Summary:

- It has been 8 years since our last PYPL specific research note.

- The valuation is extremely compelling for this payment franchise.

- There are a number of issues, but investors need to focus on FCF.

Justin Sullivan

Introduction:

Taking a macro perspective, the market is finding it difficult to generate growth. For the S&P 500 during the second quarter of 2023 (with over 480 firms already reported), companies posted modest annual revenue growth (only +0.8%) and earnings fell by (-8.5%). We like to differentiate between cyclical and secular growth and prefer our holdings to have long-term opportunities that are steady and predictable.

Manole Capital exclusively focuses on the emerging FINTECH industry and believes the quintessential FINTECH business is the payment sector. Many payment companies generate recurring revenue (i.e., revenue per swipe), have extremely attractive operating margins, impressive free cash flow and consistently strong earnings growth. When strive to identify secular growth businesses, generating solid free cash flow, and trading at a material discount to our calculation of their intrinsic value. For us, this can be a winning trifecta. We believe PayPal is one such company and this note will attempt to layout the merits for an investment at today’s prices.

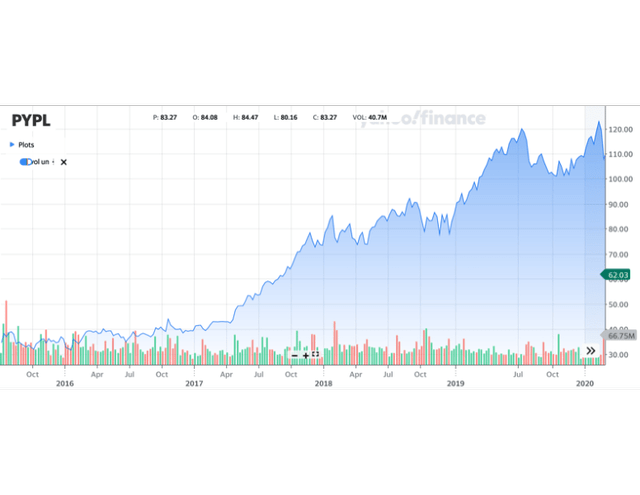

PYPL chart (Yahoo! Finance)

We published a research note on PayPal in the summer of 2015, following its spin-out from eBay (EBAY). The stock was languishing, and we believed there were several positive catalysts once it got separated from its parent company. That note can be re-read here.

From mid-2015 (its spin) through March of 2020 (pre-COVID), PayPal performed quite well. As you can see in this Yahoo! Finance chart, it materially outperformed the S&P 500, as well as the Nasdaq.

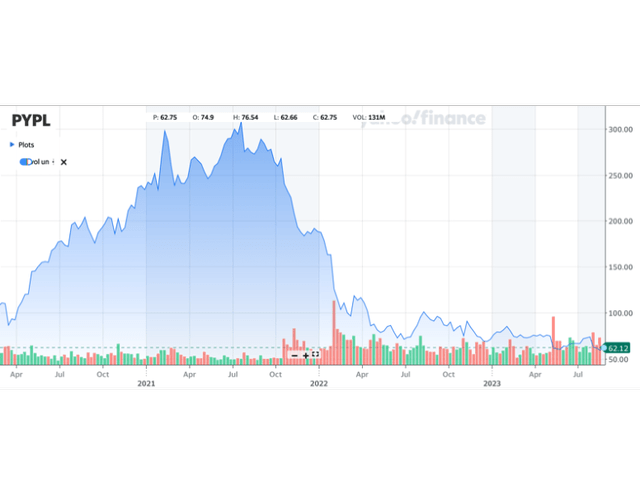

When COVID arrived, millions of consumers increased their online shopping. PayPal is a natural beneficiary of digital payments, and its business was one of the positive outliers from the global pandemic. In fact, PayPal hit an all-time high in July of 2021, when its stock price rose to $308.58 per share. This assigned PayPal a market capitalization of over $300 billion and it briefly eclipsed the size of rival Mastercard (MA).

