Summary:

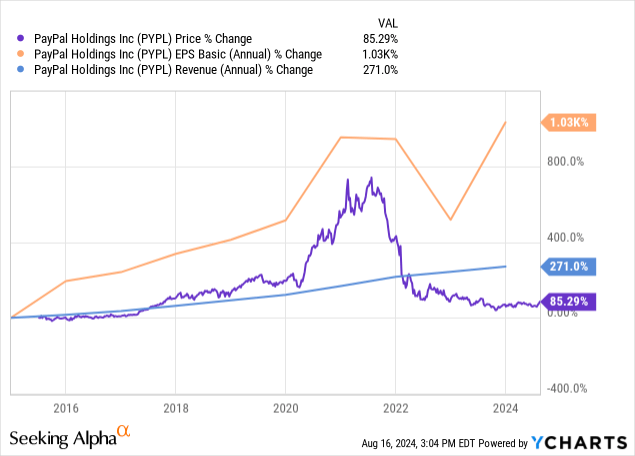

- Paypal is trading below it’s long term growth trend lines in revenue and EPS growth.

- The company recently beat and raised, leading to the trajectory in share price since the last earnings call.

- Even with the price increase, the stock still trades at a more than 9% free cash flow yield or 7.1% when backing out share based compensation.

- The company is still near -80% off it’s highs with a fortress balance sheet to boot.

Chainarong Prasertthai

Great trends

Having previously covered Paypal (NASDAQ: PYPL) in November of 2023, the stock is up but not as much as I would have imagined and remains undervalued. Starting off any good analysis with the measurement of price growth [expectations] to revenue and earnings growth [reality] shows that the market has given up any hope for future Paypal growth trends for the most part.

In my opinion, PayPal is way too young to be considered a stogy old stock at this point, and digital payments along with buy now pay later remain an ever-growing trend. During the height of COVID-19, the price growth of the stock ran well ahead of revenue but has now collapsed even below top-line measures of profitability. With the young and newly minted CEO Alex Chriss at the helm, I continue to bet that PayPal’s best days are still ahead of it.

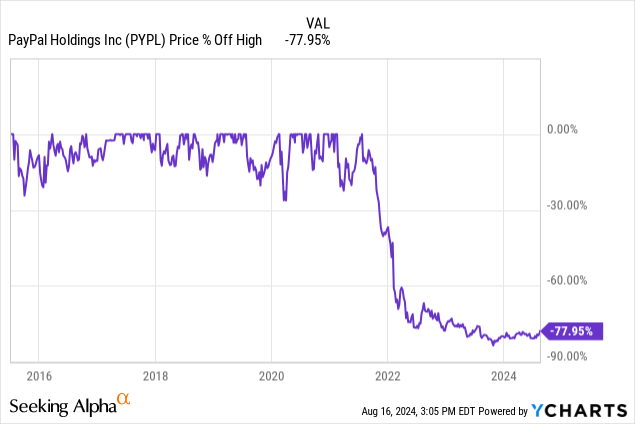

Percent off high

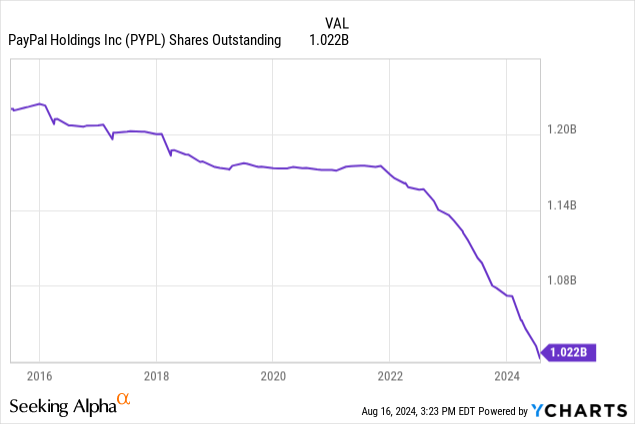

When I first wrote about Paypal the stock was more than -80% off it’s high. As I have reiterated in other articles, collapses in price this large where revenue remains in tact are far more attractive than betting on private equity in my opinion. As long as the investor is not being diluted as a second factor, that is all I ask. In this case not only is the investor not being diluted, they are actually seeing increases in shareholder equity as the company buys back shares.

