Summary:

- PayPal’s growth and margin outlook has improved due to product innovations and a focus on unbranded checkout, which makes sense as a strategic move for the company.

- With a de-risked business model, a stronger revenue growth outlook, and a discounted valuation, PYPL shares may have reached a ‘bottom’, offering a solid margin of safety to investors.

- Selling put options on PYPL appears to be the optimal play to capitalize on the situation, receiving an immediate cash payout as the company’s operational transition continues.

- We’re upgrading PYPL to a ‘Hold’.

Rouzes

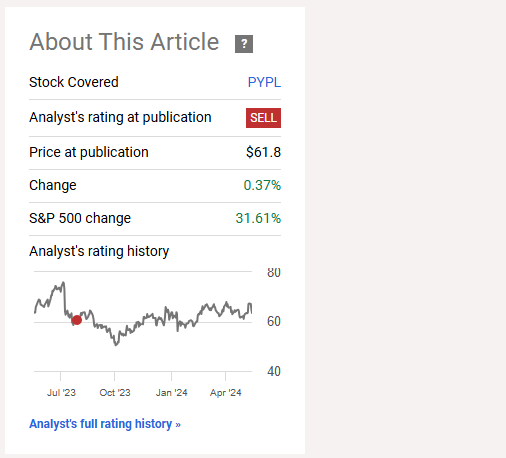

About a year ago, we published our first bearish article on PayPal (NASDAQ:PYPL).

Titled “FedNow Makes PayPal A Value Trap“, the article talked at length about how changes in the payments landscape, including the introduction of FedNow, had driven our negative view on the company’s growth and margin outlook.

At the time, new customer growth was slowing considerably, and we estimated that it was poised to decelerate further on the back of scaled competition and proposed structural market changes that could render PYPL’s core P2P proposition obsolete. This would then (in theory) result in a weakened value proposition to businesses, in addition to a less inspired multiple from investors.

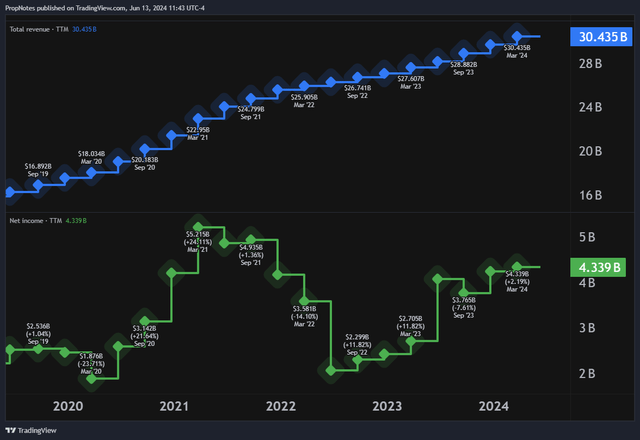

Our thesis has played out somewhat as anticipated. Over the last year, top-line growth has kept up somewhat as the company has flipped a number of sales levers, but EPS growth has flat lined, and is expected to shrink 19% YoY from FY 2023 to FY 2024.

There hasn’t been a material decline in the stock price, but PYPL investors have missed out on 30%+ potential gains enjoyed by the wider market, which is a huge level of underperformance for the once-prolific stock:

Seeking Alpha

To remedy this, the board brought in new management to re-invigorate things, and results have improved somewhat. EPS is expected to lag in 2024 as we mentioned, but innovations on the product end – in addition to an increased focus on unbranded checkout – have driven solid TPV growth, which is encouraging.

It’s not enough to have us flip to a ‘Buy’ rating on the stock, but when combined with the discounted valuation, it does make us think that shares may have reached a ‘bottom’.

The upside picture is still somewhat difficult to see, but further downside in the stock at this point also appears unlikely. Coincidentally, this is the perfect situation to consider selling put options on PYPL. Selling put options can yield a high amount of cash to investors, while allowing value-oriented buyers to acquire shares discounted to today’s fair market value if the stock takes a dip.

Today, we’ll explore this strategy and explain why it could be a perfect fit for those waiting to get a better entry price in PYPL, or those seeking to boost their portfolio’s yield considerably.

Sound good? Let’s dive in.

PayPal’s Financials

As always, let’s start with the financials.

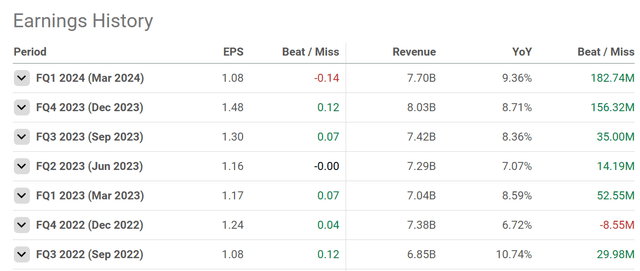

Since our articles on the company last year, PYPL has turned in three quarters of mixed results – Q3 23, Q4 23, and Q1 24:

EPS has been all over the board, but revenue has continued to grow YoY% in the high single digits, which shows how the company is prioritizing revenue over margins at present. This is smart, given that a huge chunk of the company’s selloff has been due to fears around long-term top-line growth.

