Summary:

- PayPal reported solid earnings last quarter and raised full year guidance.

- Still, the stock fell on the report as Q2 revenue is expected to grow only 7%, from over 10% in Q1.

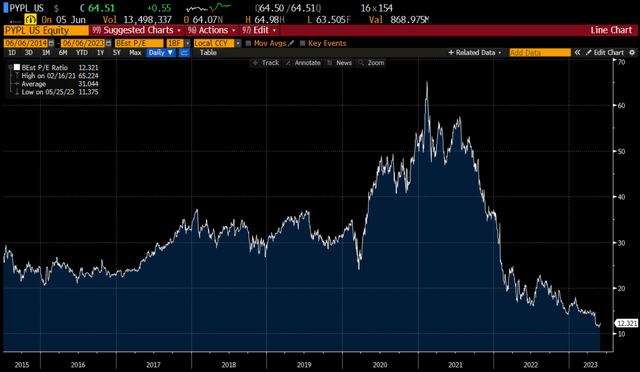

- The stock is remarkably down almost 80% from its highs just a couple of years ago.

- We have struggled to get comfortable owning PYPL given its escalating levels of stock based comp and diminishing growth.

- But for those willing to ignore these costs, PYPL looks cheap at 13x earnings and could trade up 50%+ from here. We still prefer GPN.

Justin Sullivan

Quick Overview

We owned PayPal (NASDAQ:PYPL) in funds we managed from 2018 to 2021. We were constantly impressed with its growth and management but sold it after a huge run-up in the shares in 2021.

We revisited the stock at $125 in February 2022 for subscribers, but passed mostly as we could not get comfortable with the slowing growth profile and the company’s huge stock based compensation costs.

Given the stock’s dismal performance in the past year (again), with PYPL dropping from a peak of over $300 to now $65, we felt revisiting this name made sense.

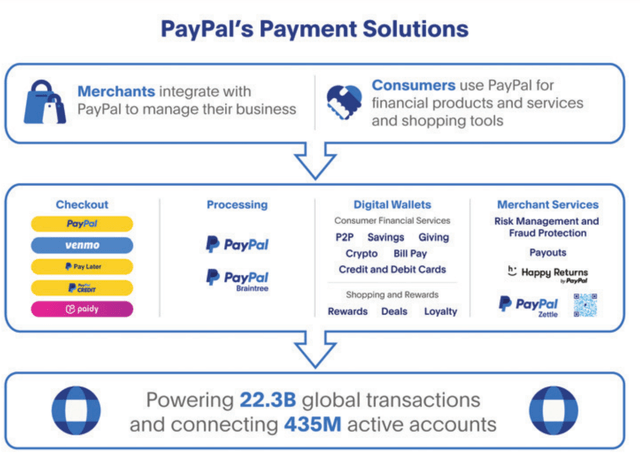

As a refresher, PayPal offers two-sided payment processing for online purchases.

PayPal IPO’d in 2015 after most of its prior life being owned and operated by eBay (EBAY). Their payments business originated on eBay and were a means of transacting securely in online transactions with unknown/riskier merchants, a clearinghouse or escrow agent if you will. eBay last June ended its relationship with PayPal and now uses Adyen (OTCPK:ADYEY).

The PayPal brand is a powerful one and most online merchants still consider PayPal a necessary payment method for consumers. With 435 million consumer accounts and 35 million merchants, PayPal is unique in owning a two-sided network, able to capture large processing fees all for itself (as opposed to Visa or American Express who split these with banks/payment processors). PayPal charges 3.49% of the transaction plus 49c in fixed costs per transaction, 50-100 basis points more than peers.

While PayPal mostly operates as an e-commerce processor, they have expanded into businesses like Venmo (peer to peer payments) and also into traditional payment processing (with card readers) under their PayPal Complete Payments segment. This is also known as their unbranded business and is the company’s primary growth focus today it seems. The core PayPal yellow button check out option is quite mature and not even growing as fast as Visa/Mastercard.

PayPal operates in 200 countries worldwide and does make money facilitating cross-border payment transfers that others are unable to do.

