Summary:

- PayPal released blowout Q1 earnings results.

- Only 7% of PayPal’s SMB volume is processed through PPCP and only 4% of US PayPal accounts have a debit card.

- The company will no longer price-too-low — they will now price-to-value.

- Despite raised guidance, management is still sandbagging guidance.

- Management finally set the right tone this quarter.

PM Images

Introduction

PayPal (NASDAQ:PYPL), the digital wallet and payment processing juggernaut, recently reported Q1 earnings that blew away expectations, sending shares higher the following day.

It’s not so much that Q1 results left a positive impression on the market — it was management’s confidence in PayPal’s future and their laser-focused execution that might have improved market sentiment for the better.

This was especially refreshing after management’s underwhelming Q4 update, which I addressed in my previous article here.

Fortunately, they set the tone right this time — they should have done so a quarter or two ago, but I reckoned fresh management is just adjusting to their new seats.

That said, investors finally have something to look forward to. After a brutal 80% drawdown and nearly two years of sideways price action, it might be time for the stock to regain what it has lost.

Growth

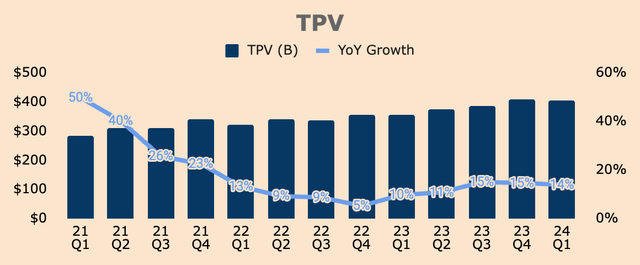

Jumping into PayPal’s Q1 results, Total Payment Volume (“TPV”) was $404B, up 14% YoY. Similar to last quarter, Unbranded Processing drove the majority of growth, with Branded Checkout being the laggard. However, Branded Checkout growth did accelerate a couple of percentage points QoQ, a good sign that PayPal’s core business is regaining momentum.

- Unbranded Processing TPV grew 26% YoY

- International TPV grew 18% YoY

- US TPV grew 12% YoY

- Venmo TPV grew 8% YoY

- Cross-border TPV grew 8% YoY

- Branded Checkout TPV grew 7% YoY

TPV growth was also driven by strong engagement within the PayPal ecosystem.

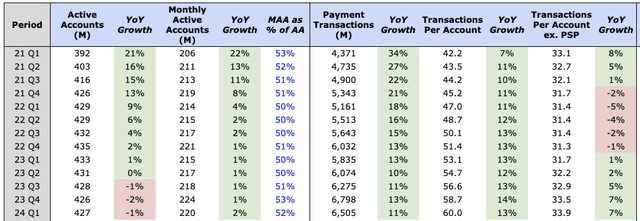

- While Active Accounts dropped 1% YoY, it was up 0.4% QoQ, to 427M. This is the first time AA increased sequentially since Q4 of 2022, and this was driven by lower churn and growth in accounts.

- On the other hand, Monthly Active Accounts increased 2% YoY to 220M. On a sequential basis, MAA dropped 1.5% QoQ due to normal holiday seasonality.

- MAA as a % of AA was 52% in Q1, up 200bps YoY, showing a more “active” account base overall.

- Payment Transactions was 6.5B, up 11% YoY.

- Transactions Per Account was 60.0, up 13% YoY, driven by Braintree.

- Transactions Per Account ex. PSP — or Branded TPA — was 33.9, up 7% YoY.

PayPal continues to maintain robust activity levels within its platform. What’s surprising is that AA increased QoQ, which is a welcome sign that maybe, just maybe, PayPal could return to expanding its ecosystem.

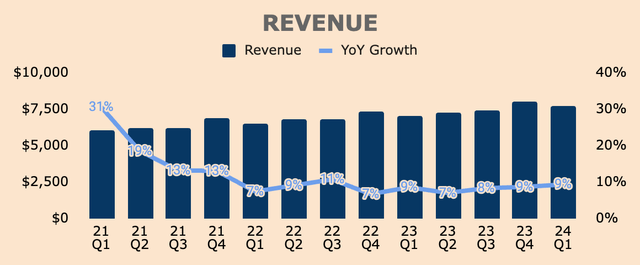

As a result of higher engagement and TPV, Revenue grew 9% YoY to $7.7B, which beat analyst estimates by nearly $0.2B and management’s guidance of 6.5% YoY growth. As you can see, this was the third consecutive quarter where Revenue growth accelerated.