PYPL chart (Yahoo! Finance)

As this Yahoo! Finance chart plainly shows, the stock is down over (80%) from that peak. There are several reasons for this decline, and we will identify a handful causes.

Acquisitions:

As the stock was steadily climbing in 2021, basking in the glow of robust online shopping, a rumor emerged that PayPal was potentially interested in purchasing social media company Pinterest for $45 billion. While nothing ultimately occurred, some worried that it signaled that management was looking outside of its core competency for future growth.

Over the years, PayPal has been quite acquisitive. It acquired Braintree and Venmo for $800 million in 2013. When it was still apart of eBay, it acquired Xoom (money transfers remittances primarily to India and China) for $890 million in 2015. Also, that year, PayPal acquired Paydiant for $280 million, as it wanted to build-out its mobile wallet applications. Then, in 2018, PayPal made its largest acquisition ever, purchasing iZettle for $2.2 billion. Right before iZettle was slated to go public, PayPal purchased the European and Latin American smartphone payment company. Other deals were made, with TIO Networks in 2017 for $233 million and Swift Financial for another $183 million. Then, in 2019, PayPal somewhat veered from its payment focused deals and acquired Honey for $4 billion. Honey still exists, but it is a somewhat intrusive browser add-on providing coupons and deals to shoppers. Over the last 20 years, PayPal has made over two dozen acquisitions with varying degrees of integration success. In our opinion, Braintree and Venmo was its most successful, while the larger iZettle and Honey were its biggest whiffs.

If PayPal did acquire Pinterest in October of 2021, we believe it would have been even worse, if its (80%) decline wasn’t bad enough. Some companies are good at tuck-in acquisitions and properly integrating them. In the FINTECH space, we would argue that Fiserv (FI) has shown a solid track record of deals, dating back a couple of decades ago to its wonderful CEO Les Muma.

We always prefer our companies exhibit strong organic growth, as opposed to acquiring their growth via deals. Also, it can be a challenge to properly integrate platforms and technology in the payments space. Lastly, it comes down to the old adage of “build or buy”. Could PayPal have spent the money to build these capabilities on its own? Did it make the decision to purchase these companies to gain speed to market? We always like our companies to pay a fair, but not excessive price for deals.

Unfortunately, PayPal management has a spotty acquisition track record, especially when it veers from its payment expertise. Over the last couple of years, it appears that management has pulled back from its acquisitive ways. After spending $2.8 billion in 2018, $1.3 billion in 2019, $3.8 billion in 2020 and $3.1 billion in 2021, over the last 18 months, PayPal has only made $0.4 billion of deals. Instead of making costly and questionable acquisitions, PayPal has repurchased $4.9 billion and 63 million of its own shares over the last twelve months. Now, some might argue that these buybacks were a poor decision, with the stock plummeting. We agree, but companies are historically terrible buyers of their own stock and very few investors are skilled at market timing. We take some solace that there is ample liquidity available to repurchase additional shares, especially since the valuation of PayPal is so appealing.

Management:

Dan Schulman has led PayPal for roughly a decade, becoming its CEO on September 20th, 2014. His career is quite interesting, starting with 18 years at AT&T. Following that, he spent 2 years as the CEO of Priceline. He veered somewhat and helped grow Virgin Mobile, with the blessing of Sir Richard Branson and Sprint. Under Schulman’s leadership, Virgin Mobile handsomely grew and had a successful IPO in 2007. With the cellular carrier sale to Sprint in 2009, Schulman briefly joined as its President. Following a few years in the cellular industry, Schulman joined American Express to lead their mobile and online payments business. It was this job and experience in payments that led to his hiring as the CEO of PayPal.

