Summary:

- PayPal reported fourth quarter results and while the results were solid, guidance was rather disappointing.

- Despite declining active accounts and declining gross margins, PayPal still has a wide economic moat around its business in my opinion.

- And the stock remains deeply undervalued – even when calculating with rather cautious growth assumptions.

NurPhoto/NurPhoto via Getty Images

PayPal Holdings, Inc. (NASDAQ:PYPL) continues to be a huge disappointment for investors. Following earnings last week, the stock declined as much as 11.5% the next trading day and although it recovered a bit on Friday, the stock is once again close to the multi-year lows of $50. Right now, PayPal is trading almost for the same stock price as in mid-November 2023 when my last article was published.

In my last article I wrote that you should not be annoyed but be grateful about PayPal’s stock price and the buying opportunity. And I can understand if you don’t see any reasons during the last three months to be grateful for. Nevertheless, I will stick to my bullish call and explain once again why I still think PayPal is a huge bargain and we start with the last quarterly results, which were not as bad as the stock price action might indicate.

Great Quarterly Results

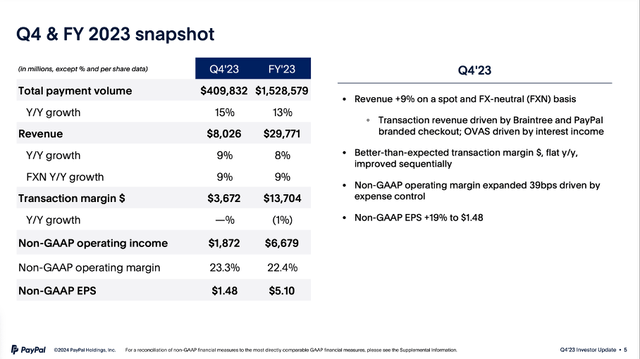

On Wednesday, February 06, 2024, PayPal reported fourth quarter and full-year results for fiscal 2023. Not only did PayPal exceed expectations for revenue (by $130 million) and earnings per share (by $0.12 on a non-GAAP basis), but the company also reported solid growth rates.

Net revenue in the fourth quarter increased 8.7% year-over-year from $7,383 million in the same quarter last year to $8,026 million this quarter. While top line increased “only” in the single digits, operating income increased from $1,244 million in Q4/22 to $1,728 million in Q4/23 – resulting in 38.9% year-over-year growth. And finally, diluted net income per share increased from $0.81 in the same quarter last year to $1.29 this quarter – resulting in 59.3% YoY growth for the bottom line. And finally, free cash flow increased from $1,433 million in Q4/22 to an impressive amount of $2,469 million.

Annual Results

When looking at the fourth quarter results, we don’t really get why PayPal is continuing to struggle and is trading once again close to its lowest price in the last few years. But quarterly results are always only a snapshot in time and hence it makes sense to also look at the annual results.

Annual Results are also solid, but not as great as fourth quarter results. Net revenue increased 8.2% year-over-year from $27,518 million to $29,771 million – similar to the high single digit growth rates in the fourth quarter. Operating income for fiscal 2023 increased from $3,837 million in the previous year to $5,028 million this year – resulting in 31.0% year-over-year growth. Diluted net income per share increased from $2.09 in fiscal 2022 to $3.84 in fiscal 2023 – leading to 83.7% year-over-year growth for the bottom line.

