Summary:

- The new CEO has released a not-so-shocking video of the upcoming innovations being released this year at PayPal.

- While these are a step in the right direction. I am not yet sold on the CEO or the vision.

- Having said that, PayPal’s valuation is compelling, offering potential for investment with a margin of safety.

Sean Anthony Eddy

Thesis Summary

PayPal (NASDAQ:PYPL) is making headlines as the company has announced a new CEO, Alex Chriss. Markets have so far received this news well, with the stock up over 10% in the weeks following the announcement.

Chriss has promised to deliver innovation to the company with hopes of reversing the trend of declining margins. But how exactly does he plan to do that?

Today, we review some of the “shocking” announcements the company has made. The market has not received these well, as the stock is now down 3.5% on the day.

Even if these new initiatives work, PayPal still faces the same problems as ever, Problems which, arguably, can’t be fixed with a new direction.

That said, the valuation is still very compelling. Even if PayPal was, for lack of a better word, “doomed, ” does that mean it’s not a good investment?

In my opinion, investors can now take a gamble on the new CEO and direction, which I am for the moment far from sold on, at a very compelling price and with a margin of safety.

PayPal’s Issues

PayPal’s new CEO, Alex Chriss, was a long-time employee at Inuit, where he last served as Senior Vice President and Chief Product Officer of Intuit’s Small Business organization.

The CEO has been brought in to revitalize a company that has been struggling for a long time.

Having experience in developing software and also in building and selling innovative start-ups, it would seem that PayPal hopes that the new CEO can bring a fresh perspective to the company.

PayPal was once a beloved growth stock for investors. It offered, in my opinion, the best of both worlds: a dominant and growing position in the exciting world of fintech and ample margins and profitability.

But in the last few years, PayPal has seen its dominance challenged and its margins compressed.