Schulman, known for his love of wearing cowboy boots, helped steer PayPal from its spin from eBay in 2015. In February of 2023, Schulman announced that he would be retiring as CEO. He successfully led its exit from eBay and grew the franchise to its current state, with over 430 million accounts. This is commendable and many view his leadership in a positive light, but the last year and a half has been challenging. The stock has grossly underperformed the overall market, the Technology sector and especially the FINTECH group. We are sure that he planned on retiring on a high note, but his tenure officially ends with a whimper. Over the last decade, we would argue Shulman’s two biggest accomplishments were the spinout from eBay and the purchase of Braintree (including Venmo).

However, from February to August of this year, it seemed like PayPal was adrift. Following Schulman’s retirement announcement in February, it appeared that there was 6 months of waiting and waiting and waiting. Investors were wondering when an announcement would be made, until Alex Chriss was appointed the new CEO in mid-August. Without a focused leader at the helm, PayPal seemed to just decline. Late last year, Elliott Management emerged as a potential activist investor in PayPal. For numerous reasons it failed to disclose, Elliott recently exited its PayPal position. Without positive results and execution, as well as no true leader, PayPal’s stock languished.

We have covered Intuit (INTU) for 25 years and believe it has numerous growth engines with Quickbooks, MailChimp and Turbo Tax. Alex Chriss comes from Intuit’s Consumer division, where he led their small business franchise for the last five years. In our opinion, Alex is coming onboard at a perfect time. While there are numerous challenges facing PayPal, we believe the upside opportunities are enormous. We believe this represents an inflection point in PayPal’s history. The last real identifiable point was the spinout from eBay. Now, there is a bit of a “changing of the guard”, with Alex Chriss taking over.

Looking at Intuit’s Quickbook franchise, we see an asset that dominates the small business accounting landscape. Over the years, it has added merchant acquiring, payroll, HR, and various other recurring revenue services. Specifically, the biggest deal the Consumer division executed was the $12 billion acquisition of Mailchimp in September of 2021. Intuit seems to have absorbed this successful (and private) company, while adding another feature to its Quickbooks core franchise.

Free Cash Flow:

In our opinion, the single most important financial metric (for any company) is free cash flow. Certain companies play games with earnings per share, by excluding the dilutive impact of options. Others back out various items from earnings, to hit Street expectations. Once again, we believe that free cash flow cannot be manipulated, and it represents the best indicator for valuation (in our opinion).

Over the last year, PayPal’s management focused on driving free cash flow and didn’t execute any unnecessary and complicated deals. The balance sheet has $9.9 billion of cash and $4.5 billion of investments versus $10.5 billion of debt. We like the current balance sheet, as it is essentially un-levered and capable of flexibility.

Since its July 2015 spinout from eBay, PayPal has generated $29 billion of free cash flow. 45% of its free cash flow or $13 billion has gone towards acquisitions, while $19 billion has been allocated to re-purchasing its stock. We think that PayPal management will continue to utilize its sizable free cash flow to repurchase a significant amount of its own stock.

In the 2nd quarter of 2023, PayPal bought back $1.5 billion of stock, or 22 million shares for roughly $68.89 per share. Since the end of 2021, PayPal has retired 6% of its shares. With its $5 billion of free cash flow this year, PayPal is slated to buyback another 3% of its total shares outstanding. Instead of making costly acquisitions, we prefer managements and the Board of Directors decision to buy back its own stock. Not only does it “know this business” remarkably well, but the valuation is quite compelling. With $5 billion of 2023 free cash flow, PayPal is essentially trading at a FCF yield of roughly 8% or roughly 2x the US 12-month Treasury.

If the stock continues to suffer, it might make some sense for the Board of Directors to consider a dividend. While it currently does not pay out a dividend, it might make sense to appeal to true value investors. With its current valuation, PayPal probably appeals more to value investors, than growth investors. Adding a dividend (or possibly a 1x, special dividend), might bring value investors into this company. Just a thought…

BNPL:

In 2019 and 2020, the market was infatuated with BNPL or buy now, pay later. Firms like Klarna (privately held), Afterpay (purchased by Block for $29 billion in 2020) and Affirm were FINTECH darlings. In 2020, PayPal launched its own BNPL offering, and it has been fairly successful. It has made 300 million loans to over 35 million customers in 8 different markets. Last year, PayPal’s BNPL offering did $20 billion of payment volume, up +160% year-over-year which places it in roughly 4th place (market share). With the market declines of 2022, these unprofitable businesses materially pulled back.

