Summary:

- Sellers are focused on the wrong metrics, which is leading them to be overly pessimistic.

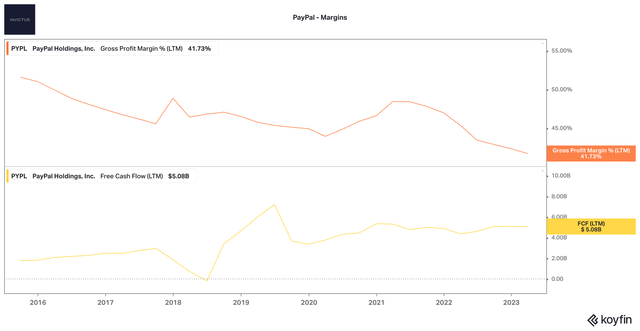

- While PayPal’s operating margins have been compressing, FCF margins have stayed flat and give investors an exceptional FCF yield.

- At ~$61 per share, PYPL makes for an extremely attractive risk/reward investment.

Editor’s note: Seeking Alpha is proud to welcome Lincoln Olson as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Justin Sullivan

Investment Thesis

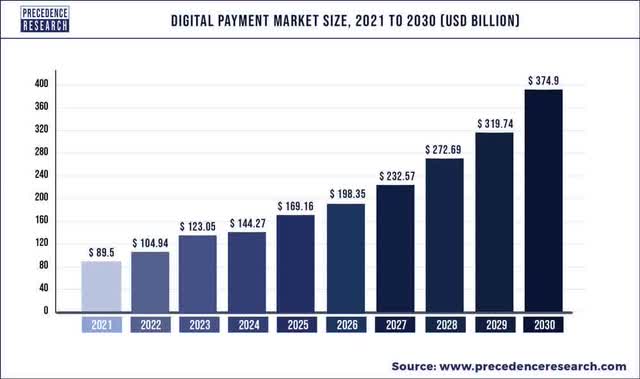

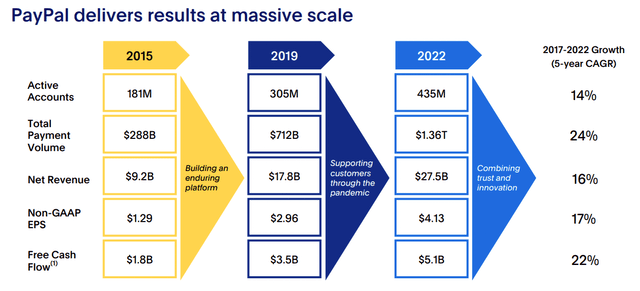

PayPal (NASDAQ:PYPL) is one of the premier companies in the fintech space, an industry set to be worth ~$375 billion by 2030.

Sellers are overly focused on 2 metrics (active accounts and operating margins) while missing the stellar results the company continues to print in the face of competition.

It’s not the high-flying growth stock with limitless potential it once was, but PayPal is beginning to mature into a high EPS, high FCF company that is positioned to grow steadily for years to come.

And at ~$61 per share, it’s hard not to love the risk/reward profile.

Q1 2023 Results

Last week, PayPal released Q1 2023 results.

Following the announcement, shares plunged to finish the week ~18% lower.

I believe the move was completely overblown, and PayPal remains one of the most attractive investments in the fintech space.

Here are a handful of key figures from the report that will provide additional context for my thesis and guide the rest of this update.

Financials

For the quarter, PayPal reported revenue of $7.04 billion (up 9% YoY), EPS of $1.17 (up 33% YoY), and FCF of $1 billion.

Management also raised full-year EPS guidance to $4.95, which would represent ~20% YoY growth.

The company also completed $1.4 billion in share repurchases.