Growth was driven by Braintree and Branded Checkout, offset by lower Other Value-added Services Revenue as a result of lower credit Revenue and other small areas of the company.

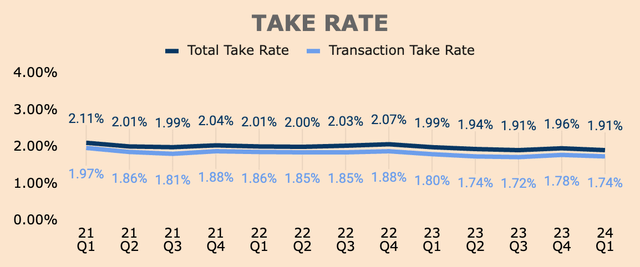

Despite a strong Revenue print, Revenue still grew slower than TPV, due to lower Take Rates. The decline in Take Rates was driven by lower FX fees, lower gains from FX hedges, and a mix shift to larger merchants.

- Total Take Rate was 1.91%, down from 1.99% last year.

- Transaction Take Rate was 1.74%, down from 1.80% last year.

PayPal has been highly criticized for its falling take rates and its declining pricing power. However, new management is laser-focused on turning this narrative around, essentially by pricing their products to value — management knows that PayPal has a strong brand with powerful network effects that consumers and merchants can tap into, so they intend to price their products accordingly, as well as monetize the user base as best as they could.

For instance, management is taking proactive measures to improve monetization and engagement. Here are some examples.

- PayPal is currently testing Fastlane with selected merchants. Fastlane allows users to save their payment details for future purchases and quickly check out wherever Fastlane is available. So far, merchants have seen an 80% checkout conversion rate for returning Fastlane users. Moreover, unrecognized users or non-PayPal users are signing up for Fastlane at a 40% rate. These kinds of results are driving strong demand for Fastlane which the company expects to launch in the US later this year.

- The company also expanded PayPal Complete Payments (PPCP) to over 34 countries. PPCP offers SMBs an all-in-one suite of financial products and payment processing services, including PayPal’s latest Branded Checkout features such as Fastlane. On average, PPCP merchants use about four PayPal products which has an average Revenue per account that is nearly 100% higher compared to a non-PPCP merchant. And with only about 7% of PayPal’s SMB volume processed through PPCP, management is investing heavily “to serve and win the small business market”.

- PayPal has also upgraded the PayPal app with a new interface. Additionally, PayPal has shifted its go-to-market strategy for some of its products. For example, PayPal tweaked its debit card onboarding flow, which led to a 38% YoY growth in first-time debit card users and 69% YoY growth in debit card engagement. Keep in mind that debit card users generate two times more transactions and 20% higher Revenue per account compared to those who don’t have a debit card. With only 4% of US PayPal accounts currently with a debit card, management is focused on driving more card adoption to boost high-Revenue TPV.

- CEO Alex Chriss also expressed his dissatisfaction with Venmo and how the company has failed to leverage Venmo’s strong brand and massive network — he’s committed to making a change here. More specifically, he wants Venmo to facilitate more inflows AND payment activities. Venmo has already attracted a ton of inflows into the platform — $18B per month, in fact — but 80% of those funds leave the platform within 10 days. That is a lot of monetization opportunities left on the table. That is why management is focusing on improving Venmo debit card penetration, which has the potential to drive “six times the incremental Revenue than that of a P2P-only customer”. PayPal is already putting a lot of work into this department, growing Venmo debit card users by 21% YoY. Card penetration and balance-funded payments are still excruciatingly low — management realizes this and they are switching to high gear to capitalize on this massive opportunity.

In short, PayPal still has a decent growth runway ahead. TPV growth remains robust but Revenue growth remains lackluster. This means PayPal is not monetizing its user and merchant base effectively, as evident from its declining Take Rate figures.

However, that could all change as new management reevaluates their go-to-market and monetization strategies. PayPal will no longer price-too-low — they will now price-to-value.

