Summary:

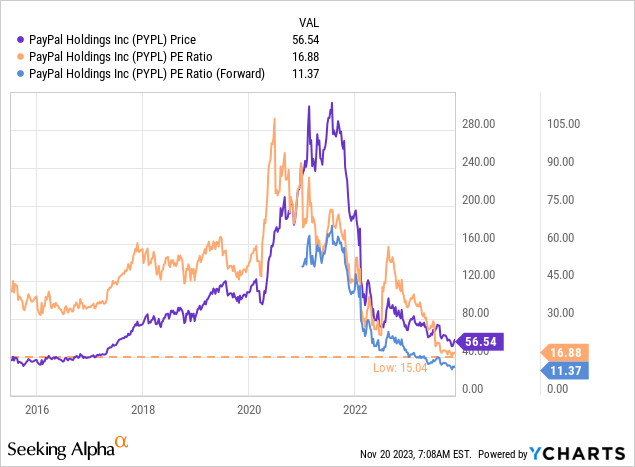

- PayPal’s stock is trading at its cheapest level ever, with a forward price-to-earnings ratio of 11.3x and price-to-free cash flow of 11.5x, making it the most discounted among competitors.

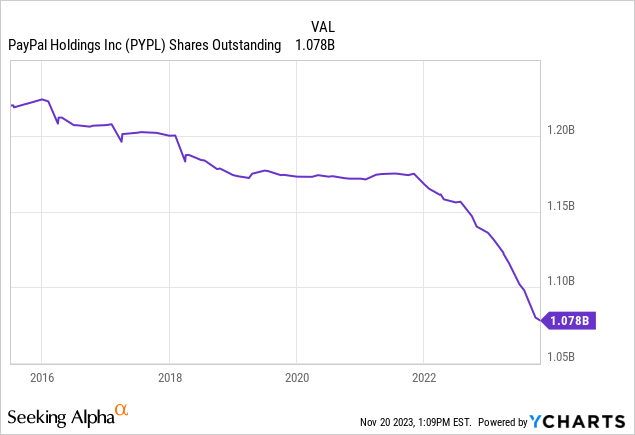

- Despite a decline in stock price, PayPal’s revenue and net income keep growing, and this creates the opportunity to buy back shares at attractive prices to reward shareholders.

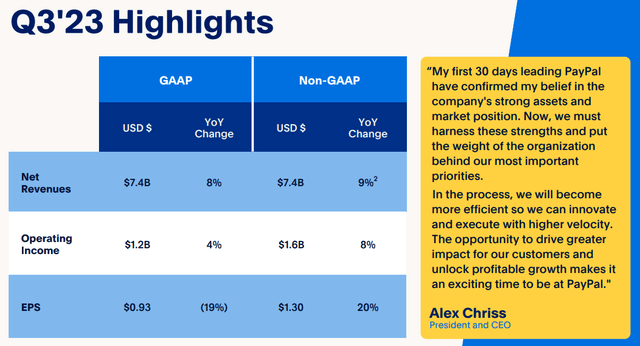

- The new CEO, Alex Chriss, has made his first appearance in the earnings call and showed the steps he is going to take to re-accelerate profitable growth.

JasonDoiy

PayPal (NASDAQ:PYPL) has seen some rapid moves up and down over the course of its time on the stock market exchange. However, we believe the stock is now trading the cheapest it has ever been. Not only by reason of the price decline, but also by the fact that PayPal has shifted focus heavily towards cost efficiencies. With the stock price trading at only 11.3x forward earnings, most of the downside looks to be priced in. Revenue and net income keep growing, while the company remains buying back shares. The new CEO has laid out a thorough plan for us to reaccelerate PayPal back to profitable growth.

Resilient Business

Despite PayPal’s fall from stock market darling in 2021 to one of the most unloved stocks in 2023, the company’s business performance does not reflect the same decay. Revenue grew high single digit by 9% year-over-year on a constant FX basis and non-GAAP EPS grew 20% to $1.30. GAAP EPS year-over-year comparison is incomparable because the third quarter of 2022 had a $0.34 positive impact. If we compare these numbers to the third quarter of 2021, when the stock price hit $300 a share, then revenue increased from $6.18B to $7.4B (close to a 20% increase) and non-GAAP EPS increased from $1.11 to $1.30 (17% increase). A positive change in fundamentals compared to a negative change in stock price is what value investors like to see.