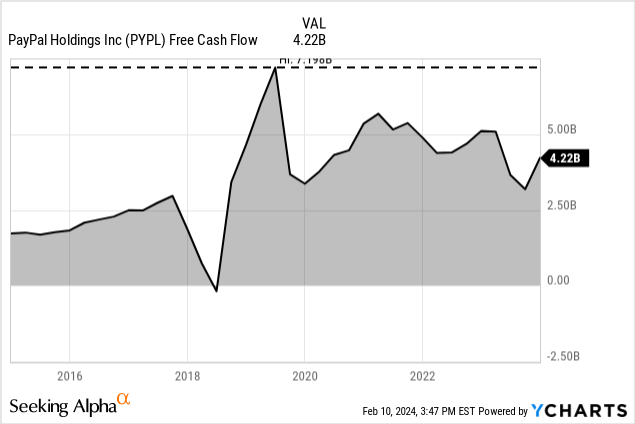

But we must point out that free cash flow for the full year declined 17.4% year-over-year from $5,107 million in fiscal 2022 to $4,220 million in fiscal 2023. Additionally, we must point out that earnings per share in fiscal 2022 were extraordinarily low (in fiscal 2021, EPS was $3.55, in fiscal 2020 even $3.58).

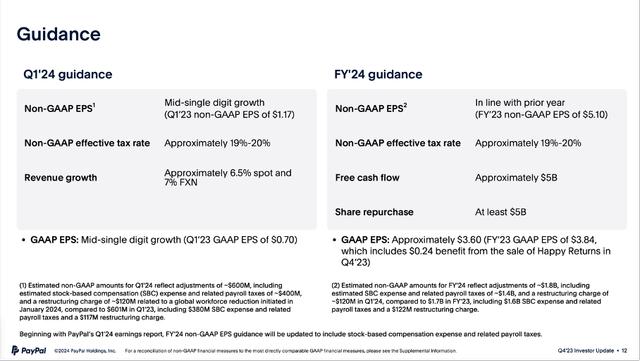

Guidance 2024

When looking at the results, I certainly understand that PayPal is not trading for $300 or $200 anymore – as these prices were not justified. However, when looking at the results the steep decline we saw in the past three years does not seem to be justified. On the other hand, the guidance PayPal gave for 2024 is also no reason to be optimistic.

For fiscal 2024, PayPal is expecting GAAP earnings per diluted share will be around $3.60 and compared to $3.84 in fiscal 2023 this is resulting in a mid-single digit decline. And non-GAAP diluted earnings per share are expected to be around $5.10 – and therefore in-line with fiscal 2023 results.

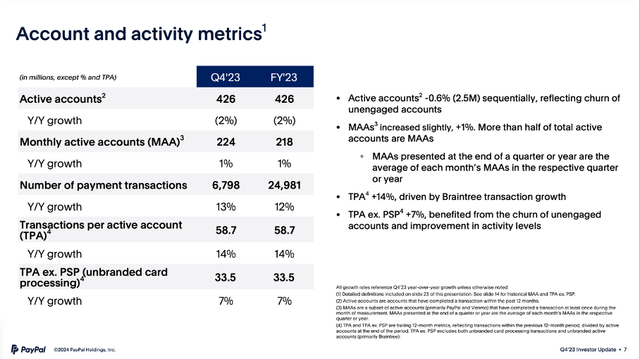

Active Accounts Or MAU?

One of the major problems PayPal seem to be facing – and I have already talked about this in previous articles – is the number of active accounts declining. On December 31, 2023, PayPal had 426 million active accounts compared to 428 million three months earlier and 435 million one year earlier. Some are arguing that PayPal is doomed just because it can’t increase the number of active accounts anymore. A similar argument was made for Meta Platforms (META) one or two years ago and the company clearly demonstrated the opposite with the number of daily and monthly active users growing slowly as well.

While some might make the case that Meta Platforms is growing its monthly active users at least in the mid-single digits while PayPal is reporting declining numbers, we must contradict. So far, PayPal has just been releasing numbers for active accounts and PayPal is defining active accounts as

an account registered directly with PayPal or a platform access partner that has completed a transaction on our platform, not including gateway-exclusive transactions, within the past 12 months.

And to be honest, accounts that were active in the last 12 months is not a dumb metric and certainly important. But most companies are rather reporting daily active users or monthly active users. And in case of PayPal daily active users is certainly a metric that doesn’t make much sense as almost nobody will use PayPal daily to make payments. But we can look at the number of monthly active users and while the number of active accounts declined in the last few quarters, the number of monthly active users is increasing. It is increasing slightly but moving into the right direction.

