Summary:

- PayPal’s stock is substantially undervalued and offers a 36% upside potential, even with conservative assumptions.

- The company is a major player in the digital payments industry, which is expected to experience solid growth in the next five years.

- The management’s focus on profitability improvement and investment in innovation supports the positive outlook for the stock.

JasonDoiy

Introduction

My discounted cash flow analysis suggests that PayPal’s (NASDAQ:PYPL) stock is extremely cheap even when I implement extremely conservative assumptions. The negative sentiment around the stock in recent years was caused by the rapidly shrinking profitability in 2022, but the operating margin rebounded promptly and recent developments suggest that the profitability improvement trend will likely last for years beyond. I also like the management’s plans to aggressively invest in innovation in 2024 together with focus on financial discipline. My target price is $80 per share and I assign PYPL a “Strong Buy” rating .

Fundamental analysis

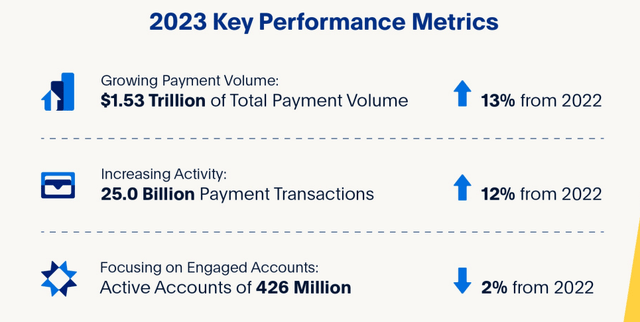

PayPal is one of the largest players in the digital payments industry, with a total payment volume of $1.5 trillion (“TPV”) processed in 2023, which means a 13% YoY growth. The TPV processed by PayPal in 2023 looks solid considering that Statista estimates the total transaction value of all digital payments in 2024 to be at around $11.5 trillion. According to the same source, the total transaction value is expected to reach $16.6 trillion by 2028, which means a solid 9.5% CAGR. To summarize, PayPal is an important player in the large industry, which is expected to deliver solid growth in the next five years, which means that industry trends are favorable.

PayPal’s 10-K

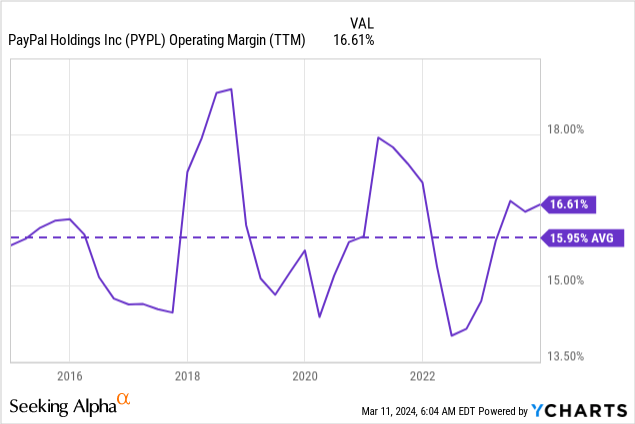

Despite being a large player in a growing industry, PayPal is not a hot stock and currently trades well below its historical highs. I think that a big drop in the operating margin after the pandemic-driven spike was a strong negative catalyst for PYPL. However, we can see that the operating margin demonstrated solid rebound in recent quarters and the TTM level is slightly above the last decade’s average.

The global lockdown has led to increased demand for e-commerce and that was a huge tailwind for the whole digital payments industry, and PayPal in particular. PYPL’s revenue increased by 42% in 2021 compared to 2019, and this rapid revenue growth has led to a rapidly increasing headcount between 2019 and 2021. However, the company’s revenue growth started decelerating significantly in 2022 due to the challenging macro environment, which included high inflation in the U.S. and the global geopolitical crisis. I believe the mismatch between the revenue growth pace and rapidly increased headcount was the primary reason why profitability started shrinking rapidly.

Operating profitability started climbing up in 2023 after PYPL laid off 2,000 employees. Since the management announced a new round of layoffs, which will cut the headcount by another 2,500 jobs, I expect the profitability improvement trend to remain solid in 2024. The new management prioritizes profitable growth and financial discipline, which is better for me than growth at all costs.

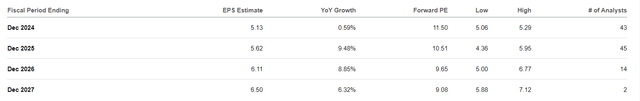

SA

Despite a notable 2,500 jobs cut (which is around 9% in relative terms), the company’s profitability is expected to be flat in FY 2024. Consensus estimates project a 0.6% adjusted EPS improvement, which is approximately in line with the company’s soft guidance. Readers should be aware that layoffs do not aim to have an instant effect on the P&L. Instead, over the short-term layoffs are relatively expensive to any company because compensation package is paid to employees who are leaving the company due to the headcount cut. However, it is important that this will have a long-term effect and will contribute to the improvement of profitability in the next years. Moreover, to stay competitive in the evolving environment and intensifying competition, the company plans to increase investments in innovation in 2024, which will also be a temporary headwind for the company’s profitability.