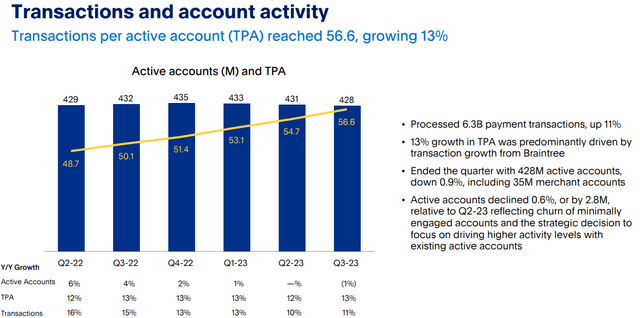

The total payment volume increased 13% FX neutral, mainly driven by the strong performance of Braintree which grew 32% quarter-over-quarter. One of the fears investors have is the decline in active accounts. It is important to notice that PayPal has reallocated spending and deprioritized the acquisition of customers in parts of Latin America and Southeast Asia, together with deleting in-active accounts. However, transactions per active account keep increasing at a steady pace, which is a clear positive.

The interim CFO, Gabrielle Rabinovitch, mentioned in the third quarter earnings call:

As a reminder, we said this would be a year where we churn off lower-quality actives and, in which, total accounts would decline. Year-to-date, churn has been lower than our expectations. Customer growth is a vital pillar of our growth agenda. We’re an organization focused on serving our customers and improving our value proposition, and we’re positioning ourselves for a return to growth in our customer base.

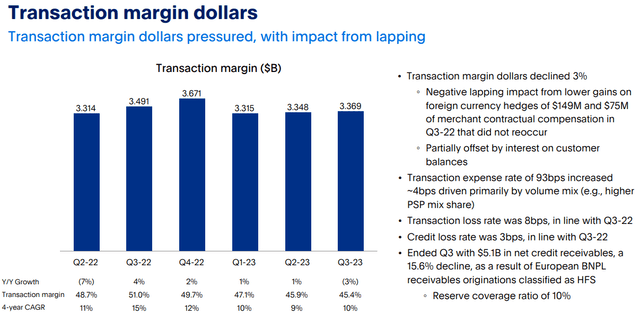

A second worry of investors is the decline in transaction margin. The reason for the decline is the change in product mix. The branded or higher margin business has been growing slower than expected, while the unbranded “Braintree” or lower margin business has been performing above expectations. Therefore, the transaction margin saw a decline alongside an increase in revenue.

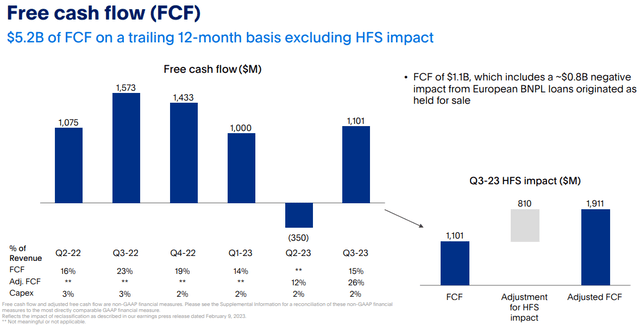

While at the surface the free cash flow generation in the third quarter looked mediocre, it was impacted by the sale from the European buy now pay later loans. Excluding the impact of the sale, free cash flow accounted for 26% of revenue and increased 21.5% year-over-year. Compared to 2021, free cash flow increased by 47%. The free cash flow growth was one of the things that impressed me the most in the third quarter.

Overall, the business is doing alright. There are definitely working points and PayPal’s new CEO, Alex Chriss talks about it in the latest earnings call:

To give you some additional context, here are a few of my initial observations. On our employees. Our people are kind, caring, dynamic, innovative, and engaged. They care deeply about our customers and one another, and are energized by our mission. My focus is to clearly define our mission, vision, and purpose and unleash this team to execute a clearly defined and durable strategy. We will establish and refocus systems and processes to galvanize the entire organization behind our purpose and growth outcomes.

On our customers and innovation, I generally see our customers falling into three categories: consumers; small businesses; and large enterprises. When looking at our customers through this lens, each segment has unique assets and a multitude of growth opportunities. I’ve been encouraged by how much innovation our teams are delivering, but we have an opportunity to, a, focus our teams on what’s most important to these customers; and, b, package our innovation in a way that is clear and differentiates us in the market.

The strategy going forward will be around scaling back the focus to three key areas, increase the synergies inside the company with the assets PayPal currently has and use data effectively with assistance of AI. I am a big fan of what Alex showed us in the earnings call with only one month of presence in the company. The next quarters will be important to further convince investors that Alex is the right man to shift PayPal back into growth mode.

Valuation

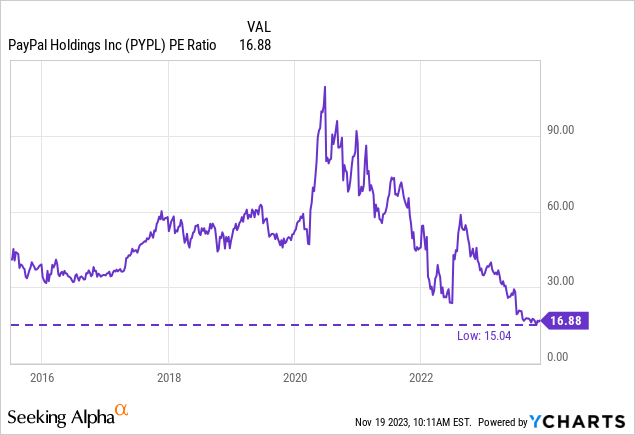

Zooming in on the valuation aspect, we can see that PayPal is trading the cheapest it has ever been. The price-to-earnings ratio is 16.8x and the forward price-to-earnings ratio is 11.3x.