And when looking at further metrics, we can also see that the active users – despite a declining number – are using PayPal more and more, which is another way to grow (and a good sign). The number of payment transactions increased from 6,032 million in Q4/22 to 6,798 million in Q4/23 – resulting in 12.7% year-over-year growth. Additionally, payment transactions per active account increased from 51.4 in Q4/22 to 58.7 in Q4/23 – resulting in 14.2% year-over-year growth.

Of course, I also think management should focusing on growing its MAU and active accounts with a higher pace again and clearly focus on ways to fight the competition, but I don’t think PayPal is doomed or facing such a serious problem as many are assuming right now.

Having A Moat?

At this point we can also raise the question once again if PayPal has a wide economic moat around its business. Having trouble to increase the number of active accounts or seeing the number of MAUs increasing only in the low single digits is raising the question if PayPal has a wide economic moat around its business and if PayPal is able to fend off competitors.

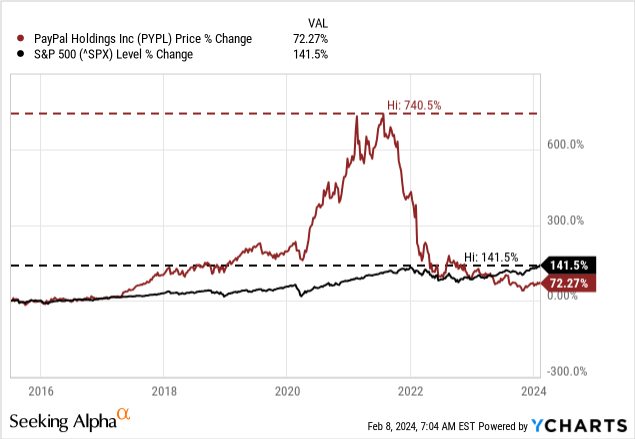

A first hint for a wide economic moat can be the stock price performance. Since the (second) IPO of PayPal, the stock price increased only 72% while the S&P 500 increased 142% in the same timeframe and these numbers make it difficult to argue for a wide economic moat.

But PayPal is a great example to explain why we can’t just look at the stock price performance and draw conclusions about a wide economic moat. We have less than a decade of data for the stock price performance and this is not long enough: At the end of 2021 PayPal’s stock price has increased 740% compared to 140% for the S&P 500, which could be seen as hint for a wide economic moat – now we have only 70% increase indicating no moat. Hence, we need several decades of stock price data to draw conclusions as after such a long timeframe potential over- or undervaluation of a stock won’t play such a huge role anymore.

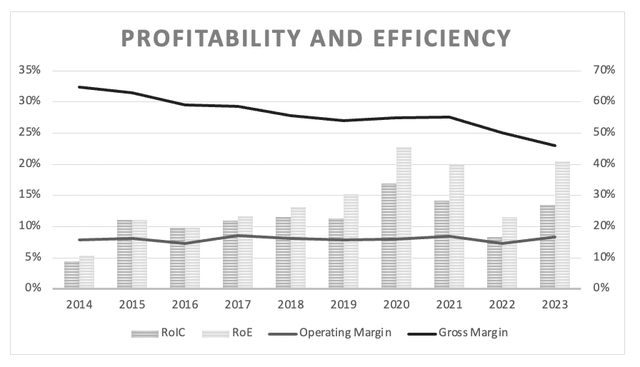

PayPal: Margins and return on invested capital (Author’s work)

We can also look at the margins PayPal is reporting. And while the operating margin is more or less stable (which is certainly a good sign), the gross margin is constantly declining in the last decade. Usually, a stable or growing gross margin is seen as a strong hint for pricing power and a declining gross margin is indicating increased competition and a company having trouble to fend off competitors.