Bullish View

PayPal (PYPL) stock has dropped by an astounding 78% from over $300 to approximately $65 today. While growth and margins took a hit in 2022, this is mostly the result of a slowdown in online shopping as consumers took off to travel and shop and dine again in the real world.

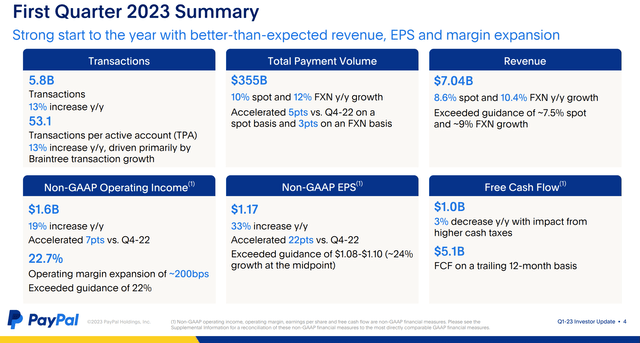

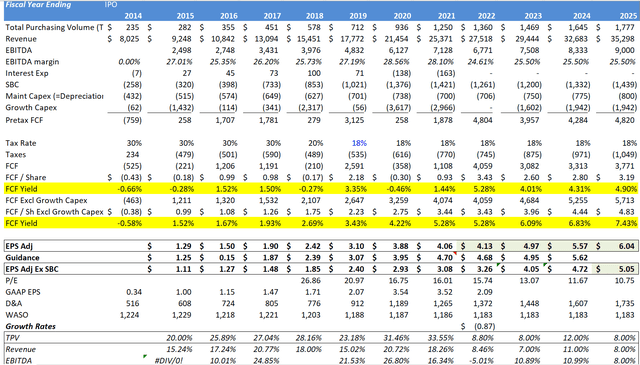

Indeed, total payment volumes (TPVs) are starting to recover and grew 12% in the first quarter after growing only 9% in 2022. Guidance for the year was raised to $4.95 in EPS, up 20% vs last year.

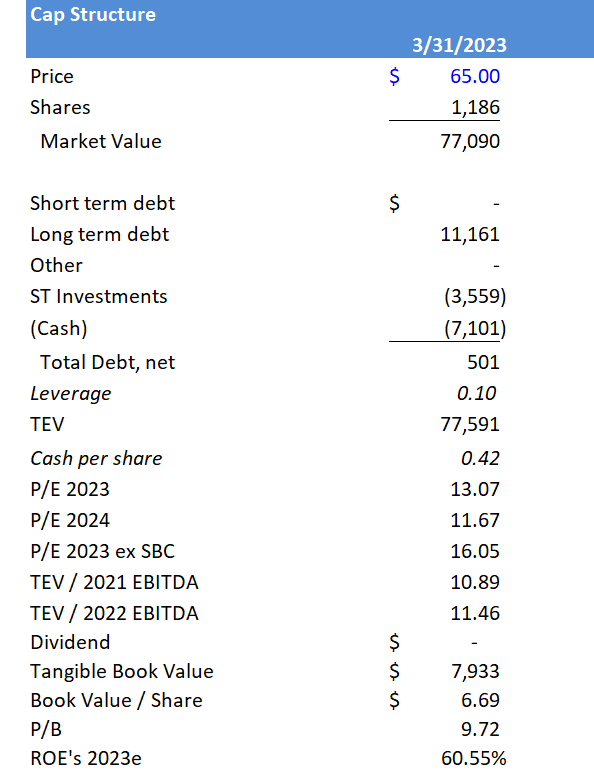

Historically, PayPal has traded at an average multiple of over 30x earnings since its IPO. With a debt free balance sheet and growth resuming, 20x seems a reasonable multiple for PYPL. The current 12.3x valuation is insanely low for a company with a brand this strong and trusted by consumers and merchants all over the globe.

In 2023, EPS will grow 20% at the midpoint of guidance. In 2024, assuming 12% growth in revenue and EPS, PayPal could easily re-rate to 20-25x.

That implies $112 to $140 per share, upside of 70-116%.