Now, investors are understandingly questioning PayPal’s rationale for taking on credit risk. One of the many reasons Visa and Mastercard are able to garner their valuations stems from the fact that they are payment networks and processors, not credit sensitive financials. The BNPL business is a credit sensitive business, that experiences cyclical ups and downs. Over the last two quarters, as the credit environment has struggled, PayPal has booked credit losses of $254 million.

We applaud PayPal’s decision last June to partner with KKR on the credit portfolio. As a quick reminder, PayPal will continue to underwrite and service BNPL loans in France, Germany, Italy, Spain, and the UK. The main difference is that KKR will own the receivables and take on the underlining credit risk. This converts PayPal back into a payment processor and network and starts to get it out of the cyclical and credit sensitive loan business. With KKR backstopping the loan receivables, PayPal frees up nearly $2 billion on its balance sheet. This allows PayPal to funnel more of its capital towards its buyback. Also, PayPal no longer needs to provision for expected loan losses, like a bank.

Recent Results:

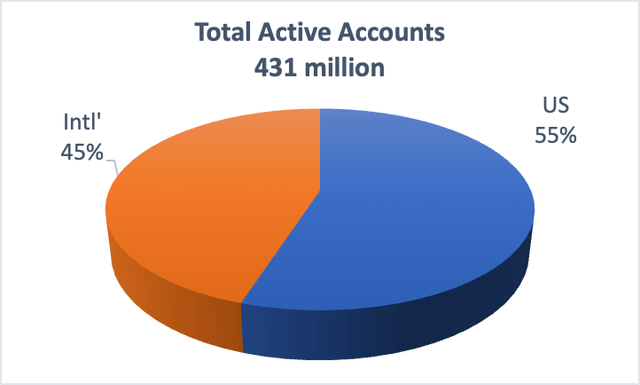

Following 2nd quarter 2023 results, PayPal’s stock fell by over (10%). While it exceeded revenue expectations and generated in-line earnings, it continues to struggle with two key metrics. The first concern was the second straight quarter of declining active accounts, which fell by 0.6%. The total number of active accounts at PayPal is 431 million, which is an extremely strong customer base. A few quarters ago, management “cleaned up” their official number of accounts, by removing some fraudulent accounts and non-active customers. Frankly, we always view account metrics with a “grain of salt” and could probably discount the accuracy of most account bases by 10%. Some investors were disappointed that PayPal management laid out an expectation for 750 million accounts in the future, only to remove that guidance and see the number decline. This is absolutely a fair criticism, but we believe it misses the bigger picture or point.

PayPal is now providing a “clean” account number and it is impressively large at over 431 million (both consumers and merchants). We would rather have a smaller base of active accounts (using the product) than a larger number of questionable or inactive accounts. It is important to breakdown PayPal’s accounts into US versus non-US customers. With continued growth in its international customers, PayPal’s account mix is 55% US and 45% International.

PYPL Active Accounts (Manole Capital)

PayPal’s customers made 6.1 billion transactions last quarter, which was up +10% year-over-year. We like to look at TPA or transactions per active account, which continues to steadily improve. Last quarter, TPA was 54.7, up +12% year-over-year. We believe this metric shows solid client engagement and it has grown in the low teens for the last 6 quarters.

In addition to their active customer base, PayPal has over 35 million merchants on its platform; 80% of the Top 1,500 internet retailers. Between its customers and business accounts, PayPal has built an impressive payment ecosystem. Even if it isn’t going to reach that long-term goal of 750 million active accounts, we are impressed with its sizable network of engaged customers.