We can also look at return on invested capital. And in the last ten years, PayPal reported a RoIC of 11.22% on average. While there are certainly companies reporting higher numbers for RoIC, it can already be seen as an indication for a wide economic moat. And in the last five years, return on invested capital was 12.85% which is a good sign that the metrics are improving.

But drawing conclusions about an economic moat of PayPal based on these numbers is nonsense. We must answer the question about an economic moat from a qualitative point of view (quantitative numbers are just hints for or against the existence of an economic moat). In my article The Strength Of PayPal’s Network Effect I wrote:

Very simply put, PayPal is a 2-sided network, with the distinguishing characteristic being, that there are two different classes of users: supply-side and demand-side or customers and merchants. Each side comes for different reasons into the network and both produce complementary value for the other side. Each new seller (merchant) directly adds value for all the buyers (customers) by increasing the number of shops where I can pay by using PayPal. Likewise, every additional buyer (customer) is a new potential customer for all the merchants and one more customer that can pay by using PayPal. People can also send money to each other without differentiation in customer and merchant and hence we could describe PayPal also as direct market network, but 2-sided network is probably the best description.

I don’t want to dispute the network effects PayPal clearly has – and the wide economic moat resulting from these network effects. But when looking at the declining gross margin and the resulting PayPal reported in the last few years, we clearly see PayPal being faced with some problems. One of these problems is multi-tenanting, which I also described in the article:

A final problem, PayPal (and its network) is faced with, is “multi-tenanting”, which basically describes the problem, that users can switch between different payment services simultaneously without facing huge costs and PayPal is not really able to prevent its customers from switching to a competitor. I myself have a PayPal account, I use my Mastercard regularly, but I am still paying a lot of things in cash every day. This is a problem networks are often confronted with, and it seems unlikely that PayPal (or other companies) will solve that problem anytime soon.

While I have always pointed out that PayPal probably does not have such a strong network effect as Mastercard (MA) or Visa (V), I was pretty confident about PayPal’s economic moat in the past. Mastercard and Visa are two companies that can block multi-tenanting quite successfully – especially for offline payments – as expensive infrastructure is necessary making the moat around those two businesses wider.

Right now, I would still see a wide economic moat around PayPal’s business and due to the well-known brand name the company has a leading position among the fintech businesses that is hard to attack – even for companies like Apple (AAPL), Amazon (AMZN), or Google (GOOG). These companies are powerful competitors, but I would still argue that most people think about PayPal when thinking about payments. Nevertheless, we should not ignore the problems mention in this section (gross margin constantly declining) and the section above (number of active accounts declining). Hence, we can certainly see some issues with PayPal, but we are still dealing with a solid business – and especially when putting the business in context to the stock price, we can only come to a bullish conclusion.

Intrinsic Value Calculation

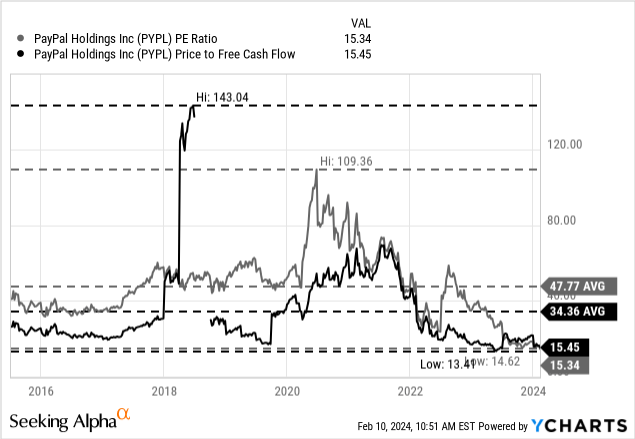

In a final step we are therefore looking at the intrinsic value of PayPal. We can start by looking at simple valuation metrics and the two of the more important metrics are the price-earnings ratio as well as the price-free-cash-flow ratio. And in both cases, PayPal is trading close to its lowest valuation multiples.

