Summary:

- PayPal is a leading company in the digital payment marketplace.

- This market is anticipated to grow significantly up until at least 2032 and PayPal is set to take a significant portion of that market.

- PayPal has a history of strong performance, a solid financial position and has a bright future ahead.

- The main risks are that PayPal operates in a competitive landscape, as well as the potential risk of new regulatory requirements that may come up in the future to affect PayPal’s business model. The previous CEO has also just left at the end of September, which raises an element of uncertainty.

- I’ve calculated the fair value of PayPal’s share price to be approximately $129.43 and believe this company is currently significantly undervalued.

Editor’s note: Seeking Alpha is proud to welcome Financial Odyssey as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Justin Sullivan

Introduction

Unless you’re hiding in a secret underground lair plotting your evil schemes, you’ve most likely heard of PayPal (NASDAQ:PYPL). In fact, there’s even a good chance that you’ve used PayPal’s digital payment services at one point or another – unless you’ve been paying for everything with jars of pocket lint (not recommended).

But let’s address the elephant in the digital payment room: Is PayPal a company worth investing in? I’ve taken a deep dive into what PayPal does, what their financials look like and their future prospects and have come away very bullish. They have opportunities to retain and take market share, the risks can be managed – and I estimate an intrinsic value of the stock to be $129.43. Let me walk you through why I believe this to be the case.

What’s PayPal’s opportunity?

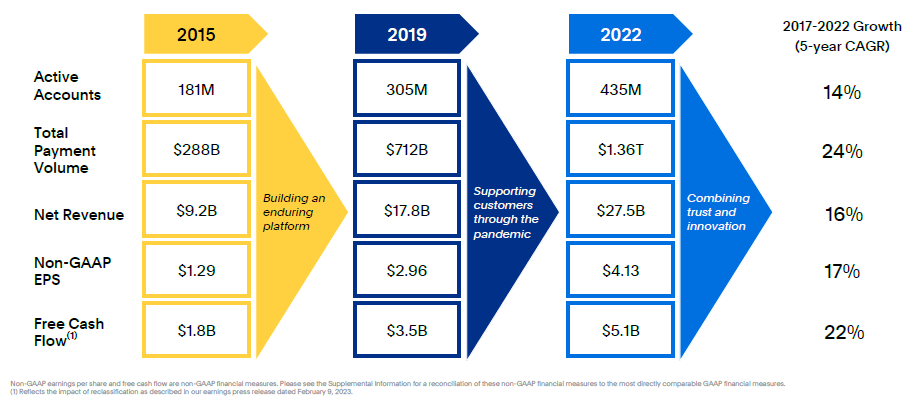

As of the end of 2022, the global digital payments market size was valued at approximately $103 billion USD. This is forecasted to grow at a CAGR of 20.8% to reach around $510 billion USD by 2032. As per the below screenshot from PayPal’s Q1 investor presentation, PayPal has a history of strong performance since 2015 and have given no reason to suggest that they will stray off this path:

PayPal’s Q1 investor presentation

Also of note is the substantial increase in total payment volume (TPV), which is a key indicator for the amount of market share PayPal is getting its hands on. As the name suggests, TPV is the total value of all transactions that are processed through PayPal’s various systems. As long as this is still growing at a reasonable rate each year, then PayPal will still be a leading player in this market. Their recent Q3 is still showing growth in this metric, with approximately $388 billion USD in TPV – a 15% increase y/y. Even more impressive is the fact that they’ve processed a total payment volume of $1.5 trillion USD in the trailing 12 month period, which is estimated to be around 15% of the $9.5 trillion total transaction value in the digital payments market.

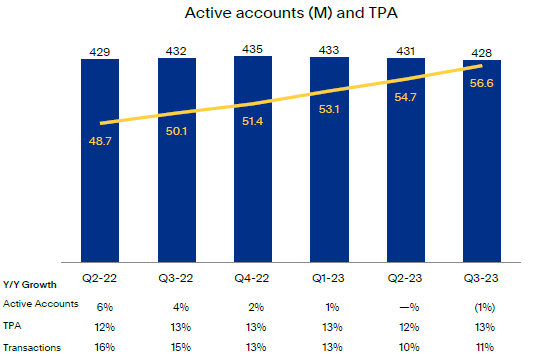

One metric that is concerning is the recent decline in active account growth. As of Q3 of this year, the total active account number was around 428 million – which is actually a decline of 4 million since the same quarter last year. I definitely would prefer this number to be increasing, however keep in mind that this is offset by the continual increase in TPV (as mentioned earlier) as well as the growth in Transactions Per Account (TPA) – which is primarily due to the continual adoption of PayPal Braintree. These numbers are more important than active accounts in my opinion, as it demonstrates the important principle of “quality over quantity” as well as shows PayPal is continually being utilized to process more and more transactions. This relationship can be visualized in the below screenshot from PayPal’s Q3 investor presentation:

PayPal’s Q3 investor presentation

It should be noted that the rapid increase in TPA is due to PayPal’s innovation – most notably transaction growth from Braintree. Speaking of Braintree, this is a fantastic opportunity for PayPal to capitalize on. In short, Braintree is a complete payment platform (both front and back end) that provides tools for developers to build and integrate payment solutions into websites and mobile applications. Braintree allows transactions in multiple currencies and payment methods (such as Visa and Mastercard) and is well suited for use on mobile phones – which is important given the rapid adoption of payments on mobile devices. In addition to being simple to use at the checkout, all of these combine to make Braintree incredibly user friendly for both consumers and businesses.

Another factor to consider is PayPal’s opportunity to grow market share. PayPal’s CEO Alex Chriss stated in their Q3 conference call that approximately 70% of all adults in the US have used PayPal in the last 5 years. In case that doesn’t hammer home the trust that PayPal has earned, it’s estimated that PayPal controls approximately 41% of the market share for online payment processing technology – with Stripe coming in second place with around 20%. This will give them a significant edge going forward and should also give them trust in the international markets that are still developing to this day.

This leaves the big question – will this strong growth continue into the future? Unfortunately for PayPal, I don’t think this is the case. While in my opinion PayPal will remain a growth company (where growth was also reiterated to be PayPal’s focus by Alex Chriss in the Q3 earnings call), I think their days of high growth are in the past due to the reasons which I’ll cover in the next segment.

What about PayPal’s management team?

I’ve had a look through PayPal’s management team and didn’t notice anything out of the ordinary – all seasoned individuals as you’d might expect from a company of this size. Dan Schulman’s departure as CEO and Alex Chriss taking the reigns in September was a big shakeup of the management team for obvious reasons. Love him or hate him, you can’t deny that this man has been an effective leader since becoming the CEO in 2014. There are definitely a few thoughts that run through my mind about this.

During the Q4 2022 conference call, Dan mentioned that he thinks that PayPal is in a strong position to succeed in the coming future years. I have no doubt that he believes this – considering he currently owns nearly 400,000 shares of PayPal. I doubt he would leave the company in the hands of someone incompetent. Dan was also on the board of directors and gave his support for Alex to take over.

I’m sure Alex will be the appropriate person for the job. He sounded very enthusiastic in the latest Q3 earnings call and has a proven track record when he was VP at Intuit. Obviously we will need to continue to monitor his performance and decisions over the next few months, but assuming that this doesn’t turn to custard, then this could be a huge catalyst for the share price one he settles in and we see it’s either business as usual – or even business booming.

On the flip side, if Alex doesn’t perform, then this could severely impact PayPal’s future growth. I honestly believe this scenario is unlikely, but you never know. Alex could decide to switch PayPal’s business model to making super-sized straws for giraffes – which I think may be… less than ideal.

As stated, this is an ongoing situation that will need to be monitored closely, however I don’t anticipate there being any major issues with Alex’s leadership. While it will definitely be concerning for the next few months, I think that it’s more likely to be a catalyst for share price appreciation once we see PayPal continue on the right track.

What about PayPal’s financial position?

PayPal is in a very strong financial position. While taking a look at their latest income statement, balance sheet and cash flow statement I didn’t notice anything that raised an immediate red flag.

Their recent quarter was also incredibly strong, as they beat on both revenue (of $7.42 billion) and GAAP EPS (of $0.93) estimates. They’ve also raised full year guidance for their GAAP EPS to $3.75. I have however found 2 downsides so far. The first is that during Q1 of this year, PayPal reduced their guidance for their non-GAAP operating margin expansion from 125bps to 100bps due to the unbranded payment solutions (i.e. Braintree and PPCP) – which, as mentioned earlier, are currently providing PayPal with their rapid increase in TPA. Slightly sacrificing operating margin expansion for the sake of remaining relevant is fine with me. The second was during the recent Q2, where they actually reported a negative free cash flow – which was a nasty shock. However, a negative FCF of $1.2 billion was incurred due to their adjustment from European buy now, pay later (BNPL) loans originated as held for sale. These are expected to be sold during the second half of 2023. This is overall a good move in my opinion as it will help to de-risk PayPal’s balance sheet in the long term for the sake of some seemingly bad numbers in the short term.