Another important PayPal metric we follow is TPV or total payment volume. During the 2nd quarter, PayPal’s TPV was $376.5 billion, up +11% year-over-year. Once again, we like to break down this metric into US versus non-US volume. Last quarter, the US TPV was 63% of the total and it grew +9% year-over-year. The International TPV was 37% of the mix, but it grew +14% year-over-year. Just like the outsized growth being experienced in the number of accounts outside the US, we are pleased to see PayPal and its volumes get embraced internationally.

We like to understand per transaction metrics and our starting point is the average payment amount, which was a solid $62 last quarter. We then like to look at margins and understand the profitability PayPal generate per transaction. The first profitability metric is “total take rate”, which simply takes total revenue divided by TPV. This was 1.94% last quarter, and it has declined for the last 6 quarters. This clearly isn’t positive, but it seems like it is somewhat stabilizing. The next metric we analyze is “transactional take rate”, which is transaction revenue divided by TPV. In our opinion, this is a cleaner profitability metric, as it just focuses on transaction revenue, not total revenue. Last quarter, this was 1.74%, which was also down for the second consecutive quarter. Looking at it a year ago, it is down a modest 11 basis points, and it should continue to stabilize. Management believes that two-thirds of this decline is due to foreign currency changes, which seems somewhat explainable (due to the strength of the US dollar). The last profitability metric (on a per transaction basis) is something PayPal calls “transaction margin”. This is total revenue less transactional expenses and credit losses, divided by total revenue. A year ago, transaction margin was 48.7% and it continues to decline; last quarter it was 45.9%. None of these transaction-based margins are positive, which should be concerning. If we didn’t understand what was causing this pressure, we would “run for the hills”. However, our analysis of the payment landscape tells us a very different story.

In its highly competitive online payment business, PayPal’s Braintree group competes with privately held Stripe and publicly traded Adyen (OTCPK:ADYEY) (ticker ADYN). We don’t have financial metrics from Stripe, but Adyen just reported 1st half of 2023 results. As a European company, they report semi-annually, not quarterly.

In the North American market, Adyen grew payment volume by +23% and revenue by +23%. While impressive on the surface, this was materially slower growth than it reported in the 1st half of 2022. In comparison, PayPal’s Braintree posted +30% revenue growth and +30% payment volume growth, both in-line with a year ago growth levels. On the PayPal conference call, its management team proclaimed that Braintree was experiencing “tremendous momentum” and success.

The market is highly competitive and there are a few parties fighting for market share. With somewhat high switching costs, it makes some sense to aggressively price your product to win business. PayPal’s Commerce Platform is winning, but the environment for margin expansion is temporarily pressured. The margin profile of PayPal’s payment platforms – branded versus un-branded – is quite different.

While PayPal is currently absorbing this mix shift pain, we believe some investors are missing the bigger picture. When we analyze payment companies, we love to examine operating margins. Overall operating margins for PayPal were 21.4% last quarter, up +230 basis points year-over-year. On its conference call, PayPal management reiterated its goal of delivering 100 basis points of operating margins improvement this year. Specifically for the 2nd quarter of 2023, PayPal management guided for 22% operating margins. With actual results being 60 basis points lower, the Street was obviously disappointed. While we understand this issue, it fails to understand how payment platforms operate, when they are at scale.

Payment Companies:

We have covered the payment industry for decades, long before Mastercard’s IPO in 2006 and Visa’s IPO in 2008. The beauty of the payment business is that they will steal market share from a sleepy giant, every day. That market share donor is cash. We are sure that you are using less and less cash in your daily lives. The numbers show that roughly 75% of global purchase transactions are still done in cash. While some Nordic countries are trying to become cash-less, there are developed countries like Japan and Germany that still are primarily cash based. While the US has lowered its cash usage, roughly 1/3rd of all transactions are cash based and 50% of transactions under $10 are done in cash.

Payment businesses are great examples of scale businesses. For example, Visa can process 65,000 transactions per second over its network. Each incremental transaction is nearly 100% profit, as the cost to process is essentially already built and paid for. This is why (last quarter) Visa can generate operating margins of 61.8% and Mastercard has operating margins of 58.6%.