Other metrics

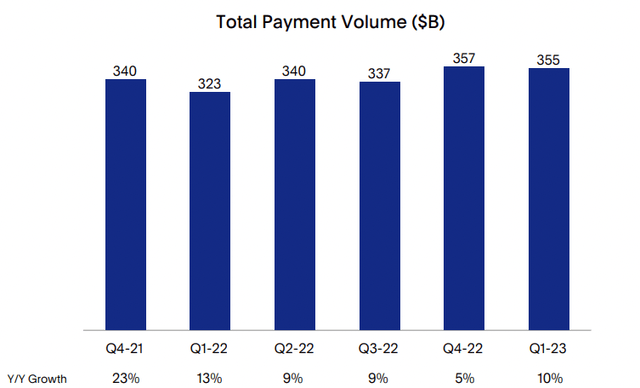

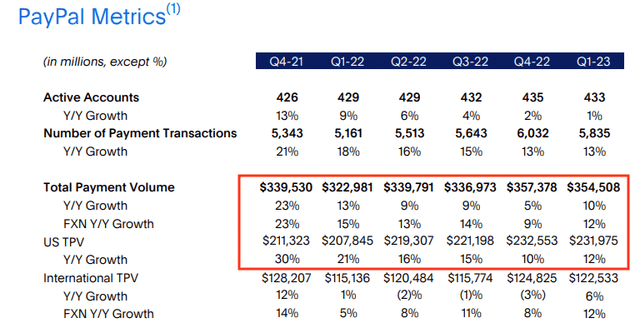

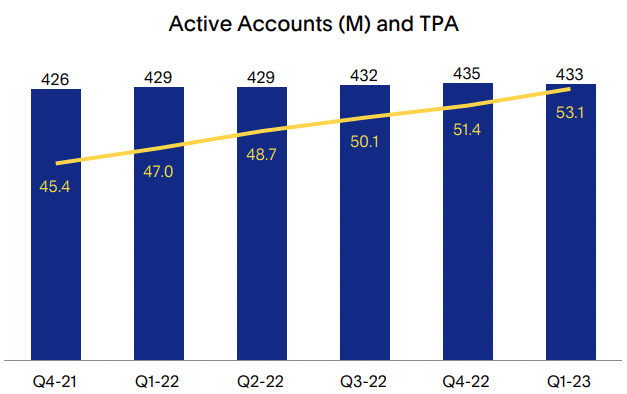

Its most important non-financial metrics are 5.8 billion Transactions (up 13% YoY), $355 billion in Total Payment Volume (up 10% YoY), and 433 million active accounts (up 1% YoY).

Why the Post-Earnings Drop?

PayPal reported strong top- and bottom-line growth, so why the 18% drop?

Sellers are most concerned about 3 things:

-

Competition

-

Viability

-

Compressing margins

Each of these risks is covered in more detail below.

Risks

Competition and Viability

I’m going to combine the competition and viability concerns into one section since they both revolve around 1 question: Will PayPal still be around in 5, 10, and 20 years, or will it be a shadow of what it once was?

In other words, what is the future for PayPal?

While active accounts grew 1% YoY, active accounts actually decreased by 2 million on a quarterly basis, the first such decline since at least 2014:

Q1 Presentation

For sellers, this was evidence PayPal is losing market share to competitors and its network effect is showing cracks.

While it’s certainly a red flag I’ll be keeping my eye on, I don’t think this metric tells the whole story.

The more important metric to gauge PayPal’s platform strength is Total Payment Volume (TPV), which increased 10% YoY:

And TPV in the U.S. (where competition should be the fiercest) grew by 12% YoY:

Payment Transactions also grew a healthy 13% YoY, supporting management’s claim that they are prioritizing high-value accounts.

Based on these figures, I do not see a reason to believe PayPal’s competitive advantage is deteriorating.

That said, Apple is still in the beginning stages of its rollouts in the fintech space. While Apple Pay has seen a slow adoption rate since its release in 2014, Apple’s $111 billion in annual free cash flow gives it plenty of potential ammunition.

The competition narrative is legit, but the results paint a clear picture: PayPal has yet to be disrupted. PayPal remains highly relevant for customers and merchants alike.

Compressing Margins

Alongside the lack of new account growth, sellers pointed to compressing margins as cause for concern. This one is a bit simpler to unpack.

Revenue from Braintree, PayPal’s unbranded payment processing business, grew 30% YoY, a result of new wins and share gains among enterprise-level customers. Unbranded payments are a lower-margined business than PayPal’s core unit, and its surprisingly high growth diluted overall margins.

Although this segment is likely to continue to put pressure on margins, management is addressing the issue through its value-added services within PayPal Complete Payments:

Q1 Presentation

While its focus has been on enterprise clients, the company is now shifting its attention to small and midsized businesses, which will have much higher margin structures.

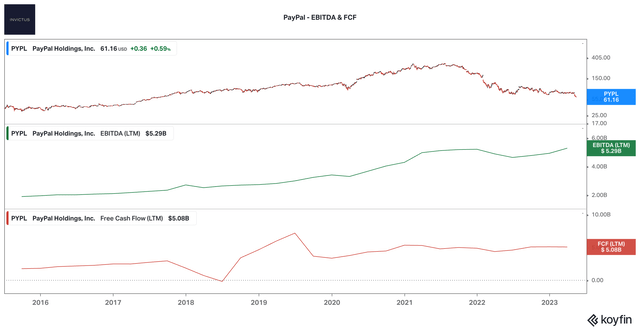

Plus, the company generated $1 billion of FCF on $7.04 billion in revenue for the quarter, a 14% FCF margin. Despite its operating margins decreasing over the last few years, its FCF margins have stayed strong:

While I don’t like to see the trend in operating margins, its FCF margins are reassuring.