Plus, the CEO purchased 26,000 shares of stock at $75 in the open market earlier this year.

Bearish View

PayPal’s business is mature and getting chipped away at on multiple fronts. Affirm has taken share in Buy Now Pay Later (BNPL), as has Stripe among merchants, whose backend appears far superior to PayPal’s. The historical escrow/security reasons for having a PayPal account are long gone as every credit card offers online purchase fraud protection (and at lower fees). Last year, PayPal’s processing volumes (TPVs) only grew 8.8%, far below Visa/MC/AMEX and well below even the legacy processors like Fiserv (FI) and Global Payments (GPN).

EBITDA margins also got pummeled in 2022, dropping from 28.1% in the prior year to 24.6%. Pricing pressure from competition and a failed attempt to build a “super app” bloated the company’s cost structure and Venmo earns little if anything in the way of profits. Given this, CEO Dan Schulman has decided to resign by year end, leaving the firm rudderless for the next 2-4 quarters while the board seeks a replacement.

PayPal is now cutting costs and buying back shares in a desperate attempt to simply maintain gross margins/EPS growth. Stock based comp (SBC) was a whopping $1.3 billion last year, taking the company’s adjusted EPS from a reported figure of $4.13 to a real/economic figure of $3.26 in 2022. In 2023, EPS post SBC will be roughly $4.00 per share (not $4.95), putting this increasingly irrelevant business at a too high 16.2x earnings multiple.

Compared to Global Payments (GPN) whose merchant business is expected to grow revenues by 15-16% this year, why pay a higher multiple for PYPL when you can own a similar/faster growing, higher margin comp in the form of GPN at 9.5x 2023 earnings? GPN by the way grew TPVs by 13% in 2022, 420 basis points higher than PYPL.

The fact that the CEO has sold 280,000 shares of PYPL stock since 2020 offers little in the way of comfort, even if he did add some shares this year.

At 10x economic EPS, PayPal could be a $40 stock from $65 today.

Our View

We are torn here but do consider PYPL an interesting speculative play. Stock based comp arguments are entirely valid but the market rarely pays attention to this. If an online buying cycle does reassert itself, then PYPL could take off. They did raise EPS guidance after Q1 results for the year.

In an ideal world, we consider approximately $55 as a better entry point for PYPL. Excluding SBC, GPN should do about $9.75 in EPS and so trades just over 10x vs PYPL at 16.3x (to get to an apples to apples comparison). GPN has higher margins and better organic revenue growth, expected to be mid-teens on the merchant side.

Our network of experts had mixed reviews of management and execution at PayPal. Communication between the top leaders of the firm and “everyone else” was lacking. The company also lacks vision and has been forced to buy its way into many businesses (like Venmo and Zettle to get into the card reader/processing space). With CEO Dan Schulman leaving by year end, management is a big question mark.

GPN appears to be the better risk reward play, but we do wonder if a Google or an Apple would consider buying PayPal as it seems vulnerable. Elliott is still a holder of 1mm PYPL shares, pushing for change.

PayPal Recent Results

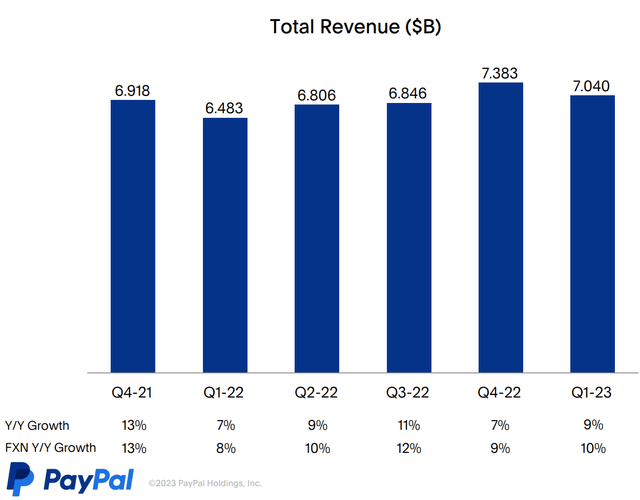

We thought PayPal had a decent first quarter this year but there were some concerning elements.

