Summary:

- The market’s optimism for PayPal Holdings, Inc.’s Q1 beat and raise last week has faded swiftly, highlighting investors’ ongoing concerns about execution risks ahead.

- In addition to ongoing uncertainties in the macroeconomic environment, PayPal also faces elevated competition from the Fed’s introduction of FedNow, which risks thwarting Venmo’s monetization efforts.

- However, we believe PayPal’s raised guidance remains conservative, with additional upside likely as the year progresses with the general availability roll-out of strong-performing new features like Fastlane.

chameleonseye

PayPal Holdings, Inc.’s (NASDAQ:PYPL) year of transition has been off to a strong start, with the Q1 beat and raise lifting full year 2024 earnings growth expectations. Yet, the stock’s post-earnings gains that neared our $70 PT were swiftly wiped out in the following week. This trend continues to highlight investor angst about execution risks ahead as new management navigates turnaround initiatives that include accelerating innovation, driving adoption, and reversing underperforming services amid competition and macroeconomic uncertainties.

Yet, we believe the stock remains undervalued on both a relative and intrinsic basis, given its forward growth and cash flow outlook. Specifically, anticipated value accretion from PayPal’s ongoing rollout of innovative features aimed at restoring its disruptive reputation in end-to-end payment processing and checkout solutions have yet to be reflected in the stock at current levels. Meanwhile, the combination of PayPal’s valuation discount at current levels, its existing FCF generation roadmap, alongside its robust capital returns program also compensates for continued execution risks in the near-term. Taken together, we remain confident that PayPal continues to represent a compelling risk-reward opportunity at current levels.

Is PayPal at Risk of Being Disrupted?

Concerns about PayPal’s slowing growth trajectory and growing risks of obsolescence have cast a dark cloud over the stock recently. To make matters worse, a string of onerous transactions and expansion efforts made under previous management have only yielded limited returns, harboring extended multiple compression risks. Although new management aims to turn a new page, getting straight to work by rightsizing PayPal’s operations and narrowing the company’s strategic focus, elevated execution risks remain.

Venmo Competition

Recall that Venmo monetization is one of the key focus areas for management in driving up PayPal’s higher take-rate branded volumes. Despite the peer-to-peer (“P2P”) payment transfer app’s widespread adoption and market leadership in the U.S., its contributions to PayPal’s cash flows remain nominal. And one of investors’ biggest concerns regarding PayPal’s outlook also lies within the emerging competitive threats facing the P2P app.

Specifically, the U.S. Federal Reserve has rolled out a new P2P payments solution, “FedNow,” that aims at facilitating instant money transfers in a streamlined and secure environment. Yet FedNow has received little airtime during recent quarterly earnings calls at PayPal, begging the question of how the nationwide rollout of this product could threaten Venmo’s monetization roadmap.

FedNow will be integrated into participating financial institutions’ respective mobile apps. This effectively streamlines every day account-to-account transfers and bill payments by reducing app-to-app friction, while also eradicating processing time inefficiencies by ensuring money is sent and received in real time. To date, close to 800 financial institutions across the U.S. – spanning the largest banks, credit unions, and certified service providers – have participated in FedNow.

The government’s newly introduced service effectively adds to the growing pool of increasingly popular P2P payment transfer solutions, such as Zelle. Zelle has gradually eroded market share from Venmo lately, with many users alluding to the former’s ease of use given inherent integration to their respective bank apps. Specifically, the competing platform is integrated across 2,100+ banks and credit unions in the U.S., with the majority of Americans already signed up to Zelle due to the product’s ease of use. While FedNow’s inherent integration into banking platforms risks greater disruption to Zelle’s business model than Venmo’s, it remains a threat to the latter’s market share leadership, nonetheless, and risks thwarting PayPal’s ambitions in further monetizing the platform.

Looking ahead, successful diversification of Venmo’s monetizable features will be key to PayPal’s strategy in ramping up branded transaction volumes at scale. Yet, relevant efforts remain a work in progress. Specifically, management’s latest update shows 80% of new funds averaging $18 billion per month deposited into Venmo leave the platform within 10 days.

This highlights that new product uptake, such as the Venmo debit card and cash back (up to 3%) credit card, continue to place a nominal impact on platform monetization. This comes despite 21% y/y growth in Venmo debit card users in Q1, with the cohort exhibiting on average 6x greater revenue contribution for the platform compared to P2P-only users. Meanwhile, competition is also ramping up in offline payment solutions. In addition to consumer revolving credit products from PayPal itself, such as Pay Later and other card products, Venmo also faces rivaling solutions from other virtual financial institution upstarts, including the recently launched Robinhood (HOOD) Gold Card, which boasts up to 5% in cash back rebates.

However, in carving out its differentiated value proposition, Venmo is honing in on its unique user demographics. Specifically, Venmo has been diving into the interests of its millennials-dominant user base by introducing targeted features such as enhanced merchant profiles and Smart Receipts. Recall that the enhanced business profiles aim at improving vendor discovery and access to promotional offers, which are favorable to both merchants and consumers in the purchasing process. Meanwhile, Smart Receipts aim at improving the post-checkout experience and reinforcing repeated purchases by offering personalized product recommendations and promotional offers to consumers.