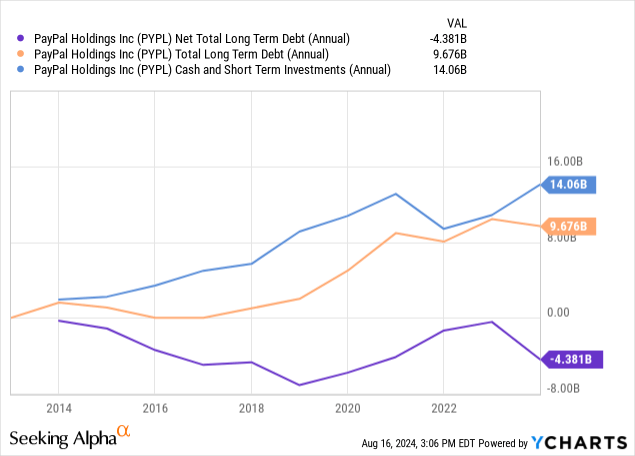

Fortress balance sheet

Additionally, the company runs a fortress balance sheet with cash and short-term investments running ahead of long-term debt. Net debt is at -$4.38 Billion due to this and the company actually collects $235 million in net interest income! I would love the comment box to populate with other -80% ish off all-time high ideas with all of these factors combined. I’ll buy those too.

Recent earnings sent the stock higher

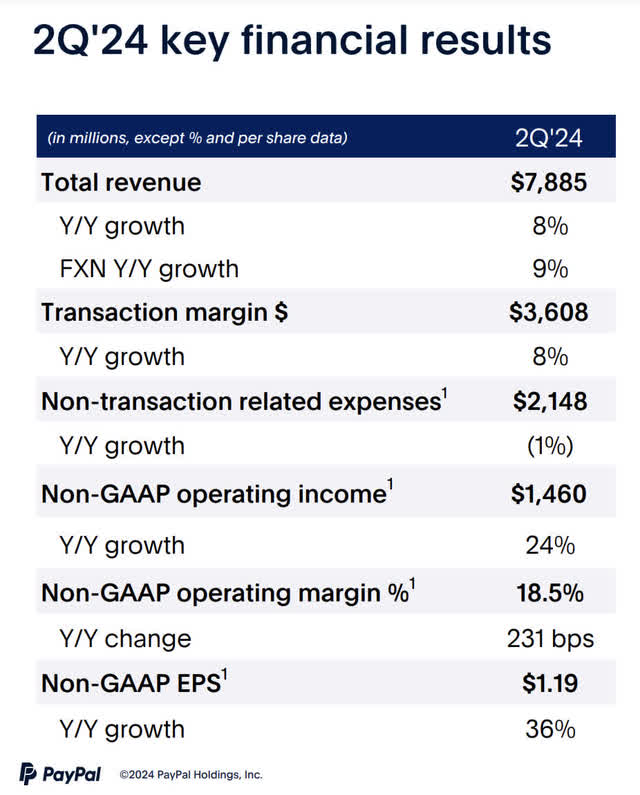

PYPL 2Q-24 Earnings Presentation

These are all things the market wanted to hear. Growth in branded checkout and Venmo. Leftover FCF from cost savings is being put back into the business to grow revenue drivers. Raises in FY’ 24 guidance for EPS and free cash flow and increased share repurchases at these dirt cheap prices.

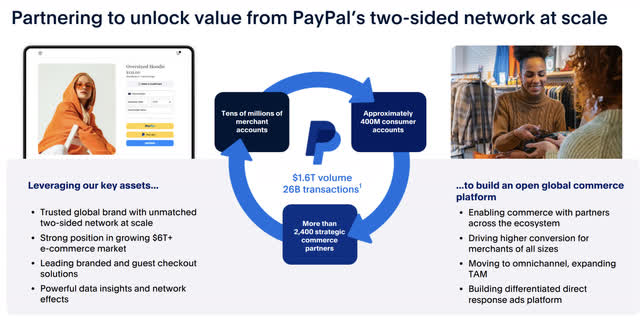

PYPL 2Q-24 Earnings Presentation

It’s mind-blowing to sit down and realize how many global transactions PayPal touches. $1.6 Trillion in volume and 26 Billion transactions.

Branded checkout continues to be a nice growth factor and is an attractive business diversifier versus typical credit card companies that do not participate in the terminals for transactions. As more and more small businesses opt for nontraditional payment terminals, this is an excellent growth TAM to pursue.