Notably, core branded PayPal TBVs were weak, growing only 6.5% in the quarter. The balance came from unbranded processing (up 30% off a low base) and low margin Venmo. The stock’s negative reaction post earnings seemed mostly related to Q2 revenue guidance as provided on the conference call. As mentioned, EPS guidance for the year was increased by 8c to $4.95.

While revenue grew 10.4% ex-currencies in Q1, for Q2 guidance was revenue growth of 7.5-8.0%. That is 300 basis points lower than actual Q1 results. No great reason was provided except for tough comps on the call to explain this; perhaps the company is just sandbagging guidance here, but a look at prior quarters suggests that revenue guidance tends to be right in line with actuals.

On the cost side, while PayPal is cutting opex, pricing pressures continue to hurt gross margins. Indeed, transaction margins declined from 50.9% to 47.1% year over year. The company can only cut so much sales and marketing, technology and development costs to offset these headwinds.

While PayPal will continue to cut costs in 2024, the company needs a better ecommerce revenue picture before any kind of real re-rating can happen.

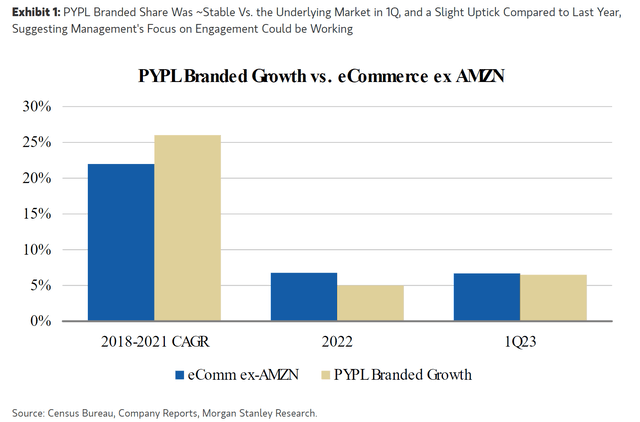

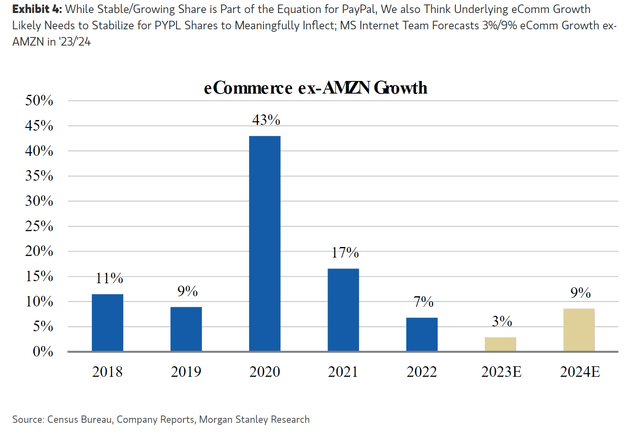

Note below that in the past, PayPal was able to grow branded sales by higher levels than ecommerce revenue (excluding Amazon).

But lately, the company is underperforming. In 2023, Morgan Stanley is projecting only 3% growth in ecommerce sales before rebounding to 9% in 2024.

We cannot say we have a lot of faith in 2024 estimates at this point, especially if we have a recession.

Capitalization

Author Spreadsheet/Co Reports

PayPal does generate $5 billion of annual free cash flow, $4 billion of which the company plans to use to buy back shares. $1.3 billion of FCF is related to stock based comp, so the underlying picture is $2.7 billion of net annual buybacks, which is over 3% of the annual shares outstanding. That should offer some support here.

Other Thoughts

We find it interesting that PayPal is now pivoting into unbranded payments and competing directly with Global Payments (GPN) and Fiserv (FI). Their Venmo app doesn’t make them much money and PayPal has its Xoom app (for foreign exchange transactions) rumored to be for sale. We are not sure it is worth more than the $1.09 billion that they paid for it.