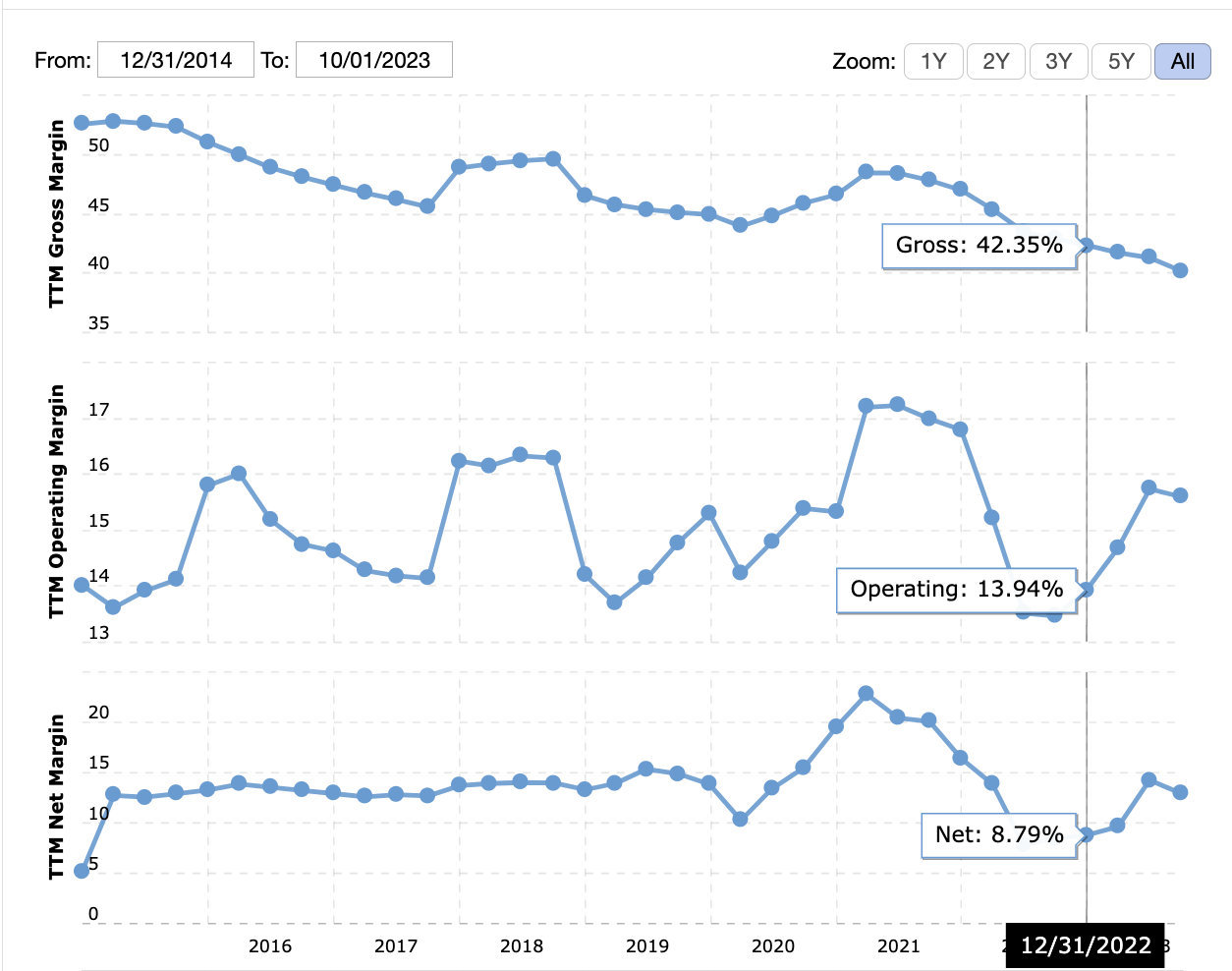

PayPal Margins (Macrotrends)

As we can see, Gross margins have been declining steadily since 2015. Operating margin has been a bit more volatile but has been coming down since it topped in 2020.