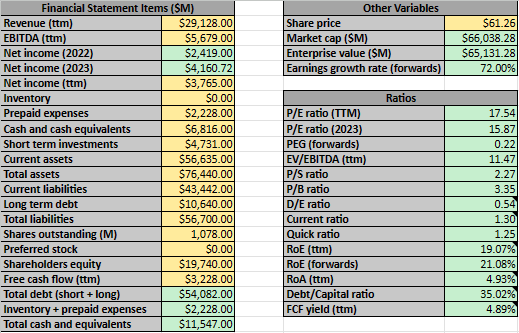

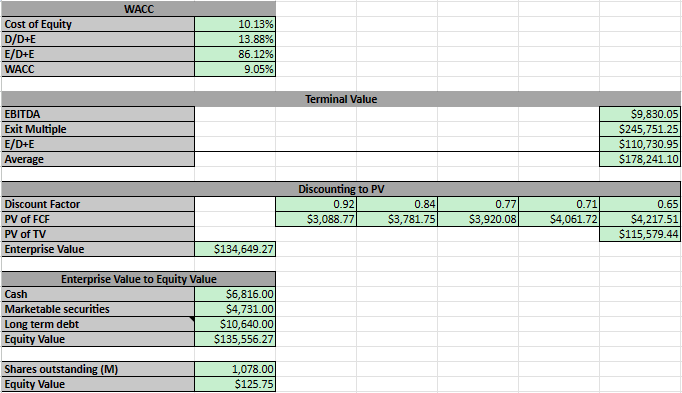

PayPal’s balance sheet is also in a strong position, with approximately $11.5 billion in cash and cash equivalents and $10.6 billion in long term debt. I’ve taken a few key metrics and outlined them in the table below, along with a few important ratios that I’ll discuss. In case you were wondering, the yellow cells indicate information I’ve input and the green cells are output cells via the relevant formula:

Author’s calculations

Regarding the above ratios, the stock is not trading expensive by any means. PayPal has historically traded anywhere between a trailing P/E of 25 to 100 – although anything over 65 is an extreme overvaluation in my opinion and therefore won’t be considered. Given PayPal’s current TTM P/E of 17.54, we’re currently at an extremely low valuation. The projected PEG is also below 1.0 by a huge margin, which is fantastic.

PayPal has also historically held an EV/EBITDA of 15 to 60 – so currently being at a 11.47 EV/EBITDA suggests an undervaluation. Another thing to factor in is that the industry median trailing P/E is approximately 35 and industry median EV/EBITDA (TTM) is approximately 17. These are both good signs that the stock could be a buy.

Regarding the balance sheet ratios, the majority of these are in excellent condition – if not at least within acceptable parameters.

What’s PayPal’s intrinsic value?

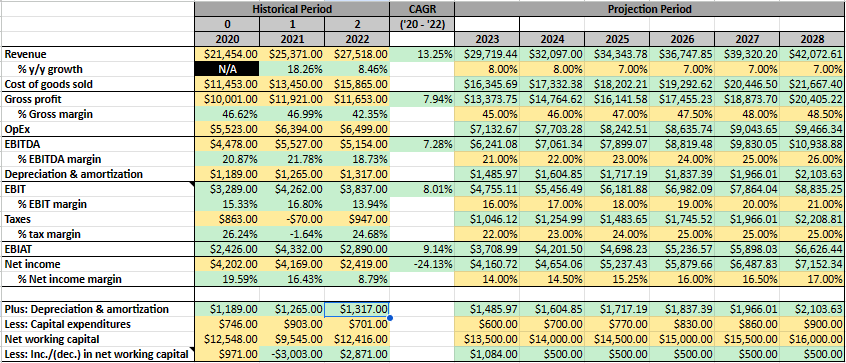

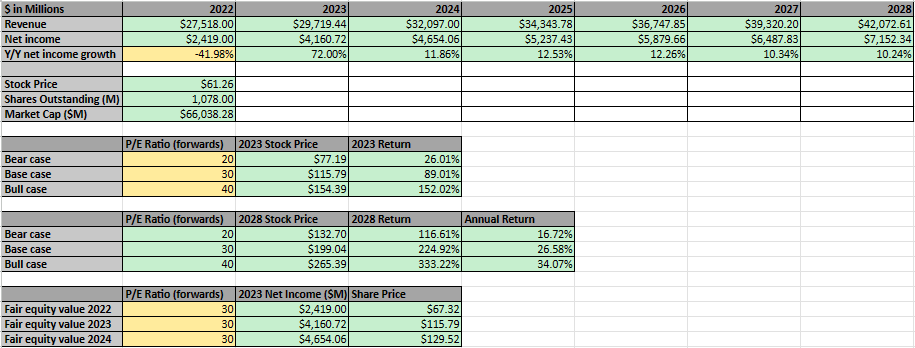

I’ve decided to undertake 3 different approaches to determine the fair value per share of PayPal stock: A net income analysis, a EV/EBITDA analysis and a DCF analysis. But firstly, please see the below financial projections, which I’ll provide a brief discussion on:

Historical financials and projections

Author’s calculations

I’ve decided to lean towards the conservative side of projected revenue growth, where there will be an increased 8% y/y for 2023 and 2024, followed by 7% per year for the remainder of the projection. Judging by how the digital payments market is projected to grow into the future, PayPal should have no trouble hitting these numbers.

I’ve also decided to increase margin expansion by around 100bps or so each year. I specifically focused on using this for the EBIT to reflect the guidance we’ve been given on operating margin expansion decreasing from 125bps to 100bps. Based on the recent GAAP EPS guidance of $3.75, I’ve decided to use this as the baseline net income margin for 2023 and then reverse engineer the EBIT margin to get around 16.00% – which I believe to be somewhat accurate. I’ve also slightly increased CapEx and maintained the change in net working capital at a constant rate over the span of my projection. I’m sure these numbers will jump around a bit, however these should be conservative.

Net income analysis

I’ve put together the below net income analysis based on the above projections:

Author’s calculations

I’ve decided that PayPal currently should have a base case forward P/E ratio of around 30. PayPal is a solid company that will reliably increase revenues and print cash flow/profits. Companies like these never trade at a “fair P/E” – see Tesla, Nvidia, Apple, Amazon, etc. The list of companies is near limitless. This also places it within the 25 – 65 P/E range I stated earlier.

Assuming they hit their $3.75 GAAP EPS they’ve guided for the year 2023, the fair price for PayPal currently should be around $115.79 – which gives us a 89.01% upside from the current price.

It should also be noted that if my projections are correct, a 30 P/E ratio will allow the stock price to reach $199.04 by 2028 – implying a 224.92% return in 5 years which is something we shouldn’t ignore.

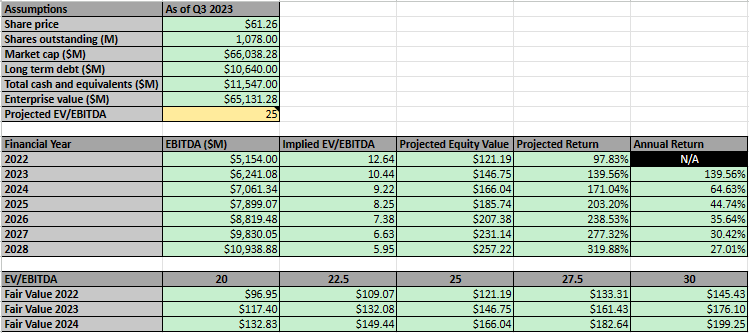

EV/EBITDA analysis

I’ve put together the below EV/EBITDA analysis based on the earlier projections:

Author’s calculations

I’ve decided that a EV/EBITDA of 25 should be fair for PayPal. This is above the 17 average for the S&P500, but as I stated earlier this should trade at a premium. Given PayPal has historically held an EV/EBITDA of 15 to 60, I believe that this is more than fair.

As such, the fair value for PayPal should be around $146.75 per share based on the projected EBITDA for 2023. I’ve also conducted a mini-sensitivity analysis for the EV/EBITDA – in case you believe this should be lower/higher than 25.

Furthermore, assuming my EBITDA projections are on point, it’s implied that the stock price should reach $257.22 by 2028, which implies a solid return could be in the making.