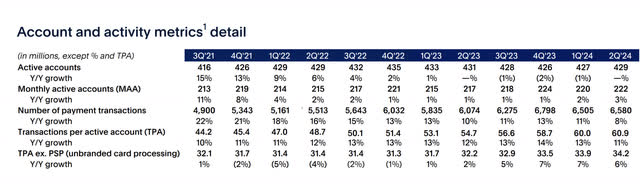

PYPL 2Q-24 Earnings Presentation

As many would point out in bear cases for Paypal, active and monthly accounts have stalled in growth. However, we can see very positive trends in the increases in payment transactions and transactions per active account.

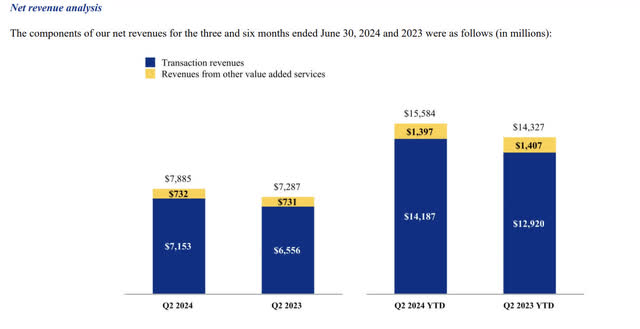

Transaction revenues: Net transaction fees charged to merchants and consumers on a transaction basis based on the TPV completed on our payments platform. Growth in TPV is directly impacted by the number of payment transactions that we enable on our payments platform. We generate additional revenue from merchants and consumers: on transactions where we perform currency conversion, when we enable cross-border transactions (i.e., transactions where the merchant and consumer are in different countries), to facilitate the instant transfer of funds for our customers from their PayPal or Venmo account to their bank account or debit card, to facilitate the purchase and sale of cryptocurrencies, as contractual compensation from sellers that violate our contractual terms (for example, through fraud or counterfeiting), and other miscellaneous fees.

Revenues from other value added services: Net revenues derived primarily from revenue earned through partnerships, referral fees, subscription fees, gateway fees, and other services we provide to our merchants and consumers. We also earn revenues from interest and fees earned on our portfolio of loans receivable and interest earned on certain assets underlying customer balances.

PAYPAL HOLDINGS, INC. 10Q

Here we can actually see that the majority of growth within Paypal is occurring organically with increased transaction revenues. Revenues from other value-added services are flat. This shows an increase in demand for the core product of Paypal’s transaction processing lineup rather than non-core influences. While the user trend may be relatively flat, those users are making more transactions.

PYPL 2Q-24 Earnings Presentation

PEG ratio valuation

Looking at year over year growth for the company we can see the top line up about 9%, the non-GAAP margins increased 2.31% and Non-GAAP EPS grew 36% to $1.19. Let’s take a look at some PEG ratio scenarios based on FY 24 to FY 25 earnings growth rates:

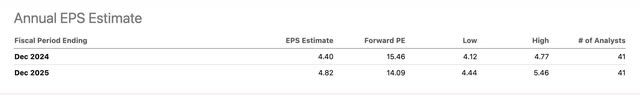

Seeking Alpha

Paypal has now beat on 3 of its last 4 quarters, but for the sake of brevity, let’s say the average analyst estimate of $4.40 is accurate. We know the company is both reinvesting more than originally thought as per new guidance and buying back more and more shares at suppressed values. These are all things that should enhance growth rates. If PayPal were to come in at the high 2025 number of $5.46 a share, that would be a growth rate of 24% in EPS year over year.

As a fair PEG ratio of 1 or less is what we aim for when buying growth stocks, the model is simply the P/E divided by the growth rate [dropping the percent sign], we can thus use 24 as the multiplier and $5.46 as the multiplicand.

In this case [if you are in the bull camp], the fair value where PayPal is trading at a PEG 1 to FY 2025 EPS growth would be 24 X $5.46 = $131.04. This would be the bull case scenario of a PEG 1 on high-end guidance.

I am personally in the bull camp and see continued buybacks being the key to hitting high-end analyst estimates in the coming year. A price lingering in the low $60s is very beneficial to this thesis in general and will help PayPal clear this hurdle and also improve free cash flow per share with now around $6 Billion in buybacks scheduled.

Free cash flow

Speaking of free cash flow, the company is generating $6.4 Billion in free cash flow on a TTM basis, or $6.27 a share. With the stock trading at $68, this is a free cash flow yield of 9.2%, a number that is relatively unheard of in tech or fintech-related stocks. Yes, there are criticisms of stock-based compensation enhancing this number but the company has also been buying back net shares over compensation outflows.