As a long-term investor, I understand how crucial it is for any company to invest in innovation, and the flat EPS in FY 2024 does not look like a problem. Moreover, according to the above screenshot, the EPS is expected to expand by 8-9% yearly after FY 2024. The company’s profitability metrics are already stellar and if remains at these levels in 2024 with likely expansion in the following years will be a good dynamic for the company and its investors.

Valuation analysis

The stock’s momentum is weak if we look at different timeframes within the last 12 months. If we zoom out and look at the share price chart for the last five years, we can see that PYPL currently trades almost 40% cheaper than it did in March 2019. The current share price is five times lower than the all-time high achieved in 2021.

SA

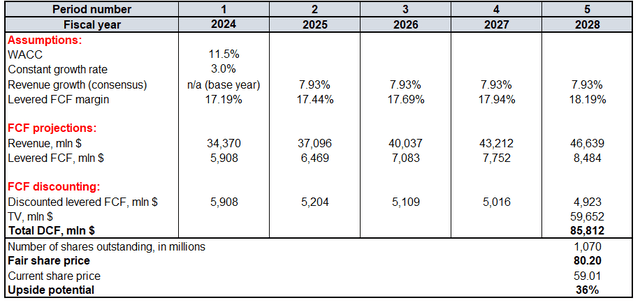

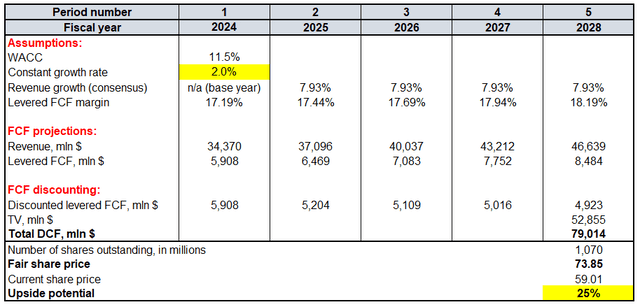

To understand whether the stock’s weak momentum is fair, I want to run the discounted cash flow (“DCF”) modeling with an 11.5% WACC. I am relying on revenue consensus estimates for the current FY, and a 7.93% forward growth rate looks like a fair CAGR for 2024-2028 to me. As I usually do, I use a levered TTM FCF margin for my cash flow projection and expect an expansion depending on the revenue growth trajectory. Since I incorporate a modest sub-8% revenue CAGR, I expect the 17.19% FCF margin to expand slowly at a 25 basis point per year rate. According to Seeking Alpha, 1.07 billion PYPL shares are outstanding. Since the sentiment around the stock is apparently negative, I am using a very conservative 3% constant growth rate for the terminal value (“TV”) calculation.

Calculated by the author

With all the modest assumptions I have incorporated, the DCF suggests an $80 fair share price. This means there is a 36% upside potential, and such a discount for PayPal is a real bargain, in my opinion. The constant growth rate is usually a big factor affecting the valuation, but even assuming that PYPL’s revenue and profits will be growing in line with long-term inflation 2% average, the stock still appears 25% undervalued.

Calculated by the author

To conclude, it looks like the stock has bottomed since, even with very conservative assumptions, it still demonstrates a 25% undervaluation.

Mitigating factors

I think the main reason for investors’ weak sentiment around PayPal’s stock is the intensifying competition in digital payments, which is crowded with several strong players. For example, Apple (AAPL) has disrupted the digital payments industry in recent years with its Apple Pay solution, which is very convenient at the point of sale since just a couple of taps activate it on a smartphone. Google’s (GOOG) Pay also demonstrates impressive penetration levels across the wealthiest economies and a staggering around 80% usage in the world’s most populous country, India. Besides technological giants, there are also established players focused solely on digital payments, like Visa (V) and Mastercard (MA). However, considering the deep discount the stock trades at, it is highly likely that elevated competition risks are already priced in.

Dealing with customers’ digital money means significant cybersecurity risks for PayPal. Any slight indications that the safety of customers’ digital wallets might be compromised will lead to extreme reputation damage and will likely force users to switch to other digital wallet providers. The company needs to invest heavily in cybersecurity as the sophistication of cybercrime is likely evolving.

The company had reputational struggles in late 2022 after a controversy around the potential $2,500 fines for customers in case of “misinformation”. While it is apparent that it was just a misunderstanding and PayPal does not have the legal power to fine anyone without a court decision, I think that the company failed to communicate the real message properly. While such situations are unlikely to affect the fundamentals, these unfavorable headlines might be bad for the stock price.

Conclusion

A 36% upside looks too attractive to ignore, even considering significant competition risks. PayPal is a large player in a growing industry and the management is making sound steps to improve profitability and is willing to build long-term revenue growth drivers. Therefore, I believe that the stock deserves to trade closer to its fair value once the sentiment around it improves.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.