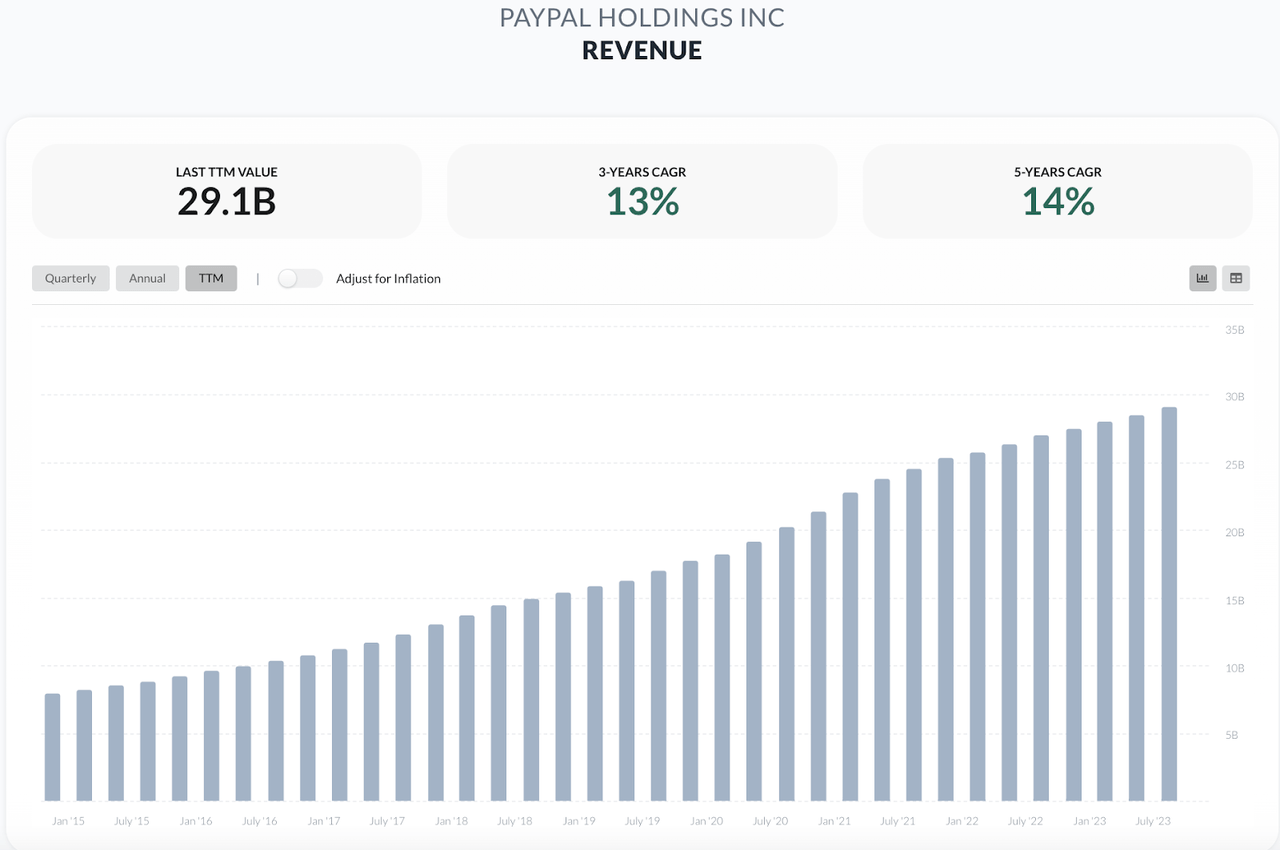

On the other hand, revenue growth has been pretty solid, achieving double digits, but it has slowed down a tad in the last three years.

Operationally, the company has had some issues, but it’s far from a disaster. Perhaps, though, the issue is the sentiment. PayPal is not exciting anymore. There’s nothing compelling for investors to grab onto. Perhaps now they will.

Upcoming Earnings

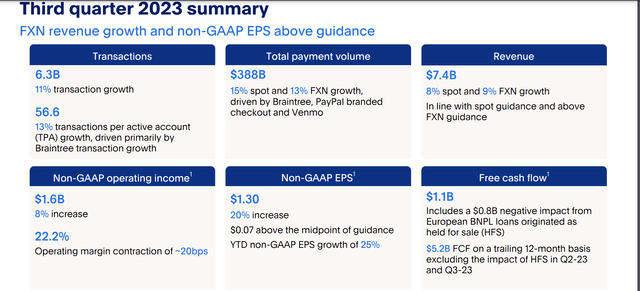

PayPal is expected to report earnings on November 1. Analyst consensus for EPS is $1.23, a +10.8% YoY increase) and while revenue estimate is $7.38B (+6.6% Y/Y).

As we can see, it’s not only a matter of shrinking profitability but also potentially falling growth that is concerning investors.

The coming quarter will, of course, not be truly reflective of the new vision and direction of the CEO, who has only been around for a few months.

However, we will see some great insights into just how bad the situation at PayPal is right now.

Personally, I will be most interested in seeing how the Q4 numbers compare to the Q3 numbers. PayPal actually posted some recent growth in revenues, but operating margins did contract. Will this trend continue?

It will also be very interesting to see if the company makes any mention of its new launches, which were covered in the innovation video.

The Innovation Video

A few weeks ago, PayPal promised to shock the world with its online Innovation event. And while some innovation was discussed, I’d hardly call a 17-minute video posted on YouTube much of an event.

With that said, let’s not focus on the format but rather on the contents of this presentation, which focused on six main new products/re-imagined products.

PayPal Checkout Experience: Alex Chriss starts off by talking about the re-imagined Checkout Experience, which will reduce the checkout time by 50%.