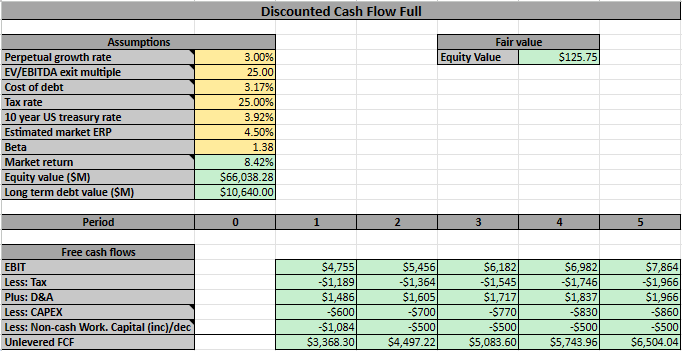

DCF analysis

I’ve put together the below DCF analysis based on the earlier projections. Please note that I’ve calculate the terminal value using the average of the EV/EBITDA exit multiple method and WACC method:

Author’s calculations Author’s calculations

I believe a 3% perpetual growth rate is fair for PayPal – which is between the average inflation rate and GDP growth rate of 2.9% and 3.2% respectively. You could make an argument that I was conservative with my revenue growth rate up to 2027 and therefore this could be slightly higher. I’ve adjusted for this in my sensitivity analysis later on.

I believe a 25 EV/EBITDA exit multiple is appropriate for PayPal. I can definitely understand both arguments for why this should be higher or lower – however, I believe this is a fair compromise between the two.

I calculated the cost of debt from PayPal’s latest 10-Q and used an effective tax rate of 25% based on historical averages. I’ve also chosen the 10 year US treasury rate as the risk free rate, which was 3.92% at the time of writing.

PayPal’s current agreed beta is 1.38 according to various financial services and I used a market return of 8.42% as not only does this lie within the within the average annual returns for the S&P 500, but it also is an approximation of the risk free rate added to the current estimated market ERP (currently around 4.5%)

Using these numbers, I’ve calculated a fair share price of approximately $125.75. As stated before, I believe that my numbers aren’t unrealistic and it’s entirely possible PayPal grows their revenue faster or is even more profitable than I’ve predicted

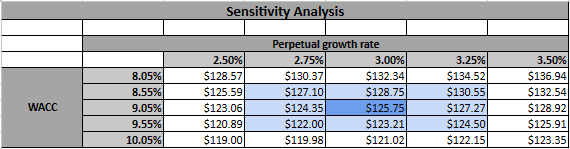

I’ve also conducted the below sensitivity analysis, should any of you want to move the numbers a bit:

Author’s calculations

Overall, it’s possible that we could drop the share price up to between $119 and $123 if you believe I’ve been too aggressive with the perpetual growth rate or the WACC. However, I’m happy sticking with the $125.75

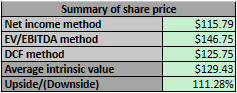

Average share price

As per the below screenshot, the average of these 3 methods gives us a fair share price of $129.43 – marking a 111.28% upside from the current share price. This therefore implies that PayPal is significantly undervalued and (in my opinion) a strong buy.

Author’s calculations

What are the risks?

Although the fundamentals of PayPal appear to be strong, there are definitely some risks involved.

The non-GAAP operating margin guidance being decreased from 125bps of growth to 100bps is a red flag. If we see this (or other profitability metrics) start to drop consistently without justification (for example, we don’t see acceleration in revenue growth to mirror this decline), then caution will need to be exercised.

The negative free cash flow print in the most recent quarter. Although this should be a one time metric due to the previously mentioned reasons, I don’t want to see this to become a pattern.

The new CEO performs poorly. If over the next few quarters we start to see y/y comps significantly deteriorating and only receive excuses in return, it may be time to mourn Dan Schulman’s departure and part with our PayPal shares. I do think these are all low risks, however they are risks nonetheless.

PayPal needs to stay on top of consumer trends, ensuring that they stay relevant and don’t lose necessary ground to the competition.

Lastly, they need to ensure they stay on top of the evolving regulatory environment. A good example of this is the Brexit situation – as the U.K. has now left the EU, new laws and regulations may be put in place that could affect PayPal’s ability to do business in the U.K. This must be managed appropriately because (as per PayPal’s latest 10-Q) the U.K. currently accounts for around 7% of PayPal’s revenue, which could be a significant hit to PayPal’s business if they drop the ball.

Conclusion

Based on the analysis I’ve conducted, I believe PayPal is a strong buy and I’ve added this to my portfolio. The company is a market leader and should have no trouble increasing their revenue and profits going forwards – especially when considering that the digital payment market is still in its growth stage.

PayPal has had performance issues in the past (besides the last few quarters) and there are some risks in its business model – and if you believe the stock should be a sell based on this situation then that’s a fair opinion. But should it be sold off to such a level that it now implies an intrinsic value over 100% higher than the current share price? This is a growth stock trading at value stock prices and it makes no sense.

Buying stocks is like telling a joke at a party. You never know if it’ll go up or down, but if you believe in the punchline, you’ll keep buying. This is one stock that I believe has a strong punchline and look forward to the upside in the future.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.