transition year”. And the company’s fundamental strength observed in 1H24 is likely to muscle through the remainder of the year considering idiosyncratic tailwinds, making management’s guidance potentially conservative.

However, we see growing uncertainties to PayPal’s longer-term outlook, given the lack of progress to date in securing a sustained adoption gateway. While the new initiatives introduced at “First Look” are steps in the right direction, PayPal seems to be missing an inroad to ensuring mass consumer and merchant market exposure, which would be critical to reinforcing long-term usage and enabling a self-sufficient flywheel.

While we believe the stock remains undervalued at current levels, a substantial upward valuation re-rate would require PayPal’s restoration of its industry leadership. And in our opinion, this remains out of reach under its current business roadmap.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.