PayPal is currently “at scale”, with its global, two-side payment network. On the consumer side of the equation, it has 430 million active consumer accounts. On the merchant side of the business, it services 35 million businesses. This year, it will handle over $1.4 trillion of volumes, 24 billion of transactions, in over 200 countries. While it may not equate to Visa and Mastercard scale, it is large enough to generate prodigious free cash flow and benefit from its extraordinary size.

Now, we aren’t trying to necessarily compare Visa (V) and Mastercard (MA) with a company like PayPal, as they are somewhat different. We own all three but understand the significant differences in their business models. All three companies produce impressive free cash flow and have secularly growing businesses. For perspective, Visa generated $5.5 billion of free cash flow last quarter and that is what PayPal will do all year. However, Visa and Mastercard are at a somewhat different stage of growth in their evolution. Last quarter, Visa and Mastercard posted revenue growth in the low-to-mid teens, while PayPal’s was much higher. We believe that the payment networks should produce low double digit top line growth and mid-teens earnings growth for the next several years, but PayPal should grow slightly faster (off of a smaller base). The payment networks should maintain and slightly increase their operating margins (from these already high levels) and use their free cash flow to make selective acquisitions and buyback their stock.

In our opinion, the significantly higher operating margins of Visa and Mastercard are reflected in their much higher valuations. The payment networks deservingly trade at an average of 26x next year’s earnings, which is a significant premium to the S&P 500. Considering their prospects and higher growth profile, we believe that premium is justified. However, PayPal is receiving none of the love that Visa or Mastercard is receiving. In fact, PayPal isn’t even getting a multiple similar to its peer Adyen (ADYEN) or its competitor Block (SQ). Even after Adyen fell by (56%) in August, it still garners a forward P/E multiple of above 30x. Block declined by (31%) in August and has a ton of issues it is wrestling with. Despite this, Block trades at a forward Enterprise Value to EBITDA multiple approaching 20x.

Revenue growth at PayPal will be nearly +8% this year. Analysts are projecting revenue growth of +11% next year, equating to nearly $30 billion. For comparison purposes, the S&P 500 might post 3% growth in sales this year and expectations are looking for 7% in 2024. So, even using lowered expectations, PayPal should deliver 50% higher revenue growth than the overall market.

We never utilize revenue multiples because we feel that they are only employed by companies that cannot produce profitability. We do not believe that revenue multiples fairly assign value, but companies without free cash flow or profits need something to hold onto. Investors using revenue multiples often convince themselves of forward upside by granting an extra one or two or three points of multiple expansion. In our opinion, this ignores profitability. It is nice to have top line growth, but we strongly believe that share price appreciation is driven by free cash flow and earnings growth, not necessarily revenue growth.

As we mentioned earlier, PayPal should generate $5 billion of free cash flow this year. Even if its operating margins stay flat at roughly 22%, PayPal will deliver nearly $5.00 per share in earnings this year (up +20% year-over-year). Looking ahead while still keeping margins flat, PayPal should post $5.75 per share in earnings (up another +15%). In comparison to the overall market, the S&P 500 should experience a (4%) decline in EPS this year, with sky-high expectations for +17% growth next year (per Zacks Research). For that modest growth, the S&P 500 trades at 21x 2023 and 18x 2024. Once again, when compared to the S&P 500, PayPal’s earnings growth is expected to eclipse the market, yet it trades at 10.6x 2024. This is a 40% discount versus the overall market.

Conclusion:

Does PayPal have issues? Absolutely! It has made a number of poor acquisitions, it has experienced significant management turnover, it failed to deliver on its guidance, and it competes in a highly competitive environment. That being said, the outlook for growth is predictable and the valuation puts PayPal in the “deep value” category. As we mentioned earlier, PayPal must address its account declines and it needs to improve and stabilize its margins. However, these issues are reflected in the current stock price. In comparison to the overall market or even payment and FINTECH companies, PayPal is “dirt cheap”.