Right now, PayPal is trading for 15 times earnings and 15 times free cash flow and in both cases, this is clearly below the average P/E ratio and P/FCF ratio the stock has been trading for since its IPO. And on an absolute basis a valuation multiple of 15 is not really expensive for a company that seems to be able to grow with a solid pace and probably has an economic moat around its business (even if the moat is not the best one can have).

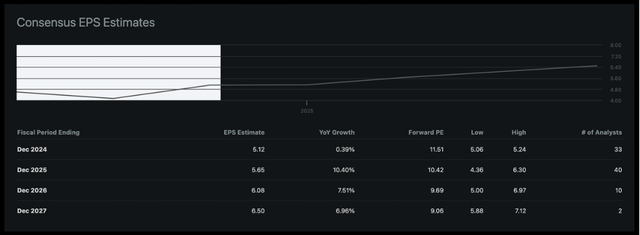

And as always, we will also use a discount cash flow calculation to determine an intrinsic value for PayPal. As always, we calculate with a 10% discount rate (as 10% is the annual return we like to achieve) and with 1,084 million in diluted outstanding shares (the last reported number). And for free cash flow in 2024 (and as basis for our calculation) we use the reported free cash flow of fiscal 2023 ($4,220 million). As PayPal is expected to stagnate in 2024 this seems like a reasonable and cautious basis. Now, we must focus on the more difficult question what growth rates might be realistic for PayPal. In my opinion we can make the case for PayPal growing at least 6% annually from now till perpetuity. In the next few years, analysts are expecting PayPal to growing earnings per share in the high single digits.

PayPal: Earnings per share estimates (Seeking Alpha)

And while PayPal grew EPS only with a CAGR of 2.75% in the last three years, operating income increased with a CAGR of 12.98% in the same timeframe and in the last five years earnings per share increased 17.56%. While we should never pick just the best years and highest assumptions, we should also not pick the worst years and assume this as basis. In my last article about PayPal I also showed how the overall market is expected to grow at least in the high single digits (some studies are even more optimistic) and I think PayPal will be able to match the overall market growth rates (with 6% growth being even below these expectations).

When calculating with these assumptions we get an intrinsic value of $105.03 for PayPal and the stock is clearly undervalued. And when listening to management during the earnings call, we can be even more optimistic. The new CFO Jamie Miller stated that PayPal is aiming to generate about $5 billion in free cash flow in 2024. When calculating with this amount as basis – all other assumptions being the same – we get an intrinsic value of $115.31 for PayPal.

In my opinion, the assumptions used here are realistic and PayPal should be able to achieve these growth targets in the years to come. Especially as PayPal will spend almost its entire free cash flow on share buybacks once again and with a current market capitalization of $63 billion it can repurchase up to 8% of outstanding shares (of course, the calculation is different when the stock price might rise).

Conclusion

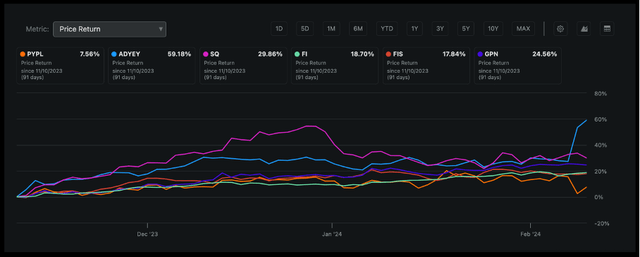

I don’t know if PayPal has found its bottom yet and it certainly seems possible for the stock to drop lower than $50 in the coming months and quarters. However, when looking at the stock performance of some of PayPal’s peers we see not only PayPal clearly lagging, but we also see first signs for a potential bottom for the sector.

PayPal: Stock price performance vs. Peers (Seeking Alpha)

And of course, we can make the argument that Adyen for example – which performed great in the last three months – is growing with a much higher pace than PayPal and therefore the performance is not comparable. However, PayPal is still growing with a solid pace and the stock lost more than 80% of its previous value and is therefore clearly trading below its intrinsic value.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PYPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.