PayPal’s value is its unmatched scale, impenetrable brand, and gigantic network. Management realizes this — they are determined to leverage PayPal’s moats to maximize value creation.

Profitability

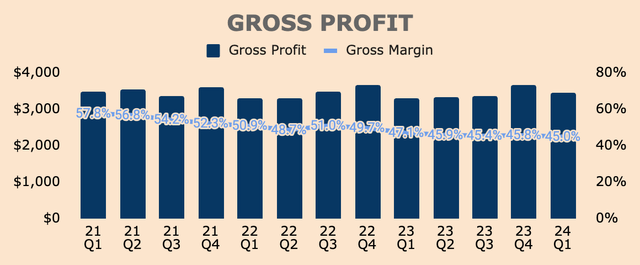

Despite lower Take Rates, PayPal’s Gross Profit (Transaction Margin Dollars) grew 4% YoY to $3.5B, due to interest income on customer balances, Branded Checkout growth, and lower losses.

This was a pleasant surprise for many, since Gross Profit has been flat to down over the last few quarters, so the growth acceleration this quarter was welcome news for investors. Even better, management now expects Gross Profit “to be slightly positive for the full year” — they previously expected Gross Profit to be flat YoY.

Nevertheless, Gross Margin dropped 210bps YoY to a record low of 45.0% due to lower Take Rates. Gross Margin needs to bottom for PayPal to maintain robust earnings growth — the company can’t possibly rely on OpEx cuts for all eternity.

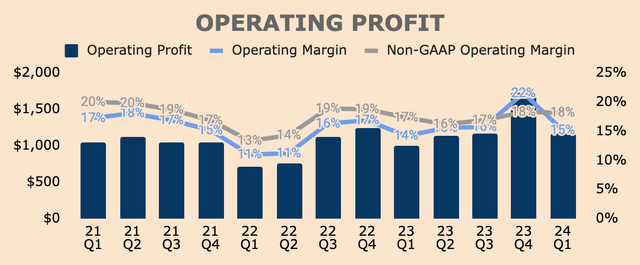

Moving on, here’s what PayPal’s Operating Profit numbers look like. Keep in mind that beginning this quarter, Non-GAAP measures now include Stock-based Compensation and related employer payroll taxes.

- GAAP Operating Profit was $1.2B, up 17% YoY. GAAP Operating Margin was 15%, up 98bps YoY.

- Non-GAAP Operating Profit was $1.4B, up 15% YoY. Non-GAAP Operating Margin was 18%, up 84bps YoY.

- Profit growth was driven by lower headcount and SBC expenses, as well as some marketing and investment expenses being deferred to the back half of the year.

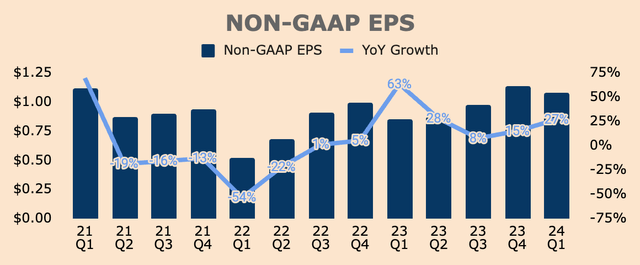

Non-GAAP EPS under the new Non-GAAP methodology was $1.08, up 27% YoY, driven by operating leverage and share repurchases.

Non-GAAP EPS under the old Non-GAAP methodology was $1.40, up 20% YoY. This beat analyst estimates by $0.18 and beat management’s guidance of mid-single-digit growth.

Those are large beats, which mean management probably sandbagged their guidance by a huge margin. That said, we could expect robust EPS growth throughout 2024, certainly higher than the “mid to high single-digit growth” that management guided.

In addition, management is still determined to cut any unnecessary excess costs and streamline the entire business through automation, which, altogether, should boost PayPal’s bottom line moving forward.

Finally, a few words on our continued efforts to drive operational efficiency and productivity across PayPal. We are instilling a rigorous cost benefit discipline throughout the company and leaving no stone unturned when it comes to reducing unproductive costs.