Both newly introduced features capitalize on key trends dominating the interests of the millennial and Gen Z spending cohorts – namely, social media and price sensitivity. Specifically, the largest cohort of active social media users are between the ages of 18 and 24, similar to the dominating segment of Venmo’s user base. Meanwhile, this age group also currently boasts the “highest spending power,” despite also being one of the most price sensitive consumer cohorts. More than 70% of U.S. Gen Z consumers are incentivized by pricing discounts when making a purchase, with deals and trends typically sourced through social media platforms. This accordingly highlights how Venmo could potentially differentiate its value proposition within the increasingly competitive digital payment solutions market as it plays according to its strengths.

Is PayPal Still Capable of Disruption?

Management’s continued commitment to driving profitable growth and sustained FCF expansion, while promising a robust capital returns program amid continued reinvestment into the business, reinforces confidence in PayPal’s prospects, nonetheless. And the company’s strong Q1 results and upward-revised earnings guidance corroborate delivery of this commitment.

Admittedly, management has warned that transaction margin dollar tailwinds observed in Q1 are likely to moderate through 2H24. This is primarily due to the challenging prior year compare for interest income on customer balances when capital costs surged during the latter half of 2023. Meanwhile, growth improvements in higher-margin branded checkout volumes remain at a gradual pace.

However, further general availability (“GA”) of recently introduced features anticipated in 2H24 is likely to be a key compensating factor. Specifically, Fastlane garnered significant airtime during the latest earnings call, making it one of the most important features introduced at PayPal’s “First Look” event earlier this year. Recall from our previous discussion that Fastlane is a branded checkout product aimed at reducing friction for consumers who prefer guest checkout, while ensuring improved conversion rates for merchants. Consumers can easily save their payment information once when using guest checkout on a vendor site that is integrated with Fastlane. Every guest checkout transaction completed thereafter on any site that uses Fastlane will be as simple as one click moving forward.

Although Fastlane is still in the testing phase, with integration across a limited number of merchants only, early observations show strong results. About 40% of consumers choosing guest checkout at participating merchants have opted into Fastlane, with the product demonstrating an 80% conversion rate for returning users. And management is already recognizing a flywheel effect in Fastlane – as merchant participation and consumer uptake rates improve, returning user volumes will also increase and further drive-up conversion rates, and effectively refuel merchant participation. Fastlane is expected to enter GA in the U.S. in 2H24, which coincides favorably with the upcoming back-to-school and holiday shopping seasons.

While management has yet to unveil the GA go-to-market strategy for Fastlane, they have hinted at potential seek opportunities outside the PayPal ecosystem with the newly introduced product. This is likely to deepen its penetration of online checkout opportunities – particularly the 60% of consumers that have yet to integrate Fastlane into their guest checkout experiences.

Broader rollout of Fastlane frictionless guest checkout capabilities beyond the PayPal ecosystem would also appeal favorably to the increasing volume of SMBs moving online and/or adopting an omnichannel storefront. More than 80% of commerce remains offline, with “trillions of offline retail dollars moving online over the much longer-term”. This accordingly suggests significant growth headroom still at PayPal, despite signs of slowing growth recently.

In addition to Fastlane, PayPal has also doubled down on investments across adjacent products. These include pre-purchase recommendations shared through in-app products CashPass, checkout solutions such as Fastlane and card products, post-purchase experiences such as Smart Receipts, and unbranded back-end payments processing solutions offered through Braintree. This accordingly reinforces PayPal’s leadership in the provision of end-to-end solutions critical in the merchant to consumer end-market process across both online and offline settings. It also deepens PayPal’s capture of emerging opportunities in commerce and payments, improving the durability of its long-term growth roadmap.

Fundamental Considerations

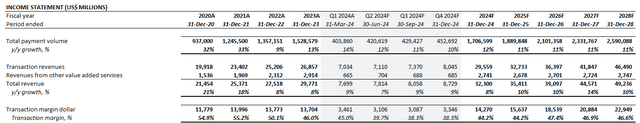

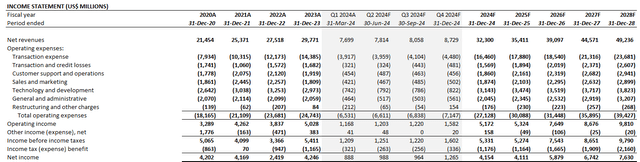

Adjusting our previous forecast for PayPal’s Q1 beat and raise, and our foregoing discussion on potential opportunities and execution risks ahead, we expect 8% y/y growth to total revenue of $32.3 billion in 2024. We believe there remains conservatism in management’s consideration of nominal contributions from the upcoming general GA of newly announced features in PayPal’s 2024 guidance.

This is further corroborated by robust evidence in the early test phase of recently announced products like Fastlane. The 80% conversion rate observed in guest checkout from returning Fastlane users provides validation that there is a unique value proposition in the product for both consumers and participating merchants. And with 40% of unrecognized users already leveraging PayPal Fastlane during guest checkout in participating vendors, there remains significant headroom for growth in the product. This combination is expected to reinforce branded volumes, which feature higher take rates and, inadvertently, margin accretive for PayPal. Meanwhile, Venmo monetization is also expected to remain an additive contribution to PayPal’s cashflows.