Fastlane: In a similar vein, PayPal is introducing Fastlane, which reduces guest checkout completion time by 40%. In simple terms, it can allow shoppers to much more seamlessly make a purchase with one tap. Upload your information to Fastlane, and any business that uses PayPal will be able to accept your transaction in one click. This has been piloted by BigCommerce (BIGC) and has led to a 70% conversion rate.

Smart receipts: PayPal is looking to launch smart receipts in an effort to enter the eCommerce space. The idea is that after every purchase, your receipt will feature an AI personalized recommendation based on previous purchases.

PayPal Advanced Offers Platform: Serving relevant, personalized, real-time offers to customers. A new way for PayPal to connect merchants and customers.

PayPal Consumer App: Cash-back rewards and other incentives to reward loyal PayPal customers.

Venmo Business Profiles: Venmo is often used for P2P transactions, but they are often also used by small businesses as a form of payment. PayPal will now “enhance” the Venmo experience by allowing users to subscribe, and shops on Venmo can send nearby users and subscribers personalized offers.

My 2 Cents

The presentation was a step in the right direction, but it was far from shocking.

A lot of the innovations presented may be innovations for PayPal, but they are not true innovations. Fast checkouts have been implemented by Amazon (AMZN) and Shopify (SHOP).

Most businesses already offer loyalty programmes, and CashApp has already implemented much of what Venmo is now touting as innovation.

The smart receipts and Advanced Offers Platform could definitely be a value add. Alex Chriss was not shy about using the words “AI” and “data”, but there’s definitely something to this.

PayPal does have a plethora of data, still being one of the largest players in this space. If this can truly be optimized in order to facilitate sales, then there’s money to be made.

Overall, as I said above, I was hardly shocked. Still, Alex Chriss has been around for 90 days and already delivered some notable improvements.

With Venmo, it is finally catching up to some of the stuff CashApp introduced a while ago.

PayPal is also finally leveraging its massive user base and data to enhance sales for its merchants.

And it is introducing more value to its consumers through special offers.

I am most excited about how the company can use its data to enhance sales, which will ultimately give merchants a big reason to stick with PayPal.

I also think a key area will be how the company can introduce this in emerging markets in order to establish itself and gain even more market share.

I am curious to see what’s in store for the future, and I can do so with a big margin of safety.

Valuation

The main point to this thesis is that we have a company that is failing. That much is priced in. What is not priced in is the fact that the new CEO may be able to actually leverage technology and innovate enough to at least notably increase earnings.

Just look at this:

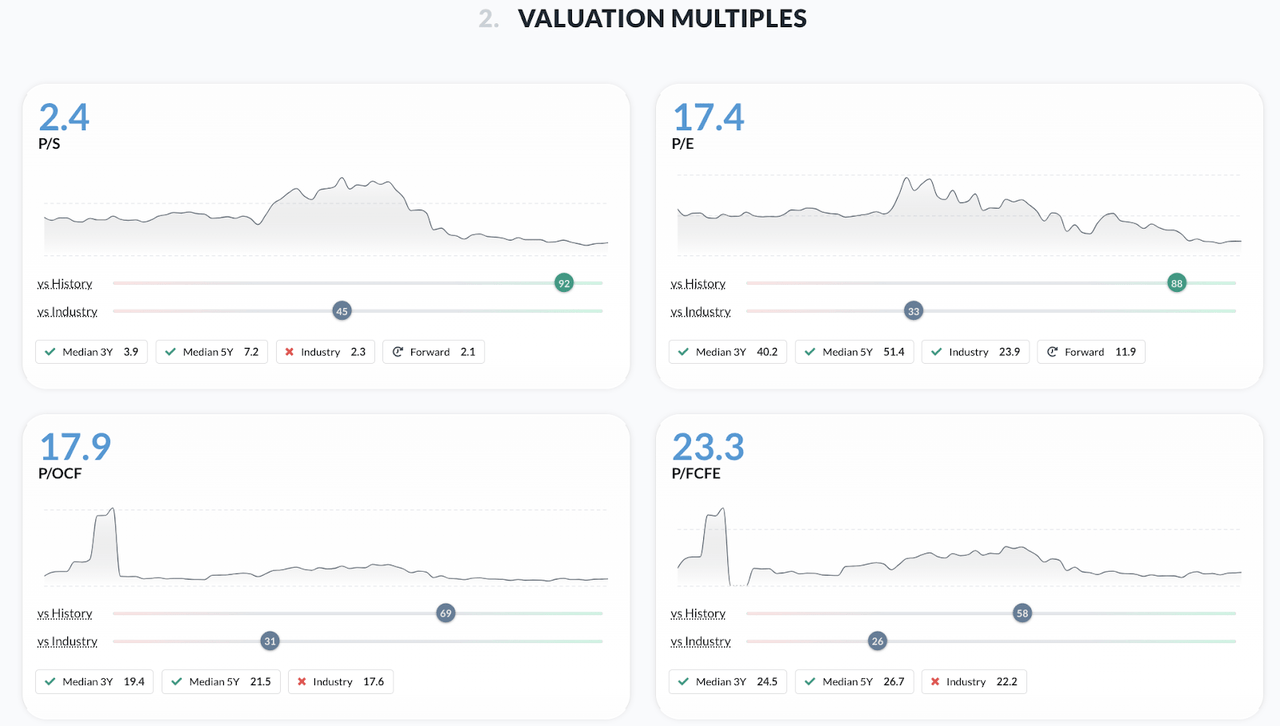

Valuation Multiples PYPL (Alphaspread)

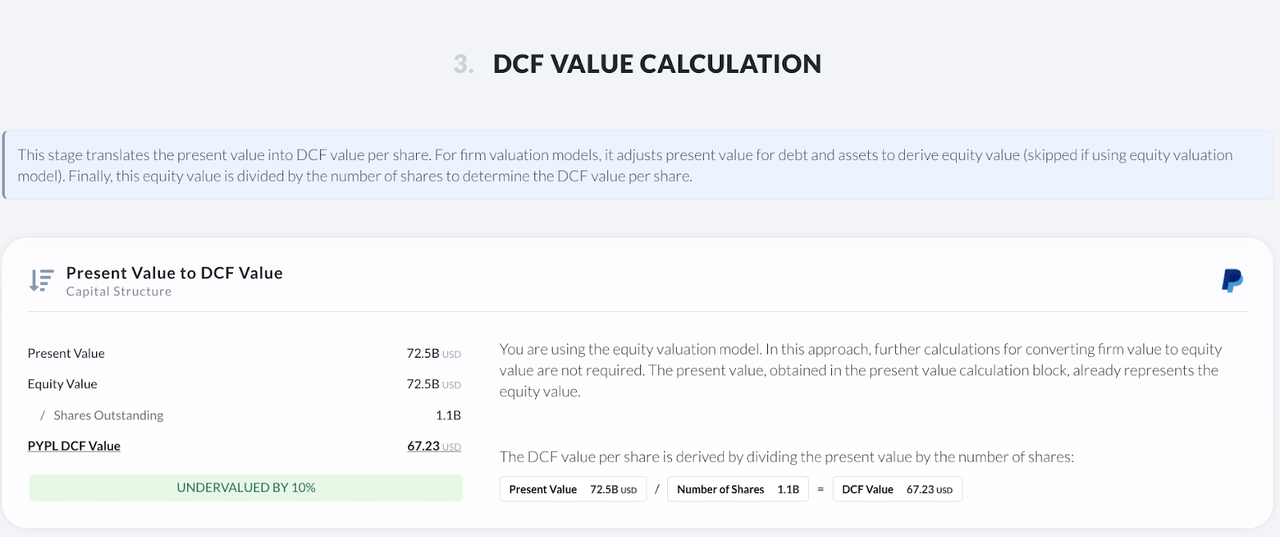

PayPal is cheaper than 92% of its history based on P/S and 86% of its history based on PE.