(CEO Alex Chriss — PayPal FY2024 Q1 Earnings Call)

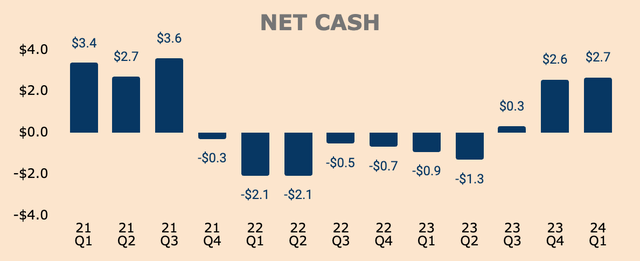

Health

PayPal has a strong balance sheet with a Net Cash position of about $2.7B, which includes $14.3B of Cash and Short-term Investments and $11.6B of Total Debt. As you can see, Net Cash has been growing over the last few quarters.

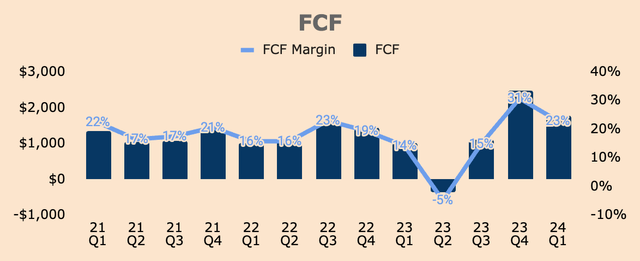

This was driven by robust Free Cash Flows, which was $1.8B in Q1, representing a FCF Margin of 23%. FCF also includes a $0.1B net negative impact from European BNPL receivables, so Adjusted FCF would have been $1.9B.

Net Cash would have expanded much more if not for PayPal’s aggressive buyback program. In Q1, the company bought back 25M shares, or $1.5B worth of common stock, at an average price of $59.18.

Over the last twelve months, share repurchases totaled $5.1B, reducing share count by 5% YoY. As of Q1, PayPal still has $9.4B of share buyback capacity left — expect more buybacks ahead, which should accelerate EPS growth as well.

Outlook

In my previous article on PayPal, I was a little upset with how management overpromised the markets through their “shock the world” statement, only to flop on their guidance.

Fortunately, management did better this time around.

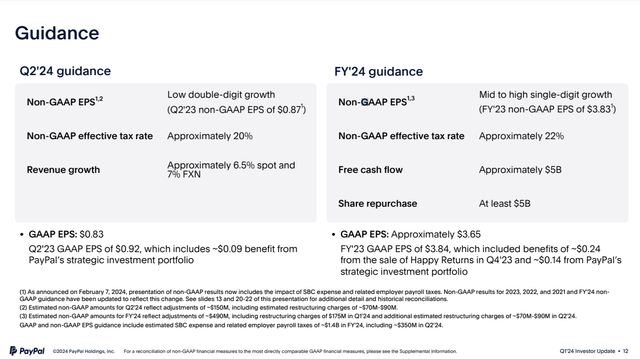

While Q2 Revenue came in light, investors were delighted to hear that management has raised their full-year outlook across several metrics:

- GAAP EPS raised by $0.05 to $3.65.

- Non-GAAP EPS is now expected to grow by mid to high single digits, up from “flat” last quarter. This was due to two main reasons: 1) Q1 outperformance and 2) a 3-point benefit to EPS growth due to the inclusion of SBC under the new methodology.

-

Transaction Margin Dollar growth is now expected to be “slightly positive” for the year, an improvement from “roughly flat”.

PayPal FY2024 Q1 Investor Presentation

Due to accounting changes, 2024 Non-GAAP EPS guidance basically dropped from $5.10 to about $4.00. I was expecting some sort of negative reaction to this “downward revision” but no… the markets rejoiced.

Despite the raised guidance, it includes “minimal impact from the new innovations rolling out this year”. Given management’s remarks on the progress that they have had with these new innovations — Fastlane, Venmo, PPCP, etc. — PayPal could possibly blow their guidance out of the water.

In addition, management guided for FCF and share repurchases of about $5B, which I think is too conservative. As a reminder, Q1 Adjusted FCF and share repurchases were $1.9B and $1.5B, respectively. That is an annual run rate of about $7.6B and $6.0B, respectively.

Assuming no improvements in PayPal’s Adjusted FCF profile, I expect share buybacks of at least $6B in 2024, which should juice EPS growth well above guidance.