FedNow is a new system that will enhance bank to bank transfers. Instead of 1-3 days for an ACH transfer, it will soon be done instantaneously. We don’t really see this as competition for Venmo, but not that relevant as Venmo is only 3% of sales.

Analysts seem enamored with PYPL. It has zero sells today, but then it had only one sell on it and 44 buys back at the peak at close to $300 per share. Goes to show how little value add the analyst community offers to investors.

Finally, when growth/darling stocks show signs of slowing growth/maturing, the transition from growth investors to value ones can be a long and painful one. GPN was abandoned by growth investors in 2021 but value guys are just now starting to notice. Even though earnings growth has remained intact, the stock has dropped from 22x to 10x earnings. Ouch.

Projections

With limited visibility, we generally assume that PayPal TBV’s can grow at 5-12% over time. Recent results are good but nothing industry beating.

Nominal GDP plus 2% may be the new reality here. If take rates and margins can stay flat (we generally assume take rates continue to fall offset by some scale benefits/cost cuts), and buybacks reduce the share count by 3% annually, then EPS can grow by 8-13% annually.

Author Spreadsheet / Company Reports

We end up pretty close to Street estimates in 2024 and guidance in 2023.

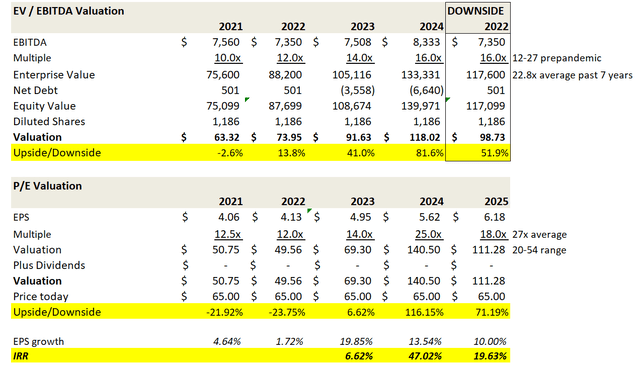

Valuation

If EPS can hit $6 in a couple of years, $90 seems a realistic upside case.

With the company focused on margins and cutting costs today, there are good arguments that revenue does not have to grow much to make this stock work.

Here are a few scenarios. Broadly we think $50-$90 is a narrow, near term range on the equity.

Author Spreadsheet / Company Reports

Conclusion

The bar seems set pretty low at PayPal for a Q2 earnings report that should not disappoint investors. If the market continues to ignore stock based comp, and revenue/earnings growth can improve a bit, then there could be material upside at PayPal again. Often tech names (like Netflix for example) fall 70-80% but then bounce back despite middling earnings. We would not ignore the 20x multiple potential, which implies $100 on the stock in round numbers should growth resume. After Facebook/Meta (META) fell 75% last year, it has now more than doubled since then.

So, we think there is a decent trade potentially with PayPal, assuming a recession does not creep up to impact revenue and earnings/margins.

The bulls argue that a company growing revenue and EPS by high single digits to double digits should be worth at least a market multiple. We tend to agree, which puts PYPL fair value at $84 (using 17x for a fair market multiple). But then, that puts GPN with similar growth at $182 per share from $101.

We are not fans of the high levels of stock based comp at PayPal or anywhere, but even net of that, PYPL generates a lot of free cash flow. Assuming SBC is a cash flow item, PayPal will generate 19% free cash flow margins as a percentage of revenue. And compared to last year when we looked, PYPL now is trading at 16.1x earnings ex-SBC compared to over 35x a year ago.

My speculative money would bet on PYPL in the mid-50s. I am considering selling short dated puts.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of FI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

May sell 60 puts on PYPL

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thanks for reading! We look for high quality stocks trading at attractive valuations in our Marketplace service entitled Cash Flow Compounders: The Best Stocks in the World. Our focus is high return on equity, high free cash flow stocks with a proven track record in compounding earnings at higher than market rates. There we provide in depth research, with 2-4 new, high quality ideas per month. My picks going back to 2011 have produced just under 30% annual returns, putting me well within the top 1% of bloggers (TipRanks). Sign up for a free 2 week trial to get my latest ideas!