We’ve just had small but, I’d say, steady ongoing product improvements in Venmo, in P2P, so we saw some shifting there, and better transaction and credit loss performance.

Source: PayPal 1Q24 Earnings Call Transcript.

This is likely to remain accretive to PayPal’s transaction margin dollar, which is consistent with the raised earnings guidance. Admittedly, management expects some of the Q1 tailwinds, such as interest income on customer balances, to moderate through the year. However, we believe the guided net positive effect, though slight, on transaction margin dollar growth for full year 2024 suggests a conservative base case. This does not only imply protection against downside risks, but also suggests further transaction margin dollar expansion, should the upcoming GA of new features reinforce branded volume growth.

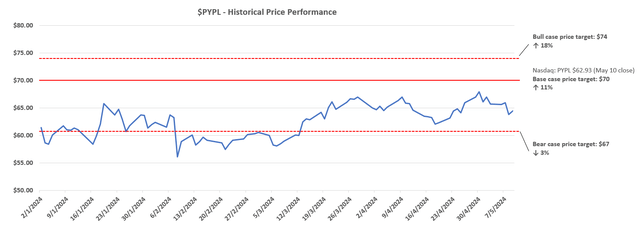

Price Considerations

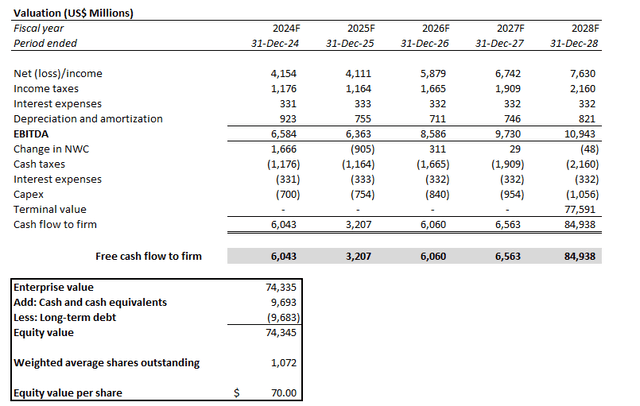

We are maintaining our base case price target of $70 for PayPal Holdings, Inc. stock. The price continues to reflect our optimism for PayPal’s roadmap given the Q1 beat and raise, offset by continued execution risks on the horizon. Specifically, PayPal continues to face uncertainties pertaining to the upcoming rollout of new features that transaction margin dollar outperformance would hinge on, which should not be overlooked in our opinion.

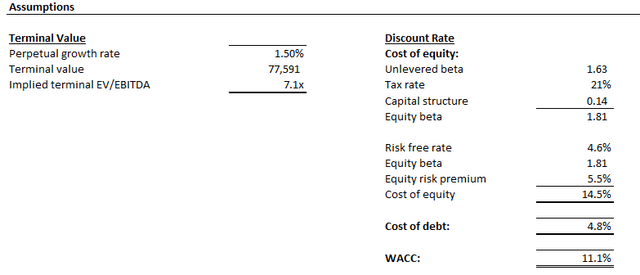

The price target is derived under the discounted cash flow (“DCF”) approach. The analysis considers cash flow projections taken with the fundamental forecast discussed in the earlier section. An 11.1% WACC is applied, which is consistent with PayPal’s capital structure and risk profile. The analysis also considers an implied perpetual growth rate of 1.5% on estimated terminal cash flows. The valuation assumption is in line with the anticipated pace of long-term economic expansion across PayPal’s core operating regions. It is also reflective of the company’s near-term exposure to elevated execution risks, given ongoing efforts in ramping up higher margin branded volumes and improving product monetization.

Conclusion

While PayPal has delivered a strong Q1 beat and raise, there is still much credibility left to restore. Investors are still expecting further consistency in positive quarterly progress from PayPal in ramping and monetizing innovations at scale, while also preserving market leadership in the increasingly digital payment processing landscape. This would ensure the company’s year of transition and execution in 2024 is setting up for a strong outlook for 2025 and beyond.

However, we believe PayPal Holdings, Inc. stock remains undervalued at current levels, nonetheless. Considering management’s guidance, which we view as a conservative base case, PayPal remains well-positioned for further upside potential on an intrinsic basis underpinned by strong cash flows. Meanwhile, trading at 12.5x estimated NTM earnings and 2.2x estimated NTM sales, PayPal also remains discounted on a relative basis to its peers in the tech-heavy Nasdaq 100 (average 6.4x NTM sales, 23x NTM earnings). Taken together with our view that management’s estimates remain conservative, with additional upside likely as the year progresses with new product GAs, PayPal continues to represent an attractive risk-reward set-up at current levels.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly, exclusive research content and ideas, and tools designed for growth investing, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to research coverage, exclusive ideas and complementary financial models

- Monitored and regularly updated price alerts for our coverage

- A compilation of complementary tools such as growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!