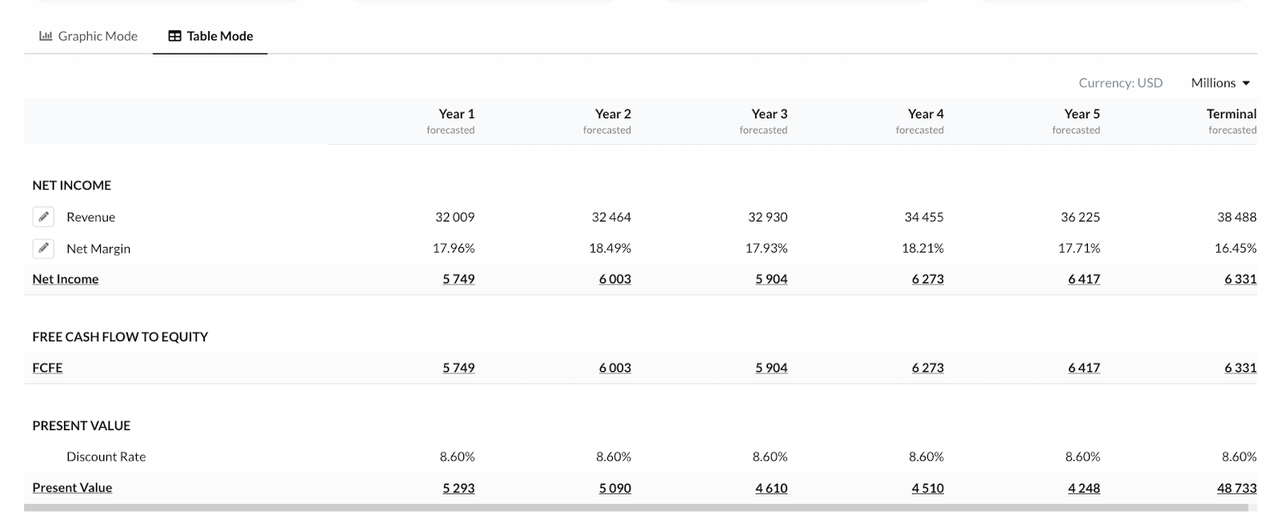

In the DCF valuation below, I apply a revenue CAGR over the next five years of under four percent, and assume a declining net margin.

Revenue expectations on SA, show that PayPal could grow at twice that rate, around 8% over the next three years. Meanwhile, Fortune Business expects the “fintech market” to grow at a 17% CAGR until 2030.

Realistically, I think PayPal will grow above this level. However, I am presenting a very bearish scenario here, to show that even in the worst possible case, PayPal still has value here.

Even under this scenario, the stock comes out 10% undervalued:

Risks

Although PayPal is cheap here, there’s still the risk that the stock could go even lower. We have to concede that the company is fighting an uphill battle. The ball is in PayPal’s court, and it has to provide new solutions in order to convince consumers, and investors, that it is still relevant.

While they have made some good first steps, the competition in this sector is fierce, and it will continue to be.

Furthermore, I also see the risk that some of its initiatives initially take a toll on profitability. It’s possible that the company needs to see some more pain, before it gets the gain.

Final Thoughts

PayPal may not be what it once was, but that doesn’t mean it should be this cheap. It is still growing and making a good chunk of money. On top of that, now you can also bet on a possible recovery. At least the company is taking steps in the right direction. I’m still not sold on the vision or the new CEO, but at this price, I can give them the benefit of the doubt.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This stock is part of my End Of The World Portfolio.

A portfolio of highly diversified, secure and reliable companies that will do well in ANY environment.

Join the Pragmatic Investor today to get full access to the portfolio and more.

– Weekly Macro newsletter

– Access to the End of The World and YOLO portfolios

– Trade Ideas

– Weekly Video