So, even though there are buybacks in the pipeline, let’s still take a look at the free cash flow yield backing out the SBC.

- TTM SBC= $1,430 million

- TTM Free cash flow= $6,406 un-levered

- $6,406-$1,430= $4,976

- 4,976 divided by 1,022 shares outstanding $4.86/ share

- 7.1% free cash flow yield based on a $68 share price backing out share based compensation.

With the current risk free rate dropping to 3.89% on the 10 year Treasury, a 7.1% yield with only improvements to come from here is very attractive.

Summary and risks

Risks in my opinion are mostly headline risks.

Not executing on growth visions, market share being taken by rivals like Square (SQ) or soon to IPO Klarna are all risks in a crowded fintech space.

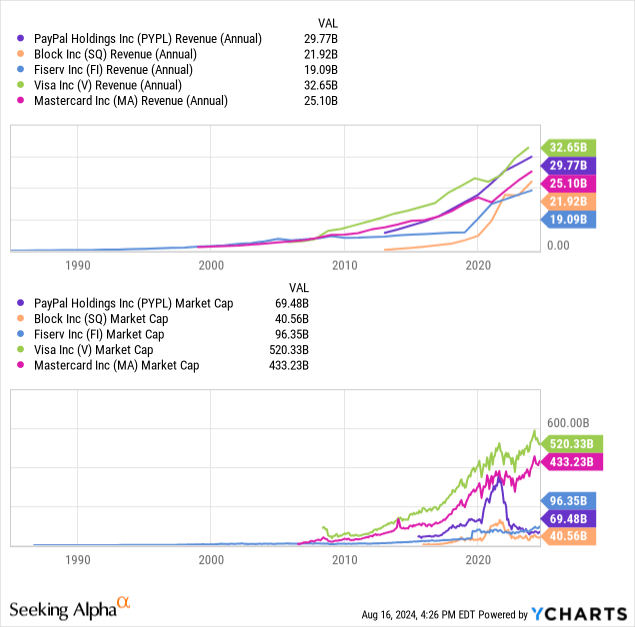

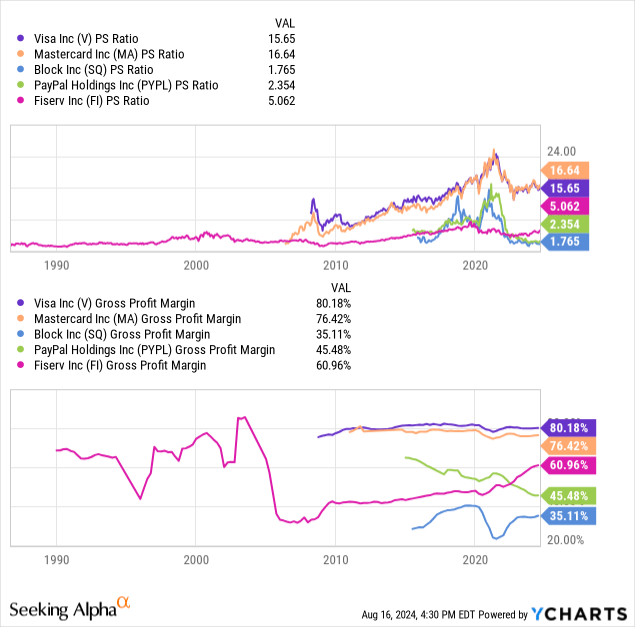

Paypal remains amongst the leaders in financial transaction revenue, but the cheapest on a price-to-sales basis. This is very easy to visualize when comparing the market caps of the company to the revenue.

The market thus puts far less value on a dollar of revenue for Square or Paypal than it does for Visa (V) or Mastercard (MA). With Paypal trading at 1.76 X sales, it is largely because each dollar of revenue has much lower gross margins than the “plastics“.This can be seen below.

However, gross margins are improving as noted on the most recent earnings call tothe tune of 2.3% year over year. Sooner or later, online payment companies may be able to put enough pressure on the sector that all of these payment methods meet in the middle. Visa and Mastercard retract while the digital payment companies trend upward. If they all settle around 60-70% gross margins, society would still win as a whole in the cost of doing business.

The stock is cheap and still growing. It is still a buy at these levels.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, V, MA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information provided in this article is for general informational purposes only and should not be considered as financial advice. The author is not a licensed financial advisor, Certified Public Accountant (CPA), or any other financial professional. The content presented in this article is based on the author's personal opinions, research, and experiences, and it may not be suitable for your specific financial situation or needs.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.