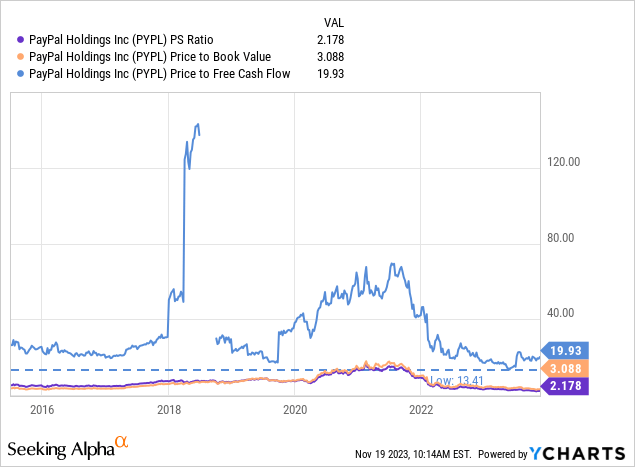

Furthermore, the price-to-sales ratio, the price-to-book value and the price to free cash flow ratio are also at all-time lows. Do not forget PayPal’s free cash flow has to be adjusted to exclude the sales of the BNPL loans. If we do the calculation ourselves, the price-to-free cash flow is $60.958B/$5.2B or 11.7x, which is extremely cheap and below the all-time low of 13.41x.

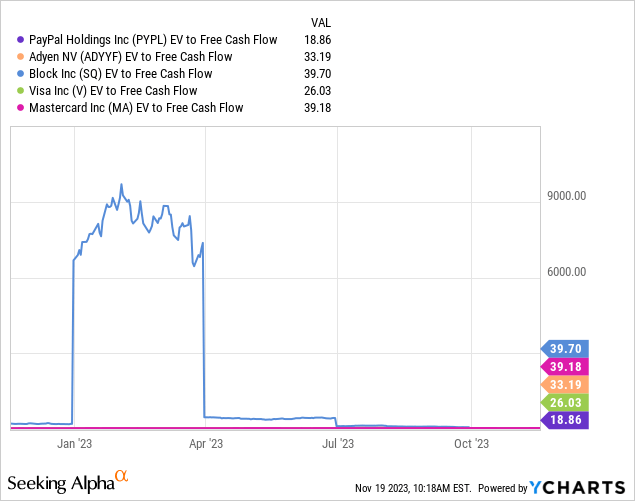

Surprisingly, when comparing the company with peers, PayPal is by far the most discounted business. The gap in valuations widens even more, if we use the free cash flow excluding the sale of the BNPL loans. The adjusted EV-to-free cash flow is $60.060B/$5.200B or 11.5x. Peers are priced between 2-4x more expensive. The free cash flow yield of 8.5% is more attractive than ever for investors.

Strong Balance Sheet & Large Buybacks

PayPal balance sheet is pretty strong given the fact that their total current assets equal their total liabilities. Further, long-term debt can be paid off within two years with free cash flow generation if necessary.

After the immense drop in share price, PayPal has been focused on buying back shares through the buyback program, as the management feels the company is trading under its intrinsic value. This is made possible by the high free cash flow the business is producing (26% of revenue). In the trailing 12 months PayPal bought back $5.4 billion of shares, showcasing commitment to shareholders. Nonetheless, stock-based compensation is ruining a part of the party. In the trailing 12 months, stock-based compensation has consumed $1.46 billion of the shares bought back, decelerating the effect of the buyback initiatives. As the business grows further, I would like this number to stay stagnant, because the current percentage of SBC’s is not healthy.

Takeaway

PayPal transformed from an expensive growth company to a value play with moderate growth. The first signs of the new CEO are promising and his straight forward attitude will be a key role in changing the business for the better. The decline in transaction margin is slowing down and could reach a turning point in the coming quarters along with the decrease in active accounts. While the cost base of PayPal remains high, Alex is planning to make the company leaner, more efficient and driving greater innovation and impact for customers.

PayPal is a cash flow machine and Venmo has become a verb. Even if Alex’s efforts do not play out, the stock should see limited downside from here due to the large share buybacks and the discounted valuation.

I rate PayPal a “Strong Buy” at today’s prices. I feel rather confident that the new CEO will perform well considering his passion and drive to create value. The stock price is currently rather stagnant as investors are waiting to see more of Alex. Once progress will be visible in the next quarters, we should start to see positive momentum in the stock and might see large investors pick up shares.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not a financial advisor. Investing is your own responsibility. I am not accountable for any of your losses.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.