The PayPal Brand

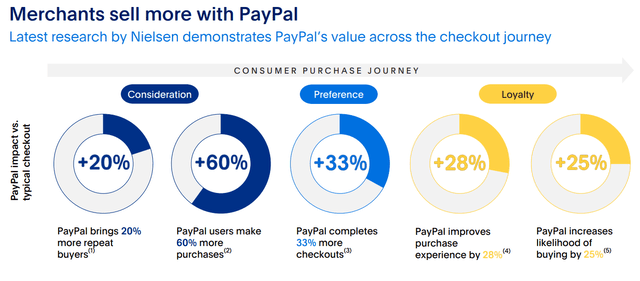

The number of digital payments is estimated to reach $375 billion by 2030:

PayPal’s global brand offers a major competitive advantage over emerging competitors, not to mention its existing network effect.

It is one of the strongest (if not the strongest) global brands in digital transactions:

Q1 Presentation

The bottom line: PayPal is the best-positioned company to benefit from any technological improvements in the industry, and has a great opportunity to increase its number of value-added services.

If you’re going to acknowledge the potential competition, you must also acknowledge its opportunity.

Valuation

PayPal’s narrative needs to change.

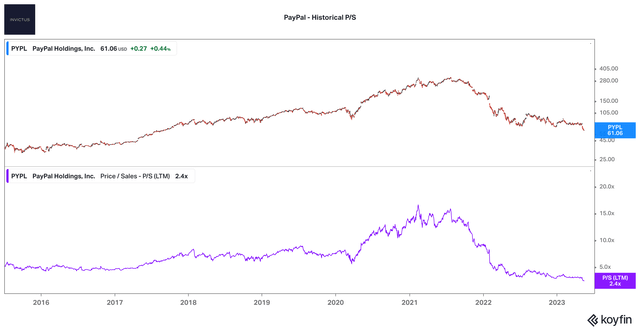

It was the industry leader in the high-flying fintech/payments space, which became totally overblown during and post-COVID. At its peak, PayPal was trading for ~17x revenue.

After falling ~80% from its 2021 highs, PayPal is now trading at a historic low 2.4x revenue:

Although I’d argue this is too low, it makes sense for the stock to be trading at an all-time-low revenue multiple. Investors shouldn’t be valuing the company as a growth stock – those days are likely behind it. Revenue, new accounts, and other “growth” metrics should now be taking a backseat.

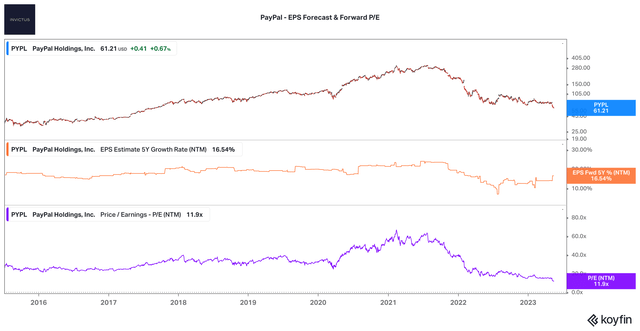

But what doesn’t make sense is where it’s trading relative to its EPS and FCF. These are the metrics used to value a mature company.

The company has a 5Y Estimated EPS CAGR of 16.54% and is trading for 11.9x forward earnings:

Meanwhile, here’s a look at what its EBITDA and Free Cash Flow:

While it doesn’t have the same growth prospects as it did before COVID, its earnings and FCF growth justify a much higher valuation.

Plus, management’s commitment to shareholder yield ($4 billion to be used for share buybacks this year) will remove ~4% of outstanding shares this year, making the per-share metrics even more attractive.

I would not be surprised to see further pressure on the stock price in the coming months, but the extremely conservative valuation has removed a considerable amount of risk.

Conclusion

If you’re willing to look beyond the narratives and focus on the business’s actual results, it’s hard to not love PayPal at ~$61/share.

Although short-term challenges are likely to remain and the payments space is becoming increasingly competitive, PayPal has yet to be disrupted and is among the best-positioned business to capitalize on what will be a $350+ billion industry in the next 7 years.

If it can continue to stave off competition and execute on improving its margins through new value-added services, there’s no reason PYPL can’t be once again trading at its ATHs.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.