Not only that, but management has also reorganized their incentive plans to better align with performance results, with special emphasis on Transaction Margin Dollars and Non-GAAP Operating Income growth.

I love this. I think these “pay-for-performance” incentive programs will drive meaningful results and shareholder value, which should be reflected in PayPal’s bottom line over time.

Valuation

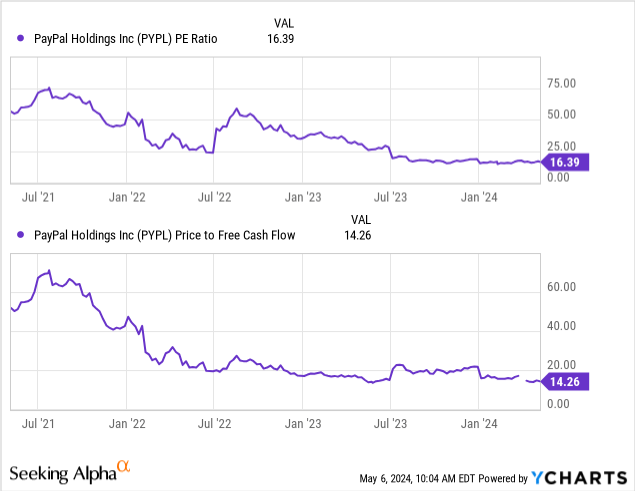

PayPal currently trades at a P/E ratio of 16x and a P/FCF ratio of 14x, which are the lowest they have ever been for the company, signifying undervaluation from a historical perspective.

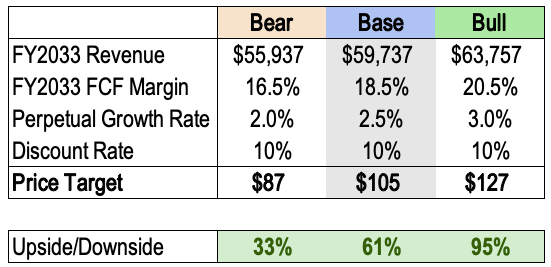

As for me, I’m maintaining my price target for PayPal stock, at $105 a share, representing an upside potential of 61% based on the current price of $65. My assumptions are laid out below.

My bear and bull price targets are at $87 and $127, respectively.

Author’s Analysis

Analysts currently have an average price target of $77 with a street high of $145.

Regardless, considering a strong outlook and laser-focused new management, I think the overall market sentiment on PayPal stock has turned positive.

In addition, given sandbagged guidance, I believe PayPal will outperform EPS expectations over the next few quarters — this should rerate the stock higher over time.

Risks

Competition remains PayPal’s biggest risk. Block (SQ), Adyen (OTCPK:ADYEY), Apple Pay (AAPL), Google Pay (GOOGL) (GOOG), SoFi (SOFI), Chime… you name it. The fintech space is overcrowded and that could lead to the commoditization of digital wallets and payment processing services, which could lower Take Rates and Gross Margins. As discussed earlier, these two metrics have been on a downtrend over the last few years, and they may continue to do so, destroying PayPal’s earnings potential along the way. If Take Rates and Gross Margins fail to bottom or improve, earnings growth may be muted. This will likely put some downward pressure on PayPal stock.

Thesis

PayPal’s Q4 results were great — but it was completely eclipsed by underwhelming guidance.

However, it all changed in Q1.

This time, management gave strong guidance with concrete evidence that their monetization initiatives such as improving debit card penetration, and new products such as Fastlane, are driving meaningful early results.

Yes, Q4 earnings were underwhelming.

But as it turned out, management was just adjusting to their new seats. They were just observing, identifying, evaluating, eliminating, initiating, prioritizing, creating, improving, assessing… you get the point.

PayPal has some of the most invaluable assets in the fintech space, including PayPal, Venmo, and Braintree.

New management knows this — and they want to leverage PayPal’s strong brand, massive network, and powerful data to generate the most value for all stakeholders.

That’s their grand plan.

And after a couple of quarters with the company, the new team is finally warming up.

With the stock still down 75% from its all-time highs and with a renewed outlook from management, I think the stock might just be warming up as well.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL, SOFI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.