Summary:

- PayPal’s Q1 2024 results exceeded expectations, though transaction margin improvements were largely driven by transitory factors.

- The new CEO is making promising changes to revitalize growth and improve cost discipline, though the success of these initiatives is yet to be seen.

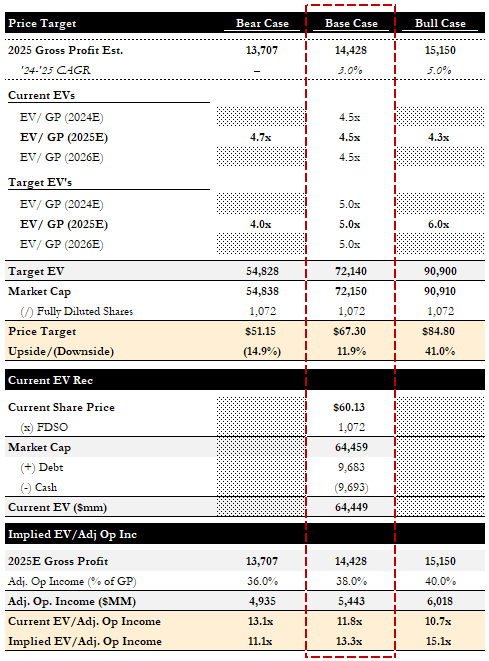

- Our valuation is based on a gross profit multiple, with a base case target of $67, bull case of $85, and bear case of $51.

- We maintain our Hold rating due to the limited upside to our base case target price and sustained competitive pressures.

vittaya25

Summary

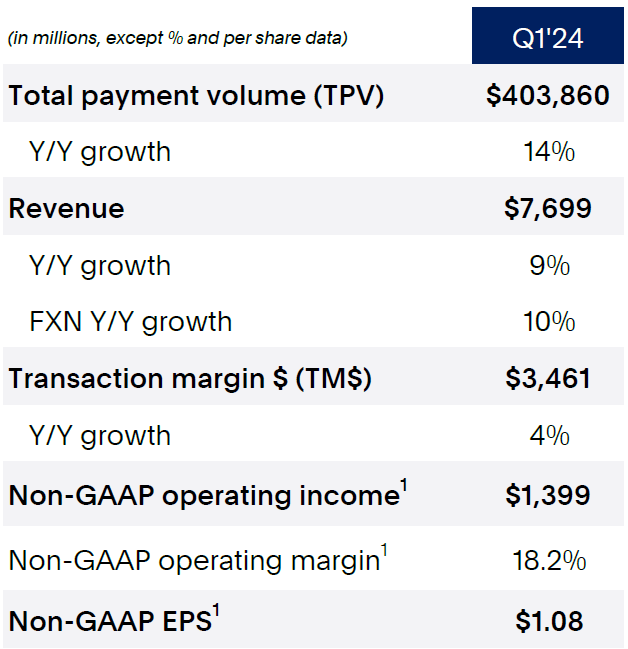

Our initial report on PayPal Holdings, Inc. (NASDAQ:PYPL) rated the shares a Hold. Despite the stock’s massive correction following a significant e-commerce-fueled rally during COVID, we did not see the valuation as attractive when considering the mounting competitive pressures, slowing growth, and uncertainty about the turnaround. Q1 2024 results surprised to the upside, with strong performance across all key financial measures, though a material amount of the outperformance was driven by transitory factors (e.g., interest income). While the shares are ~8% below the price at our initial report, we are still cautious and maintain our Hold rating on valuation.

Earnings Update

PayPal’s new CEO, Alex Chriss, had been brought in to turn the company around by revitalizing growth and bringing cost discipline. Since he took over the reins, we believe the early results are promising, with indications that it has been improving pricing in Unbranded, lowering frictions in Branded to reverse market share loss, and revitalizing Venmo.

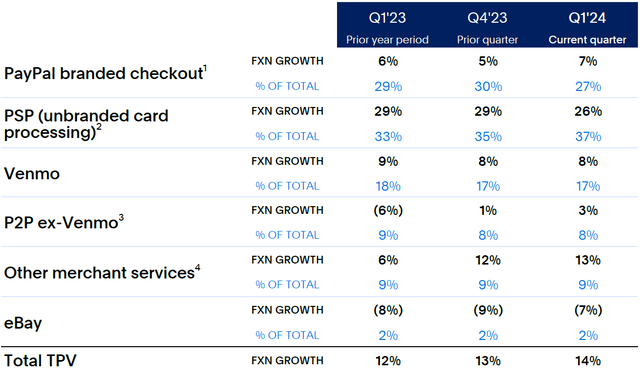

In the quarter, Unbranded volumes grew ~26% YoY due to recent pricing improvements, with management noting that negotiations with merchants have been positive to date. Unbranded growth is expected to benefit from the rollout of Fastlane, which is expected to be widely available by the second half of the year (n.b., management states that merchants who use Fastlane experience double-digit lifts in checkout conversion). Branded volume growth also outperformed expectations, driven by large enterprises and international clients. In the near term, PayPal will continue to focus on increasing its penetration with SMEs and improving its mobile UX.

Venmo volumes grew ~8% YoY, materially flat vs the prior quarter, though Venmo Debit card uptake increased ~21% YoY. A key priority for management in its efforts to reignite growth at Venmo is maintaining inflows within the app (n.b., ~80% of inflows leave the app within ~10 days).

In our opinion, the headline outperformance on transaction margin (“TM”) was supported by several exceptional items, making this a lower-quality beat. Interest income was the largest contributor to TM growth in the quarter, followed by growth in Branded (which benefitted from a +1 point contribution from leap day), improved loss performance (partly due to tightening of origination standards and portfolio sales), and a lower drag from underperforming businesses. Also on the negative side, take rate compression continued, albeit at a slower pace due to mix shift. Management expects TM growth to moderate in the back half of the year as the interest benefit rolls off and loss performance normalizes.

Q1’24 Results (PYPL)

On the capital allocation front, PayPal repurchased ~$1.5Bn of shares and expects to repurchase at least $5Bn throughout 2024.

Valuation

We are transitioning our valuation methodology for PayPal to a gross profit multiple. Our base case price target of ~$67 is based on a 5x EV/GP multiple on our ’25E GP estimate of ~$14.4Bn. We believe this is an appropriate multiple for a company facing TM pressures as it tries to return to growth profitably.

Our bull case price target of ~$85 assumes greater e-commerce growth, faster acceleration of Branded checkout volumes, and a 6x GP multiple on GP of ~$15.2Bn.

Our bear case price target of ~$51 is based on a deterioration in TMs due to increased competition in Branded checkout volumes, continued lower monetization in Unbranded volumes, and a 4x GP multiple on GP of ~$13.8Bn.

Valuation (Empyean)

Conclusion

Our Hold rating is driven by the following considerations:

- Uncertainty around the share of Branded checkout PayPal can maintain and the level of sustainable growth for e-commerce going forward

- The company’s ability to drive enough operating leverage to realize margin expansion

- Whether the company can improve unit economics/take rate for its Unbranded checkout.

Given these concerns and the modest upside we see to our base case target price, we are maintaining our Hold rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.