Tactically, staying focused on revenue growth, including unbranded checkout, better international payments, and improved conversion tech should serve to drive better results for merchants. In turn, PYPL should continue to grow revenues meaningfully. If the company continues to shrug off revenue growth concerns, then we think that the stock has a chance of re-rating higher as a result of lower perceived risk from investors.

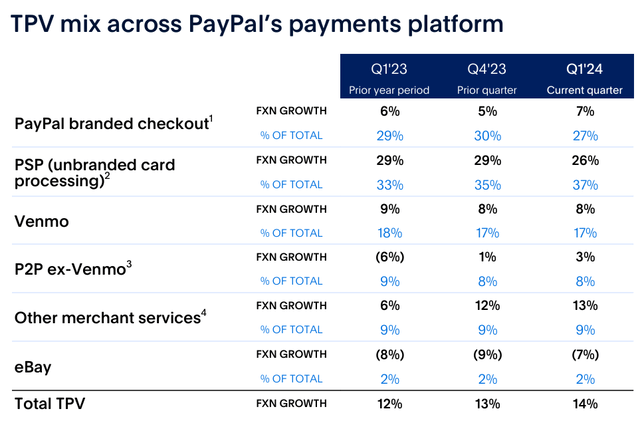

To this end, the company recently announced a number of new advancements they’re looking to make that should drive much stronger checkout experiences, which should grow TPV’s considerably, in our view. The product mix switch is already bearing fruit, and we think better merchant results with Fastlane, smart receipts, and the new offers platform should boost these numbers even further:

Here’s the bottom line: the company isn’t growing users much anymore, but they’ve started to do a better job monetizing the present user base. Plus, with the growth of PSP, the branded checkout experience matters less and less to PYPL’s bottom line.

From this frame, the company’s business model appears to be de-risking.

On the profit front, the company’s operating margins have remained largely stable as of late, with OM%’s just reaching a multi-year high at ~18%, but taxes, unusual items, and other hiccups have hurt EPS conversion on the whole:

While these adjustments and hiccups are ‘ugly’, recent bumps are somewhat attributable to the ongoing business transformation, as discussed by the CEO on the recent earnings call:

What we said at the start of the year still holds: this is a transition year where we are focused on execution and making critical choices that will set the business up for long term success. We have a plan that will return this company to where it needs to be and remain focused on execution to get there. We see clear opportunities for operational improvements across our large enterprise, small business and consumer businesses, including Venmo, and in driving more efficiency across the organization, but it will take time to prudently drive a meaningful and sustainable transformation.

(bolding ours)

In our view, improved value to merchants, plus a focus on improved operationalization & margins, will likely be enough to send top and bottom-line results up and to the right over the medium term. This would be a welcome change of pace from the last two years of stagnant profit growth.

Switching now to the balance sheet, as you would likely expect, it remains pristine, as a result of a strong business model which needs very little external investment. Cash sits at a robust $14 billion, and long-term debt stands at only $9 billion.

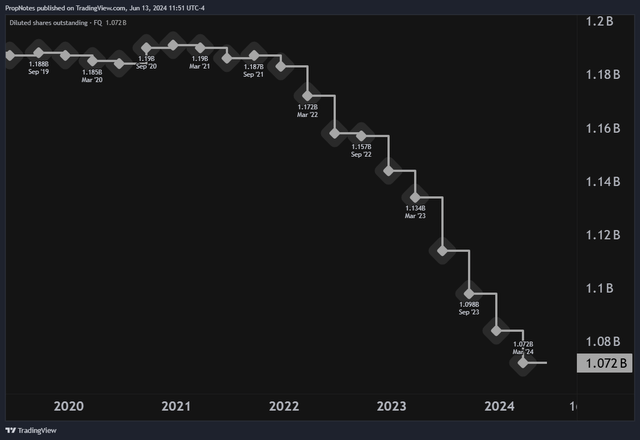

In fact, the balance sheet situation is so solid that management has been buying back shares at a rapid rate to juice EPS growth, a move that, we think, is prudent given the valuation:

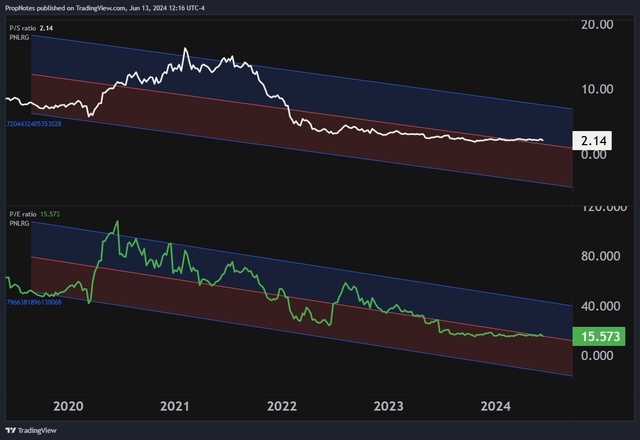

On the valuation front, the stock is looking a lot more attractive than it did last summer.

