Summary:

- PayPal’s stock has been performing poorly despite analysts raising their expectations for the company’s financials.

- Skepticism surrounds PayPal’s operating margins, true growth potential, ability to monetize Venmo, and ability to retain accounts.

- Addressing these concerns is crucial for PayPal’s stock to improve, and new management needs to focus on these areas.

chameleonseye

Overall Thesis Summary

Back in June, we outlined why we remained optimists and bulls on PayPal. Our thesis is generally pretty simple. You’re looking at a business expected to deliver $5 billion in FCF this year, a business with (we believe) large network effects with >400m users and >30m merchants on platform, a business with overstated competitive threats, and continues to have access to growth levers (higher eCom penetration and Venmo optionality to just name a couple).

Our thesis at its core has not been changed, but challenged. While we think eventually Wall Street will have a perspective shift on the stock, we’re not at that point yet, and it’s going to take (like we said in June) execution.

Premise – Something’s Broken, What Is It?

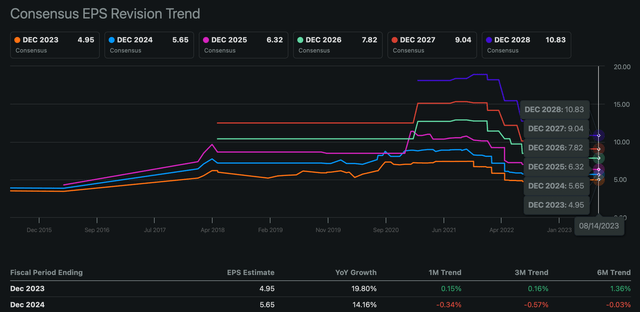

If you mapped the last couple of quarters of PayPal’s (NASDAQ:PYPL) stock price performance against the business estimates, you would find a surprising trend. As analysts continue to leave estimates at least unchanged, if not raise their expectations for PayPal’s top and bottom line, the stock has moved in the opposite direction.

PYPL YTD (CNBC) PYPL Cons. EPS Estimates (SA Premium)

These aren’t the trends of a stock that should be in the heap. Analysts are mostly unchanged because the business is mostly unchanged. Estimates for this year continue to rise while out-years are mostly flat.

And yet here we are, with a stock down 15% YTD and down 38% in the last year. So what’s wrong? What isn’t this working, and what will it take for PayPal to work?

To understand this, we need to understand why people are skeptical on the stock. Nobody doubts the cheapness of the stock (~7% FCF yield, ~12x non-GAAP EPS growing ~20% y/y w/HSD revenue growth). What they doubt is the go-forward narrative on a few key issues:

- operating margins and margin mix

- true top-line growth potential in an increasingly competitive market

- ability to monetize Venmo TPV

- ability to retain accounts

If you solve these four things, the stock re-rates. It’s as simple as that when Wall Street refuses to look at estimates trajectory. And the great thing is, that with today’s news, you have a new, younger, story teller who can return the focus and the narrative to the bulls.

Addressing The Four Bullet Points Of The Skeptics

What do operating margins look like? That’s question #1. Under the hood, margins are incrementally worsening as the unbranded business grows faster than PayPal’s bread and butter name-brand payment processing business. This is the profit driver of the whole business, and when that’s growing slower than the lower margin business, the lower-margin business is going to incrementally weigh on margins. New management needs to clarify and maybe even break out the unbranded business so investors can get a better picture of the margin profile of the different business segments. Additionally, management needs to start giving some commentary and/or a timeline on improving margins.

The next point is on market share. This is less in management’s control, but the key here is seeing stabilizing wallet share and core TPV stability in spite of the growth of other buttons. As long as TPV is stable, and take rates aren’t meaningfully eroding, competition isn’t enough of a worry to get incrementally skeptical of the stock at ~7% FCF yield. That’s more of a concern when the bull case is growth, not value, and the multiple reflects it. In my view, the competition is more of a prove-it story for the bears. That being said, investors should still be keeping an eye on it.

Thirdly, and hopefully the new CEO can work on this, is monetizing the P2P optionality in Venmo more efficiently. The fact that they have such a massive install base and TPV base and yet aren’t generating any major incremental revenue is something that is quite concerning. Management needs to lean in here. If they want to spur talk of a re-accelerating growth story, we need to start seeing Venmo become a meaningful business.

And finally, we need to see PayPal return to growth account wise. Now, maybe that’s easier said than done, but even still, PayPal isn’t at the scale where they’ve simply run out of people to turn into account-holders. Whether that means they need to ramp S&M spend on marketing initiatives to boost awareness, or invest in account retention and transaction-related activities I don’t know. What matters is the skeptics are worried about the fact that we’ve seen two back to back quarters of negative sequential account growth. Management needs to focus on addressing investor concerns first and foremost.

Conclusion – PayPal’s Doctor Needs To Check The Diagnosis

If new management wants to address this dichotomy between higher business expectations and a worsening share price, they need to review these four points. Without that, the company can keep posting beat-and-raise quarters and nothing will change with the stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am not a financial advisor. This is not financial advice. Please do your own due diligence before initiating a position in any of the aforementioned securities.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.