If new management does absolutely nothing but use its free cash flow to buy back its stock, PayPal could go private in a decade. If one assigns a market forward multiple to PayPal, it would be worth over $100 per share, or over 70% higher, but let’s not get carried away. While we believe PayPal’s strong growth and impressive account base justifies a premium to the overall market, but there is no need to make herculean assumptions. If one uses conservative estimates (say $5.75 for 2024) and assigns a discounted multiple (say 16x), PayPal is a $92 stock in a year or so (representing 50% of upside). Considering that the market (represented by the S&P 500) is up +15% this year, and the Tech sector (represented by the XLK) is up +36%, there aren’t many technology companies trading at this attractive of a multiple. Once again, there isn’t a need to put lofty expectations on new management. All it really needs to do is use its impressive free cash flow to repurchase its own stock. If new management is able to grow the account base or improve operating margins, that would be gravy, right?

When it comes to the payments industry, one of our favorite lines is that investing in this space is like “winning by breathing”. Each and every day, cash continues to be a market share donor and more and more people are using the internet to purchase goods and services. These are secular growth drivers and provide us the confidence that digital payments are still in the “early innings”.

You continue to use less and less cash and continue to purchase more goods online. When you are shopping online, you can’t use cash and are likely to use either PayPal or Visa or Mastercard. From our perspective, since we own all three, we are happy with your transactions. The only caveat is that Visa and Mastercard are trading at premiums to the overall market, while PayPal is on the “discount rack”.

In our opinion, it is usually wise to purchase wonderful, free cash flowing payment companies when they trade at these types of attractive valuations. If we are wrong, we would fully expect another company to step in and acquire this global, at scale, two-side payment network.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

DISCLAIMER:

Firm: Manole Capital Management LLC is a registered investment adviser. The firm is defined to include all accounts managed by Manole Capital Management LLC. In general: This disclaimer applies to this document and the verbal or written comments of any person representing it. The information presented is available for client or potential client use only. This summary, which has been furnished on a confidential basis to the recipient, does not constitute an offer of any securities or investment advisory services, which may be made only by means of a private placement memorandum or similar materials which contain a description of material terms and risks. This summary is intended exclusively for the use of the person it has been delivered to by Warren Fisher and it is not to be reproduced or redistributed to any other person without the prior consent of Warren Fisher. Past Performance: Past performance generally is not, and should not be construed as, an indication of future results. The information provided should not be relied upon as the basis for making any investment decisions or for selecting The Firm. Past portfolio characteristics are not necessarily indicative of future portfolio characteristics and can be changed. Past strategy allocations are not necessarily indicative of future allocations. Strategy allocations are based on the capital used for the strategy mentioned. This document may contain forward-looking statements and projections that are based on current beliefs and assumptions and on information currently available. Risk of Loss: An investment involves a high degree of risk, including the possibility of a total loss thereof. Any investment or strategy managed by The Firm is speculative in nature and there can be no assurance that the investment objective(s) will be achieved. Investors must be prepared to bear the risk of a total loss of their investment. Distribution: Manole Capital expressly prohibits any reproduction, in hard copy, electronic or any other form, or any re-distribution of this presentation to any third party without the prior written consent of Manole. This presentation is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use is contrary to local law or regulation. Additional information: Prospective investors are urged to carefully read the applicable memorandums in its entirety. All information is believed to be reasonable, but involve risks, uncertainties and assumptions and prospective investors may not put undue reliance on any of these statements. Information provided herein is presented as of December 2015 (unless otherwise noted) and is derived from sources Warren Fisher considers reliable, but it cannot guarantee its complete accuracy. Any information may be changed or updated without notice to the recipient. Tax, legal or accounting advice: This presentation is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. Any statements of the US federal tax consequences contained in this presentation were not intended to be used and cannot be used to avoid penalties under the US Internal Revenue Code or to promote, market or recommend to another party any tax related matters addressed herein.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.