For the first time, the stock is trading at a relative discount, and EPS growth is expected to grow double digits from FY 2024 to FY 2025. This is an interesting potential entry point to consider from a multiple perspective.

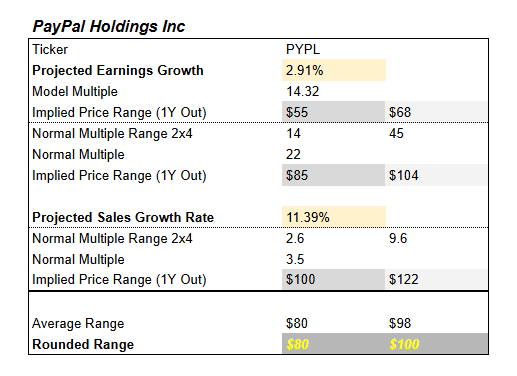

If you mix in the company’s expected top and bottom-line growth, historical valuations, and a model multiple that’s based on AOEPS growth, we estimate that the stock’s Fair Value is somewhere in the $80-$100 region:

PropNotes

This is an average of the 3 separate historical and model multiple ranges calculated above. Typically, we average the highs and lows of 2-year historical multiple ranges, but we view the 2020 and 2021 numbers as an aberration, so we’ve adjusted those down somewhat.

This indicates that the stock is priced with a solid margin of safety, currently at $62 per share, which again, appears to be a de-risked entry point.

More nominally, PYPL shares look depressed, which shows just how unloved the company is at the moment:

Overall, with the changes made in the company’s product mix, along with improvements to revenue and non-revenue generating infrastructure, we’re comfortable upgrading the stock given that the big risks discussed in previous articles have largely ameliorated.

With the valuation coming into a more reasonable area, we do think that shares truly may have reached a local ‘bottom’.

The Trade

But what is the most optimal way to play this potential turnaround? Sure, you could purchase the stock and take the bet that the company re-rates higher on improved financial results, but it’s tough to say how long that will take.

The market may need more proof before investors start to trust that the company won’t be demolished by competition that’s putting pressure on PYPL from every direction.

At the same time, with early green shoots in the company’s recent business moves and the stock’s cheap looking multiple, it’s hard to envision material downside from this level as well.

That’s why we think selling put options is the most optimal play right now in PYPL.

In case you’re unfamiliar, selling a put option is essentially like selling insurance on the stock.

When you sell a put option, you reserve buying power in your brokerage account, and trade upside appreciation potential for an immediate cash return.

If the stock goes up or trades sideways until expiry, then you get to keep the cash and your reserved buying power is returned to you.

If the stock drops below the strike price, then you keep the cash, and your reserved buying power is used to buy the stock outright.

No matter what, you keep the cash premium, which can be seen as an enticing yield for an investor – a yield on ‘capital’; cash, or the new, resulting equity position.

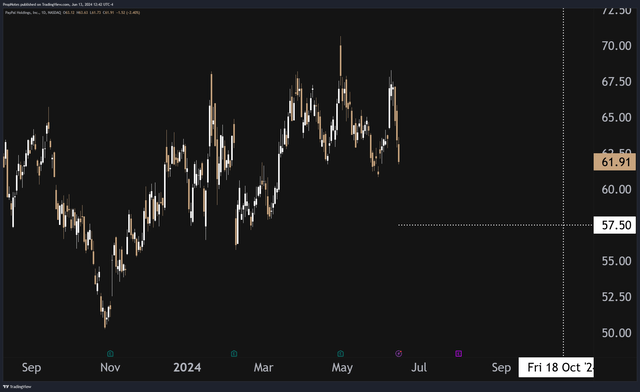

In this example, we like the idea of selling the $57.5 strike options that expire on October 18th:

These pay out $255 per contract, which represents a 4.64% yield on the buying power needed to open the position. Since the options expire in 127 days, the yield, when annualized, comes to 13.3%, which is highly competitive, even in today’s cyclically high market for yield.

As we said, this $255 is kept by the put seller no matter what, but if PYPL ends mid-October below $57.50, then the investor would need to buy shares in the stock to satisfy their requirements.

That said, with the potential for continued improvement on the back of strong Fastlane, offers, and smart receipts performance and shifting TPV revenue, being assigned shares below $60, when we see Fair Value as being $80 and above, certainly appears to be a win-win opportunity.

Summary

In the past, we’ve seen PYPL’s stock as highly risky due to structural concerns around competition, market shifts, and the valuation.

However, as PYPL management steers the boat towards unbranded processing, tech improvements to checkout, and improved monetization from offers, we think the business model looks more and more de-risked. Plus, with the valuation where it is, we think there’s a solid margin of safety for bulls at these levels.

While you could purchase shares and wait for the market to do its thing, we think that selling puts on the stock and trading upside for an immediate cash payout, to the tune of 13.3% annualized, is the best course of action. Whether you’re assigned shares or not, this appears like a win-win proposition for value and income investors alike.

Additionally, we upgrade our rating on PYPL from ‘Sell’ to ‘Hold’.

Good luck out there!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.